PPC trade ideas

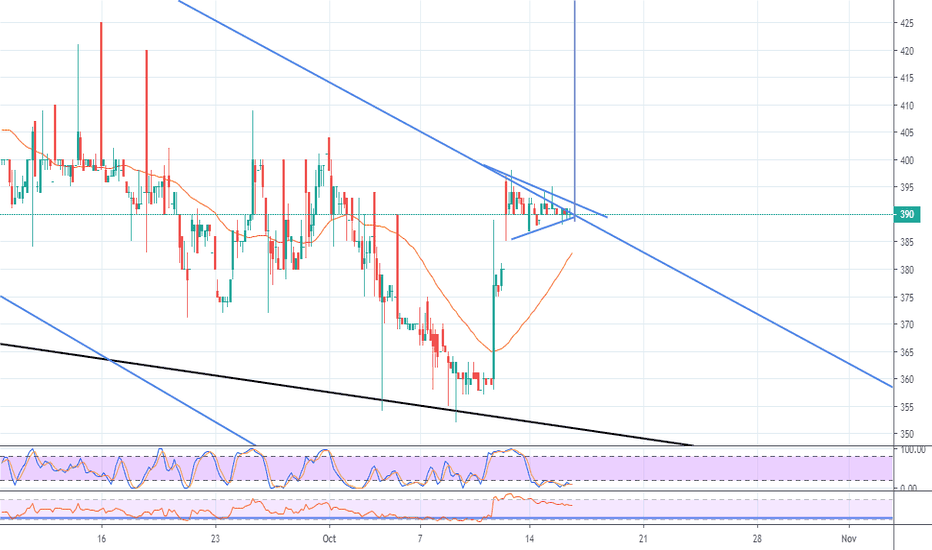

Trading updates sees PPC testing trendlineJumped over 10% in the morning, will need to break the trendline to remain interesting.

Disclaimer: The views provided herein do not constitute financial advice.

Please feel free to comment, critique or add to my view, I welcome feedback, whether it agrees with my views or not.

This idea is based on my strategy, please consider your own before using it in any way. Always use a stop-loss and manage risk.

Could PPC rise from the dead?Not much, but keeping an eye if it can break the resistance line.

Disclaimer: The views provided herein do not constitute financial advice.

Please feel free to comment, critique or add to my view, I welcome feedback, whether it agrees with my views or not.

This idea is based on my strategy, please consider your own before using it in any way. Always use a stop-loss and manage risk.

Taking a shot at PPCSomething like 700% down from where it was a year ago, I don't expect a quick rise, but think it might be worth a shot here.

Disclaimer: The views provided herein do not constitute financial advice.

Please feel free to comment, critique or add to my view, I welcome feedback, whether it agrees with my views or not.

This idea is based on my strategy, please consider your own before using it in any way. Always use a stop-loss and manage risk.

PPC looking very strongPPC broke out nicely above the 5 day MA with RSI now above 30 level and ATR at low point. Nice gap to fill upwards to 50 day MA (118 price level). Breaking 118 levels, we can see previous resistance being retested at 180 levels. Entry 83, stop 63 with full target 176. Reward to Risk ratio 4.5.

Disclaimer: My analysis should not be construed as financial advise. Share trading is risky and unpredictable at best. I'm just sharing what I see.

JSE:PPC PPC Limited Showing Signs of StrengthPPC has been forming a base since the middle of 2016 after a down trend. The downward stride has been broken. We see low volume on the down moves and increased volumes on the up moves (Signs of Strength). After a spring we see price finding support at the yearly pivot point. After a doji formed on increased volume, a bullish reaction and divergence with the Volume RSI the expectation is for a bullish move to the recent highs at R9 and possibly as high as the next volume cluster at between R11 and R12.

PPC - Bouncing Off SupportI know that the SA Construction Industry is probably the most hated sector however, yesterday we saw PPC bounce off the horizontal support level. Currently monitoring for the share to stabilize for a buy/long.

_______________________________________________________________________________________

Please feel free to contact the Unum Trading desk for any Trading related queries : 011 384 29 29

Unum Capital. An authorised South African Financial Services Provider (FSP 564)

PPC - BUY/LONG Pending PPC continues to trade below the downward trend line in place following the break below the upward trend and double top formation that developed during the month of May. While the trend is lower, the RSI technical indicator points to early signs of a potential reversal with bullish divergence currently being seen. Monitoring.