NZDJPY What Next? SELL

My dear friends,

Please, find my technical outlook for NZDJPY below:

The price is coiling around a solid key level - 84.950

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clearsell, giving a perfect indicators' convergence.

Goal - 84.452

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

JPYNZD trade ideas

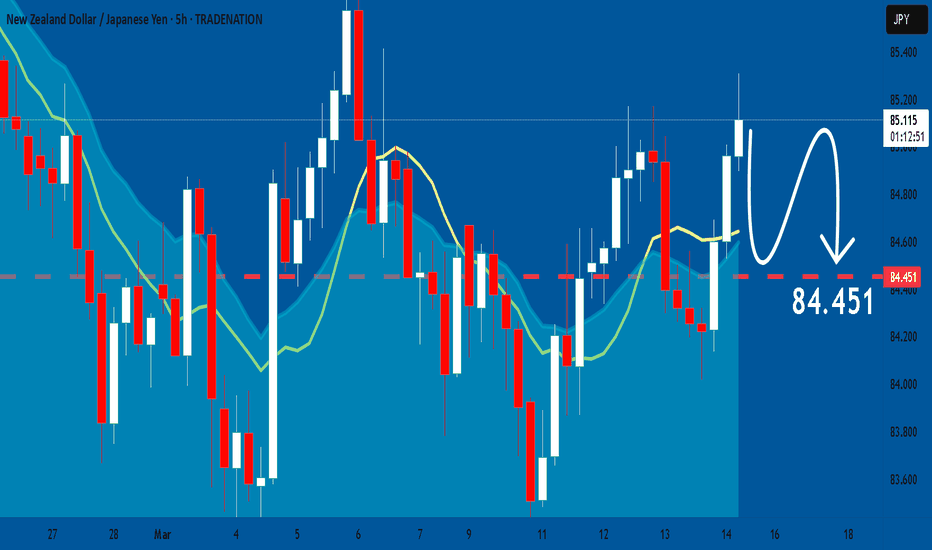

NZD_JPY SHORT SIGNAL|

✅EUR_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 85.6800

We can enter a short trade

At 85.3890 with the Target of 84.9110

And the Stop Loss of 85.7260

Just above the resistance

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

NZDJPY: Expecting Bearish Movement! Here is Why:

The analysis of the NZDJPY chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZD/JPY BEARS ARE STRONG HERE|SHORT

NZDJPY SIGNAL

Trade Direction: short

Entry Level: 85.167

Target Level: 84.161

Stop Loss: 85.834

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish drop?NZD/JPY has reacted off the pivot and could drop to the 1st support.

Pivot: 86.22

1st Support: 83.43

1st Resistance: 86.10

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off overlap support?NZD/JPY has bounced off the support level which is an overlap support and could rise from this level to our take profit.

Entry: 84.57

Why we like it:

There is an overlap support level.

Stop loss: 83.93

Why we like it:

There is a pullback support level that is slightly below the 61.8% Fibonacci retracement.

Take profit: 85.61

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD JPY🚀 NZD/JPY Trade Setup Alert! 📊🔥

Hey T.Y.L.A. family! 🎯 This week, we’ve got a 🔥 high-probability setup on NZD/JPY that’s looking primed for action! Let’s break it down:

📌 Entry: 84.848

🛑 Stop Loss: 84.478 (Safe risk management!)

🎯 Take Profit: 86.447 (Targeting strong momentum!)

📈 The market is showing solid structure, and we’re capitalizing on this move with precision. Stick to the plan, trust the process, and let’s stack those gains! 💰🔥

💬 Drop a comment if you’re in & let’s win together! 🚀 #TYLA #ForexSetup #CopyTrade #WeTradeSmart

NZD/JPY Long Trade Setup – Trendline BreakoutI am looking to enter a buy position on NZD/JPY if the current 4-hour candle closes above the red descending trendline, confirming a breakout.

Trade Details:

Entry: 84.85, once a confirmed 4H candle closes above the trendline.

Stop Loss (SL): 84.19, placed below recent structure support to minimize risk.

Take Profit (TP) Levels:

TP1: 85.63

TP2: 87.18

TP3: 88.14

TP4: 89.11

Price has been in a downtrend, respecting the descending trendline (red).

A breakout and candle close above the trendline signals a potential trend reversal.

A recent higher low suggests bullish momentum is building.

Risk-to-reward is favorable, targeting multiple take-profit levels.

WHY NZDJPY BULLISH, DETAILED TECHNICAL AND FUNDAMENTALS ANALYSISNZDJPY is currently trading at 84.8, forming a descending channel pattern, a classic technical setup that often signals a bullish reversal upon breakout. If the pair successfully breaks above the upper trendline, we can anticipate strong upward momentum, with a potential target of 88.8, offering a gain of over 300 pips. Traders should closely monitor key resistance levels, as a breakout confirmation could trigger a significant price surge.

From a technical standpoint, the descending channel pattern indicates a series of lower highs and lower lows, reflecting a temporary downtrend. However, once price action breaks above this structure, a sharp bullish rally is often observed. The breakout zone to watch is around 85.5-86.0, with initial resistance at 86.5 before the final target of 88.8. Support remains strong around 83.5, where buyers are expected to step in if any pullback occurs before the breakout.

On the fundamental side, NZDJPY is heavily influenced by risk sentiment, global economic trends, and monetary policy differences between the Reserve Bank of New Zealand (RBNZ) and the Bank of Japan (BOJ). The yen remains weak due to BOJ’s ultra-loose monetary policy, while NZD could strengthen on improving commodity demand and a stable interest rate outlook. If risk appetite increases, NZDJPY could see further bullish momentum, accelerating the breakout.

With technicals aligning for a breakout and fundamentals supporting further gains, NZDJPY presents a strong trading opportunity. A confirmed breakout above the descending channel could fuel rapid upside movement, making this a high-probability setup for traders looking to capitalize on the next bullish wave.

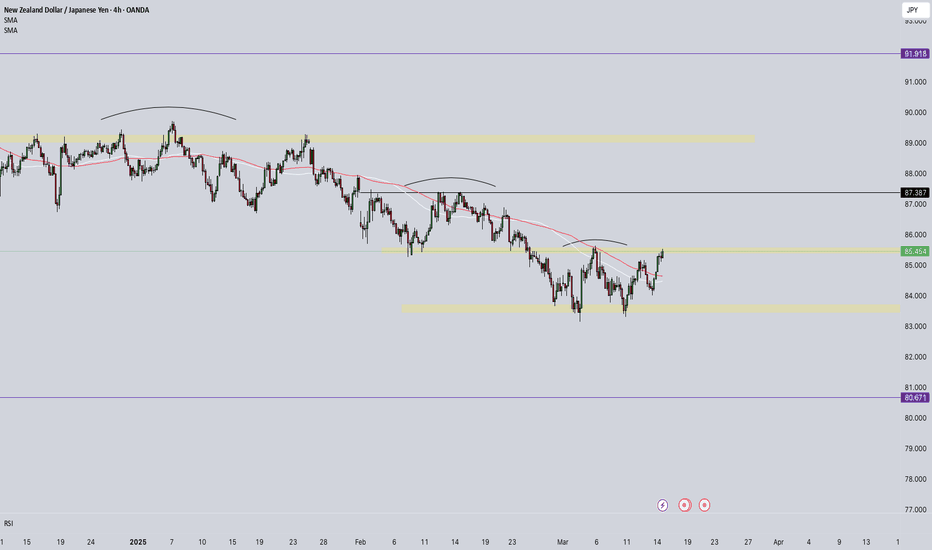

NZD/JPY 4-Hour Timeframe AnalysisNZD/JPY 4-Hour Timeframe Analysis

The NZD/JPY pair is currently exhibiting signs of sustained bearish momentum following a period of accumulation. On the 4-hour timeframe, the price continues to form a series of lower highs (LH) and lower lows (LL), reflecting a well-defined downtrend structure.

A key technical area of interest is the 85.000 level, which previously acted as a minor support zone. After breaching this level, the price accumulated a significant volume of sellers. However, the downward movement stalled, leading to a liquidity grab—a scenario where price temporarily moves higher to trigger stop-losses placed by early sellers before reversing.

Following this liquidity hunt, the market structure suggests a potential transition into a distribution phase, where price may continue to decline if key technical levels are respected. We are currently observing whether price will revisit the 84.900 region for another retest before a potential continuation to the downside.

A confirmed 4-hour candle close below 85.000 would further support the bearish outlook and indicate continued selling pressure toward lower support levels.

Key Technical Levels:

Key Resistance: 85.000 (Previous Support Turned Resistance)

Observation Zone: 84.900 (Potential Retest Area)

Next Support Target: 82.190 (Next Significant Support Level)

Fundamental Insight:

The NZD faces continued pressure due to weak economic data, a dovish stance from the Reserve Bank of New Zealand (RBNZ), and concerns about slowing economic growth. Recent reports indicate that New Zealand’s business confidence has softened, raising speculation that the RBNZ may hold off on future rate hikes or even consider easing policies to support the economy.

Meanwhile, the JPY is gaining strength amid rising safe-haven demand due to global economic uncertainty and increased speculation that the Bank of Japan (BoJ) may soon adjust its ultra-loose monetary policy. Additionally, Japan’s improving inflation outlook has increased expectations for a policy shift, which could further support the yen and drive NZD/JPY lower. This divergence in monetary policy between the two central banks enhances the case for continued bearish pressure on the pair.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

Confidence Trading is performative. And an aspect in trading that contributes to performance is your CONFIDENCE ,the confidence of you losing your A+ trade set up knowing you would take that same set up again if the market gave it to you. That’s what sets you apart. That’s what gives you a huge advantage

NZD/JPY Giving Amazing Bullish P.A , Best Place To Buy Cleared !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

bearish thesis for the week for NZD/JPYBased on my projections of my watchlist a range of 83 pips must be honored within this week ,

(Range projection based on last 5 yrs)

as BoJ is increasing rates by 0.5%

And

Japan accounts for 6.3% of NZD total exports

therefore widening rate gap nzd/jpy faces downward pressure

and taking TA into perspective , we can take advantage by selling for exactly 0.12% or 83 pips.