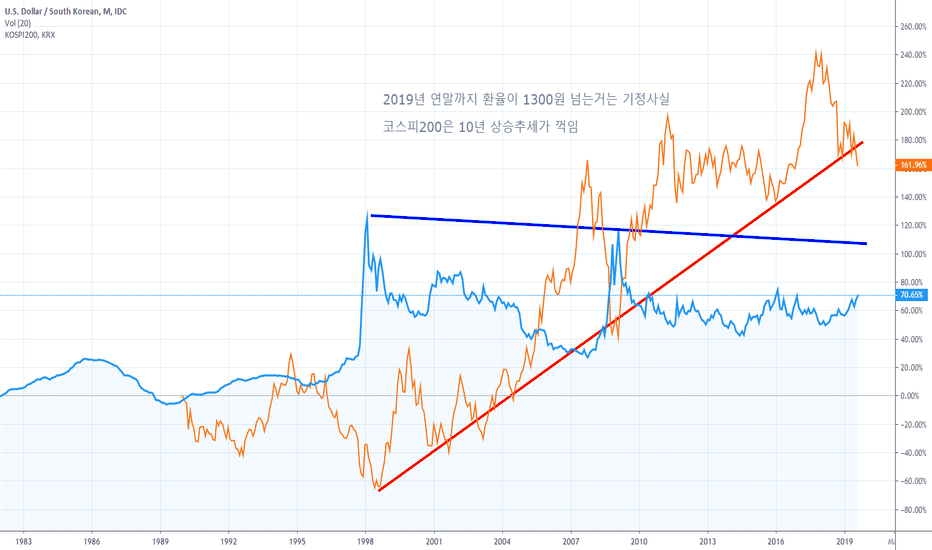

KRWUSD trade ideas

Turning point for the South Korean WonPicture perfect technical setup here for a short play to the downside for USDKRW.

- We hold a guarded optimistic view on economic recovery across the South Korean economy following revisions in growth expectations. We see slowing growth bottoming out with sensitivity now positioned to the upside and a gradual rebound across the semiconductor sector as a hedge against further monetary easing.

- Confirmation via BOK commentary should see decisive technical conviction through the neckline and flows into the buyside floor as optimism rises.

- Put exposure added across our macro and directional portfolios.

ridethepig | KRW 2020 Macro MapKorea's economy looks set to be forming a meaningful floor in Q4 and with a helping hand from a temporary pause in protectionism we should see KRW remain in bid for the first half of 2020.

For the domestic story, Korean exports have fallen which spilt over to the demand side. With this in mind, should the USD devaluation / reflationary theme pick up pace for the first half of 1H20 it will mean repricing in KRW. On the monetary side, cuts are widely priced from BoK for January. Fundamental risks to the thesis com from US-China trade and the significance of USD devaluation.

On the technicals, a textbook Steel Resistance has held at 1219.xx after completing an ABC target sequence. Very high odds a meaningful top is in place and invalidation to this count comes in above 1200.

Thanks for keeping the support coming with likes, comments, questions and etc. Another round of 2020 FX maps coming over the next few sessions. For those wanting to dig deeper with the 2020 strategies:

NZDUSD

USDJPY

EURUSD

EURSEK

USDCNY

USDKRW 5 RRR longTrading Methodology:

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch points, beginning at the earliest touch point.

3. A trend-based Fibonacci retracement triangle is drawn starting from the earliest trend touch point and ending at the earliest touch point of the opposite trend line .

4. Based on the degree, of the earlier defined angle, the appropriate (and secret) levels are selected for the fibonacci retracement ; two levels for stop-loss and two levels for take-profit. The closest stop-loss level to the current price level is the top priority stop-loss. Though the secondary stop-loss level is often chosen for some markets such as FX and some equities in order to account for seldom unexpected resistance breaks. The greater target level is the top priority, and where majority of the shares are sold, though some may choose to close part of the position at the first target level or set it to be the stop-loss once price exceeds it. Entries should be laddered in around the levels closest of the yellow line.

This trading strategy can be applied to any market and time frame, and positions most often garner the greatest risk-to-reward ratio with the highest success rate. What more can you ask for? I will only be posting my unique trading strategy until EOY. I work solely with price action to identify pennants and apply unique trend-based fibonacci retracement levels for SL and TP levels. Reach out to me if you have any questions.

USDKRW - Depreciation of the Korean Won Accelerates. After breaking the 2yr highs a couple of days ago, now it seems we will get close to 1210, a level reached on January 2017.

I expect the USDKRW to go higher, especially since the slowdown in local economy and not good news from the US/China trade talks.

I do not recommend buying the KRW at his levels. Any bad news from US/China trade talks will make the KRW go lower, and in case of good news I do not see traders going back to KRW.

What the Korean Won Can Tell Us About Chinese GrowthMarketplace analysis of attempting to determine Chinese macroeconomic stability and growth is insatiable. Because of this, I am continuously interested in finding proxies for the Chinese economy since low- to medium-frequency data out of China (GDP or manufacturing figures) are notoriously inaccurate.

With South Korean GDP figures out this week unexpectedly low and the Korean won depreciating significantly against the dollar, to what extent can we use the Korean economy as a proxy for Chinese domestic industrial or consumptionary activity?

According to correlation coefficients, the answer is yes. Strength in the US dollar against the Korean won is highly correlated with the Australian dollar, a proxy for Chinese raw material consumption, the EEM emerging market index, a less speculative proxy of Chinese equities than the traditional Chinese indices, and also a Chinese consumption ETF. Although the latter follows a bit of a speculative bent, it still can provide interesting insight.

Overall, trade with China accounts for 26 percent of all South Korean exports. Chinese GDP figures are based on political promotions, but currency and equity markets are not. Price action in the Korean won against the dollar and South Korean GDP figures do not lie. The economy is hurting because less won is in demand from less Chinese consumption. This could be a canary in the coal mine or it could be a blip on the map as had been last 1Q19 US GDP growth which saw a rebound up beyond 3 percent in 2Q19 as just reported today.

But all good things must come to an end. Chinese growth was always unsustainable at such high levels and still is. Markets require corrections. The question remains can Chinese domestic stimulus continue to soften the landing which is required for it to reverse from unsustainable levels of extraordinarily high provincial and national debt to GDP. To be determined. For now though, let’s just keep on looking at the more transparent economies that are highly tied to China for more accurate insights into the Middle Kingdom’s economy.