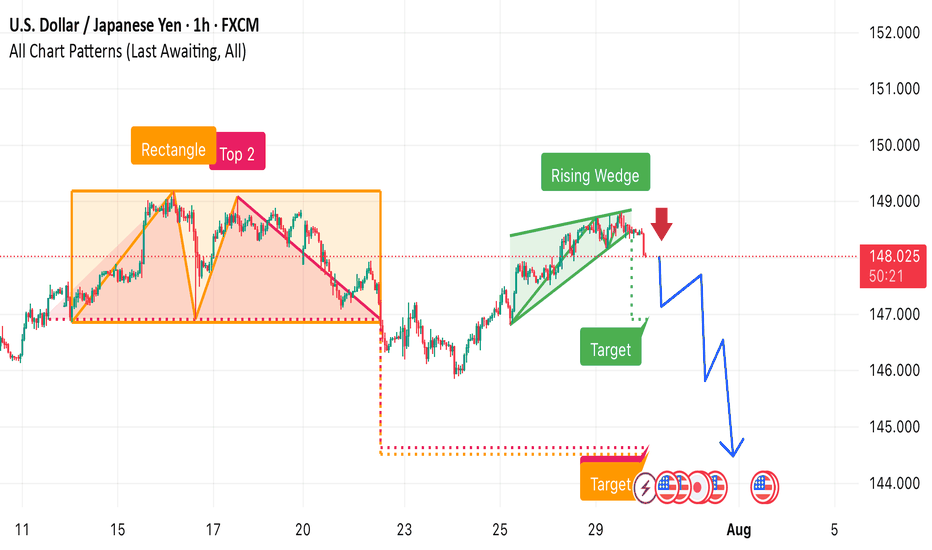

Key Observations 1. Rectangle + Double Top (“Top 2”) Formation (left side):

• Price ranged between ~147.5 and ~149.5.

• A double top inside the rectangle signaled resistance and potential reversal.

• Breakdown from the rectangle zone occurred, confirming bearish momentum.

2. Rising Wedge Pattern (right side, green zone):

• A bearish pattern forming higher highs and higher lows.

• The red arrow indicates an expected breakdown from the wedge.

3. Bearish Price Projection (blue arrows):

• The chart projects a sharp drop following the wedge breakdown.

• Multiple target levels are marked:

• First Target: ~147.0 zone.

• Final Target: Near 144.0, aligning with the measured move from previous breakdown.

4. Confluence of Bearish Signals:

• Rectangle breakdown + rising wedge.

• Bearish candle rejection near 149 resistance.

• Pattern-based technical targets drawn using past behavior.

JPYUSD trade ideas

USDJPY Short from ResistanceHello Traders

In This Chart USDJPY HOURLY Forex Forecast By FOREX PLANET

today USDJPY analysis 👆

🟢This Chart includes_ (USDJPY market update)

🟢What is The Next Opportunity on USDJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

USDJPY A Fall Expected! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 148.71

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 147.93

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDJPY rising wedge capped at 148,90The USDJPY pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 149.90, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 148.90 could confirm the resumption of the downtrend, targeting the next support levels at 146.93, followed by 146.50 and 146.10 over a longer timeframe.

Conversely, a decisive breakout and daily close above 148.93 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 149.75, then 150.20.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 148.90. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDJPY - 30/7/25 - BoS to a bearish pull backI dont normally trade USDJPY but i see a setup based on my strategy. The price was climbing to take out a previous high on the 4H and Daily TF. But on the hourly there is a clear BoS which suggests that there may be a pull back even though the HTF bias is still bullish.

+ve:

1. there is a BoS on the 1 hour chart

2. Equal low liquidity just below which will draw price to this zone

3. Big imbalance below the equal low liquidity

-ve:

1. Fed news today may push the market against my trade idea

USDJPY Forming Bullish Reversal | MMC Analysis + Target🧠 Chart Overview (2H Timeframe)

🔸 1. Head and Shoulders Inverse Pattern – MMC Bullish Blueprint

The chart beautifully shows an Inverse Head & Shoulders pattern, one of the most powerful reversal signals under MMC logic:

Left Shoulder: Formed after the initial drop and quick recovery.

Head : Deep liquidity grab and reversal from the lowest point (demand zone).

Right Shoulder: Higher low structure, indicating reduced selling pressure and shift in momentum.

This pattern is forming around a previous liquidity zone, which makes it more valid and aligned with smart money behavior.

🔸 2. Retesting Zone – Critical MMC Demand Area

Price is now retesting a highlighted demand zone, which acted as the springboard for the previous bullish move:

Bullish Pattern marked aligns with MMC’s concept of “Return to Origin”.

This zone also sits just above the right shoulder, confirming that buyers are defending aggressively.

If this level holds, we may see a strong continuation move to the upside.

🔸 3. Previous Reversal Zone (Supply) – Next Target Area

Marked in light green, this area is the next critical resistance:

Acts as liquidity target for institutions if price rallies.

Historically acted as a major reversal point.

Price is likely to show reactions or profit-taking behavior here.

Once broken and retested, it becomes a new support for further upside continuation (as marked on the chart).

🔸 4. Dual Scenarios – Bullish vs Bearish Pathways

Your chart correctly outlines two strategic possibilities:

✅ Bullish Scenario:

Price respects demand zone.

Breaks above previous reversal zone (149.000+).

Bullish continuation toward 149.800–150.500 range.

MMC tip: “If it goes bullish, use previous demand or double it” = Add confluence or stack demand zones for scale-in entries.

❌ Bearish Scenario:

If price breaks below retesting zone, bullish invalidation triggers.

Look to the previous all supply zone (Zone Pattern Must) for next reaction.

This scenario reflects smart money rejection of upside continuation.

🗂️ MMC Structural Elements Identified:

Zone/Pattern Role in Analysis

Inverse H&S Trend reversal signal

Retesting Zone Demand/entry area

Previous Reversal Zone First key resistance / next liquidity pool

Supply Zone Below Target in case of downside breakdown

MMC Logic Follow price structure, fakeouts, demand/supply traps

📈 Summary Outlook:

USDJPY is showing a technical bullish structure backed by MMC-based price psychology. The current pullback into a demand zone gives traders an excellent R:R opportunity for long positions, targeting higher zones upon breakout confirmation.

🟩 If bullish, breakout >149.000 will likely lead toward 150.000+

🟥 If bearish, breakdown <147.600 opens doors to deeper drop toward 146.000 zone (watch for reversal pattern).

🔑 Key Levels to Watch:

Type Level Range Notes

Support 147.600–147.800 Current retesting demand

Resistance 148.800–149.300 Previous Reversal Zone (Profit booking area)

Higher Resistance 150.500+ Final upside objective

Breakdown Zone <147.500 Flip to bearish scenario

USDJPY – DAILY FORECAST Q3 | W31 | D30 | Y25📊 USDJPY – DAILY FORECAST

Q3 | W31 | D30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:USDJPY

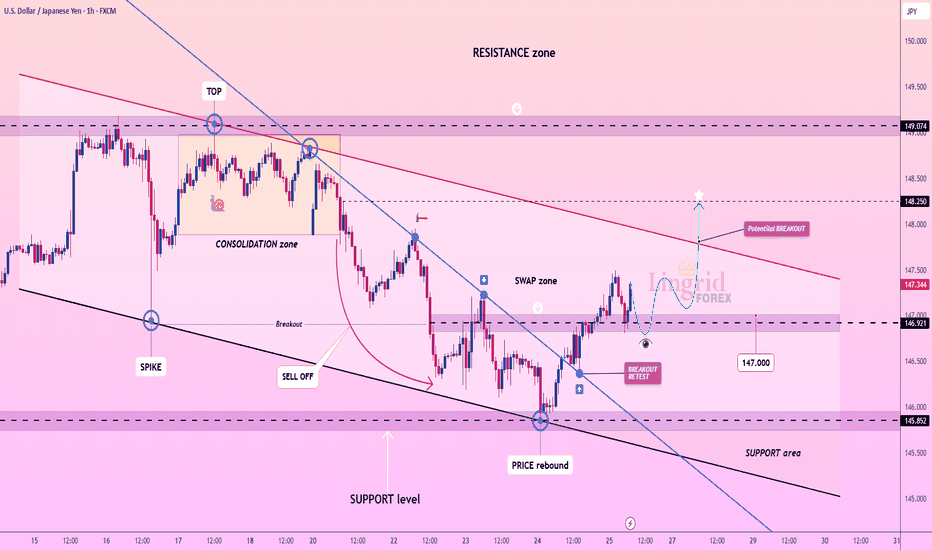

Lingrid | USDJPY Potential Channel Breakout. LongFX:USDJPY is retesting the breakout zone after reclaiming support from a prior swap area near 146.9. Price action has broken above a downward trendline and is forming a bullish retest structure. As long as USDJPY holds above 146.920 zone, the setup favors a continuation toward the resistance barrier. A breakout above the red descending trendline could accelerate upside momentum.

📉 Key Levels

Buy trigger: Break and hold above 147.500

Buy zone: 146.900 – 147.000

Target: 148.250

Invalidation: Break below 146.000

💡 Risks

Failure to break the descending red trendline may trigger renewed selling

Consolidation below resistance could signal buyer exhaustion

Break below 146.000 would invalidate bullish retest setup

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

USDJPY | H4 Bullish bounce offBased on the H4 chart analysis, the price is falling towards the buy entry, which is an overlap support that aligns with the 61.8% Fibonacci retracement and could bounce from this level and rise higher.

Buy entry is at 147.08, which is an overlap support that lines up with the 61.8% Fibonacci retracement.

Stop loss is at 145.82, which is a multi-swing low support.

Take profit is at 148.72, which is pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDJPY Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 148.900 zone, USDJPY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 148.900 support and Resistance area.

Trade safe, Joe.

USDJPY BUY FORECASTUSDJPY New forecast👨💻👨💻

Note:

Follow proper risk management rules. Never risk more then 2% of your total capital. Money management is the key of success in this business...... Set your own SL & TP.

Please support this idea with a Like and COMMENT if you find it useful click "follow" on our profile if you will like these type of trading ideas delivered straight to your email in the future.

Thanks for your continued support!! lemme know your thoughts in the comment sec...

USDJPY- STRONG BUY NEAR 1D MA50

After our June 13 buy signal hit 148.675 target, USDJPY now forms a Channel Up, supported again by the 1D MA50 (blue line).

As long as this Higher Low holds, expect a new bullish leg with a +4.14% upside toward 152.500.

The 1D RSI confirms strength, holding a higher lows trend-line.

Subscribe ✍️ & BOOST 🙌 if you like this setup!

USDJPY 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal : 148.100

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

USD/JPY 1D Forex Chart - August 12, 2025daily performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) as of August 12, 2025. The current exchange rate is 148.277, reflecting a 0.09% increase (+0.136). The chart includes a trendline indicating a potential upward movement, with a buy signal at 148.277 and a sell signal at the same level. Key support and resistance levels are marked, with a notable range between 146.786 and 151.234. The chart spans from early 2025 to mid-2026, showing historical price action and future projections.

Fundamental Market Analysis for August 12, 2025 USDJPYThe yen has refreshed monthly lows as the Bank of Japan last week reaffirmed its commitment to ultra-loose policy and kept the 10-year JGB yield target around 1.49%. Inflation is easing, with July core CPI falling to 1.7%, below the target range — an argument for maintaining yield-curve control.

Against this backdrop, the U.S. 10-year yield climbed toward 4.25% on expectations of a firm CPI print, widening the spread with Japanese bonds to 425 bps. Accelerated Japanese capital outflows into dollar assets support USDJPY. Japan’s Ministry of Finance has only issued verbal warnings about possible interventions, with no actual dollar selling observed — market participants view 150 as the next target.

Dollar demand is also supported by steady oil prices above $85/bbl, which increase Japan’s import bills. Higher commodity prices worsen the country’s trade balance and spur additional dollar purchases by Japanese corporates for settlements.

Trade recommendation: BUY 148.300, SL 148.100, TP 149.500

SENTIMENT BEFORE CPI DATA RELEASE!Market & Technical Overview

Chart Insights:

USD/JPY is trading inside a downward channel, suggesting ongoing bearish pressure. Price is near the 147.79 level and is set to revisit support around 146.85. If support holds, a potential rebound toward the 157.45 level could follow, but a break below 142.65 would open the door to further declines toward 138.45.

Technical Levels & Short-term Structure

The pair remains range-bound in a medium-term ascending channel since April’s low (~139.89).

A short-term bearish bias prevails below pivotal resistance at 148.15. A confirmed break below 146.60 could trigger a move toward 145.85 (50-day MA) and then 144.50.

Macro & Sentiment Drivers

U.S. Dollar Outlook ahead of CPI

The U.S. Dollar trade-weighted index (DXY) is holding steady near 98.50 but remains under pressure from soft U.S. data and high Fed easing expectations. Speculation for Fed rate cuts has intensified—markets are pricing in a ~90% probability of a cut by September, with up to three cuts possible this year.

USD/JPY Sentiment Snapshot

Caution and indecision dominate near-term USD/JPY sentiment as traders await CPI.

If CPI data surprises...

Bullish scenario: Some see the potential for a breakout toward 149.0 if CPI surprises on the upside. Overall, most analysts expect continued dollar softness, which would reinforce yen strength unless U.S. inflation comes in hotter than expected.

If you enjoyed this analysis, follow us on TradingView. And, check out HowTo.Forex to signup on our free waiting list to get notified when we re-open admission to our Forex Ninja Bootcamp. And, don't forget you can sharpen your knowledge for free at www.youtube.com We just started our Youtube Channel, so be one of our first subscribers to instantly be entered to win a special gift you can use any way you want, when we get to 10K subscribers!

Disclaimer: We love to offer free professional analysis. But be sure to do your own analysis before placing a trade. We are not responsible for any losses you may experience. If you need help trading more efficiently, consider subscribing to our youtube channel or enroll in our flagship Forex Ninja Bootcamp curriculum. Thank you and happy trading!