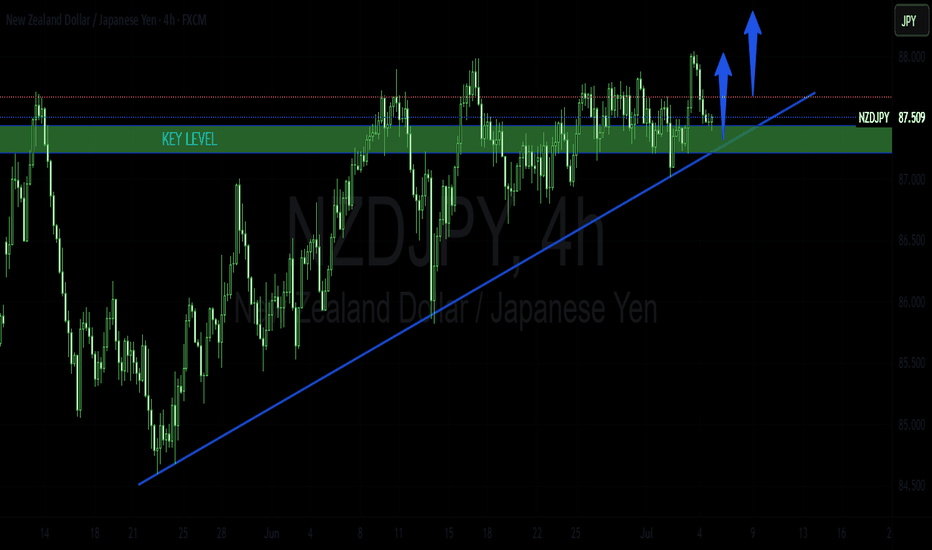

NZDJPY: Another Bullish Wave Ahead?! 🇳🇿🇯🇵

NZDJPY violated a significant daily resistance cluster last week.

The broken structure and a rising trend line compose a

contracting demand zone now.

That will be the area from where I will anticipate a bullish movement.

Next resistance - 89.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPYNZD trade ideas

NZDJPY H4 LONG SETUP: 14-18 JULY 2025TECHNICAL ANALYSIS

Market and price are both bullish. After printing a higher low bulls will be looking to push price to the upside all the way to this weeks TP target.

FUNDAMENTAL ANALYSIS

Fundamentals also indicate bullishness. The currency pair NZDJPY has a score of 11, indicating that the base currency is stronger than the quote currency. The seasonality and COT scores also indicate bullishness.

NZD/JPY – 4H Technical and Fundamental AnalysisNZD/JPY – 4H Technical and Fundamental Analysis

NZD/JPY remains supported fundamentally by a hawkish stance from the Reserve Bank of New Zealand, which recently held rates at 5.50%, emphasizing ongoing caution around inflation. This tone continues to favor NZD strength in the short to medium term.

Adding to that, seasonal trends also support bullish momentum July and August have historically been weak for the Japanese yen and relatively strong for the New Zealand dollar, aligning with the current upside bias.

On our Technical Side

NZD/JPY recently broke above a minor key resistance at 87.900, following a multi-week period of consolidation. This breakout signaled renewed buyer interest and a potential shift into a bullish continuation phase.

After the breakout, price entered a clear accumulation zone, where early buyers positioned themselves just above support. However, smart money triggered a stop-loss hunt below 87.900, targeting liquidity trapped beneath that key level.

This liquidity grab formed a Clear liquidity within the liquidity zone, creating a cleaner setup for long opportunities. Price is now heading back toward the previous resistance now flipped into a key support level.

📍 Buy Limit Setup:

Buy Limit Entry: 88.030

Stop Loss: 87.570 (below liquidity zone)

Take Profit: 89.250 (next minor resistance zone)

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

"Trap or Opportunity? NZD/JPY Smart Pullback Play?"💼🎯 NZD/JPY – The Kiwi Vault Breakout | Thief Trading Style Forex Blueprint 🔓📈

🌟Hola! Hello! Ola! Bonjour! Hallo! Marhaba, Global Market Raiders!🌍✨

Welcome to the Thief Trading Style – where smart traders strategize, strike, and secure the bag. This is not your regular trade idea... this is a market infiltration plan – a tactical move on the NZD/JPY pair, aka the Kiwi vs Yen Battle Zone.

🎯 Plan Overview – Operation: Kiwi Vault Breakout

Using a mix of technical heatmaps, smart money concepts, and macro insight, this chart outlines a bold plan for Long Position scalpers and swing tacticians.

💹 The current trend shows signs of bullish momentum, with price eyeing the upper yellow zone – a known resistance pocket where liquidity pools and trap setups often play out.

📈 Entry Strategy – The Gate Is Open

Buy Limit zones:

☑️ Watch the 15/30 min timeframe for pullbacks to nearest swing low/high.

☑️ Ideal for scalpers & swing traders aiming for precise entries.

🧠 “Enter like a shadow, exit like thunder.”

🛑 Stop Loss – Secure Your Capital

Place SL at:

☑️ Recent swing low/high (Based on 4H structure – approx. 87.200)

☑️ Adjust according to your lot size, capital exposure, and position count

Remember, SL is not fear — it's discipline.

🎯 Target – Precision Exit

🎯 TP Zone: 88.900

⚠️ Optional: Exit earlier based on reaction to key levels, or trail your stop to lock gains.

💡 "Profit isn't greed, it's your reward for precision."

⚡Trader Roles – Choose Your Mode

👀 Scalpers:

Only trade the long bias. No short-circuiting the plan.

Use trailing stops to guard gains and surf the momentum waves.

📈 Swing Traders:

You’re in for a full ride — ride the wave till the next institutional block.

Stay patient, and let price develop before jumping in.

🔍 Analysis Backdrop – What’s Fueling the Move?

The bullish push is backed by:

🔸 Positive fundamental & macro signals

🔸 Institutional positioning (check COT Reports)

🔸 Intermarket correlation strength

🔸 Market sentiment score

📊 Want full breakdowns? Dive into COT, Macro Reports, Quant Flow & more → 🔗🔗🔗 Klick

📰 Risk Reminder – News Volatility Warning

🚨 Avoid new entries during major data releases

🔒 Protect open positions with trailing SLs

⚙️ Manage risk – trading is about probability, not certainty

💬 Final Words – Boost the Blueprint

💥Hit “Like” if you vibe with this strategy and support the community of tactical traders.

This plan is designed to bring clarity, structure, and a bit of swagger to your chart screen.

See you in the next setup – stay sharp, stay stealthy. 💼🧠💪

Disclaimer:

This idea is for educational purposes only and not investment advice. Please evaluate your own risk tolerance and market understanding before entering any trades.

NZDJPY Breakout: Bulls take charge above key resistanceNZDJPY has broken out of a textbook ascending triangle on the daily time frame, signaling strong bullish momentum. Price is pushing higher with a solid structure and supportive RSI levels, leaving room for continuation. A breakout retest can offer a high-probability entry.

NZDJPY to find buyers at previous support?NZDJPY - 24h expiry

The primary trend remains bullish.

Short term RSI is moving lower.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 87.50.

We look to Buy at 87.50 (stop at 87.30)

Our profit targets will be 88.30 and 88.50

Resistance: 88.00 / 88.30 / 88.50

Support: 87.50 / 87.20 / 87.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

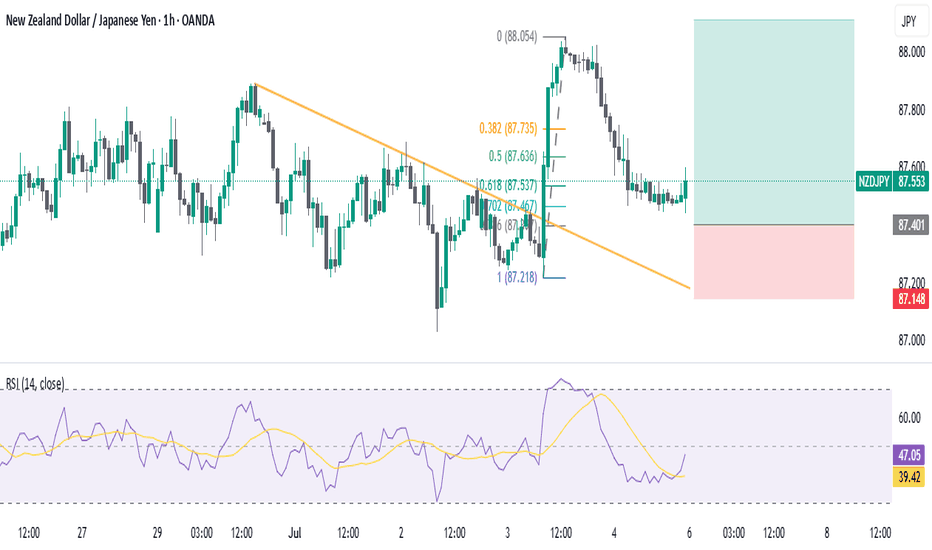

Lower time frame opportunity on nzdjpymeanwhile, while we wait for a pullback to the higher timeframe fib level for a vuy trade, we seem to be have a setup for a sell trade. to follow the market down towards our higher timeframe fib level.

if all turns out right, we can sell into our higher time frame fib level and then buy upward

lets see how the market unfolds

NZDJPY TRADE IDEANzdjpy also seems to be in an upward motion. lets see how it plays out, as we await a pullback to our fib level to the the trade to the upside.

its now a waiting game.

Trade can be taken and managed properly using the parameters shown in the image above.

please, this is no financial advice

NZD/JPY BEARS ARE STRONG HERE|SHORT

NZD/JPY SIGNAL

Trade Direction: short

Entry Level: 88.157

Target Level: 87.575

Stop Loss: 88.542

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

nzdjpy📈 The trend is clearly bullish, with the week starting strong and Friday closing above the 22-period daily moving average.

Now it’s just a matter of waiting for a correction to enter at a more interesting price zone. Personally, I believe the price has a high probability of visiting the two marked areas — roughly a 75% and 60% chance, respectively.

If you're looking to manage a tighter stop-loss and aim for a risk-to-reward ratio around 1:5, this setup could be for you. 🔍

⚠️ Always remember: risk no more than 0.5% of your account per trade.

#NZDJPY #SwingTrade #Forex #RiskManagement #TradingView

NZDJPY - bulls are exhausted! Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDJPY has been overall bullish trading within the rising flat channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong structure.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and green structure.

📚 As per my trading style:

As #NZDJPY is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD/JPY: Bearish Wedge Before RBNZ CatalystThis is a high-conviction trade idea for NZD/JPY , where a perfect storm of technical and fundamental factors is aligning for a significant short opportunity. The setup is clean, the reasoning is strong, and we have a clear catalyst on the horizon. 🚀

Fundamental Analysis 🌪️

The macro picture is the primary driver here, creating a powerful bearish case.

1️⃣ Monetary Policy Divergence (🇳🇿 vs 🇯🇵): This is the core engine of the trade. The Reserve Bank of New Zealand (RBNZ) is dovish, signaling rate cuts amid a fragile domestic economy. In stark contrast, the Bank of Japan (BoJ) is hawkish, having started a historic policy normalization to combat persistent inflation. This fundamental clash is strongly bearish for NZD/JPY.

2️⃣ Risk-Off Catalyst (🇺🇸): The market is nervous ahead of the July 9th US tariff deadline . This uncertainty is creating a classic "risk-off" environment, which typically strengthens the safe-haven JPY and weakens risk-sensitive currencies like the NZD.

3️⃣ The RBNZ Decision (🏦): The main event on July 9. The market expects a "dovish hold," meaning even if rates are unchanged, the forward guidance will likely be very cautious, highlighting economic risks and signaling future cuts. This is the catalyst that could trigger the sell-off.

Technical Analysis 📉

The 4H chart provides crystal-clear confirmation of the fundamental weakness.

1️⃣ Bearish Rising Wedge: Price is being squeezed into a classic bearish reversal pattern. This shows that buying pressure is exhausted, and the market is preparing for a move to the downside.

2️⃣ Key Resistance Zone: The wedge is pushing directly into a heavy supply zone between 87.80 and 88.00 . This area has acted as a firm brick wall 🧱, rejecting multiple attempts to move higher.

3️⃣ RSI Momentum: The RSI below the chart confirms the weakening momentum. It's failing to show strong bullish power, which supports the price action and signals that the uptrend is running out of steam. 💨

The Trade Plan 🎯

Based on this analysis, the plan is to enter with a limit order to get an optimal entry price on a potential final spike into resistance.

Direction: Short (Sell) 📉

Order Type: Limit Sell

Entry: 87.80 📍

Stop Loss: 88.40 🛡️

Take Profit: 86.00 💰

Risk/Reward Ratio: 1:3 ⭐⭐⭐

This setup presents a rare confluence of fundamental divergence, technical weakness, and a clear catalyst.

Trade safe and manage your risk.

NZDJPY- Buy SetupNZDJPY 1H – Price has broken above a descending trendline and is showing bullish momentum. RSI is recovering from near-oversold levels, supporting the bullish bias. This entry aligns with the higher time frame trend, as NZDJPY remains bullish on both the 4H and Daily charts. Trade setup targets the continuation of the overall uptrend with a favorable risk-reward.