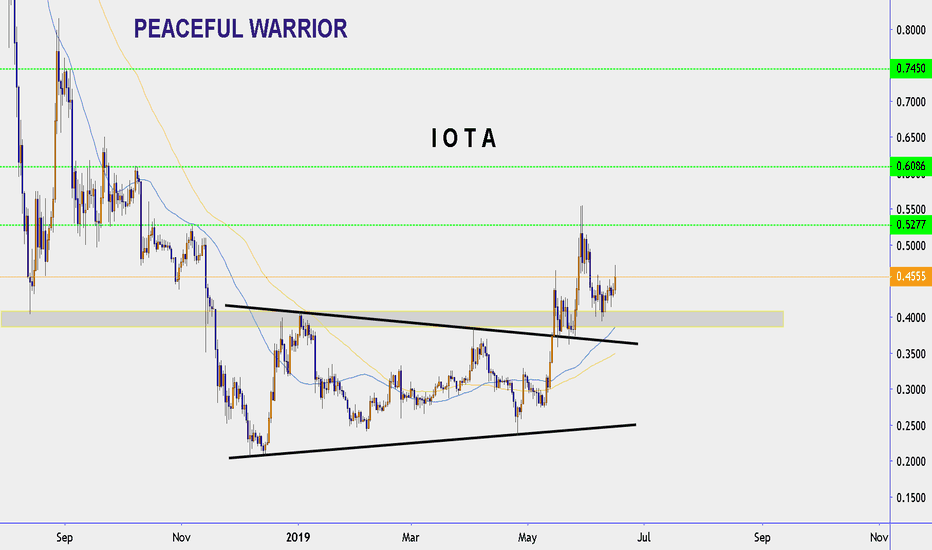

IOTUSD has completed the bullish setup | Upto 1052% profitThe IOTUSD was moving within a descending triangle and left the triangle without breakout or breakdown.

Since july 2017 the price action has found a strong support of $0.2051 and this support is not broken sofar.

The bollinger bands is extreme squeeze which is an indication of a massive move up or down soon.

MACD gave weak bull signals since sep 2018 and now it is strong bullish since aptil 2019.

After the death cross of jun 2018 the 10SMA is making golden cross with 20SMA and both moving averages has crossed down the priceline as well to lift the price action up insha Allah.

The sell targets are:

1st target: $2.26

2nd target: $2.90

3rd target: $3.72

Final targets;$ 4.68

Regards,

Atif Akbar (moon333)

IOTAUSD trade ideas

A second Chance to Buy in IOTAUSDMidterm forecast:

0.4015 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 55.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (0.4015). if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If you missed our first HUNT, you have a second chance to buy above the suggested support line (0.4015).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing", "Hammer" or "Valley", in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 15 BUY trade(s) @ 0.3196 based on 'Valley' entry method at 2019.04.29.

Total Profit: 19315 pip

Closed trade(s): 4366 pip Profit

Open trade(s): 14949 149pip Profit

Closed Profit:

TP1 @ 0.3340 touched at 2019.05.13 with 144 pip Profit.

TP2 @ 0.4015 touched at 2019.05.15 with 819 pip Profit.

TP3 @ 0.4535 touched at 2019.05.16 with 1339 pip Profit.

TP4 @ 0.5260 touched at 2019.05.29 with 2064 pip Profit.

144 + 819 + 1339 + 2064 = 4366

Open Profit:

Profit for one trade is 0.4555 (current price) - 0.3196 (open price) = 1359 pip

11 trade(s) still open, therefore total profit for open trade(s) is 1359 x 11 = 14949 pip

All SLs moved to Break-even point.

Take Profits:

TP5= @ 0.6105

TP6= @ 0.7920

TP7= @ 0.9265

TP8= @ 1.1550

TP9= @ 1.4475

TP10= @ 1.7435

TP11= @ 2.2170

TP12= @ 2.6930

TP13= @ 3.3680

TP14= @ 4.2300

TP15= Free

A second Chance to Buy in IOTAUSDMidterm forecast:

0.4015 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 55.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (0.4015). if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If you missed our first HUNT, you have a second chance to buy above the suggested support line (0.4015).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing", "Hammer" or "Valley", in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 15 BUY trade(s) @ 0.3196 based on 'Valley' entry method at 2019.04.29.

Total Profit: 19315 pip

Closed trade(s): 4366 pip Profit

Open trade(s): 14949 149pip Profit

Closed Profit:

TP1 @ 0.3340 touched at 2019.05.13 with 144 pip Profit.

TP2 @ 0.4015 touched at 2019.05.15 with 819 pip Profit.

TP3 @ 0.4535 touched at 2019.05.16 with 1339 pip Profit.

TP4 @ 0.5260 touched at 2019.05.29 with 2064 pip Profit.

144 + 819 + 1339 + 2064 = 4366

Open Profit:

Profit for one trade is 0.4555 (current price) - 0.3196 (open price) = 1359 pip

11 trade(s) still open, therefore total profit for open trade(s) is 1359 x 11 = 14949 pip

All SLs moved to Break-even point.

Take Profits:

TP5= @ 0.6105

TP6= @ 0.7920

TP7= @ 0.9265

TP8= @ 1.1550

TP9= @ 1.4475

TP10= @ 1.7435

TP11= @ 2.2170

TP12= @ 2.6930

TP13= @ 3.3680

TP14= @ 4.2300

TP15= Free

Downstream channel and triangleIOTA is steady on a downstream channel but is now approaching a bullish trendline that corrected it.

The motion shown is a channel that is being broken with the formation of a triangle.

If the currency breaks up is kind of operation is high risk because it is going against the primary trend, which is high. However it is possible to make good profits, since we wait a pullback

IOTA swing tradeIOTA has given confirmation in USD pair but 50 weekly MA is acting as a resistance. Confirmation in btc pair has not been established. Waiting for confirmation.

Meanwhile look for stability in the BTC pair around this green zone. Entering on 7 Weekly EMA on USD pair is recommended. Break below 21 EMA (either USD and BTC) on weekly invalidates this setup.

#hodl Iota IOTUSD to 1$ first Take Profit.Very good news in this ecosystem, partnerships with big company's & good news revealing this next quarter. Hodl is about patience. Buying in correct places and store your tokens in safe spaces like a hardware wallet is more professional and you are gonna hodl it more time. If you like my content give this post a thumbs up.

Technical Analysis

Buy in the yellow zone for massive accumulation. 0.30 cents is a very good price.

Don´t go to daily and 4H time frame just focus on weekly & monthly charts in altcoins.

We can have a retest of the trend line.

Namaste.

4ª onda/wave?No gráfico diário do IOT identificamos a formação da quarta onda Elliott. Após o movimento dessa quarta onda, temos uma possível quinta onda que nos levará ao rompimento da atual resistência. Então ficaremos atento e caso a quarta onda se confirme (através de um suporte na região demarcada), estaremos em uma região de compras.

In the daily chart of the IOT we identified the formation of the fourth wave Elliott. After the movement of this fourth wave, we have a possible fifth wave that will lead us to the breaking of the current resistance. Then we will be attentive and if the fourth wave is confirmed (through a support in the demarcated region), we will be in a shopping region.