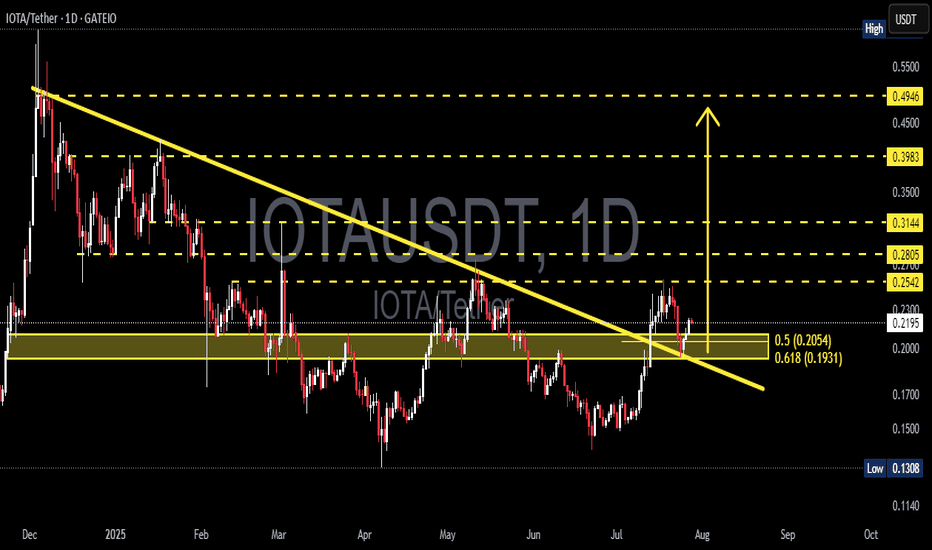

IOTA/USDT – Major Breakout from Long-Term Downtrend!📊 Chart Overview

After spending several months under pressure within a long-term descending trendline since December 2024, IOTA has finally shown a highly promising technical signal. The recent breakout didn’t just pierce the trendline — it was confirmed by a successful retest of the golden Fibonacci zone, a classic reversal trigger in technical analysis.

> This is a classic early sign of a potential trend reversal, often followed by strong momentum plays.

---

🧠 Structure & Pattern: Signs of a Macro Reversal

✅ Descending Trendline Breakout

Price has broken through a major downtrend line that had held for over 7 months, signaling a shift in market dynamics from sellers to buyers.

✅ Fibonacci Golden Pocket Retest (0.5–0.618)

The pullback landed perfectly at the golden pocket (0.2054–0.1931), a highly watched confluence area for reversals. Price bounced right from this support, showing buy-side strength.

✅ Demand Zone Activation

The yellow box highlights a previous accumulation zone that now acts as strong demand, reinforcing the potential for an upward continuation.

---

🟢 Bullish Scenario (Structured Upside Potential)

If the price holds above 0.2054:

Short-Term Targets:

📈 0.2542 → Minor resistance & previous breakout area

📈 0.2805 → Key psychological zone and past rejection area

Mid–Long-Term Targets:

💰 0.3144 → Historical resistance

💰 0.3983 → Fibonacci extension zone

💰 0.4946 → Final major resistance before the previous macro downtrend

Confirmation:

A daily candle close above 0.2542 with increasing volume would strongly validate the bullish continuation.

---

🔴 Bearish Scenario (Potential Fakeout Risk)

If the price fails to hold above the 0.1931 zone:

⚠️ It may turn into a fake breakout, indicating that buyers weren’t strong enough to sustain the breakout.

Downside targets to watch:

🧱 0.1700 → Minor psychological support

🧱 0.1308 → Previous macro low and critical support

---

🎯 Conclusion & Trading Strategy

IOTA is currently at a critical decision point, balancing between a confirmed macro reversal and a possible fakeout. However, the technical breakout above a long-standing trendline — combined with a retest of the golden pocket zone — puts bulls in a favorable position for a potential rally.

🔍 What to watch next:

Price action above 0.2200–0.2540

Volume confirmation on breakout levels

This setup is ideal for early trend traders, swing traders, or position traders looking to ride a larger bullish wave with well-defined risk.

#IOTAUSDT #CryptoBreakout #MacroReversal #FibonacciSupport #BullishSetup #AltcoinAnalysis #CryptoTechnicalAnalysis #TrendlineBreak #BuyTheDip

IOTAUSDT trade ideas

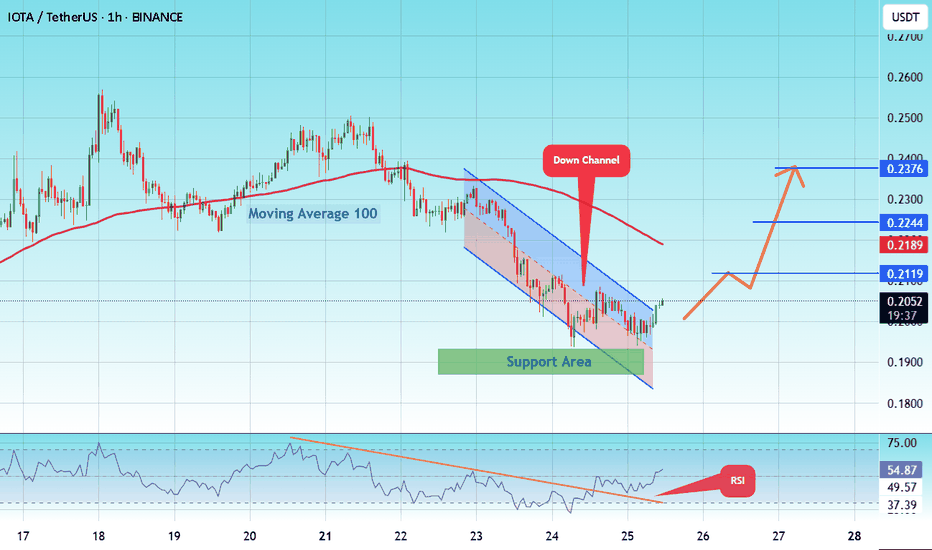

#IOTA/USDT T looking good to buy #IOTA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.1847, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.1880.

Entry price: 0.2054

First target: 0.2119

Second target: 0.2244

Third target: 0.2376

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

IOTA / USDT looking good to buy at the price of $0.2100IOTA/USDT faced rejection from local horizontal resistance and is now heading for a retest of the lower support zone. If market conditions remain stable, the $0.2100 area looks like a solid buy zone. The structure suggests a healthy pullback before a potential strong bounce.

IOTA/USDT Weekly Analysis – Critical Support Retest

📊 Pattern & Price Structure:

The chart indicates that IOTA is currently retesting a major historical demand zone in the range of $0.110 – $0.160, which has served as a strong support since 2020. The price has bounced off this area multiple times in the past, reinforcing it as a solid accumulation zone.

There is also a potential formation of a double bottom or accumulation range around this level, which often acts as the foundation for a major reversal if accompanied by volume and momentum.

🟢 Bullish Scenario:

If this support holds and buyers show strength:

1. The price could rebound and test key resistance levels:

$0.2454 (initial resistance)

$0.3496

$0.4000

$0.4751

2. A breakout beyond those levels may trigger further upside targets at:

$0.8982 (weekly key resistance)

$1.4913

$2.000

$2.390 and potentially even $2.677

3. Bullish catalysts such as positive fundamental news, rising market sentiment, or visible accumulation volume could spark an explosive move.

🔴 Bearish Scenario:

If the price fails to hold the $0.110 – $0.160 support zone:

1. A breakdown could lead to a decline toward previous extreme lows around:

$0.0700 – $0.0534

2. This would signal a loss of long-term buyer interest and open the door to deeper bearish continuation.

⚠️ Technical Conclusion:

The yellow zone is a make-or-break level — bulls must defend this to maintain any bullish structure.

As long as IOTA stays above $0.110, the risk-reward favors a bullish reversal.

A confirmed bullish weekly candle and volume spike would strengthen the bullish outlook.

📌 Key Levels:

Major Support Zone: $0.110 – $0.160

Resistance Levels to Watch:

$0.2454 → $0.3496 → $0.4000 → $0.4751 → $0.8982 → $1.4913 → $2.000 → $2.390 → $2.677

#IOTA #IOTAUSDT #CryptoAnalysis #AltcoinBreakout #TechnicalAnalysis #BullishReversal #CryptoSetup #SupportAndResistance

IOTA/USD PREDICTION**IOTA** is a unique distributed ledger technology designed specifically for the Internet of Things (IoT). Unlike traditional blockchains, IOTA uses a system called the **Tangle**, a directed acyclic graph (DAG) that allows for **feeless transactions** and high scalability. This architecture enables each new transaction to validate two previous ones, removing the need for miners and reducing transaction costs to zero. This makes IOTA ideal for microtransactions and machine-to-machine communication—key elements in the rapidly growing IoT ecosystem.

Over the years, IOTA has evolved significantly, improving its security, decentralization, and usability. With the release of **IOTA 2.0 (Coordicide)** on the horizon, the network aims to remove the centralized Coordinator node, marking a major step toward full decentralization. This upgrade is expected to bring increased network resilience, faster confirmation times, and better support for smart contracts and decentralized applications. IOTA’s partnerships with global corporations and ongoing development suggest a promising future as a foundational layer for the next generation of digital infrastructure.

so just like that

IOTA Is Showing a Dangerous Pattern! Don't Ignore This SignalYello, Paradisers! Are you watching what’s forming beneath the surface of #IOTA’s slow drift? While the market sleeps on this coin, a dangerous structure is developing, and if this key support breaks, we could see a fast and painful selloff few are prepared for.

💎After months of low momentum, IOTA is now beginning to show signs of a head and shoulders pattern, a classic bearish reversal formation. This is a structure which cant be ignored, especially not at this stage of the market.

💎#IOTAUSDT neckline support lies between $0.1600 and $0.1500, a range that bulls have barely managed to defend over the past several weeks. If this zone breaks, the confirmation will be triggered and sellers will likely dominate, pushing price lower in a decisive move.

💎The first downside target sits at $0.1350, where moderate support exists. However, this level may not be strong enough to absorb selling pressure if the market sentiment remains weak.

💎If sellers manage to breach $0.1350, expect an accelerated move toward $0.1130–$0.1030. This deeper zone represents major structural support, where a stronger bullish reaction could finally take place.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

TradeCityPro | IOTA: Testing Key Resistance in RWA-DePIN Rally👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the IOTA coin for you. This project is one of the RWA and DePIN-based initiatives and is among the older projects in this category.

✔️ The coin has a market cap of $822 million and ranks 85th on CoinMarketCap.

📅 Daily Timeframe

As you can see on the daily timeframe, after finding support at 0.1547, the price initiated a bullish leg and moved up to the resistance zone I’ve marked.

💥 This area is a very significant resistance zone, and in this bullish leg, the price has reached it for the first time and got rejected.

🔍 In my view, as long as the price hasn’t confirmed a breakout above 0.1960, the chance of starting a downtrend is higher than continuing the current uptrend. If this resistance zone is broken, we can consider it strong confirmation of buyer strength.

📈 For a long position, we can enter on the breakout of this same zone. For spot buying, this trigger can also be used, but the main long-term triggers are 0.3774 and 0.4918.

⚡️ On the RSI oscillator, there's an important zone at the 50 level. If this level is broken, the probability of breaking 0.1960 increases. If that happens, the next support zone will be 0.1547.

📊 Make sure to pay close attention to volume. If any of our triggers are activated without volume confirmation, the likelihood of a fake breakout increases.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

IOTAUSDT UPDATE

IOTA Technical Setup

Pattern: Falling Wedge Breakout

Current Price: $0.2097

Target Price: $0.38

Target % Gain: 90.97%

Technical Analysis: IOTA has broken out of a falling wedge on the 1D chart, confirming bullish momentum with a strong price surge and volume spike. A retest of the breakout zone appears to be holding well.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

#IOTA/USDT#IOTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2125.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2135

First target: 0.2261

Second target: 0.2364

Third target: 0.2483

IOTA Analysis (1D)IOTA has a bullish structure on the higher timeframes. It is currently approaching a support zone through a time-based correction.

We are looking for buy/long positions around the POI (Point of Interest) zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

IOTA: Your Altcoin Choice (S3.5)IOTAUSDT was producing lower lows until November 2024, then it went bullish and the correction of this bullish wave ended as a strong higher low. This is the 7-April low three weeks ago. Now IOTAUSDT is full green on the third week. Growing non-stop since the bottom was hit.

So the charts are great. We can see the bear market, a consolidation period and then a recovery phase. Now comes the next stage of the cycle and this is a new bull market. See the action in 2021 for reference. Massive growth ahead.

Some targets can be seen on the chart. These are not potential ATH projections but rather conservative targets. Total growth in 2025 can be much more and it seems possible that the bull market will extend into 2026 because time is needed for massive growth.

The next cycle top can happen in November 2025 just as it can happen in February or March 2026, too early to know.

If we take November 2024 as the market bottom and count 1 year and 1 month for the totality of the bullish phase, this would put a new cycle top around December 2025, give or take a few days.

That's just the map. This can give you an idea of what to expect.

Plan and ahead and prepare.

I am wishing you great profits, ease in your personal growth journey and financial success.

May your life be blessed with abundance.

Thanks a lot for your continued support.

Namaste.