JPYCAD trade ideas

CAD/JPY Enters Bearish Trend on 4H Chart – Key Levels to MonitorCAD/JPY Enters Bearish Trend on 4-Hour Chart – Key Levels to Monitor

The CAD/JPY currency pair has recently confirmed a bearish trend shift on the 4-hour timeframe, signaling potential further downside in coming sessions. This technical deterioration follows a decisive breakdown below the previous swing low, accompanied by significantly higher trading volumes – a strong indication of increasing selling pressure. The high-volume breakdown suggests institutional participation in this move, giving added credibility to the emerging downtrend.

Critical Technical Developments:

1. Trend Structure Breakdown - The pair has established a clear sequence of lower highs and lower lows

2. Volume Confirmation - The breakdown occurred with notably elevated trading volumes

3. Momentum Shift - Oscillators like RSI remain below key levels, supporting bearish momentum

Key Price Levels:

Downside Target: 105.00

This psychological support level represents the next major target for bears. Historical price action shows this area has previously acted as:

- A pivot point for multi-week reversals

Upper Resistance: 109.00

This level now serves as critical overhead resistance where:

- Previous support becomes new resistance

- Sellers are likely to re-emerge on any retests

- A close above would invalidate the current bearish structure

Trading Strategy Considerations:

For bearish traders:

- Short positions on pullbacks toward 107.50-108.00 may offer favorable risk/reward

- Position sizing should account for potential volatility spikes

- Initial targets can be scaled at 106.50 followed by 105.00

For potential buyers:

- Caution advised until clear reversal signals emerge

- The 105.00 level may offer a potential bounce opportunity if supported by:

- Bullish candlestick patterns

- Divergence on momentum indicators

- Reduction in selling volume

Risk Management Notes:

Traders should monitor:

- Crude oil price fluctuations (key CAD driver)

- Bank of Japan policy signals

- Canadian employment data (upcoming releases)

The current technical setup favors bearish positions, with the 109.00 level acting as a critical line in the sand for any trend reversal scenarios. As always, strict risk management remains essential given potential volatility in this currency cross.

CADJPY Expected Growth! BUY!

My dear friends,

CADJPY looks like it will make a good move, and here are the details:

The market is trading on 107.35 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 107.90

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

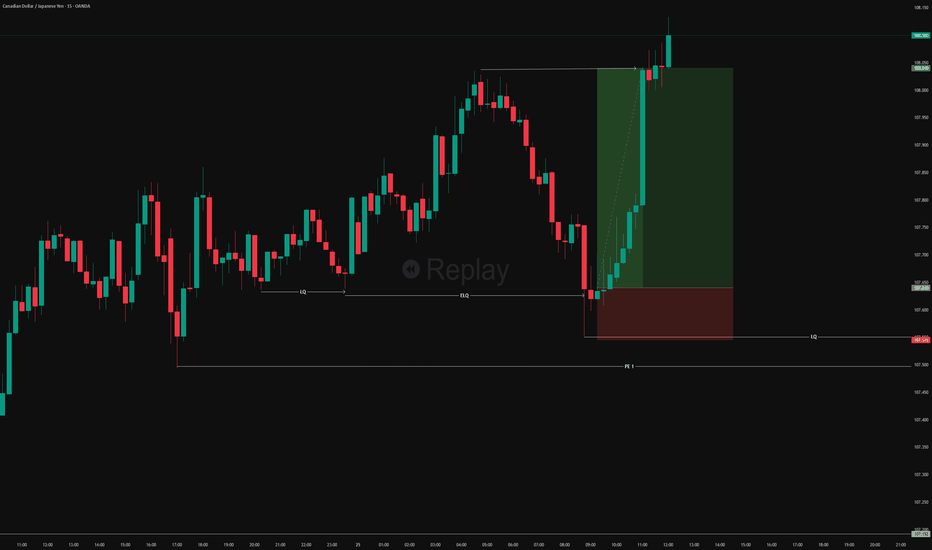

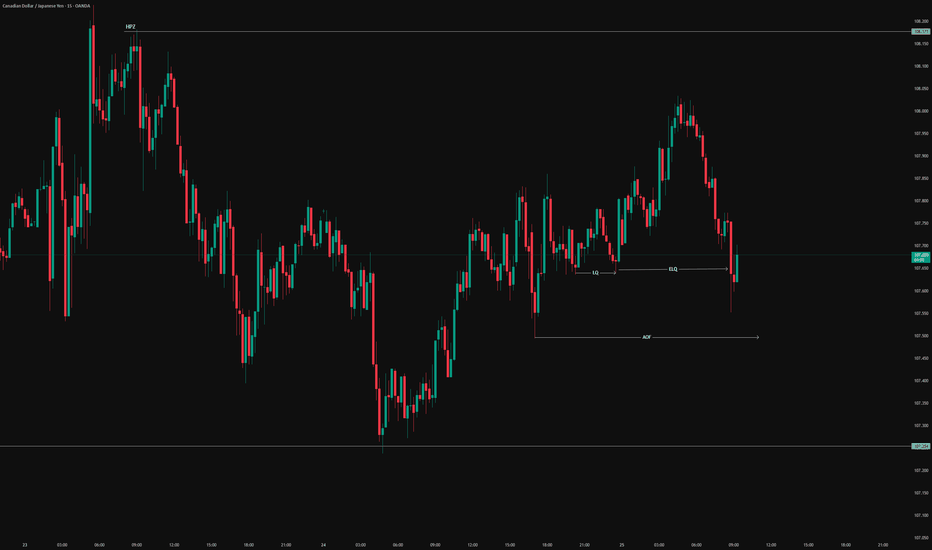

CADJPY Short Day Trade OANDA:CADJPY Short Day Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

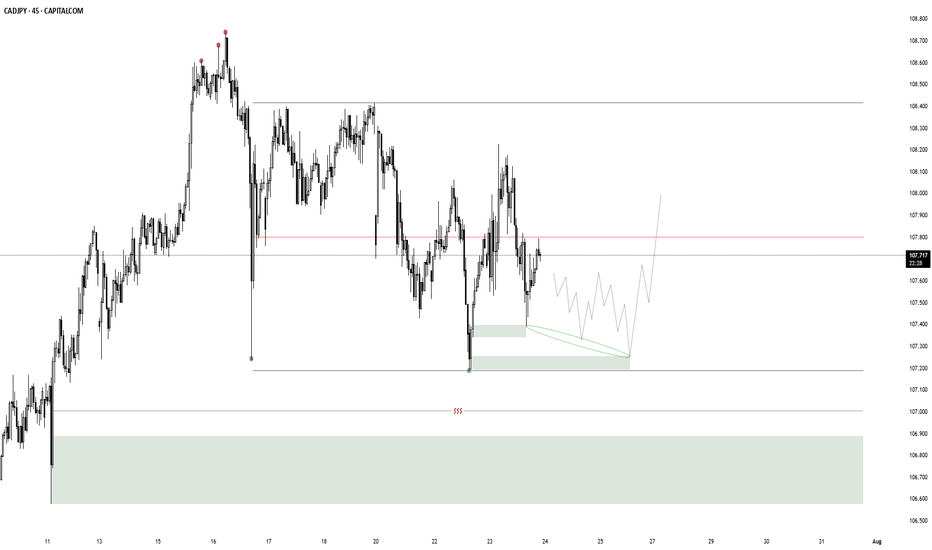

CAD/JPY reaccumulationI am looking for reaccumulation here, since we are in a higher time frame model 1 with an orderflow objective of 111.550. My model 2 POI is the extreme demand. In case there is no confirmation i am watching the liquidity+demand below for a model 1. If none of it confirms i will wait for lower levels.

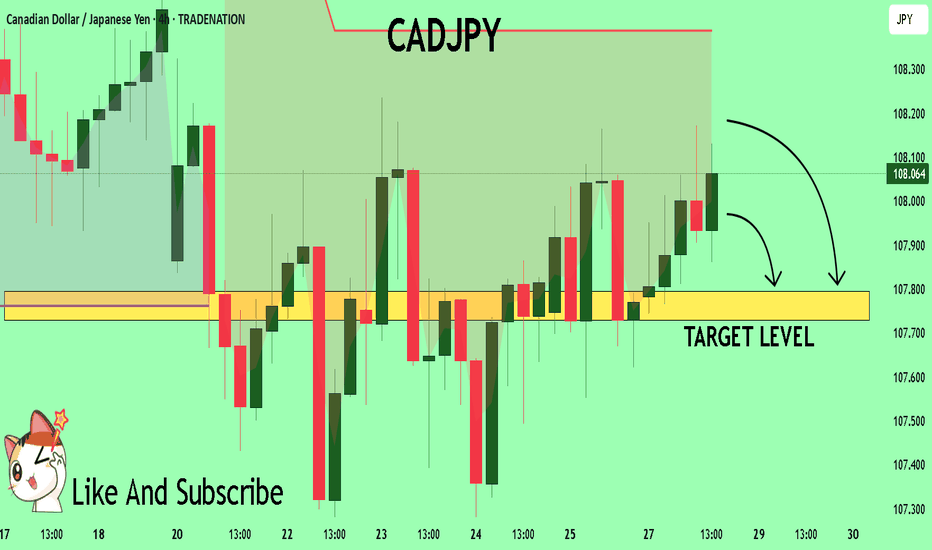

CADJPY Trading Opportunity! SELL!

My dear followers,

I analysed this chart on CADJPY and concluded the following:

The market is trading on 108.08 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 107.79

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

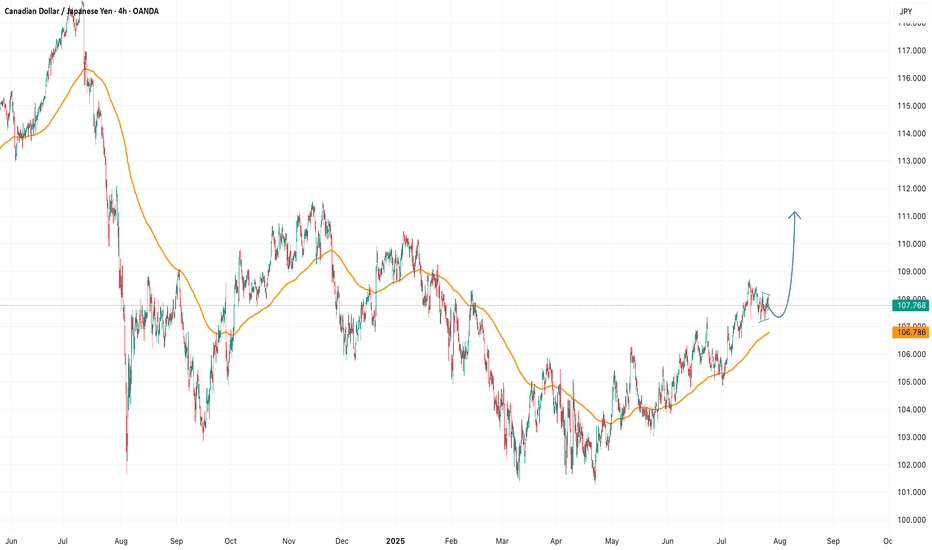

CADJPY Analysis: Uptrend Remains Intact – Look to BuyThe CADJPY pair continues to maintain its strong upward trend on the higher timeframes. Recent pullbacks appear to be temporary corrections and have not broken the overall bullish structure. Therefore, the most appropriate strategy at this stage is to wait for buying opportunities and look for confirmation before entering long positions.

Patience is key — waiting for clear price action signals or technical confirmations can greatly improve your trade success rate.

Suggested Strategy:

Monitor the H1 or H4 timeframe for bullish reversal patterns.

Look to buy when price retests key support zones and shows confirmation (e.g., pin bar, bullish engulfing, breakout).

Stick to your trading plan and follow the trend — the bulls are still in control!

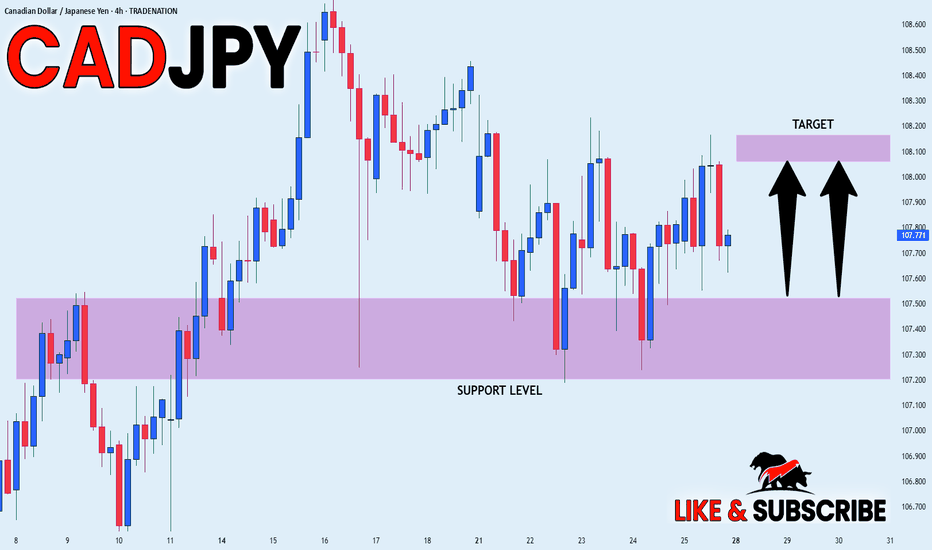

CAD_JPY WILL GO UP|LONG|

✅CAD_JPY will soon retest a key support level of 107.500

So I think that the pair will make a rebound

And go up to retest the supply level above at 108.100

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

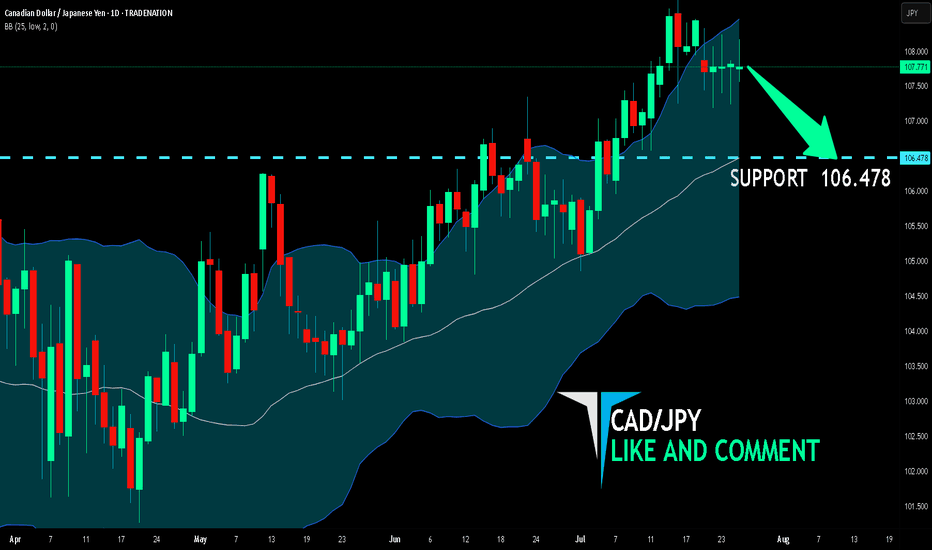

CAD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

CAD-JPY uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 106.478 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the CAD/JPY pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

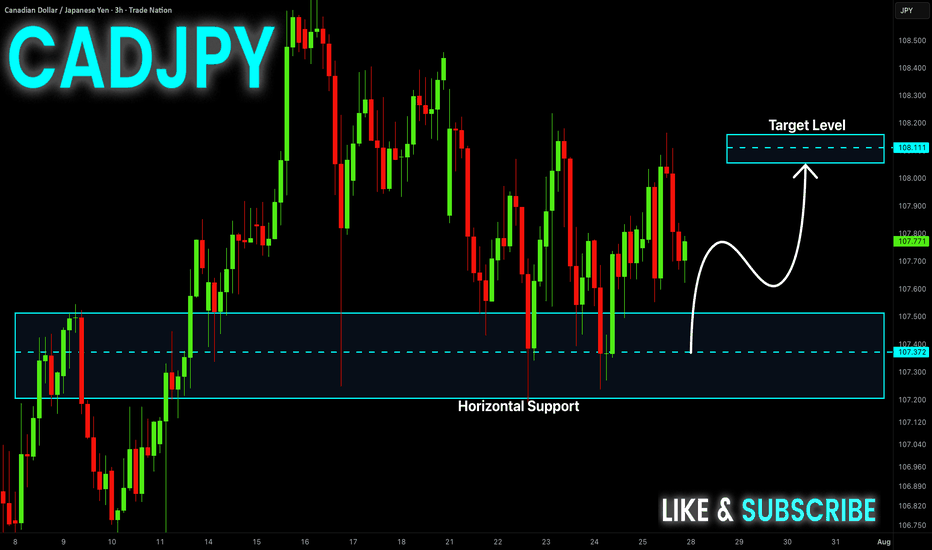

CAD-JPY Rebound Ahead! Buy!

Hello,Traders!

CAD-JPY made a retest

Of the horizontal support

Of 107.400 from where we

Are already seeing a bullish

Rebound and we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

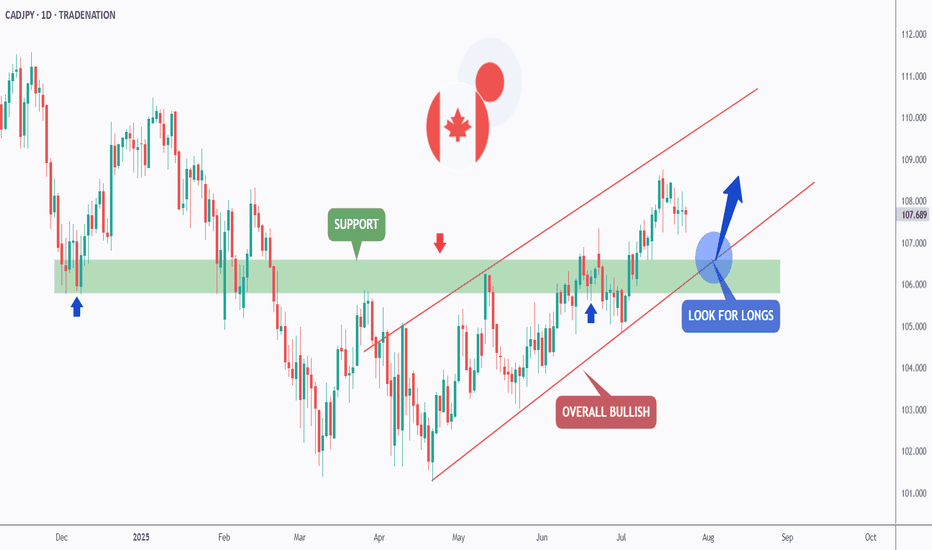

CADJPY - The Bulls Are Stronger than Ever!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CADJPY has been overall bullish trading within the rising wedge pattern marked in red.

This week, CADJPY has been retesting the lower bound of the wedge.

Moreover, the green zone is a strong weekly support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower red trendline and green support.

📚 As per my trading style:

As #CADJPY approaches the blue circle zone, I will be looking for trend-following bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.