EUR/JPY NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

JPYEUR trade ideas

EUR/JPY Chart Analysis - Falling Wedge Target with Bullish SetupThis EUR/JPY 1-hour chart reveals a well-defined falling wedge pattern, which is a bullish reversal formation. Additionally, we see key support and resistance levels, a double bottom, and a breakout potential that traders can use to plan an entry. Let’s dissect this chart in a professional and detailed manner to understand the trade setup and market psychology.

🔹 Market Trend & Structure Analysis

The market was previously in an uptrend, making higher highs and higher lows, until it faced strong resistance at the 163.500 level. Upon reaching this zone, the price reversed downward, forming a series of lower highs and lower lows, which resulted in a falling wedge pattern.

This downward movement was accompanied by a trendline break, signaling a shift in momentum. The price has since reached a strong support level and is showing signs of potential bullish reversal.

🔹 Key Technical Patterns & Indicators

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge is a pattern characterized by two downward-sloping trendlines that converge, indicating that selling pressure is weakening. This pattern is considered a bullish signal because:

✔️ The declining price movement shows exhaustion of sellers.

✔️ Volume typically decreases as the wedge forms, indicating a breakout is coming.

✔️ Once price breaks out of the wedge, a strong bullish move often follows.

The key here is to wait for a breakout above the upper trendline, which will confirm the bullish momentum.

2️⃣ Double Bottom Formation at Support (Reversal Confirmation)

The price tested the 160.500 support level twice, forming a double bottom pattern. This is another bullish sign, as it indicates:

✔️ Buyers are actively defending this level.

✔️ There’s strong demand around this price zone.

✔️ If price breaks above the wedge resistance, it could trigger a significant rally.

🔹 Key Support & Resistance Levels

Identifying support and resistance is crucial for defining entry and exit points.

✅ Support Levels:

160.500 – Strong horizontal support (Price tested this twice).

158.982 – Stop-loss level (Below this, the bullish setup is invalid).

✅ Resistance Levels:

163.500 – Major resistance (Previous high and supply zone).

165.090 – Final target (Key breakout level).

If the price successfully breaks out of the wedge, it has room to rise significantly, with 163.500 as the first target and 165.090 as the ultimate goal.

🔹 Trade Setup & Execution Plan

🎯 Bullish Breakout Trade Strategy

Since this setup signals a potential reversal, here’s how traders can execute a high-probability trade:

🔹 Entry Points:

✅ Aggressive Entry: Enter as soon as price breaks above the wedge resistance.

✅ Conservative Entry: Wait for a breakout and a retest of the resistance-turned-support before entering.

🔹 Target Levels:

🎯 First target: 163.500 (Previous resistance level).

🎯 Final target: 165.090 (Major resistance zone).

🔹 Stop-Loss Placement:

❌ Place the stop loss below 158.982, as a break below this level would invalidate the bullish setup.

🔹 Risk-Reward Ratio & Trade Justification

📈 Why This Trade Has a High Potential Reward?

Low-risk, high-reward: The stop loss is tight, while the upside potential is large.

Confluence of bullish signals: Falling wedge + Double bottom + Strong support.

Institutional interest likely: Buyers are stepping in at key levels.

A proper risk-to-reward ratio (RRR) for this trade would be at least 1:3, meaning for every 1% risk, there’s a 3% profit potential. This makes it a great swing trading setup.

🔹 Market Psychology Behind the Setup

The falling wedge represents a market correction after a strong bullish trend.

The double bottom shows that sellers are exhausted and buyers are gaining control.

If price breaks out, many traders will enter, triggering a strong upward rally.

This bullish breakout setup aligns with the smart money concept, where institutions accumulate positions before a big move.

🔹 Final Thoughts & Trade Outlook

This EUR/JPY setup presents a high-probability trade opportunity with a bullish breakout scenario. The combination of:

✅ Falling Wedge Pattern (Bullish reversal)

✅ Double Bottom at Support (Buyers stepping in)

✅ Key Resistance Targets (Clear trade exit points)

…creates a great trading setup.

📌 Trading Plan Summary:

✔️ Buy on breakout above the falling wedge.

✔️ Target 163.500 & 165.090 for profits.

✔️ Stop-loss below 158.982 for risk management.

🚀 If executed correctly, this trade has the potential for strong bullish momentum. Would you like a real-time update once the price confirms the breakout? Let’s keep an eye on this trade! 📊🔥

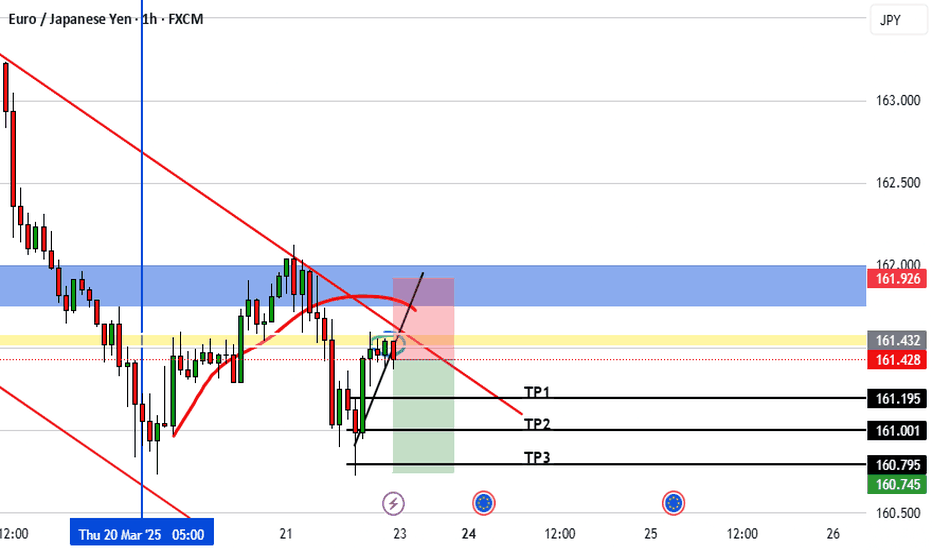

EURJPY Is Bearish! Short!

Here is our detailed technical review for EURJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 161.513.

The above observations make me that the market will inevitably achieve 160.742 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EJ updateRecent insights from Forex Factory indicate that eurozone data has been somewhat disappointing, while safe‐haven flows and dovish policy expectations in Japan continue to support the yen. Meanwhile, the latest COT report shows that large speculators have been building net-long positions in JPY futures relative to the euro, suggesting market participants are favoring the yen in the current risk‑off environment.

Combining these factors, the near‑term outlook for EUR/JPY appears to be bearish, with the pair likely to trend lower in the coming days. Key support levels should be watched closely, as a breakdown there could accelerate the decline, though any unexpected positive euro data or a shift in risk sentiment might lead to short-term volatility.

EUR JPY SHORTHello everyone, I hope you have had an excellent week of trades as well as me, I share my next trade idea to start next week, is to enter short in the eur jpy pair and continue with the current trend, if the market on Sunday opens with a higher gap at the close of today, it would be a much better entry point, otherwise if it opens right where it closed, we can still enter, I also leave the take profit zones, do not be greedy, if the market is giving us some profit we can withdraw and look for the next opportunity, greetings to all my new followers, I hope to continue sharing good ideas with everyone, good weekend.

EUR/JPY Trading Setup – Falling Wedge Breakout Potential1. Overview of the Market Structure

The EUR/JPY daily chart presents a falling wedge pattern, which is a classic bullish reversal setup. This pattern has been forming for several months, indicating that the price has been consolidating within a narrowing range. The falling wedge typically suggests that selling pressure is weakening, and a potential breakout to the upside could follow.

The chart also highlights key support and resistance zones, along with a well-defined trading setup based on technical confluences.

2. Key Technical Levels

Support Level: ~ 155.819 (Marked as Stop Loss)

This level has acted as strong support multiple times.

A break below this level would invalidate the bullish bias.

Resistance Level: ~ 163-164

The price has previously struggled to break above this region.

Currently, it is retesting this level after a breakout attempt.

Target Levels:

175.246 – This aligns with a previous all-time high zone and a strong resistance level.

179.562 – Marked as the ultimate target, indicating a full breakout potential.

3. Falling Wedge Formation & Breakout Analysis

A falling wedge is a bullish pattern that indicates a decrease in selling pressure over time.

The price has tested the lower trendline multiple times, showing strong demand at support.

Recently, the price broke above the upper wedge trendline, suggesting that a breakout is in progress.

However, the breakout needs confirmation in the form of a successful retest at the previous resistance level (~163-164).

4. Retest Confirmation & Trade Setup

Retest Scenario: If the price holds above the previous resistance and confirms it as support, the probability of continuation towards 175-179 increases.

Entry Strategy: A buy entry can be considered after a successful retest with bullish price action confirmation.

Stop-Loss Placement: Below 155.819 (previous strong support).

Risk-Reward Ratio: The target offers a strong risk-reward ratio if the breakout holds.

5. Market Sentiment & Volume Analysis

The previous downward move showed declining bearish momentum, further confirming the validity of the falling wedge.

A volume increase on the breakout would provide additional confirmation.

If the price consolidates near the breakout zone with low volatility, a strong move upward could follow.

Final Conclusion: Bullish Breakout in Progress

The falling wedge breakout suggests that EUR/JPY is poised for further upside.

A successful retest at 163-164 could push the price towards 175.246 and ultimately 179.562.

Risk management is crucial, and a stop-loss below 155.819 is recommended to avoid invalidation of the setup.

This setup presents a high-probability trading opportunity, but confirmation through price action and volume analysis remains key.

Key Trading Plan Summary:

📌 Pattern: Falling Wedge (Bullish)

📌 Breakout Confirmation: Yes, but retesting is ongoing

📌 Entry Point: Above 163-164 after successful retest

📌 Stop Loss: Below 155.819

📌 Target Levels: 175.246, then 179.562

📌 Risk-Reward: Favorable if breakout sustains

Would you like any refinements or a more concise version for your TradingView post? 🚀📈

EUR/JPY NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

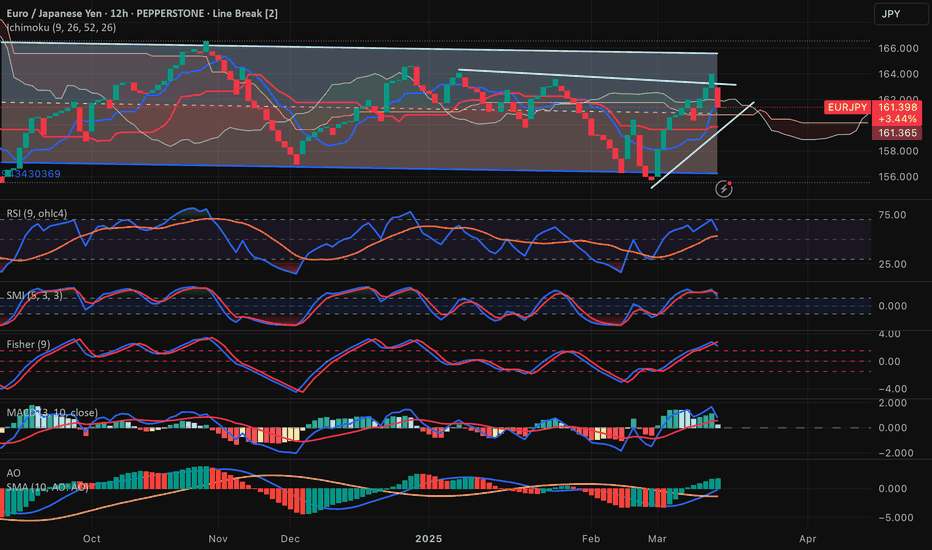

EURJPY → False breakout of key resistance ...FX:EURJPY is forming a false breakdown of resistance and draws us a reversal pattern against the upper boundary of the descending price channel, as well as the pressure on the market creates the correction of the dollar...

On the daily chart the structure is bearish. After the false breakout of the global resistance a correction is formed, within which the price can test the imbalance zone or the previously broken resistance and continue its fall after the liquidity capture. The global trend is neutral and in this case it is worth considering local support levels as targets

Resistance levels: channel boundary, 162.3, 163.0

Support levels: 160.84, 158.9

A retest of the channel resistance or the area of 162.4 - 163 is possible. But any return of the price under the resistance of the descending channel and consolidation of the price in the selling zone may provoke further decline

Regards R. Linda!

Trading Idea: EUR/JPY Buy Setup Based on Retail Flow SentimentA strong buy signal has emerged on EUR/JPY, driven by retail trading flow analysis. Let's break down the setup and why this trade aligns with smart money strategies.

Signal Breakdown

Retail Sentiment Shift 📊

After breaking above the descending triangle, we observed a surge in retail sell positions, indicating a strong bearish bias among traders.

Despite a minor pullback, the majority of retail traders remain short, reinforcing the likelihood of a stop-out rally.

Price Action & Smart Money Reaction 🏦

The breakout invalidated the bearish triangle pattern, yet retail traders continued shorting.

Our trading flow model shows short positioning far exceeding rolling averages, a classic trap scenario where market makers may push prices higher to liquidate retail shorts.

Trade Setup

Buy Entry: 📈 161.50

Stop Loss: ❌ 159.70

Target: 🎯 175.56

Rationale: Retail traders are heavily short, margin utilization is rising, and smart money may continue squeezing higher.

Bonus: 💰 This setup also benefits from a positive carry swap, making it even more attractive for medium-term holding.

Final Thought

Our EUR/JPY trade strategy is built on 80% trading flow sentiment and 20% technical & fundamental analysis. Retail traders often get trapped at key reversal points, and we capitalize on these inefficiencies.

📊 Will the smart money push EUR/JPY higher? Drop your thoughts below! 👇

EURJPY: Potential downward move towards 161.00?OANDA:EURJPY is currently approaching a significant resistance zone, an area that has been a key point of interest where sellers have regained control, leading to notable reversals in the past. Given this, there is potential for a bearish reaction if price action confirms rejection, such as a bearish engulfing candle, long upper wicks or increased selling volume.

If the resistance level holds, I anticipate a downward move toward 161.00, a target that seems at least achievable. This would more likely be a call on a bearish outlook, as sellers may step in to push the price lower from this key level. However, if the price breaks this zone and sustains the up move, the bearish outlook may be invalidated, and we could potentially see a larger upside move.

Given the potential volatility around this zone, it’s crucial to monitor candlestick patterns and volume closely to identify strong selling opportunities. Proper risk management is essential to handle any potential volatility and protect your capital if the price breaks out.

EURJPY Breakout Analysis: Falling Wedge & Key LevelsChart Pattern Breakdown

The chart presents a 4-hour timeframe for EUR/JPY, revealing a strong technical setup with multiple key patterns in play. The price action has been forming a falling wedge, a bullish reversal pattern, followed by a breakout.

Falling Wedge Formation

A falling wedge pattern is characterized by a narrowing range, where both highs and lows trend downward but converge towards a breakout point. This setup indicates a loss of bearish momentum and the potential for a strong bullish move once the price breaks out.

The wedge began forming in early February, with price making lower highs and lower lows within the structure.

The support level remained stable, while the resistance trendline kept the price within a tightening range.

Around early March, the price successfully broke above the wedge resistance, confirming the bullish breakout.

Key Resistance & Support Levels

Resistance Level (Marked on the chart)

Around 163.500 - 164.000, where the price faced rejection multiple times.

The market tested this level but struggled to break through immediately, confirming its importance.

Support Level (Marked on the chart)

Around 158.500 - 159.000, acting as a strong demand zone.

This area provided multiple bounces before the final wedge breakout.

Current Price Action & Trading Setup

Breakout Confirmation: The price successfully broke the wedge and moved higher, testing the resistance zone.

Pullback & Retest: The market is currently pulling back, testing the recent breakout area. This could be an ideal entry point for a long trade.

Bullish Target: The next significant resistance is at 166.754, followed by an extended target at 166.938.

Trade Plan

✅ Long Entry: On a successful retest of support near 160.500 - 161.000

🎯 Target 1: 166.754

🎯 Target 2: 166.938

🔒 Sell Stop (Stop Loss): Below 158.918 to minimize risk

Conclusion

The EURJPY chart is showcasing a strong bullish setup with a confirmed falling wedge breakout. As long as price holds above the key support level, the market is likely to continue its bullish momentum towards the 166+ zone. Traders should watch for confirmations such as bullish candlestick patterns, volume surges, and trendline support before entering a long position.

🚀 Do you agree with this setup? Drop your thoughts in the comments! 🚀

EURJPY Massive Long! BUY!

My dear friends,

Please, find my technical outlook for EURJPY below:

The price is coiling around a solid key level - 161.01

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 162.16

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK