INJ | ALTCOINS | Bottom Likely CLOSEIn the previous cycle, INJ made a near full retracement after the bullish cycle.

This would put us round here, to which we are already fairly close:

To make it a little easier to reference, I'll use the Elliot wave tool (although these are not Elliot waves).

In short, the bottom is likely very close for INJ - but accumulation / sideways phase may take another while.

_______________________

BINANCE:INJUSDT

INJUSDT trade ideas

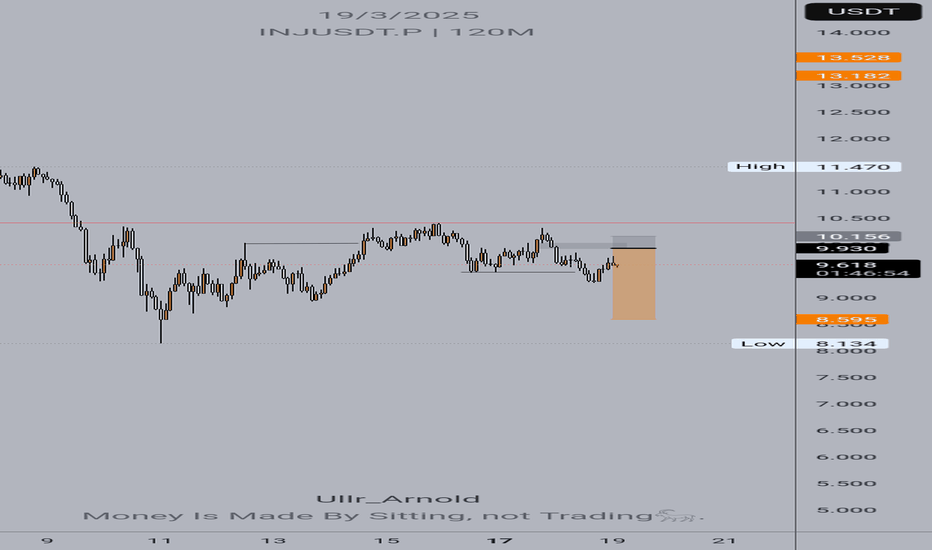

#INJUSDT is setting up for a breakout Long BYBIT:INJUSDT.P from $10,346

🛡 Stop loss $10,182

1h Timeframe

⚡ Plan:

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $10,550

💎 TP 2: $10,730

💎 TP 3: $10,849

🚀 BYBIT:INJUSDT.P is setting up for a breakout—preparing for an upward move!

Breaking: Injective Protocol ($INJ) Set For a Comeback The first and only blockchain built for finance that is open, interoperable layer-one blockchain powering next-generation finance applications, including DeFi, RWAs, AI, decentralized exchanges, prediction markets, lending protocols, and more, is set for a comeback with a speculated 140% surge in sight.

Weeks after Breaking down from a rising wedge which is a bearish pattern, CRYPTOCAP:INJ has shown signs of a reversal. With the Relative Strength Index (RSI) already oversold at 28 CRYPTOCAP:INJ is gearing up for a massive comeback with the All-time high of $52.75 a move to the $19 pivot point could spark the resurgence to the recent ATH attained.

Similarly, with growing momentum and the asset trading below key moving averages (MA) CRYPTOCAP:INJ is currently up by 3.41%. The Injective Protocol is becoming an asset worth watching.

Injective Price Live Data

The live Injective price today is $8.77 USD with a 24-hour trading volume of $166,682,991 USD. Injective is down 7.91% in the last 24 hours, with a live market cap of $867,892,886 USD. It has a circulating supply of 98,970,935 INJ coins and the max. supply is not available.

$INJ next support is at $8.45I don’t have good news.

I remember buying CRYPTOCAP:INJ last June and selling it at a loss in December. Looking back, I’m glad I did—if I had held, my losses would now be over 80%, which is catastrophic.

I’ve spent some time in the Dojo Trading Telegram chat, talking with some great people. No doubt, there are real believers and long-time holders there. I feel for them, seeing how bad things are going now.

📉 The chart shows the next support at $8.5—I can’t believe I’m writing this, but it is what it is. Hopefully, that will be the bottom.

In another idea (check my profile), I predicted a bearish crypto market until May 2025, followed by two months of relief with a pump and a mini altseason.

That said, nothing is certain in this toxic environment filled with war tensions, tariffs, and a looming recession.

I’m sticking to my view that May and June will be bullish, purely based on indicators and charts.

The dump is global. A few new coins are hyped for a couple of weeks, but the entire crypto market has been bleeding since June 2024. The brief relief in December? Completely erased—and worse.

Prepare for the worst. The storm will end in May. Go fishing, touch some grass. CRYPTOCAP:INJ and NASDAQ:ATOM are solid projects, but right now, only whale stakers are profiting, while retail investors are getting slaughtered.

DYOR.

INJ Price Analysis: Key Zones & Reversal ScenariosHey everyone! 👋

Let's dive into this price chart and see what’s going on with INJ.

Overview:

We’re looking at INJ on a weekly timeframe , and there are some interesting levels to watch. The chart shows **three key zones** where price reactions might happen, marked with price levels. There are also areas of liquidity (LQ) , where the market might make a move before reversing direction.

Potential Reversal Scenarios:

Three possible price movements are shown with yellow arrows , each representing a different way the price might reverse. The second arrow is the primary scenario, suggesting that after sweeping at least one liquidity level, the price could bounce back up—especially if there’s solid volume and a strong candlestick pattern.

- Main Support Zone (3.84 - 4.84): This area is the most important. If the price reaches this zone and shows good volume and a strong candlestick pattern, it could signal a trend change.

- Other Support Zones (2.55 - 2.85 and 7.38 - 8.92): These are additional key levels. A drop below these could change the outlook.

Take Profit (TP) Targets:

TP levels are marked on the chart. If the price reverses as expected, these targets may be reached.

Final Thoughts:

Nothing in crypto is guaranteed! Always look for confirmations like volume and candlestick patterns before making decisions. Stay informed, trade smart, and always do your own research! 📊💡

INJUSDT 1WThe price is currently in an uptrend and, after breaching the $25 threshold, it has entered a corrective phase. It is presently consolidating within the support zone delineated by the channel’s lower boundary and the ascending trendline. It appears that approximately one month will be required to complete the bottoming process for this asset. Following this consolidation, I anticipate a bullish move towards historical highs, with an initial target of $25.

INJ Long OpportunityMarket Context:

INJ has retraced into a strong support zone, presenting a high-probability long trade for a potential rebound.

Primary Trade Setup:

Entry: $13.00 - $12.00

Take Profit Targets:

$16.00

$18.00

Stop Loss: Below $11.30

Secondary Trade Setup (Deeper Support):

Entry: $10.00 - $9.50

Take Profit: Adjust based on price action

Stop Loss: Below $9.00

This setup targets a bounce from major support, with the potential for a stronger rally if bullish momentum returns. 🚀

inj short midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

INJUSDT 3D#INJ is moving inside a descending channel on the 3-day chart and has bounced back from the channel support. Currently, it is heading toward testing the middle line of the channel. There is very heavy resistance around the $22.00 level. Anyway, our targets for the mid-term are:

🎯 $22.07

🎯 $28.76

🎯 $34.16

🎯 $39.57

🎯 $47.26

🎯 $57.07

inj sell limit"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

INJUSDT NEOWAVE ANALYSISWave A is the fastest and strongest wave on the chart, indicating that the long-term trend is up, and any downward wave is counter-trend.

The pattern is a flat correction, confirmed complete in April 2024 with the drop from $52 to $18.

Currently, we appear to be in an X wave.

The X wave can be labeled as small or large based on its retracement of the entire pattern. Since it is not yet complete, I cannot provide further details based on the monthly chart.

However, the price is likely to fully retrace the $13 low, and it should head lower.