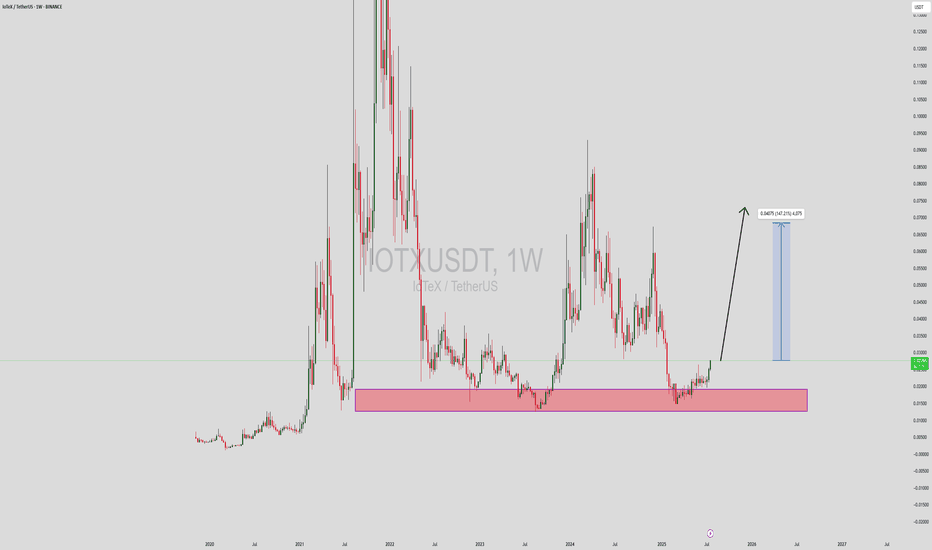

IOTXUSDT Forming Poetntial ReversalIOTXUSDT has recently shown strong signs of a potential reversal after revisiting its long-term demand zone, marked in pink on the weekly chart. This historical support region has consistently acted as a springboard for major bullish moves in the past, and the current price action indicates a similar accumulation pattern forming again. With the recent bullish momentum and a clear bounce from this critical zone, IOTXUSDT is now poised for a possible 90% to 100% gain in the coming weeks.

The volume structure remains healthy, with increased buyer activity as the price pushes higher. A clear break above the consolidation range confirms growing investor confidence, backed by rising interest in IoTeX’s real-world use cases and expanding ecosystem. The coin is now attempting to reclaim key resistance levels, which could open the path toward the $0.04–$0.045 region—aligned with a 147% move from current levels, as illustrated on the chart.

IOTXUSDT is gaining momentum among mid-cap altcoins, driven by both technical strength and renewed interest in blockchain solutions focused on IoT (Internet of Things). The project’s consistent development progress and real-world integrations make it an attractive hold for long-term investors, while short-term traders may benefit from this emerging trend breakout setup.

Keep a close eye on continuation patterns and volume surges, which may offer strong entry opportunities. This setup reflects classic technical dynamics that align with previous successful cycles in IOTX, and could be one of the more rewarding medium-term holds of this altcoin season.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

IOTXUSDT trade ideas

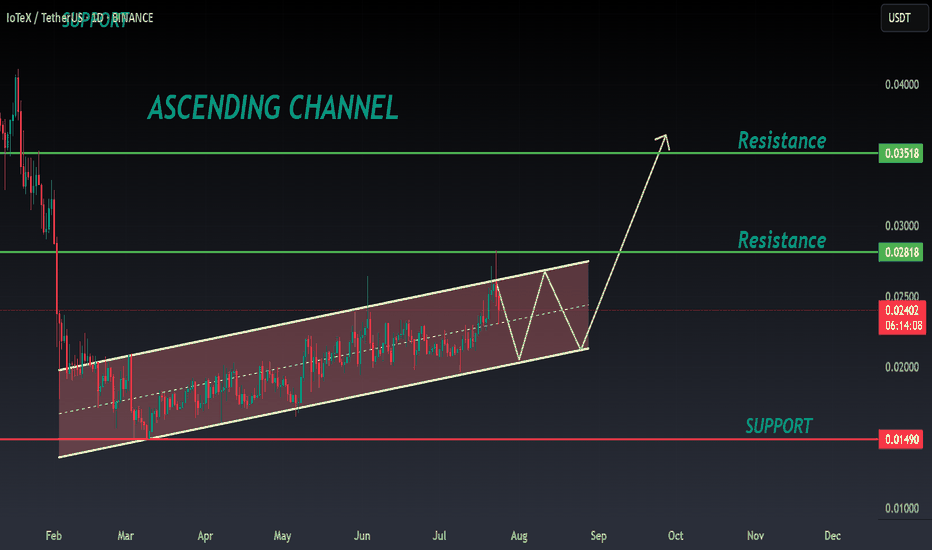

IOTX ANALYSIS🔆#IOTX Analysis : Channel Following ⛔️⛔️

As we can see that #IOTX is following ascending channel on daily time frame. We can see a bullish formation here. And if it trade with good volume then we can see a proper bullish move in #IOTX 📈📈

🔖 Current Price: $0.02400

⏳ Target Price: $0.03500

⁉️ What to do?

- Keep your eyes on the chart, observe trading volume and stay accustom to market moves.🚀💸

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#IOTX #Cryptocurrency #ChartPattern #DYOR

IOTX/USDT Weekly – Massive Bullish Setup Forming at Historical🔍 Technical Analysis Breakdown:

The IOTX/USDT pair is currently consolidating inside a strong historical accumulation zone between $0.0125 and $0.0172, which has served as a critical support area multiple times since 2021. This zone is marked by long-term investor interest, making it a potential launchpad for a major trend reversal.

What makes this zone particularly significant is that it aligns with a potential Double Bottom formation on the weekly timeframe — a classic bullish reversal pattern indicating that sellers are exhausted, and buyers are regaining control.

The projected price path on the chart shows a possible multi-leg breakout scenario, with higher highs forming in a wave structure that hints at a medium-to-long-term bullish trend.

✅ Bullish Scenario – Path of Least Resistance:

If the price successfully holds above the key demand zone and breaks above the first resistance level at $0.03221, the next upside targets to watch are:

1. 🟡 $0.04217 – Weekly resistance from a prior consolidation phase.

2. 🟡 $0.05976 – A psychological resistance and former breakdown zone.

3. 🟡 $0.08271 – $0.10163 – Strong supply zones from the 2022 bearish structure.

4. 🟢 $0.23539 (Final Target) – All-time high region, could be tested in a full bull cycle.

This bullish structure suggests a potential +800% upside from current levels if macro and market sentiment align in favor.

❌ Bearish Scenario – Caution if Support Breaks:

If IOTX loses the key support zone (closes weekly below $0.0125), then:

The market could re-enter a bearish accumulation, risking a move toward new all-time lows.

Momentum would shift back in favor of sellers, invalidating the double bottom structure.

Traders should then wait for signs of re-accumulation or divergence before re-entering.

📉 Volume & Momentum Insight:

Volume remains low but stable, signaling that smart money may be accumulating quietly.

If breakout occurs with a volume spike, this will act as strong confirmation for bullish continuation.

🧠 Conclusion:

IOTX is showing early signs of a major bullish reversal from a well-respected accumulation base. With multiple targets layered above and a clean invalidation zone below, this setup offers high reward-to-risk potential. Watch for a confirmed breakout above $0.032 to validate the beginning of a strong uptrend.

#IOTX #IOTXUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #CryptoSetup #BullishCrypto #IoTeX #CryptoTrading #AccumulationZone

IoTeX 4 Months Bottom Consolidation, Time To GrowThis is one of the best types of chart setups, very low risk and a high potential for reward. Let me explain.

IOTXUSDT hit bottom mid-March, after this bottom, it has been consolidating bullish for more than three months. If we take the drop produced in early February as the start of the consolidation phase, we are talking about more than four months sideways, this is huge. Four months sideways simply means a very long and strong consolidation phase. The longer the consolidation phase the stronger the bullish wave that follows, and bullish is what is coming next.

Notice the higher highs and higher lows. Shy, small; slow and steady growth, but still higher since March. This reveals the broader bias and market trend. IoTeX is set to grow and it will produce a very strong bullish wave. It is only weeks away. Consolidation can only go for so long and it has been already more than four months.

This is an easy pair, an easy trade. Buy and hold.

Namaste.

IOTX/USDTKey Level Zone: 0.02010 - 0.02130

HMT v8.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

IOTXUSDT🚀 IoTeX (IOTX): A Hidden Gem for Short-Term Gains & Long-Term Growth?

Looking for a crypto project with real-world utility and strong upside potential? IoTeX (IOTX)—a decentralized platform powering the Internet of Things (IoT)—might be worth your attention.

Why IoTeX?

✔ Innovation Meets IoT: Combines blockchain + IoT for secure, privacy-focused machine-to-machine (M2M) ecosystems.

✔ Partnerships & Adoption: Backed by industry giants (like Samsung) and used in real-world applications (smart devices, DePIN).

✔ Price Potential: Volatility offers short-term trading opportunities, while long-term growth aligns with IoT’s explosive expansion (projected $2.4T market by 2029).

📌 Short-Term: Watch for bullish trends amid crypto market rebounds and project updates.

📌 Long-Term: HODL potential as IoT adoption grows and IoTeX cements its niche.

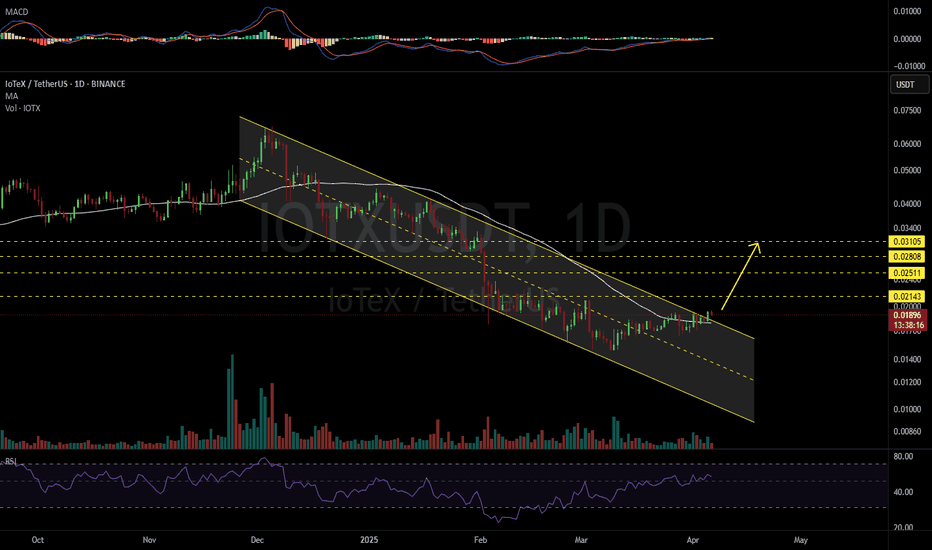

IOTX buy/long setup (1D)An important trigger line has been broken, and the price has been moving sideways for a while.

There is also a bullish CH on the chart.

It is expected that the price will make a pullback to the support zone and then move toward the supply zones higher on the chart. We are looking for buy positions at the entry points.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

IOTX Is Still Bullish (12H)The important trigger line has been broken, and the price has recently formed the main bullish CH (Change of Character).

If the demand zone holds, the price may move toward the flip line.

A daily candle closing below the invalidation level would invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Is it going to happen? IOTX/USDT Potential upword movment ?While IOTX is currently exhibiting bearish indicators, such as trading below significant moving averages and a bearish MACD crossover, the RSI suggests it is not yet in oversold territory. The increased volume during price dips may indicate accumulating interest at lower levels, potentially providing a foundation for future price stabilization or upward movement.

#IOTX/USDT#IOTX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.01877.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.01886

First target: 0.01922

Second target: 0.01949

Third target: 0.01991

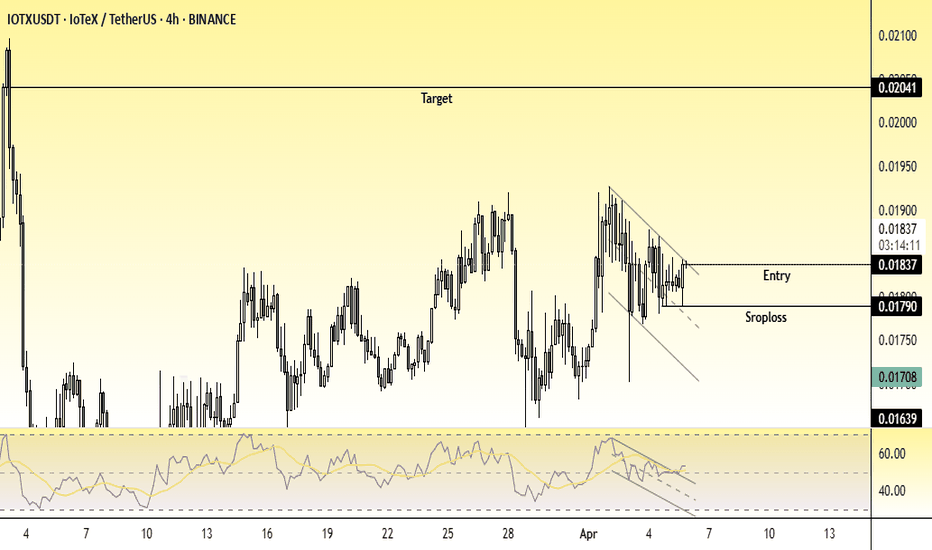

IOTXUSDT 4HOUR📊 Technical Breakdown

📈 Pattern: Falling Wedge (Bullish Reversal)

The price broke out of a falling wedge, a bullish reversal pattern.

Wedge breakout occurred with a slight increase in volume and RSI confirmation, indicating momentum shifting towards bulls.

💵 Entry Level

Marked near 0.01838 USDT, right at the breakout level from the wedge.

🎯 Target (Take Profit)

Highlighted at 0.02041 USDT

This aligns with a previous resistance level — a sensible target if the breakout continues to gain strength.

🛑 Stop Loss (SL)

Positioned at 0.01790 USDT

Just below recent lows and the lower wedge boundary — a reasonable risk management level.

📉 RSI Indicator

RSI shows bullish divergence, indicating upward momentum building while the price was declining.

RSI is heading upward, nearing the mid-50 level, supporting further bullish movement if it breaks above 60.

✅ Summary: Trade Setup

Parameter Value

Entry 0.01838 USDT

Stop Loss 0.01790 USDT

Take Profit 0.02041 USDT

Risk/Reward Approx. 1:4

IOTXUSDT | Key Resistance Zone Identified – Trade SmartIOTXUSDT has reached a critical resistance zone marked by the red box. This is the first major level where sellers could step in, making it an important area to monitor. Blindly entering positions here is a rookie mistake—as always, we need confirmations.

🔴 Short Setup Considerations:

✔️ LTF Market Structure Breaks – A clean rejection from the red box with lower time frame breakdowns is key.

✔️ CDV & Volume Confirmation – If sellers are in control, volume will confirm it. No volume? No trade.

✔️ Precision Over Impulsiveness – The difference between amateurs and professionals is discipline. We wait for the market to show its hand before acting.

🟢 What If Resistance Breaks?

If price pushes above the red box with strong volume and successfully retests it as support, then I will shift my bias towards long setups. Reacting, not predicting, is what keeps us ahead of the market.

Why My Levels Matter

These zones aren’t picked randomly—they are carefully selected based on advanced trading techniques that most traders don’t even understand. That’s exactly why my success rate is unmatched. I focus on the highest volume gainers of the day, ensuring I’m always trading the most relevant setups.

Follow my levels, trust the process, and stop trading in the dark.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

iotex is best depin projectIoTeX (IOTX) has recently garnered significant attention in the cryptocurrency market, particularly following a substantial $50 million investment from a consortium of venture capital firms. This infusion of capital is poised to accelerate the growth and adoption of Decentralized Physical Infrastructure Networks (DePIN), positioning IoTeX for a promising future. citeturn0search14

**Strategic Investments and Partnerships**

The recent $50 million funding round, led by prominent investors such as Borderless Capital and Amber Group, underscores the confidence in IoTeX's vision and technological capabilities. These strategic partnerships are expected to enhance IoTeX's infrastructure and expand its ecosystem, fostering increased adoption and utility of the IOTX token. citeturn0search2

**Market Performance and Future Projections**

As of now, IOTX is trading at approximately $0.0201, with a 24-hour trading volume of around $9.49 million. The token has experienced a slight decline of 1.68% in the past day.

Looking ahead, various analyses offer optimistic projections for IOTX. For instance, CoinCodex forecasts that IoTeX could reach a high of $0.2922 by 2025, representing a potential increase of over 1,350% from its current price. citeturn0search1 Similarly, DigitalCoinPrice anticipates that IOTX may reach $0.068 by 2025 and $0.16 by 2030, indicating sustained growth over the long term.

The substantial venture capital investment, coupled with strategic partnerships and favorable market projections, suggests a promising trajectory for IoTeX. As the platform continues to develop and expand its DePIN initiatives, the value of IOTX is well-positioned for significant appreciation in the coming years.

*Note: This analysis is based on information available as of February 10, 2025. Investors are advised to conduct their own research and consider market dynamics before making investment decisions.*