STI trade ideas

STI - Singapore - poised to deliver 15 to 25% during next 10daysSTI finished a primary degree contracting triangle pattern that should initiate a long path upward from here. It seems to be tracing a 5 wave move up that will form a minor wave 1 pattern. Currently we should be beginning a minute impulse wave 3, the strongest of the impulse waves that should deliver from 14 to 24% returns up to the next 10-15 days. Price-to-book ratio also confirms the pattern. Time to catch it ! FOLLOW SKYLINEPRO TO GET UPDATES.

SPX500 or STI , which is better ?Volatility wise, you can see STI is more volatile with sharp spikes (orange) compared to SPX500.

And then the green zone where both are moving in a bullish channel. SPX500 has a much smoother ride. This is important as traders might get stopped out due to tight SL.

More importantly, when all indices have risen lately due to the Fed's generous money printing, SPX500 has retraced more than 35% while STI is at a miserable 10%.

The downside is investing in SPX500 requires one to use own cash whereas in STI, we can employ our CPF (401K) to invest.

Of course, we have the global giants like Amazon, Facebook, Apple, etc in SPX500 while STI contains mainly regional or state owned companies blue chips.

From a returns point of view, I will go for SPX500.

Straits Times Index (STI): Bullish Forecast

hey traders,

2550 is a major weekly structure level on STI.

just recently we saw its confirmed bullish breakout with a weekly candle close above that,

now the market is retesting the broken structure and I believe that bullish sentiment will proceed.

target levels are:

2700

2850

good luck!

STI - Mid term analysisIf my technical analysis is correct, we may be on a rising trend. The lowest dip on 23 Mar 2020 may be wave 3. Initial thought that 0.382 (STI of 2580) of wave 4 is the maximum but if wave 3 is extended wave, then the retracement of wave 4 will be much higher at 0.5 or 0.618 level possibly. FOMO does play a part and the analysis may be out, especially with many economic packages in place. But if we are in bear market, then possibly wave 5 may not have been reached. Nevertheless, do feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

STI Broadening patternSTI had briefly broken down below the broadening pattern and quickly recovering back. If it stays inside the pattern then we should see it reach the top of the pattern. If not, it is headed for the previous long term support as per the pattern target.

But in reality, it might do neither. I am assuming it will do a partial pullback inside the pattern and then breakdown but may not reach the pattern target.

3rd round of bazooka stimulus for Singapore announced !Read the latest news here.

Round 1 : Unity budget - S$6.4 billion

Round 2 : Resilience budget - S$48 billion

Round 3 : Solidarity budget - S$???? billion

Implication : Government would have access to data that we retail traders will never have. This, of course is top level information accessible by high level government officials.

Guys, think about it. What is missing thus far on the news headline but brewing beneath as in already happening ? That's right, companies filing for bankruptcies. It doesn't take too long to figure this out. Imagine running a multi-chain restaurants in Singapore and now Government is saying only takeaway no more dining in effective 7 April 2020. What will you do to the excess workers in your restaurants ? How are you going to pay the rentals and other operating costs ? Read this article here to see the seriousness of this circuit breaker.

I am still bearish on STI for the short to mid term and the global macro environment is not doing well and this will affect Singapore F&B scene as well. With people now being asked to stay at home, dine-in restaurants will be hit hard ! Delivery or takeaway for most of them is a supplementary business and now it looks like is going to be their main revenue generator if they succeed in it.

F&B counters worth looking at include ABR Holdings (owns Swensen Restaurant), Japan Food Holdings, Jumbo, etc.

My mind is racing just thinking of the direct and indirect business that will be affected by this circuit breaker. One way or another, the disruption is damaging and I think the trading scene is going to remain ugly for a while....

Clearing one hurdle at a timeSTI enjoyed a 7% run up from the bottom to the current price , thanks to US ferocious jump last night. But are we being too optimistic and too early to pop our champagne ?

Let's clear one hurdle at a time. If price can continue to go up to 2433 level and close above it today, then we have a good chance of seeing it moving higher. Remember, we have seen many charts with false breakout ? It too can happen here !

We want to be cautious but not overly to the point it paralyse us into an inaction mode. That is why we have stop loss to protect us.

Read this article

and this here

Such conflicting news are going to create some volatility in the market. As parents, we are concerned about our school going kids. Now that their tuition centres will be closed, that means kids schedule change and so we too have to change as well. This is BIG for the local market as many parents with kids are sending them for tuition.

It is not known when the 2nd stimulus will be make available. My guess is the government need more time to assess the situation after the closure of entertainment venues.

So, I will be monitoring the chart and reading the updates as frequent as I can before deciding what to do next.

Trade cautiously, everyone !

Has STI really bottomed out ?The truth is : I don't know.

It has taken out the important and psychological support at 3000 price level and is now at 2960. This is a support zone where price action in Jan 2017 and Oct 2018 were and they rebounded strongly.

Is history going to repeat itself again OR will we witness another slaughter in the coming weeks to see it falling to 2763 level ?

Thus far, the Feds, central banks of the world had committed to lower interest rates to help the companies to borrow cheaply. That does not seem to prop up the market, in fact, it had gone from bad to worse.

With the world so interconnected these days, the supply chains intertwined, it is inevitable when a epidemic like Covid 19 hit hard , every countries suffer. Not a single one is spared. And now even pets can get infected.

The media , I a'int sure if they are helping with each day greeting you with more and more sombre news of how many new cases there are and how panicky consumers are rushing to stock up the groceries from the supermarket.

My take for newbie traders is :

1. If you are not confident, watch the market and learn from it. Although years back, when I was a newbie, I jumped straight into the pool and had pay tuition fees to learn the hard way. To each his own, some can learn better from studying others mistakes, others like me need to get their hands dirty to "feel" the pinch. No right or wrong so long you don't dump your whole fortune in , thinking market is going to crash, and you sell hard or expecting a major trend reversal and loads up on long in large volume. Such gambling mindset is often suicidal as you are depending on a stroke of luck and if the Angel aint on your side, then you are stucked. That is a position you want to avoid.

2. Stop loss - why do I always emphasize this ? it is the rule, the most important rule in trading. You can take profits early , it is fine but not the other way round. The mind will play tricks on you to wait a while more and you keep adjusting your SL to avoid being stopped out for fear of suffering a real loss. You probably think paper loss is fine , it is not real monetary loss. Stop kidding yourself when you messed with the rules of trading. When you do that, you have to pay a heavy price. Just see the DJI chart and you see how punishing the market can be with its near 1000 points down! It has no emotions but we do and we are afraid to face the consequences, we felt embarrassed, angry with ourselves and sometimes ashamed. So to protect that, we do the irrational thing and widen the stop loss level , pinning on false hope that somehow magically it will not reach the level. Yes, I had been there before and know how it hurts emotionally and financially. PLEASE ALWAYS EMPLOY STOP LOSS NO MATTER HOW EXPERIENCED YOU THINK YOU ARE !!!!

3. Cut Loss - I had to cut losses closed to 1000 dollars last night as the market kept tumbling down. It was painful but I did it as fast as I could not because I do not feel the pain. But because I dare not cut loss in the past and had to pay back Mr Market even more and that bleeds the heart. Don't try any of these stupid, irrational tricks I did in the past :

1. Pretend it is not there - that is denial. You avoid looking at the chart , somehow going into a self denial mode. You probably feel better for a while yet feeling guilty that you should have done something but fear pulls you back.

2. Hasty decision - make sure you know your own portfolio well even without looking at it , you should roughly know by hard. In event like this crazy sell down and if you have to cut loss FAST, you better know which one to do it in doubly quick time. If you have to pull out a calculator , the market might turn against you or you may faced margin call sooner than you expected. Use the Pareto principle I shared before to help you. 80% of your losses is also attributed to the 20% of your entire holdings. Identify them and reduce the position here is much more effective than going through individual stocks to reduce your positions. This is not the time to worry about the losses but capital protection is your objective. So long as you are in the market, there will always be another opportunity to make it back. But if you bust your account, no matter how small your capital base is, it will dent your confidence level. Some will bounce back fast while others may take weeks to recover emotionally before coming back. Others who risked too much too soon will think that this market is too brutal and is not suitable for them. It has nothing to do with the market, it is all in our mind, how we perceive things and draw a conclusion from it.

Trade safely, guys . Always use a Stop loss, employ appropriate capital and risk management.

p/s: attempting to take revenge on the market because of your losses is a futile endeavour. You are better off taking the money to donate to charity or even better, treat yourself or family to a good meal. Going to the market with rage, fear and envy is not the way. It is a way to death as it controls you to get even, to beat the market and you will not be able to think clearly and do the right thing. WARNING - DO NOT ATTEMPT THIS EVEN IF YOU HAVE MILLIONS TO PLAY WITH. IT IS A LOSE LOSE GAME. YOU HAVE BEEN WARNED

Never not be afraid Barely a week ago, when I read that people in HK are rushing to snap up the supplies like instant noodles and toilet papers in the supermarket, I really could not understand why.

Never do I thought it would also happen to Singapore. Read here

The STI after reaching a high of 3286 plunged down to 3112.56 in less than 10 days. That was pretty much in line with the global markets performance in view of the coronavirus.

The local economy was also affected by this virus as well. Read here .

China then decided to implement rates cut, pump trillion of yuans to the stock market and managed to "resurrect" the much needed drowning market. You can see the V shape recovery starting from 4 Feb 20 to 6 Feb 20.

Chart wise, it first break down from the bullish trend line on 3 Feb and traders were expecting a possible bear market is here. Then, it managed to do a sharp pullback until 6 Feb. On 7 Feb, it retreated back into the bearish trend line. So, you can understand from this chart (would be quite the same for many ), that it created quite a bit of confusion , to sell or buy.

China latest trade data was delayed and as the death toll increased and more cases recorded in different countries, panic sets in and traders are equally confused and uncertain if the recovery is genuine or a mere "dead cat bounce".

It can go both way in a symmetrical triangle, up or down. So, exercise a little patience and wait for confirmation once more - 1) heads south towards the support at 3075 where I think this is a great buying point. 2) It may retreat a little to 3159 level and rebound.

Goto smaller time frame like 4H or 1H to get a better entry point.

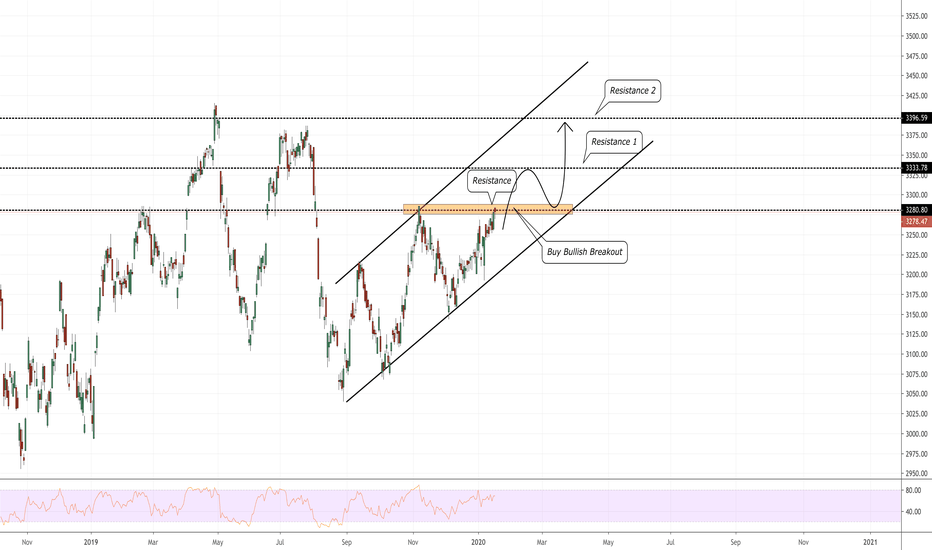

Straits Times Index (STI): Important Update

hey traders,

instead of breaking above 3280 structure resistance the market has respected it

and, moreover, set a lower high.

after a lower high formation, the market has dropped below a support line of a flag pattern.

the breakout is considered to be confirmed and our bias switches from bullish to bearish.

from the current perspective, I will expect bearish continuation to 3120 / 3050 / 2980 levels.

protect your profits based on these levels.

good luck!

Straits Times Index (STI): Prepare To Buy Bullish Breakout!

Singapore stock market may set a new higher high soon.

Pay close attention to a current resistance level and buy the market after a breakout.

The next target levels will be:

3333

3400

Targets based on the structure on the left.

*the market may retrace to the support of the channel before setting a new higher high.

Sunshine on STISunny Singapore is getting wet weather in the month of December. Lots of sales ongoing with the festive season - Christmas and year end sales.

The HK protests in some ways have contributed to a fair amount of Hong Kongers moving to Singapore and even business owners parking their funds here.

www.cnbc.com

www.channelnewsasia.com