JPYAUD trade ideas

AUDJPY – Short Setup | Volume Trap + Order Flow + Multi-TimeframWhy I'm Selling AUDJPY Here:

1. Massive Volume Trap Exposed 📊

On the left chart (5min), there's a huge cluster of volume** between 93.20–93.50 (67K–76K contracts). That’s not retail – that’s institutional distribution. Price pumped into that zone and dumped hard, confirming it was a liquidity grab.

Now we’re retesting the low-volume void (LVN) just under that cluster = perfect re-entry short zone.

2. Smart Money is Exiting (VBSM Indicator) 🧠

On the 20h Heikin Ashi chart (right), the VBSM 25 line just dropped below the moving average:

From 21+ down to 16.6

16.6 < 17.05 MA = Smart money is exiting the market, not buying the dip.

3. OBV Confirmation 📉

OBV 30 and OBV 200 are both trending downward

Price is moving sideways/slightly up, but OBV is leaking = hidden bearish divergence

This confirms distribution, not accumulation.

4. Money Flow Index Reversal

MFI 30 dropped from 80 to 62.28

Losing buyer momentum = another sign of buyer exhaustion

5. Heikin Ashi Candles: No Upper Wicks 🚫

On the 20h timeframe, the last two candles are solid red with no upper wicks

This confirms selling pressure is increasing — clean bearish price action

---

Trade Plan (Execution):

Sell Entry Zone: 93.05 – 93.20 (while price is testing the trap zone)

Stop Loss: Above 93.55 (above the highest volume spike)

Take Profit: 92.00 area (next demand zone + low-volume pocket)

Risk: Under 50% capital, in line with my risk strategy

---

Final Thoughts – From Shavarie Gordon:

This setup is the result of 7 years of deep volume analysis, order flow study, and market psychology. I only pull the trigger when all components line up — and this one checks every box.

If you're looking to learn how smart money really operates, this chart is your textbook case: liquidity grab, volume trap, weakening buyers, and stealthy exit.

Stay sharp, stay patient — 1 quality setup is all it takes.

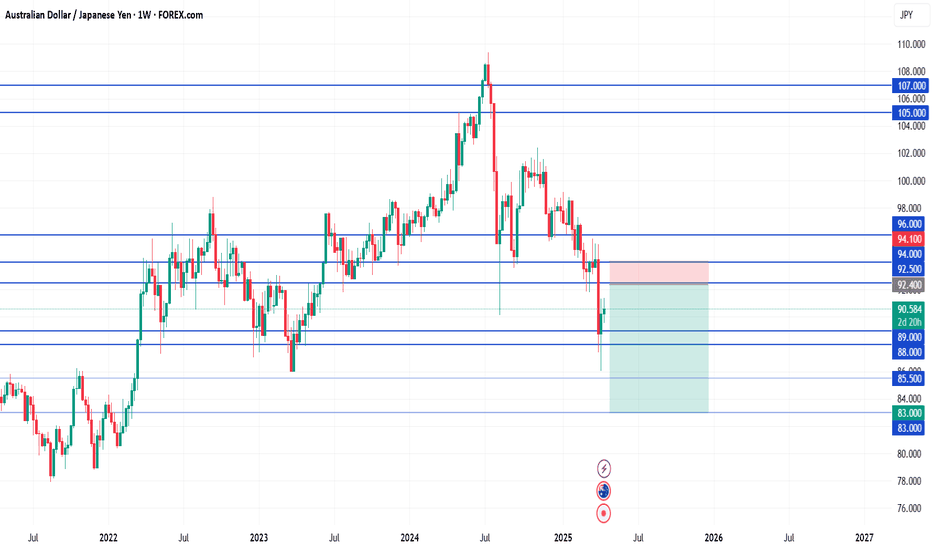

WHO'S PRINTING PIPS AND CASH? AUDJPY SHORT FORECAST Q2 W21 Y25WHO'S PRINTING PIPS AND CASH? AUDJPY SHORT FORECAST Q2 W21 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅HTF 50 EMA acting as support and resistance.

✅Gap to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY Long: Buy the Dip into Trendline + Seasonal AUD Surge🔹 Pair: AUD/JPY

🔹 Timeframe: 4H

🔹 Direction: Long

🔹 Status: Retesting Trendline Support

🔹 Entry Zone: 93.20–93.40 (Live Entry Area)

⸻

📊 Macro & Fundamental Confluence

🇦🇺 AUD – Bullish

• Strong Seasonality: Historically bullish May 19 – June 10.

• Conditional Score Rise: From 21 → 24 = Positive momentum shift.

• Dovish CB, But Risk-On: Supports carry trade flows into AUD.

• Macro View: Rebalancing inflation & trend recovery, AUD outperforming.

🇯🇵 JPY – Bearish

• BoJ Hawkish Talk, Dovish Action: Delayed inflation targets (to 2027).

• Score Flat: Minor rise (11 → 12), showing underperformance.

• Risk-On Mood: With VIX under 20, safe-haven demand fading.

• Macro Lag: JPY weakest G7 performer year-to-date.

🧠 Confluences Supporting the Trade

✅ Seasonal AUD strength

✅ Fundamental divergence: AUD strong, JPY weak

✅ Risk-on regime (favoring carry trades like AUDJPY)

✅ Trendline respected since April (bullish market structure)

✅ Support zone at 93.00–93.30 area

⸻

📈 Technical Setup

• Entry Zone: 93.20–93.40

• Stop Loss: 92.08 (below structure and ascending trendline)

• Take Profit:

• TP1: 95.40 (resistance zone)

• TP2: 96.00 (supply zone retest)

• Risk:Reward: ~1.8 – 2.2 depending on final entry

📌 Execution Notes

Watching for candle closure confirmation above 93.50.

Break below 92.08 invalidates the bullish bias.

This setup combines macro divergence, seasonal strength, and clean 4H market structure.

⸻

💬 Are you trading AUDJPY this week?

Drop your thoughts below ⬇️

AUD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the AUD/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 88.446 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPYReserve Bank of Australia (RBA):

Current cash rate: 4.10% (expected to cut to 3.85% on May 20).

RBA on a dovish pivot driven by progress on inflation (trimmed mean CPI: 2.9% in Q1) and global trade risks.

Bank of Japan (BoJ):

Current policy rate: 0.50% (held steady in May).

Outlook: BoJ signaled potential hikes if economic conditions improve, but weak GDP (-0.7% annualized in Q1) and U.S. tariffs (24% on Japanese goods) limit tightening scope

The upcoming Reserve Bank of Australia (RBA) rate cut, widely expected to be a 25 basis point reduction at the May 20, 2025 meeting, is anticipated to have a short-term bearish impact on AUD/JPY, primarily by putting downward pressure on the Australian dollar (AUD) relative to the Japanese yen (JPY). Here’s why:

Key Points on the Impact of the RBA Rate Cut on AUD/JPY

AUD Under Pressure Due to Rate Cut Expectations:

Growing market consensus around the RBA’s rate cut has already led to AUD depreciation, causing AUD/JPY to edge lower below the 92.21 level as of late April 2025. Lower interest rates reduce the yield advantage of the AUD, making it less attractive to carry traders and investors seeking higher returns.

Economic Uncertainties and Trade Outlook:

The RBA’s cautious, data-dependent approach amid rising economic uncertainties and global trade tensions (especially U.S.-China relations) adds to downward momentum for AUD/JPY. However, signs of easing U.S.-China trade tensions could provide some support to the AUD, limiting the downside.

JPY Dynamics:

The Japanese yen has weakened recently due to reduced safe-haven demand amid improving global trade sentiment, which has somewhat offset AUD weakness. However, ongoing expectations of further Bank of Japan (BoJ) rate hikes in 2025 support the yen, applying pressure on AUD/JPY.

Moderating Factors:

Reduced Aggressive Rate Cut Bets: Recent data, including a hotter-than-expected Australian Wage Price Index, has tempered expectations for aggressive RBA cuts, which could limit AUD/JPY losses.

BoJ Policy Outlook: BoJ’s commitment to possible further rate hikes supports the yen, creating a headwind for AUD/JPY.

Technical and Sentiment Outlook:

The pair has paused recent gains and is vulnerable to further downside if the RBA confirms the cut and signals a cautious path forward. However, dip-buying interest could emerge on declines due to improving trade optimism and softer USD dynamics.

Summary

Factor Impact on AUD/JPY

RBA 25 bps rate cut (May 20) Bearish AUD, downward pressure

Signs of easing US-China trade Potential support for AUD

BoJ rate hike expectations Yen strength, bearish for AUD/JPY

Wage growth in Australia Limits aggressive AUD weakness

Global trade sentiment Supports yen weakness, offsets AUD pressure

Conclusion

The anticipated RBA rate cut is expected to weigh on AUD/JPY in the short term, primarily due to reduced yield appeal of the AUD. However, improving global trade sentiment and tempered expectations for aggressive rate cuts may cushion losses. The yen’s strength from BoJ tightening expectations will also continue to exert downward pressure on the pair.

Will AUDJPY rebound?FX_IDC:AUDJPY had recently corrected lower, but continues to trade above a broken downside resistance line. Will we see a push back up anytime soon?

Let's dig in...

MARKETSCOM:AUDJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

AUDJPY Will Go Up From Support! Long!

Please, check our technical outlook for AUDJPY.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 93.383.

Considering the today's price action, probabilities will be high to see a movement to 96.039.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Trading idea AUDJPY, break at trendlineNOTE: I am not an expert trader by any means, I am open input and sharing my ideas. I am still learning.

-------------------------------

There is a break at the trendline.

I have two ideas.....

#1.. it was a fake out and will continue up to make an extension to 127%. (Near, green arrow head and buy position projection )

Factors:

A) Price still holding above key support

B) RSI oversold

C) News is positive for this pair

News= Increase in Aus. employment data, and trade surplus exceeded expectations = strength

#2 it will retest below trendline and continue down. (Somewhere near, red arrow head and sell position projection )

Factors:

A) Break of trendline

B) Some indicatiors are neutral, so price can do either way

We shall wait and see.

--------

(please know arrow bounces are not exact.... just showing price may bounce before making it to sell or buy targets.)

---------

Open to all advise or comments. Would love input on how I break down the market or make my analysis ...

------

FYI there is not audio my cursor is explaining this text here and the text on screen.

Happy trading.

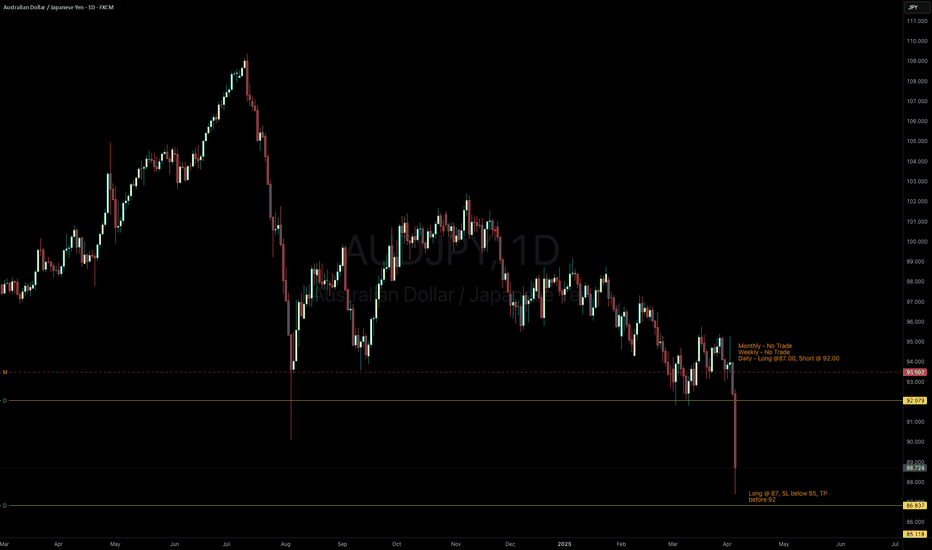

Long AUD/JPY at 87.00 with Target Near 92.00I’m looking to go long AUD/JPY around the 87.00 price area, based on levels on the Daily chart. My stop will be placed below 85.00, with a profit target just before 92.00.

Currently, there are no trade opportunities using the Weekly or Monthly levels, but I’m watching for potential longs around 83.50 and a short opportunity around 93.50.

AUDJPY SHORT FORECAST Q2 W20 D15 Y25AUDJPY SHORT FORECAST Q2 W20 D15 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Gap to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUD/JPY Struggles to Test March HighAUD/JPY snaps the series of higher highs and lows carried over from last week after struggling to test the March high (95.75).

In turn, AUD/JPY may continue to give back the advance from the start of the week, with a move/close below the 92.80 (50% Fibonacci extension) to 93.30 (23.6% Fibonacci extension) zone bringing the monthly low (91.42) on the radar.

Failure to defend the 91.50 (61.8% Fibonacci retracement) to 91.70 (38.2% Fibonacci extension) region opens up 90.50 (61.8% Fibonacci extension), but a breach above the March high (95.75) may push AUD/JPY back toward the February high (97.34).

--- Written by David Song, Senior Strategist at FOREX.com

AUDJPY Wave Analysis – 14 May 2025

- AUDJPY reversed from resistance area

- Likely to fall to support level 93.20

AUDJPY currency pair recently reversed from the resistance area between the key resistance level 95.30 (former monthly high from March), upper daily Bollinger Band and the 61.8% Fibonacci correction of the downward impulse wave (C) from November.

The downward reversal from this resistance area stopped the earlier short-term impulse wave 3 from the start of May.

Given the overbought daily Stochastic and strongly bullish yen sentiment, AUDJPY currency pair can be expected to fall to the next support level 93.20.

AUD-JPY Risky Short! Sell!

Hello,Traders!

AUD-JPY grew up fast

But then hit a horizontal

Resistance level of 95.750

From where we are already

Seeing a nice pullback

And we will be expecting

A further local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY SHORT FORECAST Q2 W20 D14 Y25AUDJPY SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Gap to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X