Our opinion on the current state of AFORBES(AFH)Alexander Forbes (AFH) is a prominent financial services company that provides asset management, insurance, healthcare, retirement consulting, and wealth management to both corporate and private clients. It operates not only in South Africa but also has a presence in five other African countries: Namibia, Nigeria, Botswana, Uganda, and Zambia. Historically, the company's share price has experienced a significant drop, falling from just over R10 in February 2015 to around 430c today. This decline was largely attributed to the leadership of its former CEO, Andrew Darfoor, who was said to have lost the confidence of the board and institutional investors, compounded by the resignation of the financial director, Naidene Ford-Hoon, after less than a year with the company. Changes to the board have been significantly influenced by Patrice Motsepe's African Rainbow Capital (ARC).

In its financial results for the year ending 31st March 2023, Alexander Forbes reported an 8% increase in operating income and a 22% rise in headline earnings per share (HEPS) from continuing operations. The company highlighted, "The group balance sheet remains robust, supported by the strong cash flow generated from continuing operations, with a sound regulatory surplus position of R1,516 million and available cash of R933 million." Subsequent trading statements further reflect the company's recovery and growth: for the six months to 30th September 2023, HEPS was estimated to increase by between 85% and 105%, attributed in part to the base effects from the performance of discontinued operations in the prior year.

Looking ahead to the year ending 31st March 2024, the company anticipated that HEPS would increase by between 23% and 33%. This optimistic forecast is attributed to "solid growth in operating income owing to acquisitions and new business." Currently, the company trades at a P/E ratio of 10.77 and has recently sold its group risk and retail life business for R100 million, potentially to fund further acquisitions.

Given these factors, Alexander Forbes is considered to be reasonably valued at current levels and is seen as being in a steady upward trend. This assessment suggests that the company could be a worthwhile investment, especially for those looking at financial services stocks within the South African and broader African markets.

AFH trade ideas

Our opinion on the current state of AFHAlexander Forbes (AFH) is a financial services company offering asset management, insurance, healthcare, retirement, consulting, and wealth management to both corporate and private clients. It has a presence in 5 countries in Africa outside South Africa - Namibia, Nigeria, Botswana, Uganda, and Zambia. In the past, the share has fallen from its high of just over R10 in February 2015 to around 430c today. Much of the fall was blamed on its previous CEO, Andrew Darfoor, who was said to have lost the confidence of the board and institutional investors. This was compounded by the resignation of the financial director, Naidene Ford-Hoon, after less than a year with the company. Patrice Motsepe's African Rainbow Capital (ARC) has been instrumental in pushing for changes to the board. In its results for the year to 31st March 2023 the company reported operating income up 8% and headline earnings per share (HEPS) from continuing operations up 22%. The company said, "The group balance sheet remains robust, supported by the strong cash flow generated from continuing operations, with a sound regulatory surplus position of R1 516 million and available cash of R933 million". In a trading statement for the six months to 30th September 2023 the company estimated that HEPS would increase by between 85% and 105%. The company said, "The increase in earnings from total operations is also attributed to the base effects from the prior year, specifically by the performance of discontinued operations". At its current price it is on a P:E of 12,58. The company has sold its group risk and retail life business for R100m which it may use for acquisitions. We see this share as reasonable value at current levels and in a steady upward trend.

ALEXANDER FORBES - Increased volumeAlexander Forbes is experiencing increased trading volumes while it has formed an inverted head & shoulders pattern. Price is above the major up sloping moving averages .

Something brewing here...

-- MANAGE YOUR RISK - -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.

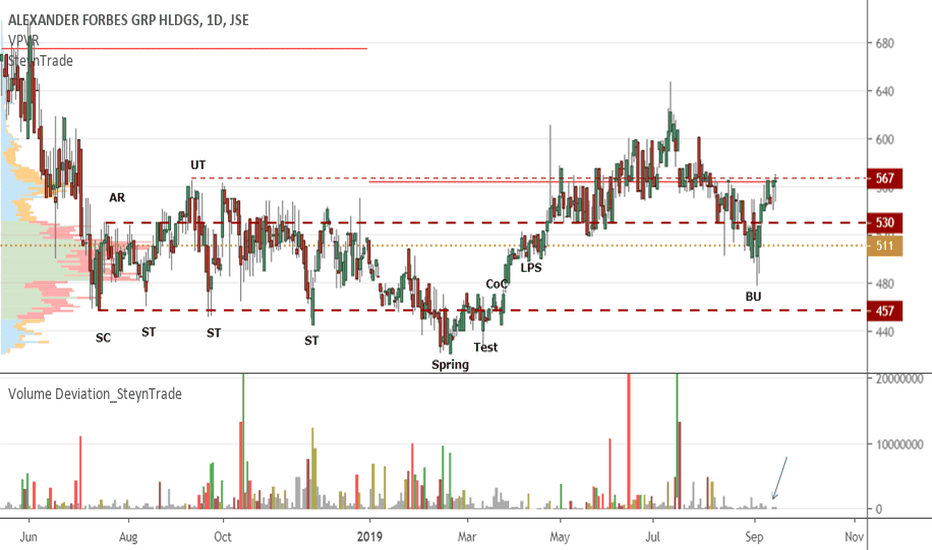

JSE:AFH Alexander Forbes Looking for a Test of the LowsAfter a trading range starting in July 2018, Alexander Forbes has been in a trading range. After an upthrust and tests forming lower lows price broke below the trading range. We have now seen a backup to the trading range and now a push lower again. We can expect the lows R2,80 to be tested again. If this is broken there could be more downside.

JSE:AFH Alexander Forbes Watch for the MarkupAlexander Forbes has backed up (BU) into the previous trading range (TR) but we see that volume is very low. It looks as if there is no supply left. Priced has moved back to the yearly pivot point (red line) where it previously found supply (at R2.60, see volume profile) but this time there is no supply. Watching next week if supply comes in or if we will see the markup start in phase E of the accumulation TR that started in 2018.

JSE:AFH Alexander Forbes Bucking the TrendI have been following the accumulation range of Alexander Forbes (See post below). Price has consolidated at the top of the TR, which is also the yearly pivot point. It has pushed above with some high volume selling pressure but remained above the TR (See the negative divergence with the volume RSI and volume spike). In spite of the week market conditions it still looks as if this is about to start the markup and is being defined by the 50 day MA and clear upward stride.

JSE:AFH Alexander Forbes AccumulationAlexander Forbes has been in a trading range which seems to be accumulation. Volume increases at the bottom of the range and divergence of the volume RSI show upward pressure (Effort without response). We have seen a Sign of Strength (SoS) and Change of Character (CoC) after a spring and currently a low volume test has occurred.