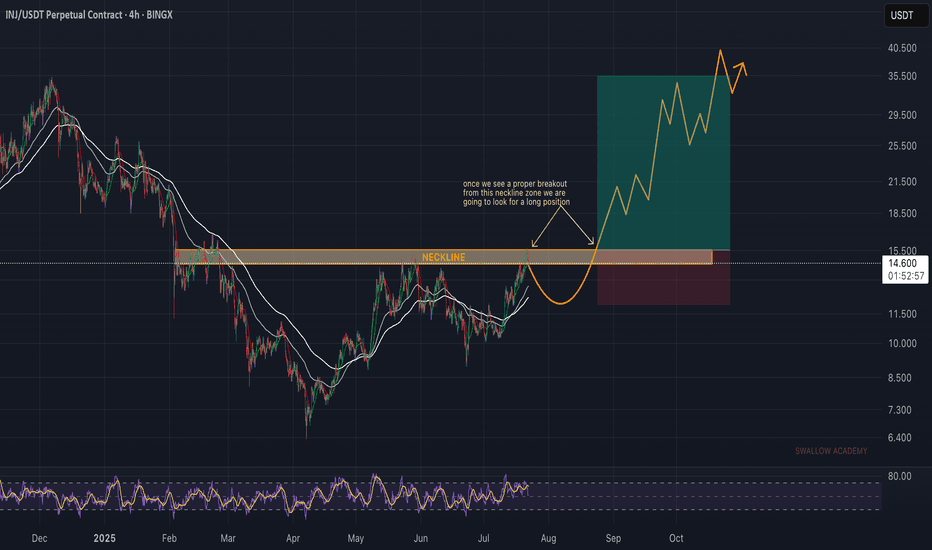

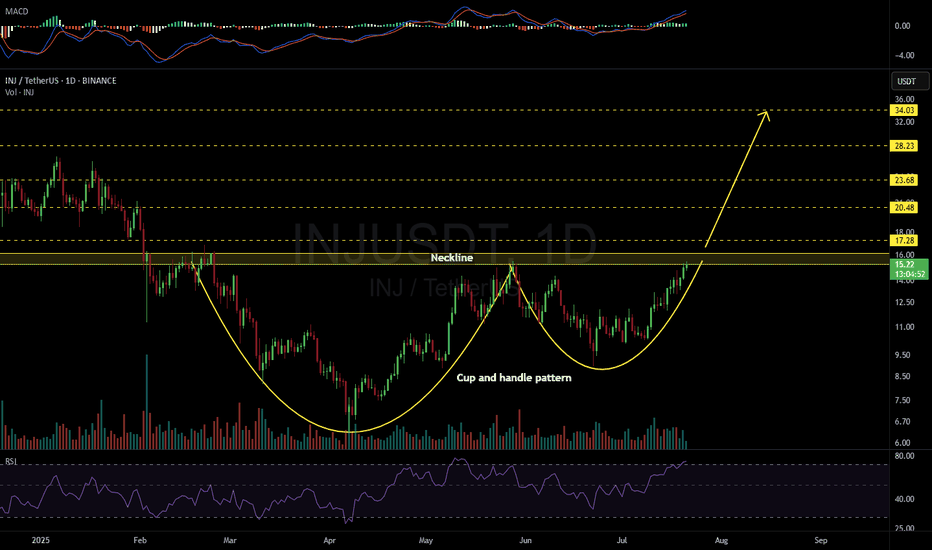

Injective (INJ): Seeing 2x To Happen, Once Neckline Is BrokenINJ looks good and strong, about to either have an immediate BOS to form or have a smaller rejection and form a cup and handle pattern.

Nevertheless, we are bullish, and once we get that BOS, we are opening the long position here.

Swallow Academy

INJUSDT trade ideas

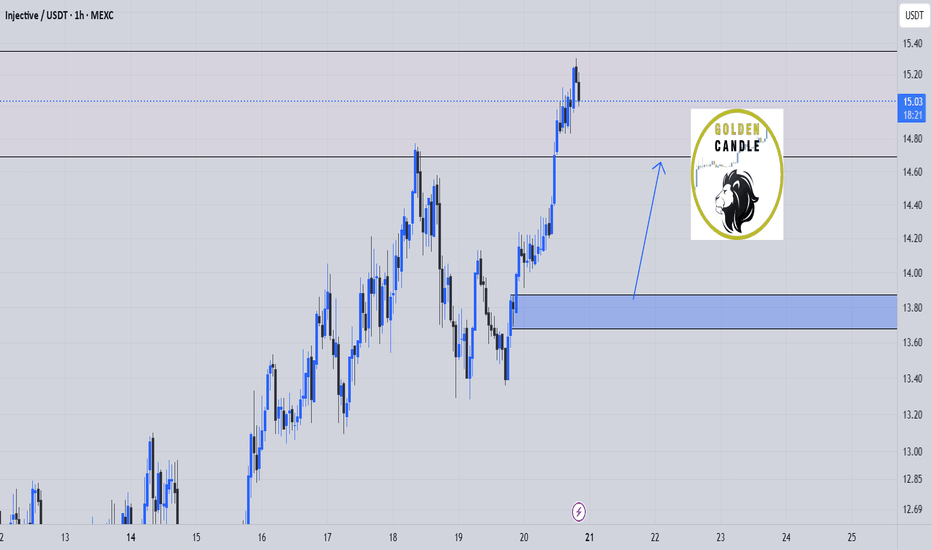

inj buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

INJ Pushes Above $14.60, $34 Next?CRYPTOCAP:INJ is breaking out of a cup and handle pattern!

The price has pushed above the neckline around $14.60 after forming a clear cup and handle structure on the daily chart.

This is a bullish setup, and as long as INJ holds above the breakout zone, the momentum could continue.

A retest toward $14.00–$14.20 is possible before the next move. If it holds, the next major target could be around $34.

DYOR, NFA

#Altseason2025

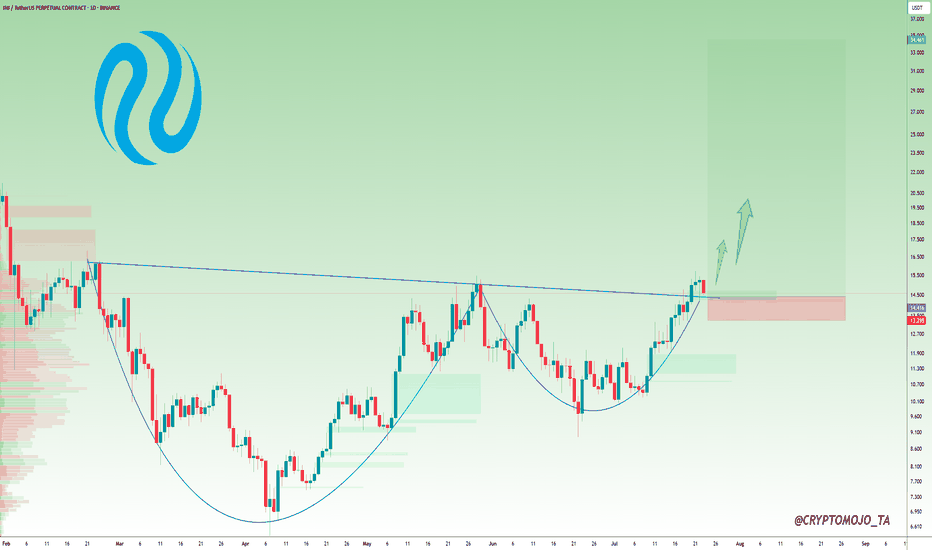

INJUSDT Bulls Are Back! All-Time High Could Be Next!

BINANCE:INJUSDT has shown a strong and clean bounce from a major support zone, indicating that buyers are stepping in aggressively at lower levels. This bounce reinforces the strength of the current uptrend and reflects growing bullish sentiment.

At the moment, the price is facing a significant resistance level. This area has previously acted as a barrier, but with increasing volume and momentum, we expect BINANCE:INJUSDT to break out from this resistance and continue its upward move.

If the breakout occurs, our target is the previous all-time high, as there is limited resistance above the current zone. This presents a high-reward opportunity for traders looking for breakout setups.

As always, managing risk is key. Use a well-placed stop loss below the support level to protect your capital. Breakouts can be explosive, but discipline and proper risk management make all the difference.

BINANCE:INJUSDT Currently trading at $14.4

Buy level : Above $14.5

Stop loss : Below $11

Target 1: $20

Target 2: $35

Target 3: $40

Target 4: $53

Max leverage 2x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

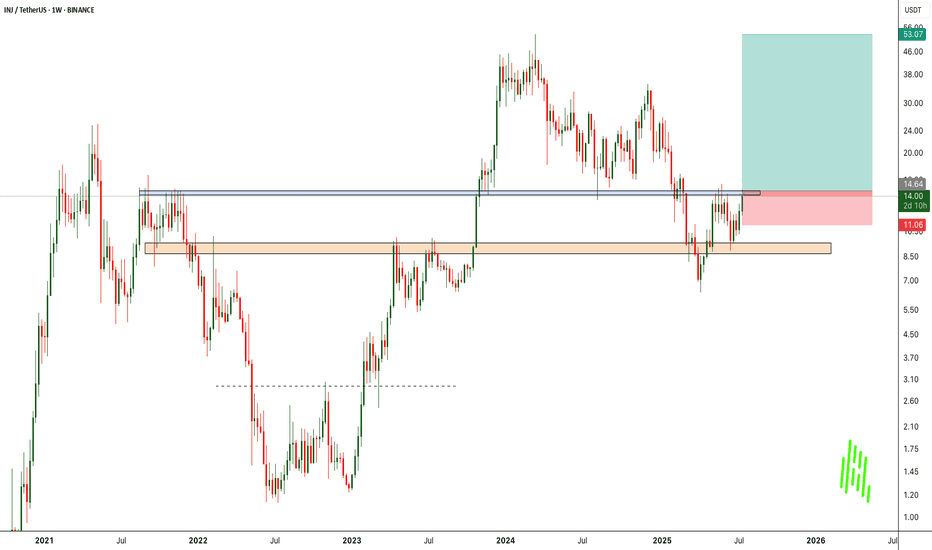

INJUSDT Approaching Key Wedge Resistance – Breakout Ahead?INJ is currently trading inside a broadening wedge pattern on the weekly timeframe. The price recently bounced strongly from the major demand zone around $8–$9, which has acted as a reliable support level in the past.

Now, INJ is approaching the upper resistance trendline of the broadening wedge. A confirmed breakout above this level could lead to a strong bullish move, potentially targeting the $50 level.

Cheers

Hexa

CRYPTOCAP:INJ BINANCE:INJUSDT

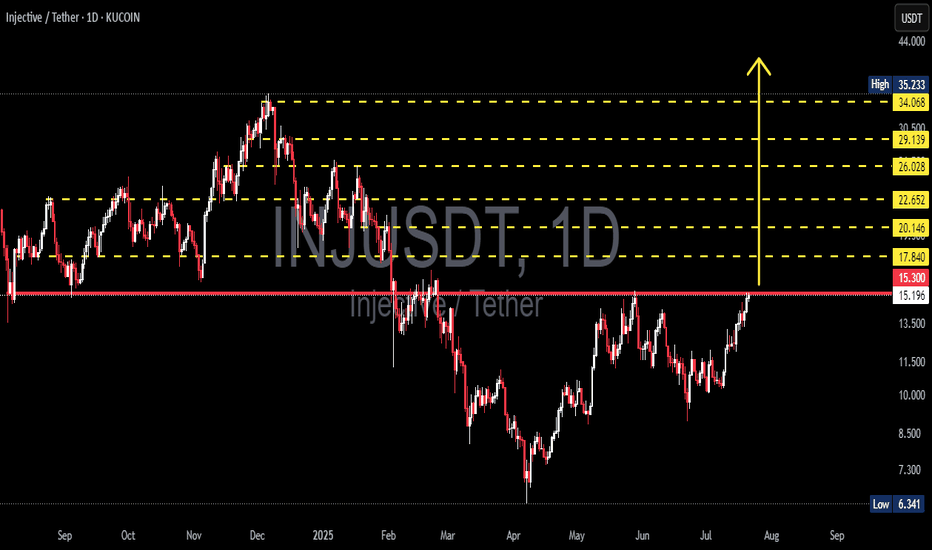

INJ/USDT at a Crucial Breakout Zone: Will the Path to $35 Unfold🧠 Full Technical Analysis (Daily Timeframe - KuCoin):

INJ/USDT (Injective Protocol) is currently at a critical decision point, testing a major resistance zone that has held strong since early 2025. After months of consolidation and a consistent structure of higher lows since May 2025, bullish pressure is now building momentum.

📊 Chart Pattern: Ascending Triangle Breakout in Progress

The price structure reveals a classic Ascending Triangle formation:

🔼 Rising support (higher lows) → signals accumulation.

⛔ Flat resistance at $15.30–$15.50 → key supply zone repeatedly tested.

This is a bullish continuation pattern, often leading to explosive upside once broken.

If the breakout is confirmed, INJ could rally through several historical resistance levels with strong potential for upside momentum.

📍 Key Resistance & Target Levels (Potential Take Profits):

Once price breaks above the key resistance, watch the following upside targets:

Level Significance

$17.84 Initial breakout confirmation level

$20.14 Psychological resistance & volume cluster

$22.65 Previous consolidation zone

$26.02 Intermediate high structure

$29.13 Strong resistance & prior distribution zone

$34.06 Final hurdle before reclaiming highs

$35.23 🔥 Major breakout target

🟢 Bullish Scenario:

✅ Daily close above $15.50 with strong volume = confirmed breakout.

🚀 Sequential target levels activated: $17.84 → $22.65 → $29.13 → $34.06.

💥 Potential for FOMO rally beyond $20, triggering long-term bullish trend.

🔴 Bearish Scenario (Rejection Case):

❌ Failure to break $15.30 leads to rejection.

⚠️ Downside targets: $13.20 → $12.00 → $10.60.

❌ Drop below $10.00 invalidates higher low structure and may trigger bearish reversal.

🧨 A sharp rejection may form a potential Double Top pattern, leading to downside pressure.

📈 Trading Strategy Recommendations:

🎯 Conservative Entry: Wait for breakout + retest confirmation at $15.50.

⚡ Aggressive Entry: Buy the breakout with tight stop-loss below $14.80.

📌 Consider laddered take-profits at each resistance level.

🔒 Use risk management — false breakouts are common in this zone.

---

🔍 Summary: Breakout Imminent or Final Rejection?

INJ is on the verge of a high-impact move. A confirmed breakout would likely trigger a trend reversal to the upside, while a failure could lead to another leg down. The next few candles will decide the medium-term direction. Traders should stay sharp, and act with a plan — this could be the start of something big.

⚠️ Always Trade with Discipline and Risk Management!

#INJUSDT #InjectiveProtocol #CryptoBreakout #AltcoinSetup #TechnicalAnalysis#BullishCrypto #PriceAction #CryptoSignals #BreakoutTrade #CryptoStrategy

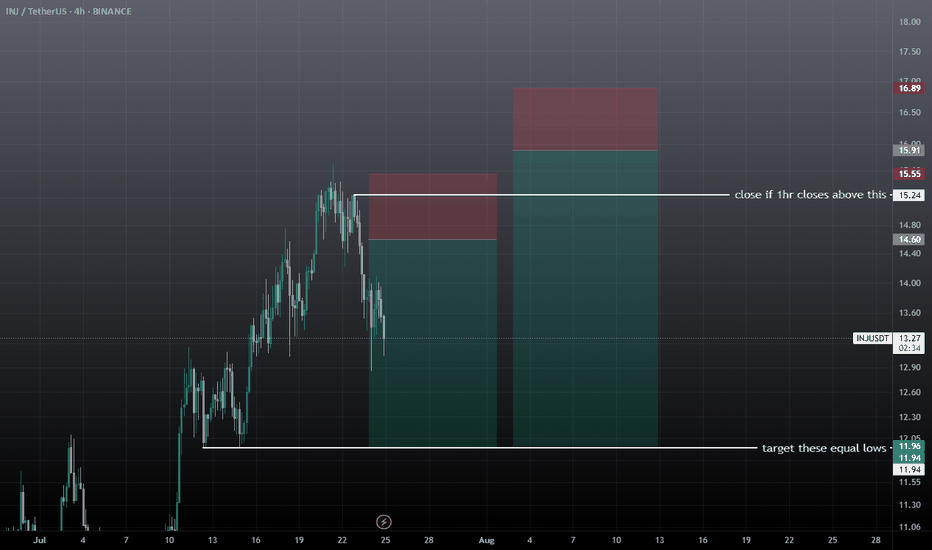

inj swing short setupWait for the entry, don't take it at current market price, entry can take time. There are two short setups forming on injusdt, after achieving the first entry if 1hr closes above the mentioned zone then close trade before sl, and then take the 2nd short setup, if tp achieves first then don't take the trade wait for the new setup.

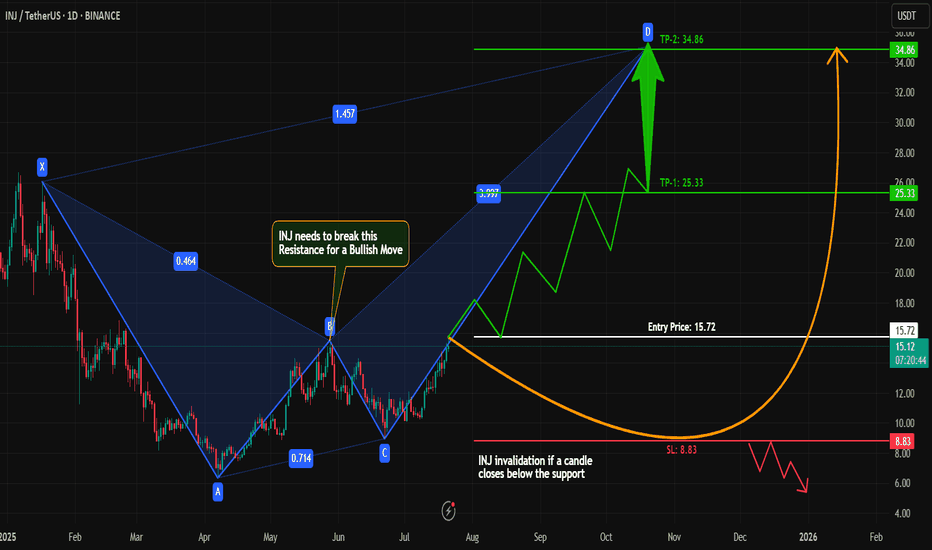

INJ Bullish Harmonic Pattern Setup – Breakout Loading?Hey traders! 👋

#INJ is forming a classic bullish harmonic pattern on the 1D timeframe, and what’s exciting is — no bearish divergence or rejection signals yet!

🔍 Key Technical:

Currently respecting the harmonic structure perfectly

B Point at $16 is acting as a major resistance

No bearish signs = bullish bias stays valid

💡 Trade Idea:

We’re watching closely for a clean breakout and retest of the $16 level (also the B point).

📌 On successful retest, this could trigger a strong long entry with a favorable risk-to-reward ratio.

🎯 Targets and stop-losses should be managed as per harmonic structure levels and price action.

📢 Let me know in the comments if you're tracking #INJ too!

🗨️ Drop your charts and analysis below — let’s discuss!

🔥 Don't forget to like, follow, and share if you found this helpful. Let’s grow together 💪

#INJ #HarmonicPattern #CryptoTrading #Altcoins #BreakoutSetup #TradingView #TechnicalAnalysis #BullishSetup #ChartAnalysis

INJUSDT 1D#INJ has formed a Cup and Handle pattern on the daily chart. All eyes are on the neckline — a breakout above it could trigger a 200–250% move. Enter this coin only after confirmation. Targets after the breakout:

🎯 $17.28

🎯 $20.48

🎯 $23.68

🎯 $28.23

🎯 $34.03

⚠️ Always use a tight stop-loss and practice proper risk management.

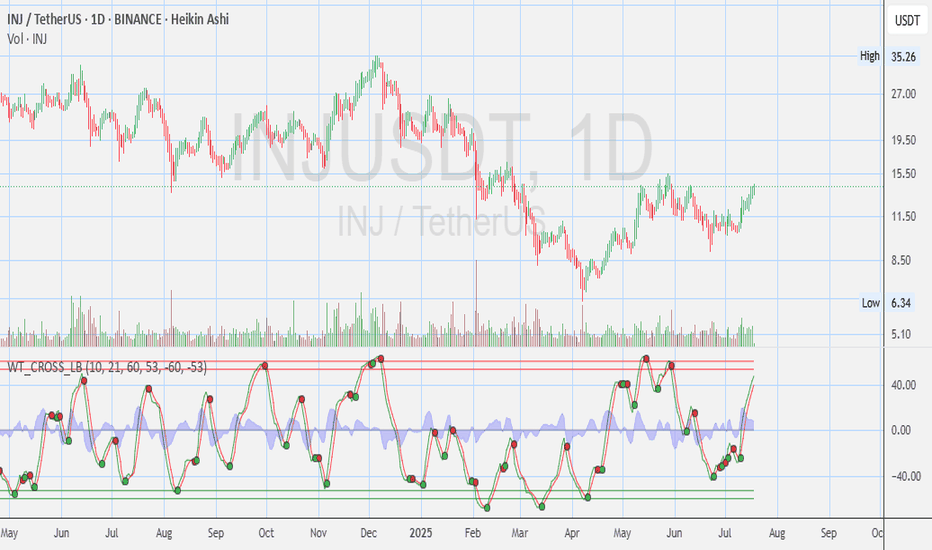

INJ - Injective Protocol - Daily Chart OpinionsHere’s a detailed **technical analysis** of the chart you uploaded for **INJ/USDT (Injective Protocol)** on the **1D (Daily) timeframe** using **Heikin Ashi** candles and the **WaveTrend Cross Indicator (WT\_CROSS\_LB)**:

---

📊 **Current Price Zone:**

* **Current Price:** \~\$13.59

* **Sell/Buy Spread:** \$14.18 Sell / \$14.19 Buy

* **Daily Range:** \$12.83 – \$14.06

* **Volume:** Moderate, slightly increasing on green candles — showing growing interest.

---

📈 **Price Structure (Heikin Ashi Candles):**

* Recent series of **strong green candles** — Heikin Ashi confirms trend direction well.

* Steady **bullish momentum** after the reversal from \~\$8.5–9.0 zone in late May.

* Price has formed a **higher low** and now attempting a **higher high**, indicating a potential trend reversal.

---

📉 **WT\_CROSS\_LB (WaveTrend Oscillator):**

* **WaveTrend lines are surging upward**, indicating **strong bullish momentum**.

* Green dot confirmed around mid-June (early entry signal).

* The oscillator is now approaching the **+60 zone** — nearing **overbought territory**, so a short-term pullback could happen soon.

* Previous tops at similar levels have resulted in **minor corrections**, so watch closely for divergence or exhaustion.

---

🧱 **Support & Resistance Levels:**

* **Immediate Support:** \$11.20 – \$12.00 range (recent base)

* **Current Resistance Zone:** Around \$14.50–\$15.00

* **Major Resistance Ahead:** \$17.50 and \$20.00 (psychological round numbers)

* **Macro Resistance:** \~\$26 and \$35 (based on previous highs)

---

🔄 **Trend Overview:**

* **Short-Term:** Bullish (higher lows, strong momentum)

* **Medium-Term:** Reversal in progress — needs a break above \$15 for confirmation.

* **Long-Term:** Still under macro resistance (\~\$20+), but shaping into recovery mode after long downtrend.

---

⚠️ **Key Risks & Notes:**

* WaveTrend is nearing overbought → watch for divergence or volume drop.

* Macro resistance levels remain strong — sentiment shift or BTC weakness could drag it back.

---

✅ Summary:

INJ is showing **early bullish structure**, with momentum indicators supportive of further upside.

It’s approaching resistance near \$14.5–15.0, which, if broken, could open up room toward \$17 and beyond.

A small consolidation/pullback is healthy here.

Volume and broader market sentiment will be critical to watch.

--

Disclosures:

This analysis is for informational purposes only and is not financial advice. It does not constitute a recommendation to buy, sell, or trade any securities, cryptocurrencies, or stocks. Trading involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

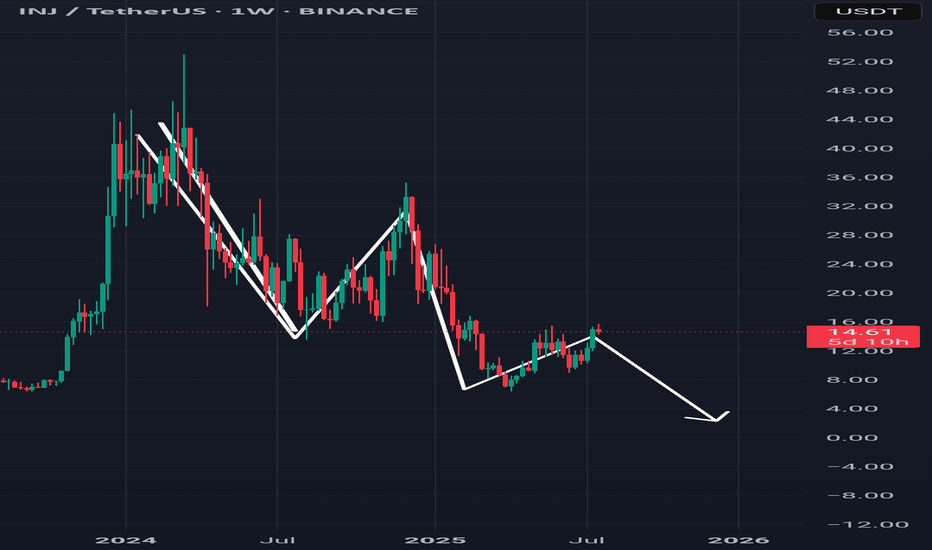

INJ/USDT -Macro Repeat in Motion?2023 was a phenomenal year for INJ, outperforming most of its competitors with an explosive +2800% rally, establishing it as a standout performer in the altcoin space.

Currently, we're observing a remarkably similar structure building on higher timeframes — consolidation, accumulation, and early breakout patterns that mirror the pre-rally phase of 2023. This raises a high-probability scenario: Is INJ preparing to repeat history?

With strong support forming at key levels and a tightening price range, any decisive breakout could trigger a significant leg up. If momentum follows through, our first macro target is the previous all-time high (ATH) around $48–$52, with further upside potential in price discovery zones.

INJ/USDT Weekly Outlook – Holding the Golden Zone!

📊 Complete Technical Analysis:

INJ/USDT is currently sitting at a critical weekly demand zone between $7.50 – $9.00, an area that has consistently triggered strong bullish reversals since mid-2022. This yellow zone represents a historical accumulation range, where buyers have stepped in aggressively during past dips.

The structure is forming a potential Double Bottom or even a base accumulation pattern, which often precedes explosive upward movements.

🟢 Bullish Scenario (Optimistic Outlook):

If price continues to hold above this key support, a bullish reversal is highly probable.

🔼 Upside Targets:

1. First Target: $12.97 – initial resistance level

2. Mid Target: $16.12 – previously a strong distribution zone

3. Major Target: $32.75 to $43.09 – major resistance from the last peak phase

💡 Bullish Confirmation:

Weekly candle closes above $12.97 with volume

Bullish price action near the support zone

Formation of higher lows on the weekly chart

Once price breaks above $16.12, INJ could accelerate toward the $30–$40 range.

🔴 Bearish Scenario (Caution Required):

However, if price breaks down below the $9.00 support zone with strong volume and a full-bodied weekly candle close, downside risk increases.

🔽 Bearish Targets:

$7.50 – psychological support

$5.00 – deeper support zone

$1.12 – extreme scenario (previous macro bottom)

⚠️ Bearish Signs:

Strong rejection at $12.97

Weekly close below the yellow demand zone with significant sell volume

📉 Market Psychology & Pattern Insight:

The market is in a highly emotional phase, but accumulation signs are visible.

Retail traders may panic near $9.00, but smart money often buys quietly in these zones.

This is a "patience zone" — where big moves are quietly prepared before launching.

📎 Conclusion:

> INJ is currently testing a powerful historical support zone. A breakout above $12.97 could trigger a multi-leg rally toward $30–$43. However, a breakdown below $9.00 would invalidate the bullish setup and call for caution.

#INJUSDT #CryptoAnalysis #AltcoinBreakout #TechnicalAnalysis

#SupportAndResistance #BullishSetup #BearishScenario #DoubleBottom

#PriceAction #CryptoTrading

INJUSDT Forming Bullish PennantINJUSDT has recently emerged as one of the more promising crypto pairs to watch, attracting significant investor interest with strong trading volume. While no specific pattern is clearly defined on the chart right now, the market structure indicates that accumulation is happening at key support zones, hinting at a potential bullish breakout. Traders expecting an 80% to 90%+ gain see this as an opportunity to ride a strong upward trend as Injective Protocol continues to grow in the decentralized finance (DeFi) sector.

Injective Protocol (INJ) is well-known for its innovative approach to decentralized derivatives trading, offering a fully decentralized layer-2 exchange and robust DeFi ecosystem. As the crypto market shifts focus towards real utility projects, INJ stands out due to its unique value proposition and active developer community. This strong fundamental backing is one of the reasons investors are accumulating positions now before any major breakout happens.

Technically, INJUSDT is poised for a move once it clears resistance levels that have capped its price in recent months. Increasing volume suggests that traders are building positions in anticipation of a breakout, which could be fueled by positive news or broader crypto market momentum. Keep an eye on potential catalysts like protocol upgrades, partnerships, or DeFi adoption that could propel INJUSDT towards its projected gain.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

INJ Long Swing Setup – Structural Recovery with SMA ReclaimINJ has retraced to a key support zone and is showing early signs of recovery, reclaiming its 20-day SMA. With structural strength returning, the $11.00–$11.60 range offers a solid swing entry—contingent on BTC holding key levels.

📌 Trade Setup:

• Entry Zone: $11.00 – $11.60

• Take Profit Targets:

o 🥇 $14.00 – $16.00

o 🥈 $19.80 – $23.00

• Stop Loss: Daily close below $9.50 (Exit early if BTC breaks major support)

INJ - Back from the Dead?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

INJ has been hovering within a wide range between our two green zones, spanning from $10 to $16.

For the bulls to take control in the medium term, a break above the last major high marked in blue is needed.

To confirm long-term bullish dominance, a breakout above the upper boundary of the green range is required.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

#INJ/USDT#INJ

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.04263, acting as strong support from which the price can rebound.

Entry price: 10.70

First target: 11.11

Second target: 11.43

Third target: 11.86