India's inflation data in focus as Modi meets Putin As Indian Prime Minister Narendra Modi engages with Russian President Vladimir Putin in Moscow, the focus back home will shift to the latest inflation figures.

India has faced significant pressure from Western nations to distance itself from Russia following the invasion of Ukraine. However, New Delhi has maintained its ties with Moscow. A key factor in this enduring relationship is energy cooperation, which has played a pivotal role in stabilizing fuel prices and, consequently, inflation in India.

In May 2024, India's annual consumer inflation rate eased to 4.75%, down slightly from 4.83% in April. Projections for the upcoming data suggest a minor decrease to 4.70%.

However, Reuters reports indicate a different trend. According to a poll of 54 economists, inflation in India likely edged up in June, breaking a five-month streak of declines. This increase is attributed to a surge in vegetable prices, driven by extreme weather conditions damaging crops. The poll forecasts inflation rising to 4.80% year-on-year in June, up from 4.75% in May. Food prices, which constitute around half of the overall Consumer Price Index (CPI) basket, are a significant factor in this anticipated rise.

For the exact date and time of these major economic events, import the BlackBull Markets Economic Calendar to receive alerts directly in your email inbox.

The USD/INR potentially maintains its bullish bias, staying above the key 100-day Exponential Moving Average (EMA) on the daily chart. Upside targets include 83.65, the upper boundary of its trading range. On the downside, the 100-day EMA at 83.40 serves as an initial support level for the pair.

INRUSD trade ideas

USDINR Bearish unless it breaks that Resistance.The USDINR pair has been trading within a long-term Rising Wedge pattern since the November 11 2022 Low. The 1W MA50 (red trend-line) has been supporting all the way and in fact has made contact with the price and held on 3 occasions, with the most recent being on June 03.

We are currently bearish as the price remains within the Rising Wedge, targeting its bottom (Higher Lows trend-line) at 83.2150. If however the pair manages to close a 1D candle above Resistance 1 (83.7000), we will take the small loss and open a buy, targeting the Higher Highs at 84.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Indian Rupee Faces Headwinds But May Outperform in BondsThe Indian rupee is currently facing pressure due to a combination of factors:

* **Weakening Chinese Yuan:** The decline in the Chinese yuan, a key regional currency, is putting downward pressure on the rupee.

* **Potential Portfolio Outflows:** Upcoming elections in India are raising concerns about political stability, which could lead foreign investors to withdraw their money from the Indian stock market, further weakening the rupee.

The Reserve Bank of India (RBI) is likely intervening to support the rupee, but the currency remains near its all-time low.

**Opposition Viewpoint**

Congress candidate Anand Sharma blames the current government's policies for the rupee's depreciation and the wider economic slowdown.

**Brighter Spots for Rupee Bonds**

Despite the short-term challenges, there are positive signs for rupee-denominated bonds:

* **Stronger Macroeconomic Fundamentals:** India's improving economic fundamentals could make rupee bonds more attractive to foreign investors.

* **Market Infrastructure Improvements:** Advancements in India's financial markets are making it easier for foreign investors to enter and exit the bond market.

* **Central Bank Reserves:** The RBI's healthy foreign exchange reserves provide a buffer against external shocks.

* **Inclusion in Global Indices:** The upcoming inclusion of Indian bonds in global indices like JP Morgan and Bloomberg is expected to attract significant foreign inflows.

**Potential Outperformance vs. US Bonds**

Analysts believe rupee bonds could outperform US bonds due to:

* **Potentially Lower Rupee Yields:** Rupee bond yields might fall as US rates decline, making them more attractive to investors seeking higher returns.

**Challenges Remain**

The main risk to this optimistic outlook is a potential rise in global oil prices due to geopolitical tensions.

**Overall**

The Indian rupee is facing near-term headwinds, but the long-term outlook for rupee-denominated bonds appears promising. Stronger economic fundamentals, improved market infrastructure, and inclusion in global indices could attract foreign investments and lead to outperformance compared to US bonds.

USD/INR Long (Buy)

Enter At: 83.6198

T.P_1: 83.8357

T.P_2: 84.2813

T.P_3: 84.8017

T.P_4: 85.4276

T.P_5: 85.7789

T.P_6: 86.1611

T.P_7: 86.4859

T.P_8: 86.8564

T.P_9: 87.5423

T.P_10: 87.9545

T.P_11: 88.6104

T.P_12: 89.0118

T.P_13: 89.4886

T.P_14: 89.8233

T.P_15: 90.6218

T.P_16: 91.3954

S.L: 80.4441

Today USDINR chart Analysis.Hello,

As per today chart Analysis, usdinr support & resistance mark on chart, wait for break out.

our new indicator give market Target touches in future.

as per Indicator gives bullish market of USDINR.

if you like my new AI tool for future market Analysis. like it follow me. share your comment.

USDINR Sell opportunity to the 1D MA50The USDINR pair made a direct hit on our 82.700 Target, which we set on our last analysis (January 10, see chart below):

Right now we see the price pulling back within a Channel Down. This is a standard pattern within the long-term Rising Wedge pattern, which as you see out of 7 Bearish Legs all broke below the 1D MA50 (blue trend-line) and only 1 managed to make just a hit-and-rebound.

As a result we are going for a moderate sell Target at 83.100 and then we will reverse to buying, targeting Resistance 1 at 83.700.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Today USDINR level Markhello,

today USDINR level mark on chart, wait for break out.

upside resistance are mark & below support line.

overall today USDINR bullish side.

if u like my analysis like & share. with our new indicator market support & resistance automatic mark on chart only trade as per Break out.

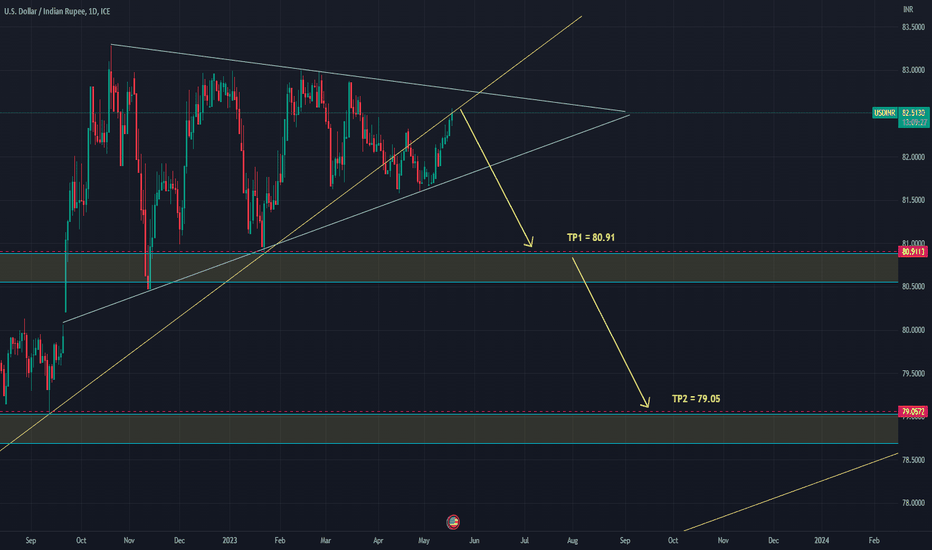

USD/INR sale nowHi everyone! USD/INR pair long was in one range, thereby a narisova a triangle. Now the price drew already 2/3 triangles. Therefore it is possible to expect it breakdown in the nearest future. I expect breakdown of a triangle down. Now the price is close to the upper bound of a triangle therefore the entrance to the transaction is safe. Stop loss can be delivered above a triangle, that is on breakdown up. I consider that the price as a result all the same will achieve the designated objectives (even at breakdown up and leaving up to 88). Technical indicators nap week and monthly schedules showed a turn long ago. So, I sold at the current price 82.53 with the purposes:

TP1 = 80.91

TP2 = 79.05

Information provided is only educational and should not be used to take action in the market.