DXY Squeeze Incoming? Watch 99.00 ReactionFundamental Analysis:

The TVC:DXY has weakened as recent data shows GDP growth slowing to 2.4%, inflation cooling to 2.4%, and unemployment rising to 4.2%, increasing expectations of potential Fed rate cuts despite rates holding at 4.5%. Investor confidence has also dropped, with consumer sentiment at 50.8, and the trade deficit still wide at $123B, signaling softer economic momentum.

📉 Projection: Continued soft data could keep the dollar under pressure unless the Fed reinforces a hawkish stance.

⚠️ Risk Level: A strong upside surprise in inflation or employment data could reverse sentiment and push DXY higher abruptly.

Technical Analysis:

DXY is currently hovering around 99.65, just above a key support zone near 99.00 (PWL), where a potential liquidity grab may occur. The RSI is near 30, signaling oversold conditions, which often precede a short-term bounce.

📈 Projection: If price holds above 99.00, a rebound toward the 100.91 gap and possibly 103.19 (PWH) is likely.

⚠️ Risk Level: A clean break below 99.00 would invalidate the bullish setup and open the way to 97.50–98.00.

DXY trade ideas

Last Week’s FX Recap: April 7–11 (Zone Reactions & Trade Notes)📈 Weekly Forex Recap – Market Reactions & Lessons (Apr 7–11)

Last week there were about +320 pips of reaction potential (excluding Gold, which I was completely off on). There were multiple opportunities to capture solid intraday or swing setups.

3 out of 6 weekly targets were hit.

5 out of 6 trend biases were either accurate or neutral —meaning no major misreads, aside from one or two volatile zones. The only pair that really got me was Gold.

Let’s run it back real quick:

✅ AUDJPY

Bearish bias accurate.

30 pip reaction off zone with just 1 pip drawdown.

Weekly target hit.

✅ NZDJPY

Bearish bias accurate.

Weekly target hit, though price never reached the watch zone.

No setup triggered, but direction was respected.

⚠️ EURUSD

Range-bound bias played out majority of the week.

Gave about 90–100 pip drop from the hot zone mentioned.

Weekly target came close but didn’t hit.

⚠️ GOLD

Watch zone completely failed.

Short-term bounce gave 480 pip reaction—but that volatility was tough to catch cleanly.

Directional bias wasn’t helpful here. Gold was chaos.

✅ EURGBP

Cleanest setup of the week.

Bias was bullish, price tapped the buy zone and ran 100 pips.

Weekly target hit. Textbook move.

⚠️ GBPUSD

Consolidation-heavy.

Watch zone gave 100 pip reaction, but weekly target didn’t hit.

Bias was unclear—no real conviction either way.

📉 Total Zone Reaction Potential: 320 pips

🎯 Weekly Targets Hit: 3/6

📊 Trend Accuracy: 50% (3 clear hits, 2 neutral, 1 miss)

But that’s done now.

Whether you hit it last week or fumbled the ball, let it go.

We trade forward. Eyes up. Mind clear.

Time to dive into the new week.

Let’s get it. 👊

DXY: Target Is Up! Long!

My dear friends,

Today we will analyse DXY together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 99.315 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 99.687.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

$DXY broke structure to the downside.Now waiting for price to retrace into the lower cause/effect zone—ideally the origin of the last impulsive move down.

If that fails, I’ll be watching for a deeper retracement into the discounted schematic, where higher timeframe liquidity sits.

Not chasing—waiting for price to come to me.

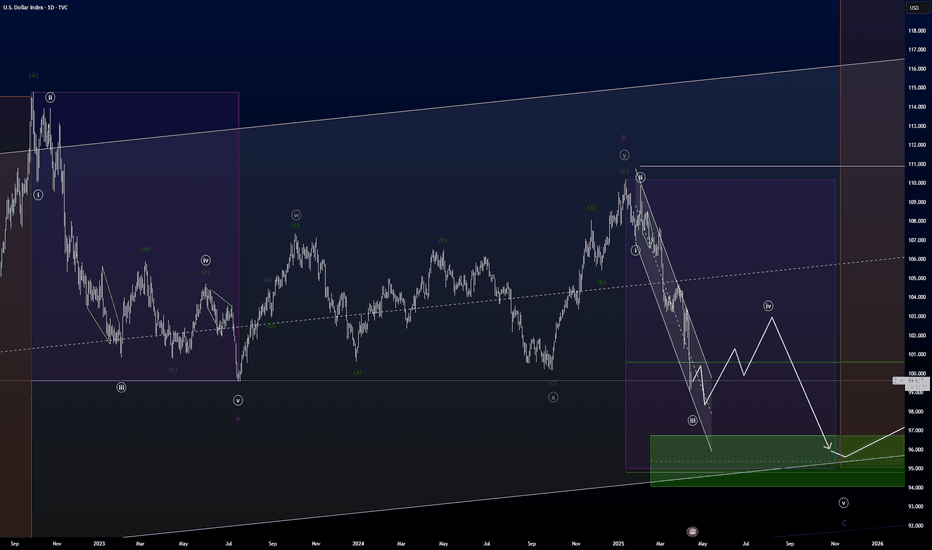

top is in for the dxygm,

this idea has been in the works for years, ever since we topped out 3 years ago. there has been quite a bit of variations of this idea, but this one right here has been my primary idea for a very long time.

initially i imagined the dxy coming up to 111-113 before topping out, and i reckon it still can, but the worst is behind us, relatively speaking.

---

if my count here is correct, the dxy will begin extending down into wave c into the last days of 2025 where a major low will be put in place .

this will create a hyper-parabolic bull phase for risk assets, in conjunction with declining rates.

---

if you've been waiting for a signal to buy alts

this is your signal.

🌙

---

ps. view my private idea from last year via:

🌙

DeGRAM | DXY has broken the downward structureThe DXY is under a descending channel above the trend lines.

The price has broken the upper trend line.

The chart maintains a harmonic pattern and has already broken the descending structure.

We expect a rise after consolidation above the resistance level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

How far could the USD fall?.. WATCH THE DOLLAR INDEXThe dollar is declining as US uncertainty continues and cash moves out of the US. I personally think the dollar will bounce, but how far could it fall in the meantime...

Price is testing the previous monthly horizontal resistance as support and the monthly 100 SMA. The dollar may find a bottom here. From 98 to 100 on TVC:DXY

Price may reach the monthly bullish channel support. There will likely be technical buyers in this area. From 95 to 96 on TICKMILL:DXY

Good luck!

U.S political events have a significant impact on the USDTrump Election (2016): subsequent DXY downtrend during the first year of TRUMP presidency. The price seems to have retraced from a peak and continued declining for about a year.

Biden Election (2020): After the 2020 election of Joe Biden, there was a notable bottoming pattern, followed by a strong upward movement in the DXY, implying a recovery or strengthening of the USD.

the DXY moved within a range during Trump's presidency, between 88.275 and 104.023 .

Current Analysis (2024): The DXY is approaching a sell zone, potentially aiming for a reintegration into the Trump range.

U.S. political events, such as presidential elections, have a significant impact on the USD's strength. The transitions in administrations are marked by notable shifts in the DXY.

A Zoom of the Weekly DXY into a Daily viewI kept the colored rectangels from my weekly analysis, to keep the focus and knowledge where we are on the chart.

DXY is doing a long A-B-C before it's is going into the last impulse og the C of Y of x of the larger degree.

It's quite a lot of corrections to manage, but if you swipe from the daily to the weekly timeframe, it makes good sense. For me at least :D.

The purple B wave took some time to figure out, but this was what made most sense to me. I was trying to look at it as a triangle, but that wouldn't have a good shape, so I ended out with this white ((w))-((x))-((y)) correction.

DXY is right now performing, what I see as, a extended 5th wave in the white ((iii) wave, before it goes into the white ((iv)) correction.

The white ((iv) wave correction could be become a long shallow drawn out correction for two reasons.

We had a steep and swift white (ii) followed by an extended white ((iii) wave. This usually means we are going to spend some time correcting that white (iii) wave and the rule of alternation tells us, if we have a quick 2nd wave, we are usually going to see a slow fourth wave.

I don't believe we have completed the white (iii) yet, so we have a long time to go still until that white (iv) wave is done.

When the white (iv) wave is done, the white (v) wave is probaly going to take us down to that green box.

So relax for the next 6 months and grab yourself a cup of coffee.

DeGRAM | DXY dropped below 100 pointsDXY is in a descending channel between trend lines.

On the downside, the price has formed a gap and dropped below 100 pips and has already reached the lower trend line.

The chart maintains a descending structure but has already formed a harmonic pattern and a descending wedge.

On the major timeframes, the index relative strength is in the oversold zone and on the 30m Timeframe it is forming a bullish convergence.

We expect a reversal after a support retest.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DXY Current Outlook 4hr , Daily and weekly analysisAt its current level, the DXY (US Dollar Index) is at a critical zone where a potential bullish reversal could occur. It is plausible that the index could reverse somewhere between the 99.50 – 98.00 range. However, there is also a possibility that this zone could break, leading to further downside continuation, potentially targeting the 96.23 – 93.95 levels.

It’s important to always watch for potential reversal signs at key levels. The reversal, if it happens, will likely be confirmed by certain indicators or patterns—like reversal candlestick formations—that we’ve mentioned before. Once price reaches those zones, look out for any of those confirmation signals, and use your own trading experience to validate them.

That being said, it’s also realistic to consider that the current zone (between 99.00 – 98.00) might already be the point where the dollar begins a strong recovery.

Note: All scenarios are valid, and key levels should be monitored closely for signs of a shift in momentum TVC:DXY

USDX-BUY strategy 12 hourly chart Regression channelFundamentally we understand the selling pressures on USD and technically also had confirmation for that as well. now we are very oversold (and even before), and since we cannot know the exact lows, we should carefully implement BUY strategy that survives. this is an individual choice and strategy.

Strategy BUY @ 99.20-99.60 and take profit near 101.57 for now.

Dollar Index Monthly Review: Key Support Levels with the help ofIn the first Fibonacci setup, we observe a retracement of the index to the 61.8% Fibonacci level, after which a trendline could be drawn. Applying a second Fibonacci retracement on the chart reveals that the Dollar Index once again found support within the 50.0%-61.8% zone.

In January of this year, the dollar attempted to break above the 110.00 level but encountered resistance at the 61.8% bullish retracement level. This led to another pullback, increasing the likelihood of a decline toward the trendline in the 98.50-99.00 zone. The 100.00 level is expected to act as support, though a temporary dip below this level within a consolidation phase is possible before another solid support is established.

Once a new support base is confirmed, the Dollar Index could initiate the next bullish rally, potentially forming a new high above the 116.00 level.

U.S. Dollar Index (DXY) – Key Resistance & Bearish Target Analys📊 Key Observations:

🔵 Resistance Zone (📍~103.5 Level)

A strong resistance area (🔵 blue box) is marked, indicating potential selling pressure if the price reaches this level.

The price is moving upwards (📈) towards this resistance, so watch for rejection or breakout.

🔵 Support/Target Zone (📍~101.5 Level)

A lower support zone (🔵 blue box) is marked as the bearish target 🎯.

If the price fails at resistance, it may head downwards (📉) to this level.

📉 Recent Price Action:

🚀 Sharp drop followed by a rebound (📈).

The price is currently moving back up (🔼), possibly forming a lower high before another drop.

📌 Exponential Moving Average (DEMA 9 - 102.488)

The price is hovering above the 9-period DEMA (📏), showing short-term bullish momentum.

If the price rejects resistance and falls below the DEMA, a bearish continuation (📉) is likely.

🚀 Potential Scenarios:

✅ Bullish Breakout: If price breaks above 🔵 resistance, it may continue rising (📈) to higher levels.

❌ Bearish Rejection: If price fails at resistance, expect a drop (📉) towards 101.5 🎯.

(SMC) and key liquidity zones aligning for a major bearish reverThe U.S. Dollar Index (DXY) is tracing out its final wave of the Elliott 5-wave structure, with a powerful confluence of Smart Money Concepts (SMC) and key liquidity zones aligning for a major bearish reversal.

Wave (iv) correction might offer the last sell opportunity before a deep wave (v) drives us into the golden demand zone near 91–93.

Watch closely:

Fair Value Gap (FVG) & Order Block aligning at resistance

Wave (iii) completed with strong momentum

Massive bearish pressure setting up for 2025–2026

Next Move?

We’re tracking the wave (iv) pullback into the SMC zone, looking for entries to ride wave (v) down.

Get ready for a potential macro-level shift in dollar strength!

#DXY #ElliottWave #SMC #ForexAnalysis #DollarIndex

--

Let me know if you like it

The impact of tariffs on the DXYIn the long term, the imposition of tariffs will trigger countermeasures from trading partners 😡, leading to a shrinkage of the global trade scale 😔. The import costs of raw materials for American enterprises will rise, and their export markets will be restricted, which will curb the economic growth of the United States 😩. This will exert depreciation pressure on the US dollar, causing the DXY to decline 📉.

U.S. Tariff Policies

Since April 9th, the United States has imposed tariffs ranging from 10% to 25% on goods from China, the European Union, Canada, and other regions, covering key sectors such as automobiles, steel, and semiconductors.😒

Countermeasures of Various Countries

China: On April 4th, China announced that it would impose a 34% tariff on U.S. goods starting from April 10th. On April 9th, the tariff rate was further increased to 84%, covering all U.S. goods.😠

The European Union: Announced that it would impose a 25% tariff on U.S. motorcycles, diamonds, and other goods starting from May 16th.😤

Canada: Imposed a 25% retaliatory tariff on U.S. automobiles on April 9th, but exempted auto parts.😏

This upward movement has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟.

💰💰💰 DXY 💰💰💰

🎯 Sell@103 - 100

🎯 TP 96 - 94

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗