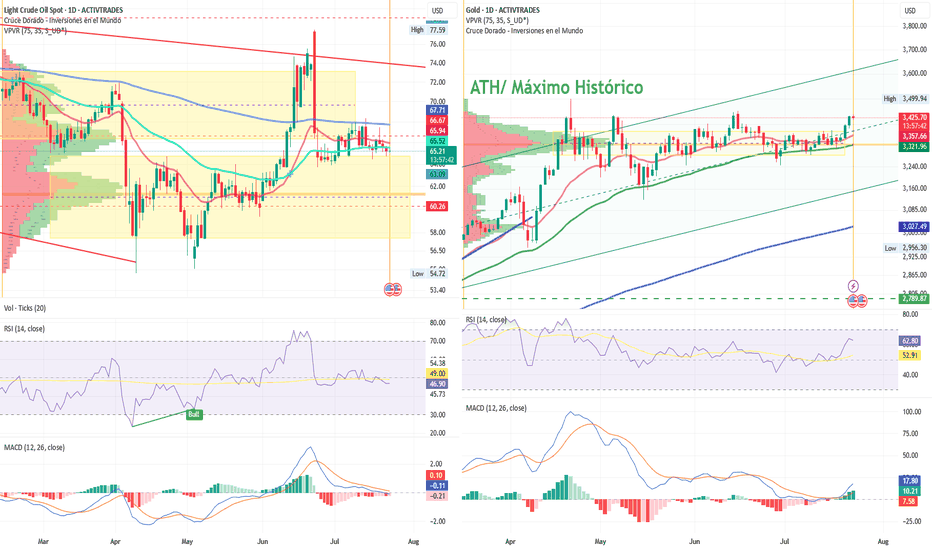

LCrude/Gold: Trump Escalates Tensions with CanadaCanadian Crude and Gold Under Pressure as Trump Threatens New Tariffs Unless Market Access Improves

By Ion Jauregui – Analyst at ActivTrades

Trade tensions between the United States and Canada are once again on the rise following Donald Trump's return to office. The president has set August 1st a

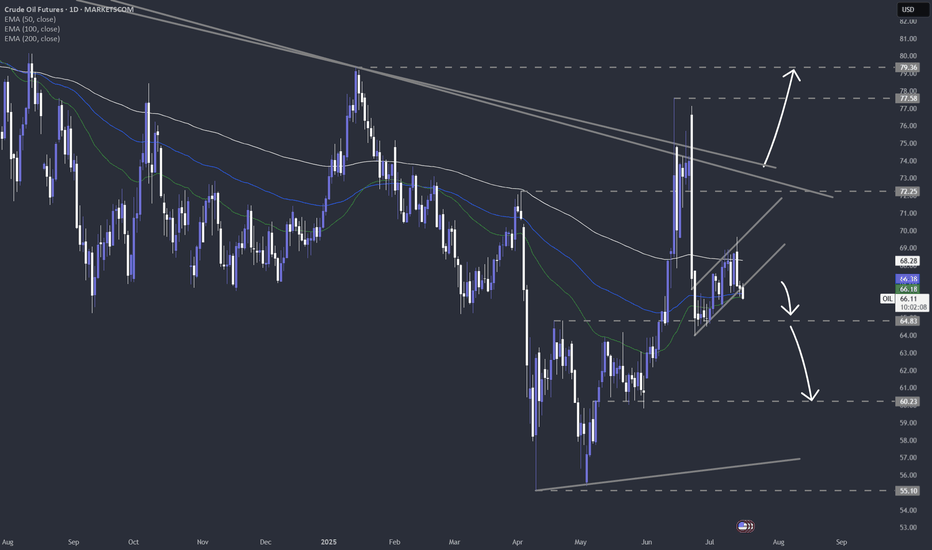

Crude Oil: Bulls vs. Bears — A Market at the Edge

Here’s what we’re seeing from the latest CME block trade data & CME report:

🐻 Confirmed & Detailed Bearish Sentiment

Big players are actively hedging and betting on a drop.

Block trades are targeting key downside levels:

$62.50 , $55.00 , and even as low as $45.00 .

This isn’t noise — it’s instit

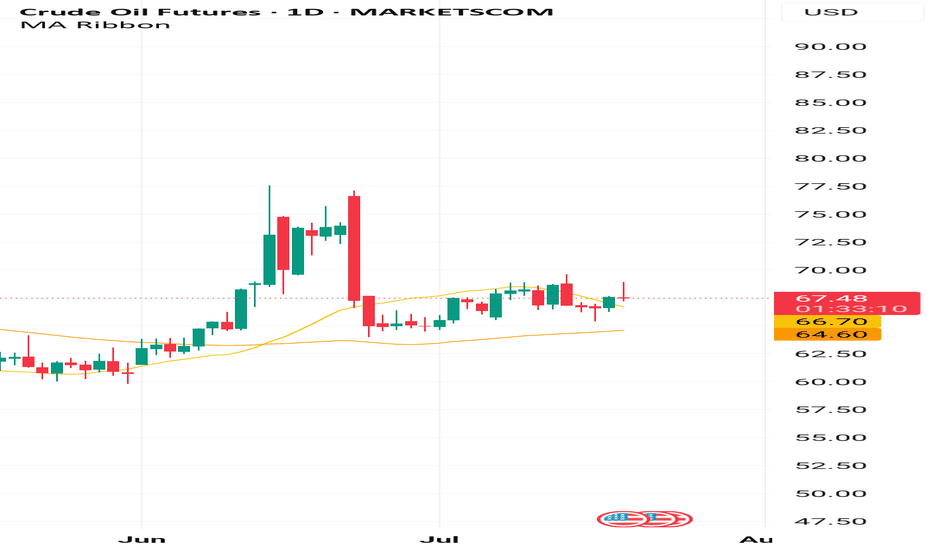

Could we see the WTI oil bears getting pleased any time soon?The technical picture of MARKETSCOM:OIL is showing a possible bearish flag formation, which may lead WTI oil to some lower areas. Is that the case? Let's dig in.

NYMEX:CL1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when tradin

OIL fell sharply, opportunity for upside target of 70$OIL fell sharply and has now been in a contraction for a while, I am taking it into account for a potential breakout, as it shows tightening price action, which reflects market indecision.

Price action has now coiled into a symmetrical triangle, this is often a classic continuation or reversal patte

OIL Price Forecast – Bearish Outlook OIL Price Forecast – Bearish Outlook

Oil prices have entered a consolidation phase, showing contracted price action—a classic sign of market indecision or a build-up before the next move.

This range-bound behaviour typically precedes a breakout or breakdown.

Given recent global supply-demand dyn

LCrude Oil: Bearish Pressure as Brazil Emerges as an Energy PHLCrude Oil: Bearish Pressure as Brazil Emerges as an Energy Powerhouse

By Ion Jauregui – Analyst at ActivTrades

LCrude (Ticker AT:Lcrude), which replicates the West Texas Intermediate (WTI) futures contract, has been one of the most volatile assets in 2025. It faces mounting pressure from a growin

Oil and orasiaConsidering the global oil chart and the twelve-day war in the Middle East, and looking at the global gold chart, the estimates of micro and macro investors indicate a decrease in regional tensions and an end to the war, and there is likely to be a further decline in gold and oil prices.

Hussein M.

Crude Oil - Major VolatilityDue to what we are seeing between the US, Israel, and Iran - Oil prices have experienced heightened levels of volatility.

Since September '23, Oil has respected a clear series of lower highs, with each touch of the orange trendline marked by a red X. Every attempt higher has been faded — and nothi

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.