000001 trade ideas

000001The price return At Extreme UpTrendline And break resistance zone

As you can see.

I highly recommend buying this stock now and holding it.

I expect the price to continue to rise until 3620.2176.

If you like trade At stocks don´t forget Like and Followe

For more Idea.

Good luck everyone.

any questions contact me.

SSE COMPOSITESSE looks like BTC in year 2018.

Price need to break top line.

Then I think we will see very good move UP.

Perhaps all time high.

Don't forget that China is building a new Egyptian capital in the desert. New Cairo.

It is a example what China is doing now and in my opinion stock market will go UP.

Shanghai SSE sharp bearishness and key level 3288.45Thanks for viewing.

I'm not a trader in SSE, or an investor.

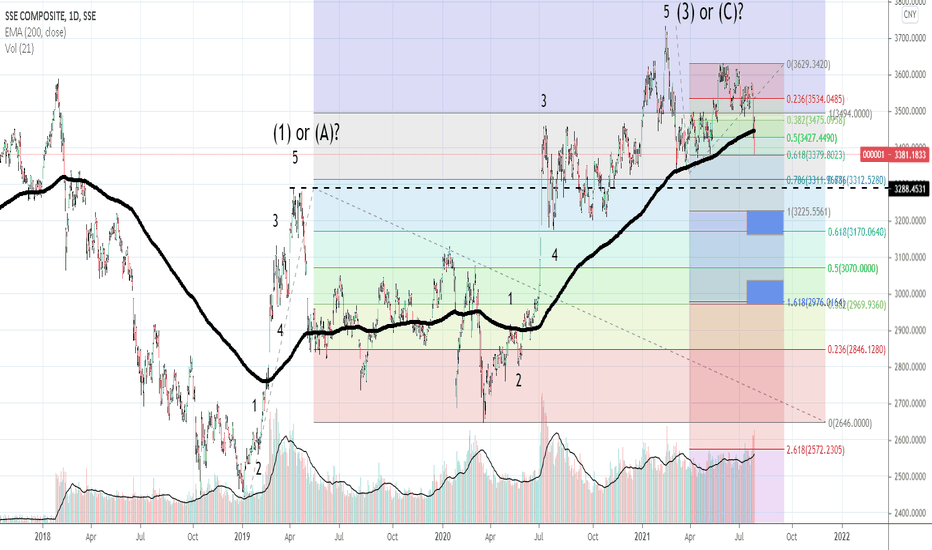

General bullishness since December 2018 has recently been met with some strong resistance and selling pressure. Apart from finding myself here after reading the news today, where the commentator predicted more "risk" in the market, I don' really track this index.

I'm not a follower of the fundamentals of the market, but have some geopolitical insight. Whatever government intervention caused the sell-off, these are the technicals as I see them.

RSI: ~35 which is "oversold" but that can always go lower... or even stay at similar levels while the price grinds lower. No bullish divergence present on daily scale.

MACD: daily histogram shows below the zero line and in a steep downtrend. The moving averages have crossed over to the downside and are still diverging (converging would mean a slowing in the trend direction.

I am using Elliot Wave (which a lot of people don't really use for whatever reason) and there is a very clear support level that has to hold if your view is for continued bullishness: It is the 3288.45 level. If this level doesn't hold then the 18 month general bull-trend is over for a while. I put a couple of blue boxes as possible near-term support - even if that 3288 level is cracked, but unless you are trained to catch knives....

Either we are in a larger bullish market and this is a small (albeit very sharp correction), or there is a more extensive downwards correction underway. Personally, I wouldn't hang around to find out as the market seems to look corrective (downwards) in nature on the weekly time-frame as well.

If all the news and stories pumped out of China are true in the last 20 years... this isn't reflected in their stock market price trend. That said, the general trend - minus some massive run-ups seems to be slow and steady and there is some multi-year trend-line support at around 2800.

Let's see I guess. Best of luck and look after those funds.

SSE Shanghai Composite W1 topped w/ a diamond? W2 comingThis China index confirmed its completion of ABC when lockdown ended & their economy resumes. It has risen so much from the ABC correction low of 2888 & we may see wave 1 topping out with a diamond reversal pattern. As seen in the past 2 times shown in chart, a diamond can be either a reversal or continuation pattern so proceed with caution.

Reasons why I see this as a reversal:

1) index has already risen 500 points (2888 to 3388 completes the 5 sub-waves of wave 1) without any major retracement.

2) price was rejected exactly at wma 50 & an anchored VWAP from 3300 bottom of July 2021

3) price was rejected at the 2015 red trendline

4) price has reached the 1.272 FIB retracement of the most recent leg down (an ideal spot for abc zigzag retracements)

The 2 most probable supports (the 2 yellow zones) for the wave 2 correction are:

1) the 0.383 FIB near the 3100 to 3200 pivot zone

2) the 0.618 zone near 3100

If wave 2 is shallow, then the future wave 4 may be a deeper correction like 61.8% or 78.6%.

Not trading advice

SSE COMPOSITE close to a bullish reversalThe Shanghai Stock Exchange (SSE COMPOSITE) broke and closed today above the 1D MA50 (blue trend-line) for the first time since January 12. This alone is a first major step towards restoring the long-term bullish sentiment. There are two more barriers ahead, the Lower Highs trend-line from December 13 2021 and then the 1D MA200 (orange trend-line). In our opinion, the index can methodically hit each target if a 1D candle closes above the previous barrier.

For example now that we got the 1D close above the 1D MA50, a buyer can target the Lower Highs trend-line. If we close above the trend-line, then target the 1D MA200. Complete long-term reversal to the bullish trend should come only above the 3500 Resistance.

Notice that the RSI on the 1W time-frame has broken above its own MA trend-line and achieved Higher Highs, which is a strong step towards the direction described above.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

Macroeconomic power transition The globalization and outsourcing of companies to China so far has taken America's macroeconomic power - which America now feels. This is due to Russia's Chinese connection to the war in Europe. We are at a time of transition of macroeconomic power and a new order of the most powerful countries from an economic point of view. We are therefore very confident that the China Stock Exchange will grow markedly over the next 5 years.

SSE China bottomed@2863;may retest it before an abc to 3500SSE china composite index may have already bottomed at 2863.65 in April. It is now at my yellow pivot zone. It may go back down to retest the low.

2888 is a very impt FIBO level, exactly @0.786 retracement & is also coinciding with exactly 0.236 of my Fibo strategy on 2 separate retracements.

It is highly probable that SSEC may rally on early June. It may reach 3300 in early August before a long consolidation above the yellow pivot zone before another rally in early Nov2022 reaching as high as 3500

In 1Q2023. (A zigzag move)

If we see the Macro view in weekly Chart, SSEC actually finished wave 2 in 2005 at 1008.60. From there it zoomed up to 6124 ATH in Oct2007 just before the 2008 crash. From these 2 points it is actually making a very big wedge that is the big & long wave 4. The apex of this wedge has a definite destination. GUESS WHERE: exactly at 3500! It will whipsaw above & below the 3300 to 3500 zone for a while. It may reach as high as 3740 to 4000 before it finally breaks out of this BIG WEDGE to start the final wave 5.

Time to shine after zero-covid accomplishment.

Not trading advice

CHINA: End of a 17 Year Consolidation - Epic Breakout next?

Regardless of your political bias, here's the bullish case

- Pandemic, regulatory clampdown, China-fear mongering has driven stocks down

- Broke down from pennant in April 2022 but recovered and closed within pennant - bear trap?

- Structural shift in new world order (see Ray Dahlio's animated explanation www.youtube.com)

- Curious timing where the major investment banks have gotten majority control of their China business in 2020

- US coming to an end of a 40 year major cycle and a 90 year mega cycle - have printed money out of their problems for the last decade or more. End of low interest rate environment. Funds have to flow somewhere!

Evergrande contagion signals on Shanghai compositeClear RSI divergence on price action at weekly period, possible long expected housing crash is near than we thought. FED interest hikes can be last straw on already shaky Chinese housing and banking sectors. CCP Chinas close trading partners and investors will be hit more than ones who kept their distance. Time to weigh ties.

The SSE Composite Index is an index- Shanghai Stock ExchangeThe SSE Composite Index is an index of all companies trading on the Shanghai Stock Exchange in categories A and B. On a large timeframe, the price has now soared high with strong momentum support. Volatility has shrunk to the downside. From a technical analysis perspective, this pattern is a flat that has unfolded in a 3-3-5 structure. (normally labeled ABC) wave C of this pattern traveled to 1.886 fib level and afterward, the bulls are now in the camp. I'm expecting the price to continue up move for the days to come. buying at CMP with a protective stop at 3146.66

How to implement Fibonacci change time algorithmI believe that many traders must be familiar with the Fibonacci sequence. In actual combat, we also use the Fibonacci sequence to predict the probability of a change in direction at an important stage of the market. , In the market analysis method, the Fibonacci sequence appears frequently.

The price trend of the market is cyclical, and the time period is the mystery of the rise and fall of stock prices. In the cycle theory, no matter how to look for a variable inventory, the Fibonacci sequence is one of the foundations of various important analysis, also known as "Magic Numbers" or "Fibonacci Cycles". Here comes the concept of the Fibonacci sequence.

The Fibonacci Sequence is a sequence of numbers introduced by the mathematician Leonardo da Fibonacci to reveal the laws of nature by taking the breeding of rabbits as an example: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233... Starting from the third number in the sequence, each number is equal to the sum of the previous two adjacent numbers. The quotient of two adjacent items in the Fibonacci sequence is close to the golden ratio of 0.618, hence the name "magic number".

How to call out the Fibonacci cycle in Tradingview, the specific operation is as follows.

After opening the icon, select "Fibonacci Time Zone" in the third tool drawer from top to bottom in the "Drawing Toolbar" on the left. After clicking this icon, pull out the Fibonacci from the high point or low point Cycle, you can see from the chart that the approximate change node can be predicted in the sequence of the trading day. Although no technical analysis can accurately predict the market situation, through the study of Fibonacci cycle lines, the high and low points of stock prices are sometimes not exactly within these cycle lines, but the gap is roughly 2-5 days. In actual trading, you can’t foolishly wait for the value on the cycle to appear. It must be combined with the market environment, market sentiment, energy state, macro policy and other factors of the big cycle at that time to conduct a comprehensive analysis to find a time window with a high probability of existence.

SSE:000001 Quote from Tradingview

Then I adjust the chart cycle to the weekly market. The original daily changing line will be displayed in weekly units. Observe the Fibonacci sequence in the large cycle. When the daily and weekly market prices are relatively close, it means that The effectiveness of the variable disks tested on multiple levels has been further confirmed. Therefore, it is a very effective method to confirm the validity of the Fibonacci cycle line drawing by using the MTF test whether the Fibonacci sequence is still accurate and effective in predicting the variable inventory. Taking into account the actual situation, an error of +0 or +1 will be allowed on the large period, because the resolution of the large period is relatively large, and the difference is caused by the difference, which we should tolerate.

SSE:000001 Quote from Tradingview

Then someone will definitely ask, can this work of drawing Fibonacci cycle lines be implemented through the script of PINE V5? My answer is yes. Drawing Fibonacci cycles manually is usually more labor-intensive. Here I tentatively implement a technical indicator that automatically draws Fibonacci time windows. It can automatically locate the high and low points of historical prices and count them. When the period displayed by the counter is a Fibonacci number, it will be highlighted with a yellow background color and marked with the Fibonacci number. value. However, there are still some drawbacks in the algorithm judgment, after all, the artificial matching accuracy will be higher. I named this script L1 Fibonacci Counter (Fibonacci Counter), and it was designed using the functions of the blackcat1402/pandas_ta library. The source code is as follows:

Comparison of algorithm drawing and manual drawing effects:

Summary:

1. The Fibonacci sequence is a natural law. On the trading days near these numbers, the market is more likely to change.

2. When drawing Fibonacci cycle lines in small cycles, historical data is required for confirmation. When more high and low points fall on the Fibonacci sequence numbers, the more effective the drawing will be.

3. If the large period and small period resonate, the reliability of the variable disk is very high, but due to the problem of large period resolution, +1 error tolerance can be considered.

4. Fibonacci change inventory does not provide accurate buying and selling points, its performance is not reliable in small cycles, and there are certain rules in large cycles, but in practice, it still needs to be combined with market trends, market sentiment, other technical indicators, volume and energy, etc. factors to confirm the reliability of the variable disc.

SSE. Is it a Doom? or BOOM! BOOM! BOOM! of China's economy? SSE ( Shanghai Stock Exchange ) chart. Shown it might completed its long term "Bullish Triangle" pattern. The Western media especially U.S Media have been debating China's Doom since many decades ago to recent "comparing" U.S Lehman brother with China's Evergrande .By checking SSE and SP500 chart.. Maybe The American should be "more worry" about their own "backyard"..