AUDJPY Strategy That Outsmarts the Noise: Entry & Target Ready!Hey friends 👋

I’ve prepared an analysis for the AUDJPY pair. If the price reaches the 96.201 - 96.169 zone, I’ll be looking to open a buy position from that level.

My target will be set at 96.524.

Every single like you send is a huge source of motivation for me to keep sharing these analyses. Big thanks to everyone who supports with a like 🙏

JPYAUD trade ideas

AUDJPY - One More Bearish Impulse Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDJPY has been overall bearish trading within the falling broadening wedge pattern marked in red and it is currently retesting the upper bound of the channel acting as a non-horizontal resistance.

Moreover, the green zone is a strong supply.

📚 As per my trading style:

As #AUDJPY retests the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/JPY – Double Top Signals Potential Bearish MoveAUD/JPY (4H) is showing a strong double top pattern at the resistance zone (96.9 – 97.1), followed by a break of structure (BOS) and rejection from the supply area.

Price has also filled the fair value gap and is showing signs of weakness with a potential downside target near 94.80.

If the bearish momentum continues, we could see further decline toward support at 94.00 – 94.20.

Key confluences:

Double top formation

BOS confirmation

Supply zone rejection

MACD bearish momentum

📌 Trade Idea: Watch for a pullback to the 96.4 – 96.6 zone for possible short entries. Targets: 94.80, then 94.00.

💡 Always manage risk properly and follow your trading plan.

AUDJPYBased on the provided 4-hour chart of AUD/JPY, here is a brief summary and outlook.

The AUD/JPY pair has recently been trading within a descending channel, as shown by the parallel trend lines. The price has just made a rally to the upper boundary of this channel, retesting a significant resistance zone. This resistance also coincides with a Fair Value Gap (FVG) area, which often acts as a point of price rejection. The Stochastic Momentum Index (SMI) in the lower panel is also showing an overbought condition, which further supports the potential for a reversal.

The chart illustrates a likely bearish scenario where the price is rejected at the current resistance level. The orange arrow depicts a potential movement where the price could fall back towards the support zone around 95.70. This support level has been significant in the past, acting as both resistance and support. A successful move to this level would be a continuation of the descending trend within the channel.

The expectation is for a bearish reversal from the current levels. Traders should look for confirmation of the rejection at the FVG and the channel's upper boundary. A successful break above the resistance at 96.73 would invalidate this bearish outlook. The key support level to watch for potential profit-taking is at 95.70.

AUDJPY Breakdown Signals Deeper Correction: Key Zones to WatchAUDJPY Breakdown Signals Deeper Correction: Key Zones to Watch

On the 4-hour chart, AUDJPY has broken out of a bearish formation, signaling strong downside momentum.

On Friday, the pair declined by nearly 180 pips—a move echoed across multiple XXXJPY pairs, triggered during the release of NFP data.

While the fundamental catalyst remains unclear, the technical setup supports a continuation of the bearish trend.

There’s a high probability that AUDJPY may retest the broken structure near the 96.00 level before extending its decline toward the projected zones of 94.30 and 92.50.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Cracking the Aussie-Yen Vault: Bullish Heist Setup in Progress🔓💸 AUD/JPY "Aussie vs Yen" Forex Bank Heist 💸🔓

🎯 Plan: Bullish Robbery | Targeting 97.300 | Stop Loss: 95.000

💰 Layered Entries | Precision Robbery | No Mercy

🚨🧠 Attention Robbers, Looters & Forex Mercenaries! 🧠🚨

The AUD/JPY vault is open, and Thief Trader is back with a multi-layer LIMIT ENTRY STRATEGY – stacking orders like cash in a briefcase. 💼💷💣

👀 We ain’t sniping one entry – we’re building an army of LIMITS. Every dip? A robbery opportunity.

💥 ENTRY: Any Price is a Good Price 💥

"Aussie Bull" on steroids – grab the loot on any pullback!

Set buy limits across key dips in liquidity pockets, swing zones, or even psychological levels.

Thief-style: Entries aren’t missed, they’re planned.

🛑 STOP LOSS: 95.000 🔐

Locked tight at the institutional panic zone – let them get triggered, we reload with confidence.

Built for multiple orders – size wisely, survive the fakeouts.

🎯 TARGET: 97.300 💸

Targeting the upper vault room, stacked with JPY weakness.

Ride the bullish getaway car all the way to the Tokyo vault rooftop.

🧠 Scalpers? Ride the trend. Swingers? Load your clip. Investors? Sit back and sip that profit. ☕💵

Use trailing SL to protect the bag as price moves in your favor.

🕵️♂️ THIEF TRADER SECRETS:

📊 Backed by technicals, macro juice, and liquidity-sniffing analysis.

🗞️ Don’t forget: News releases = volatility = sniper mode ON.

⚠️ MONEY HEIST PROTOCOL:

✅ Avoid entries during high-impact news 📉

✅ Use risk-adjusted sizing on your orders

✅ Be patient – layering needs discipline, not desperation

❤️🔥 Hit that 💥 BOOST BUTTON 💥 if you're with the Thief Squad!

Support the robbery. Respect the style. Make money like a true Market Outlaw.

🔔 Follow for the next HEIST PLAN. Big bags only. 💼💰🚀

“Markets don’t move randomly – they move for the ones who rob it correctly.” – Thief Trader

🤑📈🐂 #AUDJPY #ForexHeist #ThiefTrader #BankTheMarket #LayeredEntries #ForexTrading #RobTheMarket

AUDJPY Forming Bullish MomentumAUDJPY has recently bounced from a strong demand zone near the 94.50–95.00 region, as seen on the 4H chart. This zone has acted as a key support area in previous price action, and the market is now printing higher lows after rejecting it multiple times. Price is showing bullish momentum, and with buyers stepping in aggressively from this area, we are now anticipating a continuation to the upside toward 96.80 and beyond.

From a fundamental perspective, the Australian dollar is gaining traction due to recent upbeat economic sentiment, especially as the Reserve Bank of Australia (RBA) maintains its data-dependent stance. Although rate hikes are on pause, the RBA is leaving the door open for further tightening should inflation remain sticky. On the flip side, the Japanese yen remains weak across the board, with the Bank of Japan maintaining ultra-loose monetary policy and no near-term signals of change. This divergence in central bank policy continues to support bullish pressure on AUDJPY.

Technically, the risk-reward profile is favorable. The bullish engulfing candles off the demand zone suggest strong buyer intent. A break and hold above the intraday resistance around 96.00 would confirm bullish continuation, with upside targets stretching toward 96.80–97.20. Meanwhile, stops can be managed tightly below 94.50, keeping the setup clean and structured. With the yen facing broad weakness and Aussie resilience in play, this pair offers momentum trading potential.

Overall, AUDJPY is primed for upside as long as the support zone holds. Traders should monitor price action around current levels for bullish confirmation and scale in on minor pullbacks. This setup aligns with market sentiment and fundamental divergence, creating a high-probability opportunity in the current forex landscape.

Bearish reversal off swing high resistance?AUD/JPY is rising towards the pivot, which acts as a swing high resistance and could potentially drop to the 50% Fibonacci support.

Pivot: 96.93

1st Support: 95.80

1st Resistance: 97.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUD/JPY Daily Chart📈 AUD/JPY Daily Chart

🛠 Tools Used:

🔹 Volume Profile (Visible Range) – to spot high-activity price zones.

🔹 Support & Resistance Lines – key zones at 99.428 🛑 and 86.681 🟢.

🔹 50, 100 & 200-Day SMAs – to track trend direction and dynamic support.

📊 Market Snapshot:

AUD/JPY is currently at 96.364, showing steady bullish momentum 📈 after bouncing from the 50-day SMA.

The Volume Profile reveals a large cluster of trading activity between 95.00 – 97.50, making this the current value area.

⚠️ Key Zones to Watch:

Resistance: 97.50 → 99.428 (Major hurdle 🚧)

Support: 94.50 → 92.00 → 86.681 (Long-term floor)

💡 Trade Idea:

✅ Bullish scenario: Break & close above 97.50 could trigger a rally towards 99.40.

❌ Bearish scenario: Drop below 94.50 could invite sellers back to test 92.00 and possibly 86.68.

📌 Summary:

The bulls are in control, but the real test lies ahead at 99.428 – a zone where sellers historically step in. Watch price action closely near resistance for confirmation before entering a breakout trade.

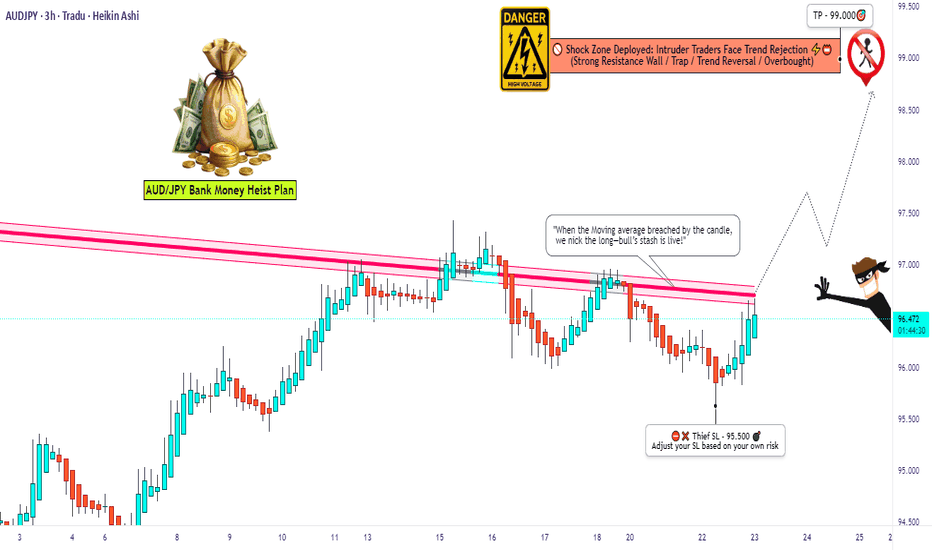

Aussie vs Yen: Setup for a Clean Long Robbery💣AUD/JPY Forex Heist: Aussie vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the AUD/JPY "Aussie vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 94.500. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 3H timeframe (around 95.500)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 99.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why AUD/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

Bullish rise?AUD/JPY is reacting off the support level which is an overlap support and could bounce from this level to our take profit.

Entry: 95.77

Why we like it:

There is an overlap support.

Stop loss: 94.92

Why we like it:

There is a swing low support.

Take profit: 97.22

Why we like it:

There is a multi swing high resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal off 61.8% Fibonacci resistance?AUD/JPY is rising towards the pivot which acts as a pullback resistance and could reverse to the 1st support, which aligns with the 61.8% Fibonacci retracement.

Pivot: 96.11

1st Support: 94.30

1st Resistance: 97.25

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish reversal off Fibonacci confluence?AUD/JPY is falling towards a support level, which is a pullback support aligning with the 138.2% Fibonacci extension, the 50% Fibonacci retracement, and the 61.8% Fibonacci projection. A bounce from this level could push the price toward our take-profit target.

Entry: 94.75

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement, the 138.2% Fibonacci extension and the 61.8% Fibonacci projection.

Stop loss: 93.80

Why we like it:

There is a pullback support that lines up witht he 100% Fibonacci projection.

Takeprofit: 95.77

Why we like it:

There is an overlap resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Falling towards overlap support?AUD/JPY is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 95.65

1st Support: 94.82

1st Resistance: 96.69

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDJPY at Resistance: Could we see a reversal here?The market on this pair shows us a classic scenario where price presses into a resistance zone after a sustained bullish move. Price action approaching this zone appears hesitant, with smaller candles and wicks showing signs of exhaustion, meaning the possibility that buying momentum is weakening. There is a clear intention in this structure and I am anticipating a reversal here.

My first target (TP1) at 95.400 is placed just above a previous structure low and it’s a logical level for a partial exit, as price may pause or react there. The second target (TP2), placed even lower, hints at a full mean reversion idea targeting the origin of the previous bullish leg.

The setup requires patience, waiting for confirmation perhaps in the form of a strong bearish rejection before committing to the short. Overall, it’s a disciplined setup that mirrors the kind of analysis I like to gravitate toward: structured, simple and driven by high probability reversal zones.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/JPY H4 SHORT SETUP – 4 August 2025📊 Trade Plan: AUD/JPY – August 2025

🧠 Summary:

AUD/JPY has broken a clear ascending channel and retested the breakdown area, aligning with a marked sell zone. Institutional data supports JPY strength and AUD weakness, while trend projections suggest downside momentum into mid-August.

1. Technical Analysis (4H Chart)

Channel Break: Price broke below the rising trendline after a multi-week uptrend.

Sell Zone: 95.98 area, acting as broken structure + pivot resistance.

TP Target: ~92.30 — near key historical support and S2 area.

Bearish Structure: Lower highs forming after failed breakouts above 97.15.

Pivot Resistance & Supply Clusters align with the sell zone.

🔔 Technical Bias: Bearish

2. COT (Commitment of Traders) Sentiment

Currency Long % Short % Δ Weekly

AUD 20.22% 79.78% +1.14% (slightly more bearish)

JPY 68.99% 31.01% -5.01% (stronger bullish sentiment)

Institutions are highly short AUD and long JPY, supporting bearish AUD/JPY.

🔔 COT Bias: Strongly Bearish

3. Retail Sentiment

Retail Traders:

64% long AUD/JPY, 36% short.

This contrarian signal supports a bearish bias, since retail is heavily long while price is breaking down.

🔔 Retail Bias: Bearish

4. Trend Projection

All models (green, black, red) suggest:

Short-term bounce around 96.5–97.2

Medium-term decline into 95.5, 95.0, then 94.5–94.0 by Aug 6–7

Bearish scenario points to 93.5 and lower.

🔔 Projection Bias: Bearish