JPYAUD trade ideas

AUDJPY Wave Analysis – 4 April 2025

- AUDJPY broke support level 90.00

- Likely to fall to support level 88.00

AUDJPY currency pair recently broke the round support level 90.00 (former multi-month low from August) intersecting with the support trendline of the daily down channel from November.

The breakout of the support level 90.00 accelerated the minor impulse wave 3 of the intermediate impulse wave (3) from November.

Given the strongly bullish yen sentiment and long-term downtrend, AUDJPY currency pair can be expected to fall to the next support level 88.00 (target price for the completion of the active impulse wave 3).

AUD-JPY Will Keep Falling! Sell!

Hello,Traders!

AUD-JPY made a bearish

Breakout then made a retest

And is going down again

So we are bearish biased

And we will be expecting

A further bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY INTRADAY capped by resistance at 94.45 The AUDJPY pair is in an overall downtrend, though currently experiencing a short-term oversold bounce back.

Key Resistance: 94.45 – A bearish rejection from this level could push prices lower.

Bearish Scenario: A break below 94.45 could lead to further declines toward 92.70, 92.00, and 91.70.

Alternatively a breakout above 94.45 and a daily close higher would negate a bearish outlook.

Upside Targets: 95.20, 95.70, and 96.20 if the bullish trend continues.

Conclusion: The trend remains bearish unless AUDJPY closes above 94.45, which would signal further upside risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

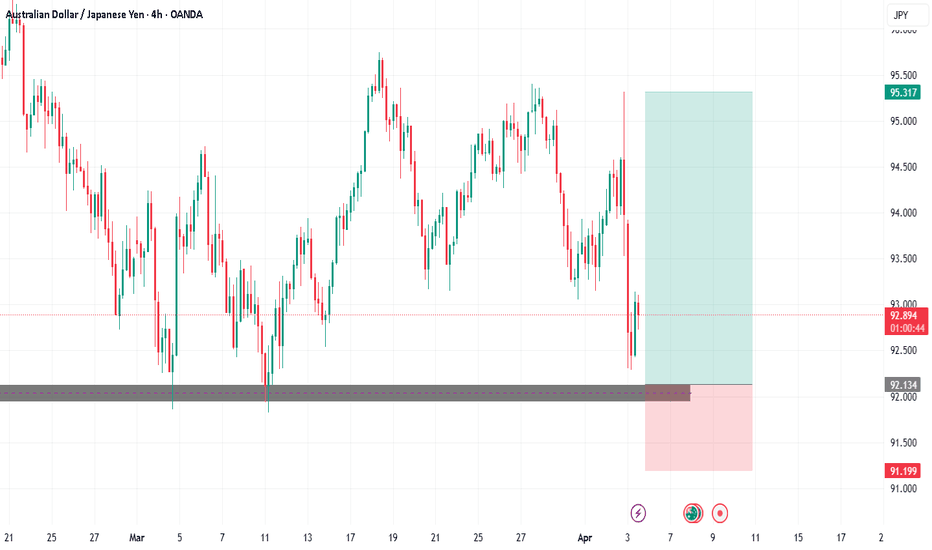

AUDJPY to find sellers at market price?AUDJPY - 24h expiry

There is no indication that the selloff is coming to an end.

Further downside is expected.

Risk/Reward would be poor to call a sell from current levels.

A move through 92.50 will confirm the bearish momentum.

The measured move target is 91.75.

We look to Sell at 93.00 (stop at 93.50)

Our profit targets will be 92.00 and 91.75

Resistance: 92.75 / 93.00 / 93.25

Support: 92.25 / 92.00 / 91.75

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUDJPY - Follow The Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDJPY has been bearish trading within the falling channel in red.

Currently, AUDJPY is approaching the upper bound of the channel.

Moreover, it is retesting a strong structure marked in orange.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the structure and upper red trendline.

📚 As per my trading style:

As #AUDJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/JPY BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

AUD/JPY pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 8H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 93.929 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPY Forecast: Bearish Move on the Radar I'm placing a Sell trade for AUDJPY, based on precise signals from our EASY Trading AI strategy. Entry is set at 93.93, targeting a Take Profit level at 93.14466667, with Stop Loss protection at 95.00166667.Why bearish? Our AI analysis identifies weakening bullish momentum and growing seller activity at key resistance areas. Technical patterns also suggest a downward correction is imminent.Stay vigilant and disciplined—effective risk management is a must to navigate market swings safely and profitably.

AUDJPY SELL TRADE PLAN🧭 TRADE PLAN: AUDJPY

📅 Date: April 2, 2025

🔖 Plan Type: Main Swing Plan

📈 Bias & Trade Type: Bearish Reversal – Premium Rejection + Liquidity Sweep

🔰 Confidence Level: ⭐⭐⭐⭐ (80%)

Reasons / Confluences:

– D1 bearish structure remains intact (LH + LL sequence)

– H4 supply zone with imbalance + previous liquidity wick

– EMA dynamic resistance confluence

– Bearish rejection with low volume follow-through

– Sentiment risk-off bias with JPY strength return

📌 Status:

Zone has been tapped – First touch complete

Awaiting H1 confirmation candle for possible execution. If price breaks above 94.60 without valid rejection, setup may be invalidated or require refinement toward Secondary Zone.

📍 Entry Zones:

🔴 Primary Sell Zone: 94.40 – 94.60

(H4 OB + imbalance zone + sweep of local highs)

🟠 Secondary Sell Zone: 94.85 – 95.00

(Extreme premium wick zone + deeper liquidity trap)

❗ Stop Loss: 95.20

(Above H4 wick high and institutional invalidation level)

🎯 Take Profits:

TP1: 93.25 🥉 (Recent demand bounce zone)

TP2: 92.35 🥈 (LTF equal lows and imbalance base)

TP3: 91.10 🏆 (Major swing low / D1 liquidity base)

📏 R:R Ratio: 1:3.8 minimum

(Optimized reward model for premium reversal setups)

🧠 MANAGEMENT STRATEGY:

– Risk 1–2% max per setup

– Move SL to BE after TP1 hit

– Secure partials at TP2

– Trail remainder below LHs for TP3 extended run

⚠️ Confirmation Criteria (Before Entry):

– H1 bearish engulfing or rejection wick inside zone

– Volume spike followed by low momentum candle

– Optional: M30 MACD divergence (bearish)

⏳ Validity: 1–3 Days (H4-based structure)

❌ Invalidation if price closes above 95.20 or forms bullish H4 BOS

🌐 Fundamental & Sentiment Confluence:

– AUD under pressure from soft commodities + dovish RBA stance

– JPY gaining strength due to risk-off tone in equities

– No major high-impact JPY/AUD news in next 24h

📋 Final Summary:

Looking to sell AUDJPY on rally into premium supply zone (94.40–94.60), with tight confirmation. Structure + sentiment + zone alignment makes this a high-probability play. Await reaction + confirmation on H1 before triggering entry.

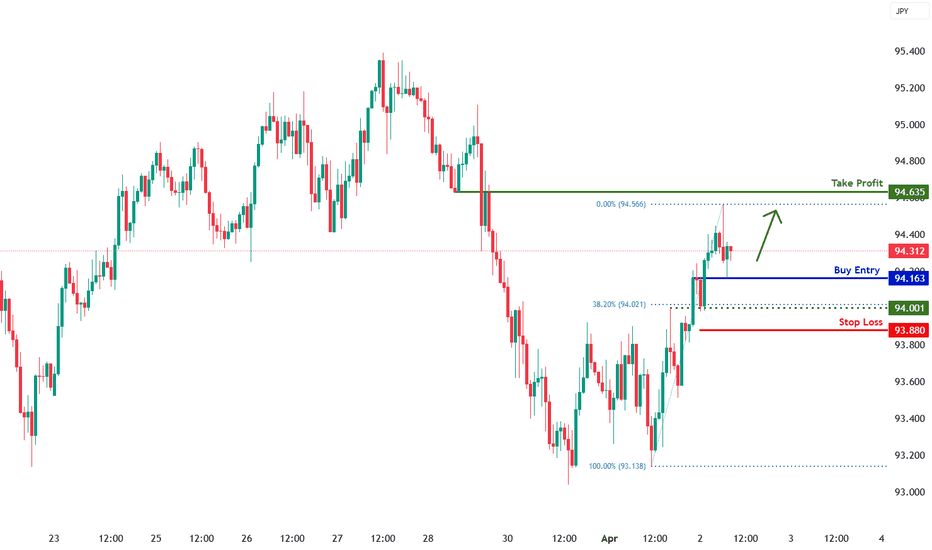

AUD/JPY H1 | Bullish uptrend to continue?AUD/JPY is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 94.16 which is an overlap support.

Stop loss is at 93.88 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement.

Take profit is at 94.63 which is an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

AUDJPY: Bullish Continuation & Long Signal

AUDJPY

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy AUDJPY

Entry Level - 93.633

Sl - 93.123

Tp - 94.417

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bullish bounce?AUD/JPY has bounced of the pivot and could potentialy rise to the 1st resistance.

Pivot: 92.28

1st Support: 92.68

1st Resistance: 94.19

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDJPY Monday 31st March 2025 Neu bias.AUDJPY Monday 31st March 2025 Neu bias.

The setup that aligns with the majority of the confluences IMO would be the short position. I've time to discus this pair as price actions needs to work prior any involvement. Since current price action is closer to the long point of interest, let's discuss.

Work needs to he done. What I'd like to see is penetration of the 4h 15' OB. Ideally this would happen prior the Break of 15' structure. As per the image, it doesn't seem like that particular set up will occur first. In any case, we need to see both before risking capital. Once 4h 15' Order block is mitigated, I will then only consider the long position upon a lower time frame break of structure. To the speculator, it is a lot of waiting and waiting for particular things however what better to await price to come to you and journal the potential set up in the mean time.

post 1'/5' turn around in price - I will then have the confidence, confluence and confirmation that the position has enough buying pressure to take me to my management point.

In contrast, a trade that I'd happily wait for without taking the long to the point of interest would be the short. Why? The weekly and daily 50 exponential moving average. I would essentially be awaiting the same confluences as with the long position but in the short direction. in addition, with the 50 weekly/daily coming down to join the short party, I will accept a lower time frame break of structure as confluence to grab the short as apposed to waiting for a 15' break of structure first.

What do you think? Let's see how the markets play out.

FRGNT