KLSE trade ideas

Green or blue arrow ?The Malaysia stock market is definitely bullish and has gone up by 30+ % since the March low.

You can also see the benefits of buying Malaysia index or stocks as SGD currency is stronger than Malaysia ringgit. That means you are exchanging SGD1 dollar for MYR 3.0674 ringgit.

That increase your purchasing power in Malaysia, in this case you have more local currency (ringgit) to invest.

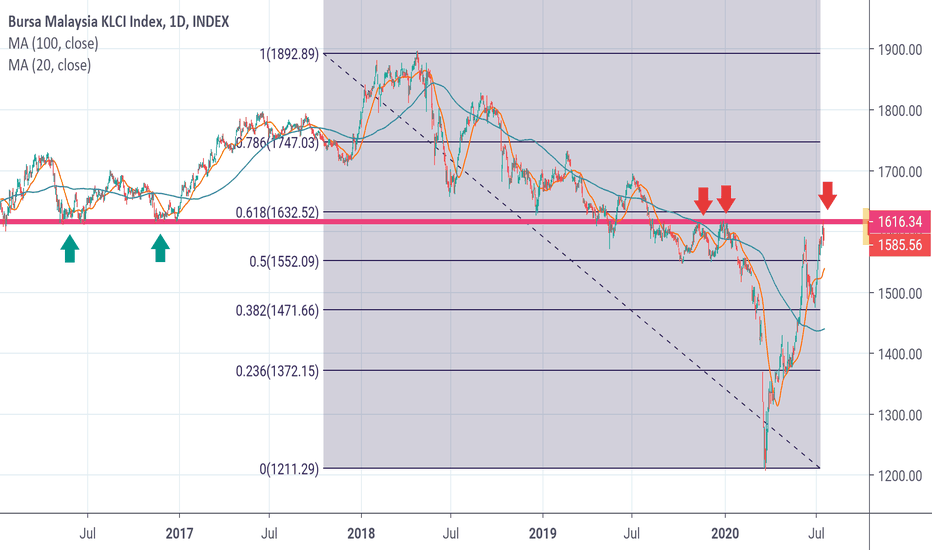

Now that it has reached a resistance level at 1616.05 , I think the next 1-2 months , we could either see a correction or the price moving sideways before it decides to go up or down.

So, if you have bought some Malaysia stocks, you may want to take some partial or full profits to be on the safe side.

Imo, it is a bit too late to go long now for this index. If you want, wait for the breakout first and observe the price action. If it breaks above 1616.05 and retrace well, then the uptrend will continue else wait for the sideway move to complete first.

FBM KLCI - Bearish Divergence FBMKLCI is closed at a new 7-month (2020) high at 1,611.42

However, the price is making a higher high (HH), but the Relative Strength Index is making a lower high (LH). This indicates the current market action is losing its momentum and weakening, meaning it could soon change direction.

KLCI - Masa kedua terbaik untuk membeli!Kemaskini KLCI : KLCI kini sudah jelas membuat pergerakkan 5 gelombang naik. Ini boleh jadi satu petanda awal bahawa KLCI sudah berjaya keluar dari bear market.

Secara kasar kelihatan pergerakkan 5 gelombang naik ini sudah lengkap, dan kini kita menantikan pergerakkan 3 gelombang kejatuhan yang bersifat korektif untuk berlaku pada bila bila masa sahaja.

Buat masa ini admin tidak menasihatkan pedagang Bursa di luar sana untuk agresif membeli, malah mungkin ia masa yang sesuai untuk mengambil keuntungan.

Bagi mereka yang sudah terlepas untuk membeli saham pada 18-22 Mac lepas, kejatuhan kali ini mungkin bakal menjadi peluang kedua buat anda!

Bagaimana pun, sekiranya kejatuhan ini membuat satu paras kerendahan yang baru melebihi paras rendah bulan Mac, ia bermaksud KLCI akan menghadapi satu bear market yang panjang dan teruk. Senario ini tidak berpotensi besar kerana Indeks serantau Asia dan Emmerging Market masih berada dalam pertengahan bull secara amnya.

Berlawanan dengan indeks indeks USA yang kelihatan sudah mencapai puncak bagi uptrend.

Abang Doji .

The first life-time major bear market for Malaysia stock market.Based on the chart pattern available and my best knowledge on applying Elliott Wave Principle, I'm currently seeing FBMKLCI undergoing its first big major bear market.

Based on currently available information, the 1998 financial crisis decline is best counted as A-B-C decline correction, and the subsequent rally from 1998 bottom to 2018 top is best intepreted as a multi-year expanding ending diagonal.

What we are witnessing currently is the unfolding of multi-year (potentially multi decade) bear market decline of larger degree/magnitude than Asian Financial Crisis and Subprime Mortage Crisis.

My view may change with time as more pieces of the puzzle are available.

An overdone bear rally that shall end soonFTSEMYX:FBMKLCI

Due to unprecendented market intervention by various central banks, we are witnessing an increasingly volatile market. Gone are the days where market moves in orderly manner with orderly pullback in between.

Instead, corrective waves are exhibiting strong movements akin to impulsive moves.

Market can be imagined as having two throttles at extreme ends of bullish-neutral-bearish spectrum.

Instead of slow/gradual transition, market now switches gear swiftly to either bullish or bearish throttle, hence the dramatic moves and being coined as Kangaroo market. Excess of bullishness will breed dramatic sharp rebound that die suddenly when the 'long' boat is overloaded, ensued by excess bearishness for dramatic decline, which die suddenly when the 'short' boat is overloaded, rinse and repeat.

Despite the potential erratic moves, I'm extremely bearish biased for the moment, and expecting the dramatic up/down swing in the nett will yield (ugly) negative return to stock market in the long run.

In near term, I'm anticipating a dramatic decline in FBMKLCI, which will be widely regarded by everyone as a 'healthy' pullback/retracement from March low rally, followed by a strong sharp rebound which will be 'celebrated' widely as resumption of bull rally.

However, this decline followed by sharp rebound more likely will be the Wave 1 decline and Wave 2 rebound of an unfolding 5-waves decline in disguise.

KLCIYes, no doubt, the IDSS is banned until end of this year. Without IDSS, it helps KLCI to run a little bull. Usually, IDSS is hedge against the KLCI. After 5 days of green candlesticks, it finally touch the most important intermediate trend resistance (in yellow), if it able to break out, the next resistance will be around (in purple window), Before that, hoping a healthy retracement can make it more perfect. Technical chart only for my own purpose, trade at your own risk.