IPUSDT trade ideas

IP/USDTKey Level Zone: 4.300 - 4.450

HMT v8.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

IPUSDT | Long | Technical Rebound from Demand Zone | (May 2025)IPUSDT | Long | Technical Rebound from Demand Zone | (May 2025)

1️⃣ Quick Insight:

IPUSDT has been trending down, but it's still respecting technical levels well. I'm watching for a potential long setup as it corrects back into a key demand zone.

2️⃣ Trade Parameters:

Bias: Long

Entry: Around $3.75 (waiting for a corrective move into this area)

Stop Loss: $3.26

TP1: $4.36

TP2: $5.43

TP3: $6.12

Partial Exits: I may take most of the position off by TP2 (~15% move), then let the rest run toward TP3 if the market allows.

3️⃣ Key Notes:

Right now, there's not much fundamental backing—volume and interest seem low—but technically, the asset is still respecting structure. I’m not expecting a major macro reversal, just a technical bounce. Market-wide liquidations seem to have cleared out weak hands, so this could be a cleaner move if it plays out. Risk management is key here. Don't overleverage, especially in uncertain conditions.

4️⃣ Follow-up:

I’ll keep an eye on the price action and may update this idea if conditions change. Entry only triggers if we see a correction into the $3.75 zone.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

Is crypto dead? NO! IP might save the day!Price Action Analysis

NYSE:IP recently declined to the $3.67 level, effectively sweeping external liquidity by triggering stop-loss orders below key support. This move was followed by a strong recovery, with price fully absorbing the bearish momentum and closing within the global trading range. This price action resulted in a Market Structure Shift (Change of Character, or ChoCH), indicating a potential reversal from bearish to bullish sentiment. The ChoCH suggests institutional buying interest, as the market rejected further downside and reestablished bullish structure.

However, caution is warranted. Bitcoin ( CRYPTOCAP:BTC ), a key market driver, may experience a corrective move lower, potentially influencing NYSE:IP ’s price action. As such, immediate entries are premature without further confirmation of bullish momentum.

Key Levels and Trade Setup

Break of Structure (BoS) at $4.28

The $4.28 level on the daily timeframe is pivotal, representing a potential Break of Structure (BoS). A decisive close above this level would confirm bullish continuation, signaling the start of a significant upward move. Should this occur, NYSE:IP is likely to target the following resistance zones:

$6.61: Initial target, likely aligning with prior swing highs or liquidity pools.

$6.98: Secondary target, potentially coinciding with a Fair Value Gap (FVG) or institutional sell-side liquidity.

$7.46: Final target, representing a high-probability zone for profit-taking.

Entry Confirmation

To ensure a high-probability trade, the following conditions must be met:

Daily BoS Confirmation: A clean break and close above $4.28 on the daily chart, supported by elevated trading volume.

4-Hour Timeframe Validation: A breakout above $4.28 on the 4-hour (4H) or higher timeframe, ideally accompanied by a bullish Fair Value Gap (FVG). An FVG forming on the 4H chart post-breakout would serve as an optimal entry zone, minimizing risk by aligning with institutional order flow.

Pullback to FVG: Post-breakout, a retracement to a 4H bullish FVG (e.g., $4.20–$4.25) that holds as support would confirm the setup for a long position.

Trade Execution

Set Alerts: Configure price alerts at $4.28 to monitor for a daily or 4H breakout. Ensure alerts trigger on a candle close above this level to confirm BoS.

Risk Management: Risk no more than 1–2% of trading capital per trade. Position size should be calculated based on a stop-loss placed below the FVG or recent swing low (e.g., $4.00–$4.10), targeting a minimum risk-reward ratio of 5:1.

Exit Strategy: Take partial profits at $6.61 (50–70% of position) and trail stops for the remaining position toward $6.98 and $7.46, monitoring for signs of rejection or bearish structure at these levels.

Bitcoin Correlation

Given CRYPTOCAP:BTC ’s influence on altcoin price action, monitor its key levels closely. A potential corrective move in CRYPTOCAP:BTC could lead NYSE:IP to retest lower supports (e.g., $3.85 or $3.67). Set a secondary alert at $3.85 to watch for a bounce in case of a broader market pullback. Conversely, a stabilization or bullish breakout in CRYPTOCAP:BTC would enhance the likelihood of NYSE:IP ’s bullish setup materializing.

Conclusion

NYSE:IP presents a compelling technical setup, with a ChoCH at $3.67 signaling a potential bullish reversal and $4.28 as the critical level for BoS confirmation. Traders should set alerts at $4.28, await a clean 4H or daily breakout with FVG formation, and execute entries with disciplined risk management. Monitoring CRYPTOCAP:BTC ’s price action is essential to avoid adverse market-wide corrections. This setup offers a high-probability opportunity for significant upside, provided the outlined conditions are met.

Breaking: Story Coin ($IP) Tanked 14% Today The price of Story coin ( NYSE:IP ) has recently dipped 14% for the past 24 hours but recent price action indicates build up momentum to reclaim loss grounds.

Story coin ( NYSE:IP ) a Layer 1 (L1) blockchain designed to serve as the foundation for intellectual property (IP) on the internet. It enables creators to register, license, and monetize their IP assets seamlessly. By leveraging blockchain technology, Story provides a transparent and efficient framework for IP attribution, licensing, and commercialization.

Technical Outlook

As of the time of writing, NYSE:IP is up 1.27%. the asset is trying to bounced off of the support point with momentum building as hinted by the RSI at 47, NYSE:IP is getting ready for a breakout to the 38.2% fib level.

Story Price Live Data

The live Story price today is $3.88 USD with a 24-hour trading volume of $118,805,575 USD. Story is down 7.65% in the last 24 hours. The current CoinMarketCap ranking is #62, with a live market cap of $1,040,840,390 USD. It has a circulating supply of 268,456,342 IP coins and the max. supply is not available.

IP – Ready for Lift-Off?The setup has been unfolding beautifully, and the momentum is now shifting.

Our analysis suggests a strong bullish breakout is imminent.

Wave structure is aligned, support is holding, and the path higher looks open.

We’ve been tracking this patiently—now it’s showtime. 📈

Let’s ride the wave.

IP ANALYSIS🔮 #IP Analysis 💰💰

🌟🚀 As we can see that #IP is trading in a symmetrical triangle and there was a breakdown of the pattern. Last time there was a bullish move from the same support level. We can expect again a bullish momentum from its major support level🚀🚀

🔖 Current Price: $4.190

⏳ Target Price: $5.500

#IP #Cryptocurrency #DYOR

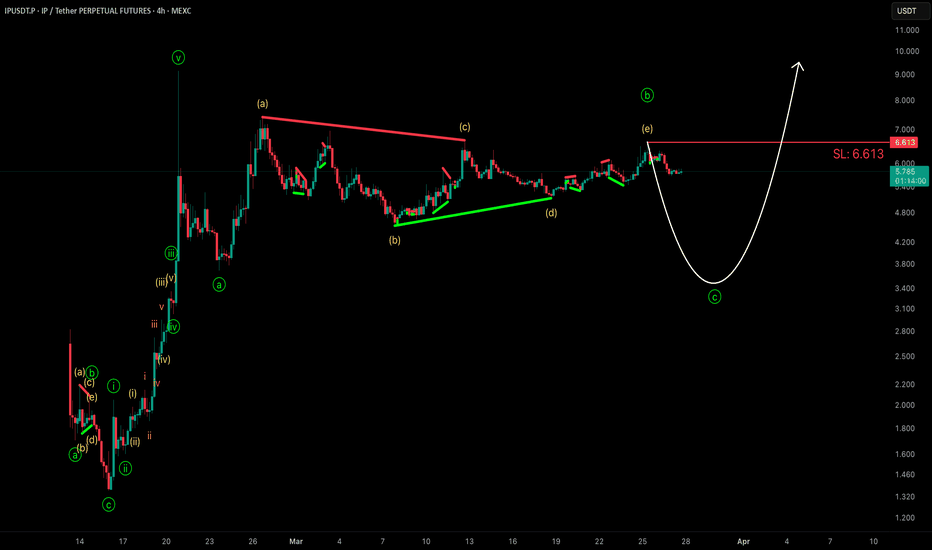

IP – Short-Term Bearish OutlookIP is expected to decline to $3.6 after completing a triangle in Wave B, now moving lower to finalise Wave C as part of an ABC pullback.

⚠️ Key Level: Any touch of $6.613 would invalidate this short-term bearish structure. Stay vigilant and monitor price action closely!

IPUSDT → Exit from the triangle may trigger a distribution ofBINANCE:IPUSDT.P is forming positive preconditions for possible growth. Bitcoin slightly revitalized the market after positive news related to SEC and XRP (the crypto community did not miss this fact)

The IP coin was in consolidation for a long time - a symmetrical triangle. Rising lows, consolidation, breakout of triangle resistance give positive signs of readiness for distribution (realization of consolidation). Ahead is the key resistance at 5.6297 separating the market from the free zone

Resistance levels: 5.6297, 6.631

Support levels: 5.116, 4.783

Price has been sticking to triangle resistance for the past few days and is gaining potential for breakout and realization. Numerous intraday retests of the area indicate the market's interest to break beyond this zone. A breakout of 5.6297 and price consolidation above the triangle will be a good signal of readiness to go up.

Regards R. Linda!

IP/USDT: BREAKOUT ALERT!!🚀 Hey Traders! IP Breakout Alert – 80% Move on the Horizon? 👀🔥

If you’re pumped for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 IP/USDT – Massive Breakout in Play! 🚀

IP is breaking out from a triangle on the 4H timeframe and looks primed for a 70-80% upside move. This setup has huge potential, making it a must-watch trade. 💥

💰 Trade Setup:

📍 Entry: $6.10 – $6.35

🎯 Targets: $6.96 / $7.84 / $8.92 / $11.2 📈

🛑 Stop-Loss: $5.78

⚡ Leverage: Use low lev (Max 5x)

🔎 Strategy:

✅ Enter with low leverage now

✅ Add more on dips and ride the breakout momentum 🚀

💬 What’s Your Take?

Are you bullish on IP’s breakout potential? Share your targets, analysis, and predictions in the comments! Let’s crush it and lock in those gains! 💰🔥🚀

IP/USDTKey Level Zone: 5.0600 - 5.2800

HMT v7 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

IP Looks Bullish (4H)Note: This chart carries its own specific risks. Proper risk management, leverage control, and stop-loss are essential.

It appears that IP is in a bullish dual structure and currently in the second ABC pattern. More precisely, it is in Wave B of this ABC, which is forming a triangle. Currently, we are at Wave E, the final part of the triangle.

If the demand zone holds, the price may move toward the targets.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#IP: Unlocking the Power of Decentralized Data

Description:

This trading idea focuses on IP, a cryptocurrency designed to revolutionize data storage, security, and ownership through blockchain technology. By leveraging decentralized infrastructure, IP aims to provide a transparent, secure, and censorship-resistant way to store and manage digital assets. With growing concerns over data privacy and centralized control, IP presents a promising solution that aligns with the increasing demand for decentralized file storage and intellectual property protection. As blockchain adoption expands, IP could gain significant traction in various industries, making it an asset to watch.

Despite its potential, the cryptocurrency market is highly volatile, with price movements influenced by regulatory developments, technological advancements, and macroeconomic conditions. As such, trading and investing in IP require a well-planned strategy and risk management approach.

Disclaimer:

This trading idea is for educational purposes only and should not be considered financial advice. Trading cryptocurrencies like IP carries substantial risks, including the potential for complete loss of capital. Always perform thorough research, evaluate your financial situation, and consult with a professional financial advisor before making investment decisions. Past performance is not indicative of future results.

IP: Wave 3 Setup – Breakout Above $9 Incoming?Since the bottom at around $4.518, we believe IP has moved up in a clear 5 waves and then corrected in a clear 3 waves. We see a potential trend reversal, with IP poised to start wave 3 on a larger timeframe, aiming to break the all-time high of $9. This setup offers an excellent risk-to-reward opportunity and is definitely worth considering.

Story IP price analysisDespite the terrible Feb of 2025 for the crypto market in general, there is a ray of hope for the coins that have just been launched.

#IP - #KAITO - #PI, what connects these coins? After the listing, the price makes a slight correction and starts to grow steadily, rather than falling below the -70-80% floor, as it has been the case with almost all new coins in the last 6-12 months.

As for the OKX:IPUSDT price, a correction to $5-5.10 is completely acceptable now, it is not necessary and impossible to go lower to continue growth.

Just hypothetically, how much would you be willing to sell your #Story #IP coins for?

$9, $11, $15, or maybe $20 or even $29?

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#IPUSDT – Long Setup, Testing Resistance ZoneLONG BYBIT:IPUSDT.P from $7.0000

🛡 Stop Loss: $6.6900

⏱ 1H Timeframe

✅ Market Analysis:

📍 The BYBIT:IPUSDT.P price is showing strong upward momentum, breaking key resistance levels.

📍 The asset has held above the $6.8982 level, which may confirm a continuation of the uptrend.

📍 POC (Point of Control) at $4.8742 – the highest volume area, previously serving as a consolidation point.

🎯 TP Targets:

💎 TP 1: $7.3100

🔥 TP 2: $7.6200

⚡ TP 3: $7.8600

📢 Holding above $6.8982 could confirm trend strength.

📢 A dip toward $6.6900 (stop loss) could be a fakeout – monitoring price action is crucial.

📢 The $7.3100 level is the first TP, where a retracement may occur before further upside.

📢 If the price breaks $7.6200, the move toward $7.8600 becomes more likely.

🚀 BYBIT:IPUSDT.P is showing strength – monitoring the $7.0000 breakout and securing profits as the price moves up.

The IP/USDT pair is set to skyrocket soon! The IP/USDT pair is set to skyrocket soon! 🚀 Get ready for a massive move!

IP/USDT Targeting $7 and $9 – Bullish Momentum Ahead! 🚀

The IP/USDT pair is showing strong bullish momentum, with key take profit (TP) levels set at $7 and $9. As buying pressure continues to build, traders should watch these targets closely:

✅ First TP at $7 – A key resistance level where partial profit-taking may occur. Breaking above could signal further upside.

✅ Second TP at $9 – If momentum continues, we could see a push toward this higher target, potentially setting new all-time highs.

With the market favoring bullish sentiment, IP is positioned for a strong breakout. Keep an eye on volume and resistance levels—this run could be just getting started! 🚀🔥

#IPToken #BullishUptrend #CryptoTrading #TakeProfit #StoryProtocol #AltcoinSeason #CryptoGains #CryptoSignals #TradingStrategy #MoonMission

#IPToken #BullishUptrend #CryptoBoom #StoryProtocol #CryptoTrading #AltcoinSeason #Blockchain #MoonMission #CryptoNews #BuyTheDip #CryptoGains