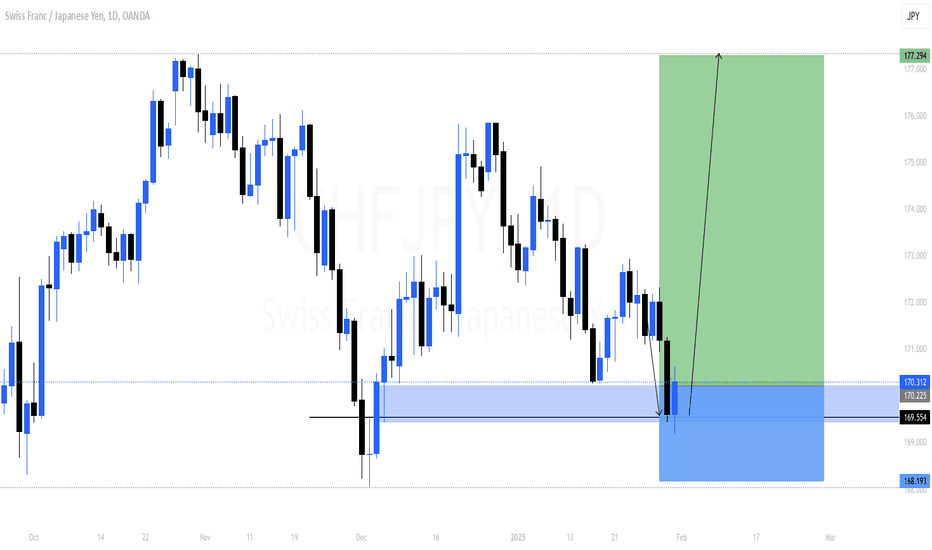

CHFJPY: Channel Down bottomed on oversold RSI.CHFJPY is almost oversold on its 1D technical outlook (RSI = 30.519, MACD = -1.120, ADX = 33.207) while the strong selling wave hit today the bottom of the October 31st 2024 High. The last time the 1D RSI was oversold was on the December 02 bottom. The bullish wave that followed, exceeded the 0.786 Fibonacci level. We anticipate an indentical rebound (TP = 173.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

JPYCHF trade ideas

CHF-JPY Is Oversold, Correction Ahead! Buy!

Hello,Traders!

CHF-JPY keeps falling

In a strong downtrend

But the pair is locally

Oversold so after it hits

The horizontal support

Level of 165.294 we

Will be expecting a

Local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

CHFJPY: Bearish CHF and Potential DownsidesHey Traders, in today's trading session we are monitoring CHFJPY for a selling opportunity around 167.500 zone, CHFJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 167.500 support and resistance area.

Trade safe, Joe.

CHFJPY: Bearish Trend Will Resume Soon 🇨🇭🇯🇵

CHFJPY looks bearish on a daily after a violation of a significant support cluster.

The broken structure and a falling trend line compose a contracting

supply area now.

With a high probability, a strong bearish wave will follow from there.

Next support - 165.9

❤️Please, support my work with like, thank you!❤️

CHFJPY POSSIBLE SELL?Based on Monthly and Weekly TF, the market is in a downtrend. Daily is currently isn a downtrend as well. Let's see if this trade idea will play out.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor.

CHFJPY - Potential short idea !!Hello traders!

‼️ This is my perspective on CHFJPY.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect price to continue the retracement to fill the imbalance and then to reject from bearish OB + institutional big figure 171.000.

Like, comment and subscribe to be in touch with my content!

CHFJPY LONGCHFJPY – Smart Money Strategies in Focus

Key Levels & Market Dynamics Revealed

Bank Sell Entry Zone:

172.00 - 172.80 - Upper supply zone where smart money may be looking to sell

Bank Buy Entry Zone:

169.00 - 169.50 - Demand zone where liquidity is accumulating

Market Breakdown:

Liquidity Sweep Below - Strong rejection at lower levels, setting up a potential bullish rally

Trendline Manipulation - Retail traders might get trapped before a significant breakout

SR Flip Around 171.00 - If price holds, we could see another push-up to challenge sell zones

Rejection at Supply Zones - Could signal a deeper retracement

What’s Next?

Bounce from Buy Entry? Bullish continuation towards institutional sell zones

Failure to Hold 171.00 Flip? Bears might step in for another liquidity grab

Big moves are on the horizon. Will Smart Money propel CHFJPY higher or lead to a liquidity sweep? Stay alert.

CHFJPY The Target Is DOWN! SELL!

My dear subscribers,

CHFJPY looks like it will make a good move, and here are the details:

The market is trading on 170.90 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 170.21

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

———————————

WISH YOU ALL LUCK

CHF_JPY RISKY SHORT|

✅CHF_JPY has retested a resistance level of 171.00

And we are seeing a bearish reaction

With the price going down but we need

To wait for a confirmation

Before entering the trade, so that we

Get a higher success probability of the trade

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

CHFJPY in bearish trendthe trend is making LHs & LLs and currently, the price is in the direction of marking the LH. The idea is to take a short position when the price touches the trendline and place SL as it is shown on the chart. One more major confluence of the bearish trend is that if the price makes its LH it will be in the region of golden Fib pocket".618". I am targeting 1:3 RR as the trend looks quite strong towards bearish.

CHF/JPY BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

The BB lower band is nearby so CHF/JPY is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 169.720.

✅LIKE AND COMMENT MY IDEAS✅

CHF/JPY SHORT FROM RESISTANCE

Hello, Friends!

CHF/JPY is making a bullish rebound on the 8H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 169.820 level.

✅LIKE AND COMMENT MY IDEAS✅