USDJPYMarket Bias: Bearish USDJPY

Recent price action shows weakening bullish momentum on USDJPY, with sellers stepping in near resistance zones.

Key Drivers:

– Broad USD softness amid dovish Fed tone and easing inflation pressures

– JPY strength supported by rising BOJ tightening expectations or yield differentials narrowing

– Risk-off sentiment potentially boosting safe-haven demand for JPY

JPYUSD trade ideas

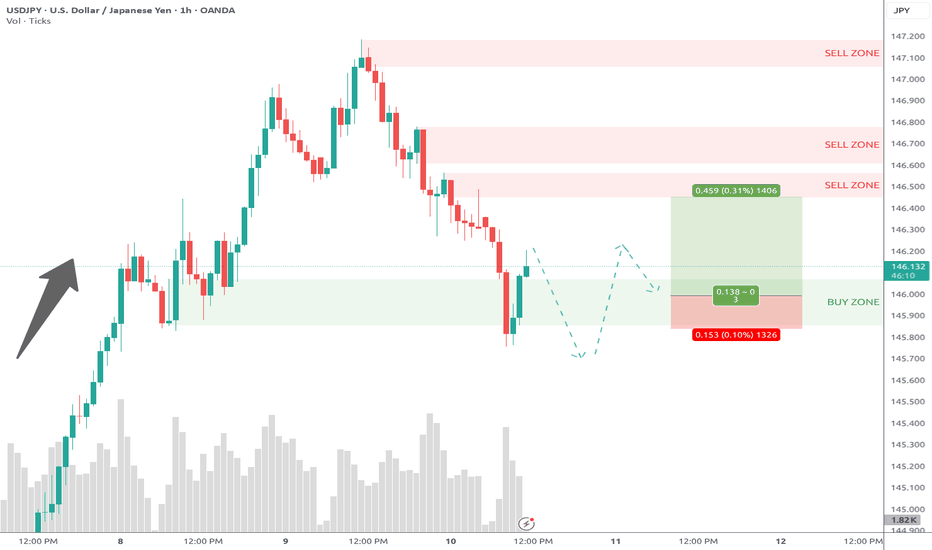

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇

Forex Market Depth Analysis and Trading StrategiesForex Market Depth Analysis and Trading Strategies

Forex market depth analysis offers traders a deeper understanding of currency market dynamics. It reveals the real-time volume of buy and sell orders at different prices, which is crucial for assessing liquidity and trader sentiment. This article explores how to analyse and use market depth for trading, discussing various strategies and their limitations.

Forex Market Depth Explained

Market depth meaning is the volume of buy and sell orders at different price levels. It's a real-time snapshot of the pair’s liquidity and depth of supply (sell orders) and demand (buy orders). Traders use this information to gauge the strength and direction of a currency pair.

This depth is typically represented through an order book, displaying a currency pair’s existing orders at various price points. This book lists the number of units being bid or offered at each point, giving us insight into potential support and resistance levels. For instance, a large number of buy orders at a certain price level may indicate a strong support area, suggesting that many traders are willing to purchase the currency pair at this price.

Understanding market depth is crucial in assessing the likelihood of trades being executed at desired prices, especially in fast-moving currencies or when trading large volumes. It may help in identifying short-term price movements, offering a more nuanced view of an asset beyond just candlestick charts.

How to Analyse Market Depth

Analysing order flow is a fundamental aspect of market depth trading, providing traders with valuable insights into the supply and demand dynamics of forex pairs. Forex market depth can be assessed using various tools and indicators.

One key tool is the Depth of Market (DOM), which shows the number of buy and sell orders pending at different prices. DOM offers a visual representation of the currency pair’s order book, highlighting potential areas where large orders are placed. We can use such information to identify significant support and resistance levels where the pair might experience a turnaround.

Another essential tool is Level II quotes. These quotes provide detailed information about the price, volume, and direction of every trade executed in real-time. By analysing Level II quotes, traders may be able to identify the pair’s momentum and potential trend shifts. For example, if there is a sudden increase in sell orders at a particular price, it may indicate a potential downward movement, prompting us to adjust our positions accordingly.

Strategies Using Market Depth Analysis

In forex trading, market depth analysis is a crucial tool for understanding and executing a depth of market strategy. Here's how traders can leverage this type of analysis in their strategies:

Scalping Strategy

By closely observing the DOM, scalpers can identify minor price movements and liquidity gaps. For instance, if the DOM shows a large number of sell orders at a slightly higher price, a scalper might open a short position, anticipating a quick downturn. This strategy relies on fast, short-term trades, capitalising on small price changes.

Momentum Trading

Momentum traders use the order book to gauge the strength of a trend. By analysing the order flow and volume, they can determine if a trend is likely to continue or reverse. For example, a surge in buy orders at increasing prices may signal a strong upward momentum, prompting a trader to enter a long position. Conversely, a build-up of sell orders might indicate a potential downward trend.

Support and Resistance Trading

Depth analysis is invaluable for identifying key support and resistance levels. Clusters of orders often act as barriers, influencing price movements. Traders may use these levels to set entry and exit points. For example, a large number of buy orders at a specific price may indicate a strong support zone, reflecting a potentially good entry point for a long position.

Breakout Trading

Traders seeking breakout opportunities can use market depth to spot potential breakout points. A significant accumulation of orders just beyond a known resistance or support level may indicate a potential breakout. If the pair moves past these areas with high volume, it could signal the start of a new trend, potentially offering a lucrative trading opportunity.

Integrating Market Depth with Technical Analysis

Integrating a depth chart trading strategy with technical analysis may enhance decision-making, combining the real-time insights of depth charts with the power of technical indicators. For instance, we can use market depth to confirm signals from technical analysis tools.

If a moving average crossover suggests a bullish trend, a corresponding increase in buy orders in the depth chart may reinforce the signal. Similarly, a significant resistance level identified through technical analysis, such as a Fibonacci retracement level, might be substantiated if there’s a large accumulation of sell orders at that price point.

Risks and Limitations of Market Depth Analysis

While market depth analysis is a valuable tool in forex trading, it comes with certain risks and limitations:

- Dynamic and Fast-Changing Data: Order book data is highly dynamic, often changing within seconds, making it challenging to base long-term strategies solely on such information.

- Lack of Centralisation in Forex: Unlike stock exchanges, the forex market lacks a centralised exchange. This decentralisation means depth data might not represent the entire marketplace accurately.

- Susceptibility to 'Spoofing': Large players might place and quickly withdraw large orders to manipulate market depth perception, misleading other traders. It’s worth noting that spoofing is illegal in many jurisdictions.

- Limited Usefulness in Highly Liquid Markets: In highly liquid pairs, the depth of market data may become less relevant, as large orders are quickly absorbed without significantly impacting prices.

- Dependency on Broker's Data: The reliability of order book data depends on the broker's technology and the size of their client base, which can vary widely.

The Bottom Line

Market depth analysis provides critical insights for forex traders, though it's vital to recognise its dynamic nature and limitations. Integrating it with technical analysis may create robust trading strategies.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Fundamental Market Analysis for July 11, 2025 USDJPYThe dollar is holding steady at 146.500 against the yen: another rise in US yields and stable demand for safe US assets following comments from the Fed are fueling appetite for the USD, while demand for the JPY remains sluggish.

The tariff front exacerbates the imbalance: the White House has already imposed 25% tariffs on Japanese goods, and new ideas for “umbrella” tariffs are heightening fears of a trade war, forcing investors to flow into financing currencies. Reuters notes that the yen weakened to 146.400, recording a weekly decline of more than 1%.

At the same time, the Bank of Japan is not yet ready for aggressive tightening: a decline in inflation to 1.8% y/y and weak real wage dynamics make it difficult to raise rates above 0.5%. The divergence in monetary policy and expectations for Japanese macro data (machine tool orders, industrial production) until July 14 form the fundamental basis for the pair's growth to 147.500 and above, while the risks of correction are limited to the 145.900 zone.

Trading recommendation: BUY 146.500, SL 145.900, TP 147.500

XABCD Double Top

Hello traders! I hope you’ve had a productive trading week.

Let’s take a look at USDJPY, where we’re wrapping up the week with a textbook XABCD Double Top formation.

📍 Structure Overview

Price action completed an extended XABCD formation, with D printing a perfect double top around the 147.17 level.

The move from C to D aligns closely with the prior XA leg, showing strong symmetry in price.

D terminates precisely within the PCZ (Potential Completion Zone), aligning with both 78.6% and 100% extensions.

🎯 Bearish Targets Below

If this Double Top confirms with bearish follow-through, the structure offers a clean setup with downside targets:

Target 1: 145.35 (100%)

Target 2: 144.96 (127.2%)

A break below point C (146.13) would further validate the bearish thesis.

🧠 Pattern Highlights

XABCD geometry

Strong price symmetry

Completion into previous high (resistance)

Clear target zone for risk-defined trades

USDJPY Sell Idea Looking to sell between 146.800–147.180, targeting a move down to 145.000 with a stop loss at 147.400 to manage risk. This setup aims to catch a pullback from resistance after the recent rally, expecting the price to drop toward lower support.

As always, watch for bearish confirmation around the entry zone and trade with discipline.

Entry: 146.800 - 147.180

SL: 147.400

TP: 145.000

USDJPY | Supply zone rejection 💣📉Price ran out internal liquidity, tapped into a refined supply zone, and showed early signs of distribution. Entry taken post-confirmation at the mitigation of the order block, with a clean R:R toward the next demand zone.

🔹 BOS + Liquidity Grab

🔹 Supply Zone Rejection

🔹 Premium Pricing Entry

🔹 Targeting unmitigated demand below (HTF imbalance)

Setup is built around smart money principles—waiting for price to deliver the sell-off. Clean and mechanical.

#SMC #USDJPY #SmartMoney #LiquiditySweep #FXTradingClub #MarketStructure

USDJPYUSDJPY ADVANCED OUTLOOK

US10Y=4.348% WEEKLY HIGH 4.436%

DXY=97.664$ weekly low 96.871

FED INTEREST RATE HELD STEADY LAST MEETING BY FOMC VOTE 4.25%-4.5%

Heads of the Federal Reserve (Fed) and Bank of Japan (BOJ)

Federal Reserve (Fed)

Chair: Jerome H. Powell

Term: Powell has served as Chair of the Board of Governors of the Federal Reserve System since February 5, 2018. He was reappointed for a second four-year term on May 23, 2022, which is set to run until May 2026.

Background: Powell is an American investment banker and lawyer, known for his consensus-building approach and steady leadership during periods of economic uncertainty. He has been a member of the Board of Governors since 2012.

Bank of Japan (BOJ)

Governor: Kazuo Ueda

Term: Kazuo Ueda has served as Governor of the Bank of Japan since April 2023. He is a distinguished academic with a PhD in economics from MIT and has guided the BOJ through its recent policy normalization and interest rate increases.

Key Executive: Koji Nakamura was appointed as the BOJ’s Executive Director overseeing monetary policy and financial markets in April 2025, supporting Governor Ueda in policy implementation.

BOJ ( BANK OF JAPAN) 10 year bond yield

JP10Y=1.491% HIGH FOR THE WEEK 1.515%

BOJ INTEREST RATE =0.5%

Interest Rate Differential:

US Federal Reserve rate: 4.25%–4.50%.- BOJ 0.5%=3.75%-4%

the interest rate differential favor USD LONG

Bank of Japan (BoJ) rate: 0.5% comes in higher giving yen a shot advantage ,on monthly TF USDJPY remains bearish.

10-Year Bond Yield Differential:

Us10y 4.35% -JP10Y 1.515%= 2.835%

The bond yield spread continues to favor the dollar, attracting capital to US assets.

Monetary Policy Outlook:

The BoJ remains cautious, signaling a slow pace of further tightening.

The Fed is expected to maintain higher rates in the near term, though some easing is anticipated later in 2025.

Technical and Fundamental Summary

Trend: USD/JPY remains in a bullish trend, we will have upside potential if US yields stay elevated and BoJ remains dovish.

the monthly TF remains bearish and its something to watch.

The USD/JPY pair is expected to remain supported above 145 as long as the interest rate and bond yield differentials favor the US.

Upside risks exist if US economic data outperforms or if the BoJ maintains its cautious stance.

Downside risks could emerge if the Fed signals faster rate cuts or if there is a significant shift in risk sentiment favoring the yen.

In summary:

USD/JPY is trading near 146.231, with the US dollar supported by higher interest rates and bond yields relative to Japan. The pair’s direction will remain sensitive to central bank policy signals and global risk sentiment in the coming weeks.

1. Uncovered Interest Rate Parity (UIP) –

Uncovered Interest Rate Parity (UIP) is a fundamental theory in international finance and foreign exchange markets. It states that the difference in interest rates between two countries should equal the expected change in their exchange rates over the same period. The concept assumes no arbitrage opportunities and that investors are risk-neutral.

Implication:

If one country has a higher interest rate, its currency is expected to depreciate by the same amount as the interest rate differential.

Carry Trade:

If UIP holds, there is no excess return from borrowing in a low-interest currency and investing in a high-interest one, as exchange rate movements offset the interest rate advantage.

Covered vs. Uncovered:

Covered Interest Rate Parity (CIP): Uses forward contracts to hedge exchange rate risk.

Uncovered Interest Rate Parity (UIP): No hedging; relies on expected spot rates.

Example:

If US rates are 4.5% and JPY rates are 0.5%, UIP predicts the US dollar will depreciate by 4% against the JAPANESE YEN over the period, making returns equal after accounting for currency changes.

Given the USD interest rate of 4.5% and the Bank of Japan (BOJ) interest rate of 0.5%, the Uncovered Interest Rate Parity (UIP) and Covered Interest Rate Parity (CIP) conditions is as follows:

1. Uncovered Interest Rate Parity (UIP)

UIP states that the expected change in the spot exchange rate between two currencies equals the interest rate differential between those countries. In other words, the currency with the higher interest rate is expected to depreciate relative to the currency with the lower interest rate by roughly the interest rate differential.

Interpretation:

Since the USD interest rate (4.5%) is higher than the BOJ rate (0.5%), UIP predicts that the USD will depreciate against the JPY by approximately the interest rate differential of 4.0% annually.

This means that although USD offers higher yields, investors expect the USD to weaken relative to JPY over the investment horizon, offsetting the higher interest return.

2. Covered Interest Rate Parity (CIP)

CIP states that the forward exchange rate should adjust to offset the interest rate differential, eliminating arbitrage opportunities by using forward contracts to hedge exchange rate risk.

With USD rates higher than JPY rates, the USD is expected to trade at a forward discount relative to JPY, meaning the forward USD/JPY rate will be lower than the spot rate to compensate for the higher USD interest rate.

This ensures no arbitrage profit from borrowing in JPY and investing in USD while hedging currency risk.

This implies the forward rate is about 151.82 USD/JPY, higher than the spot rate, indicating a forward premium on USD relative to JPY.

Note: This suggests USD is trading at a forward premium, which contradicts the earlier interpretation. This discrepancy arises because in USD/JPY quoting, USD is the base currency and JPY the quote currency. The direction of the interest rate differential effect depends on the quoting convention.

Important Clarification on Quoting Conventions:

USD/JPY is quoted as Japanese yen per 1 US dollar.

When the domestic currency is USD, and foreign currency is JPY, the formula applies as above.

Since USD interest rates are higher, the JPY is trading at a forward discount relative to USD, meaning the forward USD/JPY rate is higher than the spot rate (USD is expected to appreciate).

Summary:

Aspect Result / Interpretation

Interest Rate Differential USD 4.5% vs. JPY 0.5% → 4.0% differential

UIP Prediction USD expected to appreciate against JPY by ~4% (due to quoting)

CIP Forward Rate Forward USD/JPY rate > Spot rate (USD at forward premium)

Carry Trade Borrow in low-rate JPY, invest in high-rate USD to earn carry

Conclusion:

With USD interest rate at 4.5% and BOJ rate at 0.5%, the covered interest rate parity (CIP) implies the USD will trade at a forward premium against JPY, i.e., the forward USD/JPY rate will be higher than the spot rate by roughly the interest rate differential.

The uncovered interest rate parity (UIP) suggests that investors expect the USD to appreciate against JPY by about 4% over the investment horizon, compensating for the higher USD interest rate.

This supports typical carry trade strategies where investors borrow in low-yielding JPY and invest in high-yielding USD assets, profiting from the interest differential.

#usdjpy #dollar #yen #jpy

back to daily support USDJPY touched 148 this morning ahead of US PMI.

According to methodology

1. Resistance Zone:

• The 0.125 level (147.820) acted as a resistance point where selling pressure overwhelmed buying pressure, causing the price to reverse downward. Since the price reached 148.000 (just above 147.820), it tested and failed to sustain above this level, reinforcing its role as a barrier.

2. Daily Support

•The daily support trend line (yellow box) has been an area to watch as price continues to try and get over the 148 hump. Until then, this pair is going to wedge until a break confirmation.

Bearish drop off pullback resistance?USD/JPY has rejected off the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and could drop from this level to our take profit.

Entry: 146.50

Why we like it:

There is a pullback resistance that lines up with the 50% Fibonacci retracement.

Stop loss: 147.17

Why we like it:

There is a pullback resistance.

Take profit: 145.21

Why we like it:

There is a pullback support that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

ABCHello traders! 👋

I hope you’re having a fantastic trading week so far. Let’s take a look at the USDJPY setup unfolding right now — and it’s all about classic symmetry.

📌 Setup Breakdown

We’re seeing a textbook ABC Bearish Continuation:

🔹 AB: Sharp move down

🔹 BC: Clean correction back into structure

🔹 CD (Projected): Symmetrical to AB, aiming toward the target zone

Price just tapped into the PCZ (Potential Completion Zone) around the 127.2%–161.8% fib projections — showing early rejection and setting up a potential move lower.

🎯 Target Zone

First Objective: 100% projection (~145.35)

Extended Target: 127.2% (~144.96)

With structure clear and risk above C, the symmetry is doing all the talking.

🧠 Key Factors

✅ Classic ABC symmetry

✅ Strong reaction at PCZ

✅ Risk well-defined

✅ Trend continuation potential

No guesswork — just measured movement within structure.

💬 Final Thoughts

If this plays out, it would be a clean continuation play in line with the overall flow. As always, let the chart guide you — not emotion.

📚 Pattern → Zone → Reaction → Follow-through

Wishing everyone smooth trades ahead. Let’s keep it simple and professional.

USDJPY| 15| Liquidity Grab + Choch reaction Price formed a basic CHoCH after sweeping sell-side liquidity and creating a temporary low. A short setup was taken from a lower timeframe supply zone, aligned with bearish order flow and rejection at imbalance.

🔹 Sell-side Liquidity Sweep

🔹 CHoCH Confirmation

🔹 Rejection from Supply

🔹 Expecting bearish continuation if price holds below 146.52

Invalidation: If price closes above the LQ CHoCH zone, I’ll shift bias to longs. Until then, I’m holding the short narrative.

#SMC #USDJPY #OrderFlow #LiquiditySweep #FXTradingClub #PriceAction #CHoCH

Japan PPI slips to 10-month lowThe Japanese yen is showing limited movement on Thursday. In the North American session, USD/JPY is trading at 146.45, up 0.10% on the day.

Japan's Producer Price Index rose 2.9% y/y in June, down from an upwardly revised 3.3% in May and matching the consensus. This marked the lowest increase since August 2024. On a monthly basis, PPI fell 0.2%, a second straight decline after a 0.1% decline in May.

The PPI report signals that underlying inflation pressures are dropping at the producer level, which could delay the BoJ's plans to hike rates and normalize policy. The BoJ has been in a wait-and-see stance since it raised rates in January, exercising caution in a turbulent economic environment. The Bank of Japan held rates in June and meets next on July 31.

The FOMC minutes indicated a broad consensus that the Fed will deliver additional rate cuts this year. The pace of those cuts, however, is up for debate. Some members favored cutting as soon as the July meeting, while others were more cautious and wanted to see where inflation and employment were headed. President Trump's tariffs have not boosted inflation so far, but the tariff effect on inflation could be felt in the following months and the Fed remains cautious. Fed Chair Powell has stuck to his guns, pushing back against persistent calls from President Trump to lower rates.

Fed policymakers are keeping a close eye on the US labor market, which has softened but not deteriorated. Earlier, unemployment claims dropped to 227 thousand, down from a revised 232 thousand in the previous release and below the consensus of 235 thousand.

USDJPY downtrend resistance at 147.30The USDJPY pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 147.30, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 147.30 could confirm the resumption of the downtrend, targeting the next support levels at 145.60, followed by 145.10 and 144.65 over a longer timeframe.

Conversely, a decisive breakout and daily close above 147.30 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 147.70, then 148.14.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 145.30. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USD/JPY bears getting trapToday's main data release was the weekly jobless claims figures, which came out better than expected at 227K vs. 236K eyed, down from 232K the week before.

In response, the dollar extended its rebound, and the USD/JPY has turned positive on the day after yesterday's reversal.

In recent days the UJ has been pushing higher, thanks to a weakening JPY amid threats of tariffs from the US. But we have also seen some support for the dollar owing to expectations that the tariffs will prove inflationary and that could limit Fed rate cuts.

The UJ has been forming a few bullish price signals and now finds itself above the 21-day exponential average. Stops resting above those inverted hammer candles from yesterday and June 23 could be in trouble. Can we see price rally towards those liquidity pools?

Support at 146.00 held firm after a brief dip below it. Next support is around 145.00 then 144.25 and 144.00 thereafter.

By Fawad Razaqzada, market analyst with FOREX.com