LDOUST trade ideas

LDO is bearish for MidTerm (2D)Before anything, pay attention to the timeframe; it’s a 2-day timeframe and requires patience.

From the point where we placed the red arrow on the chart, it seems that the bullish LDO pattern, which was a triangle, has completed. LDO has now entered a bearish pattern of the same degree as the previous bullish pattern.

LDO is expected to remain bearish in the medium term and not break above the red box marked on the chart.

The low-risk area for buy positions in spot has been identified for buyers.

The closure of a daily candle above the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

LDO - big lie - Many influencers have been touting this coin.

- the coin is found in the side

- the exit was down and I expect the downtrend to continue

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.

Is This the Final Drop Before a Major Reversal? Read This NOW! Yello, Paradisers! Are we about to witness the final leg of this move, or is one last shakeout coming before a massive reversal? Let’s break it all down using Elliott Wave principles.

💎Wave 1 initiated the downtrend, marking a strong sell-off from higher price levels. Volume surged during this phase, signaling institutional selling and overall market panic. This aggressive downward move set the foundation for the corrective Wave 2.

💎Wave 2 began as the price rebounded after hitting the local low at $1.406. This move aligns with a typical Elliott Wave correction, often retracing 50%–61.8% of Wave 1. The recovery phase pushed the price back up, potentially reaching as high as $1.964 before the next major move.

💎Wave 3, the strongest and longest in the sequence, started once the price failed to sustain above $1.964. This move could extend all the way down to $0.809, a critical level where selling pressure is expected to peak. Historically, volume is highest during Wave 3, indicating aggressive selling and potential accumulation zones forming.

💎Wave 4 might be unfolding right now, forming a short-term recovery. If the price retraces toward $1.392 but fails to break above it, the bearish wave count remains intact. It’s crucial to note that Wave 4 must NOT enter the price range of Wave 2—if it does, the entire Elliott Wave structure is invalidated, suggesting an alternative pattern like an ending diagonal or a larger correction.

💎Wave 5 is the final impulse wave. If Wave 4 faces rejection below $1.392 and consolidates, the market could see the beginning of Wave 5, pushing price toward the $0.746 support zone. This phase typically marks the last exhaustion move before a potential market reversal or a shift in structure.

Patience and strategy win the game, Paradisers! The market is designed to shake out weak hands before the real move happens.

MyCryptoParadise

iFeel the success🌴

TradeCityPro | LDO: Comprehensive Market Analysis and Prediction👋 Welcome to TradeCity Pro!

In this analysis, I want to review LDO for you. It is one of the key DeFi platforms, and its token currently holds a market cap of $945 million, ranking 72nd on CoinMarketCap.

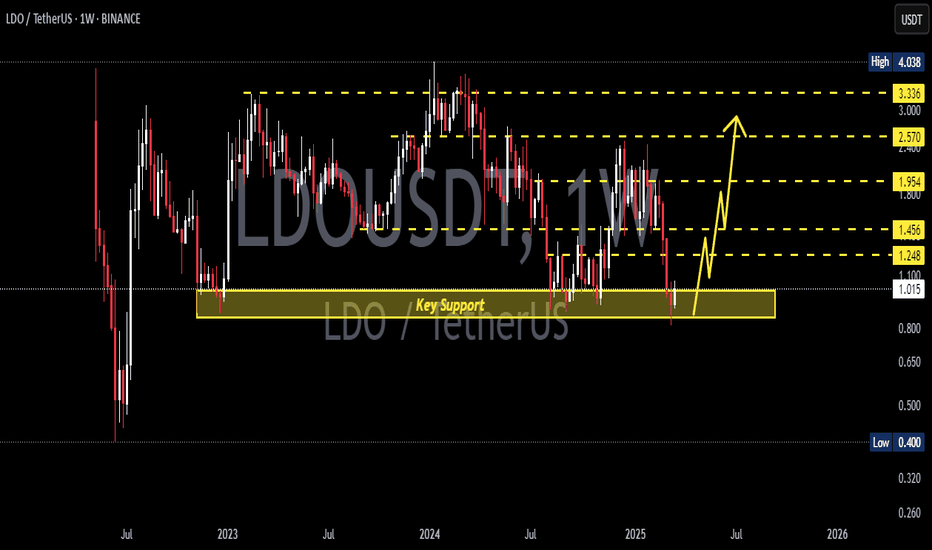

📅 Weekly Timeframe

On the weekly timeframe, we can see a range box between the $0.957 and $3.389 levels, where the price has been fluctuating for almost two years.

🔽 If you already hold this coin, I recommend activating your stop-loss in case the $0.957 level is broken and waiting for bullish momentum to re-enter the market before buying again.

📈 If the price holds above the $0.957 support, it could rally back toward the top of the range at $3.389. The key trigger levels between the current price and the top of the box are $1.447 and $2.488.

🚀 The main buying trigger is at $3.389, as breaking this level could lead to significant capital inflows, potentially initiating a long-term bullish trend.

📅 Daily Timeframe

On the daily timeframe, a range box between $1.447 and $2.387 had formed, which was broken to the downside, leading to a bearish leg. The main support level is $0.957, and if it fails to hold, the price could enter a new bearish cycle.

🛒 For spot buying, there isn’t a clear trigger yet, so we need to wait for a new structure to form. However, if the price rallies sharply, you could consider entering on a break above $1.489.

💫 As seen on the chart, the red candle volume is significantly higher than the green candles, indicating strong seller dominance. Additionally, the RSI is near the 30 level, and if it breaks below this zone, the bearish scenario becomes more likely.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Lido DAO: Long-Term Support—Long-Term Sideways—Long-Term BullishSome charts just make technical analysis easy. The same support level that worked in late 2022 worked again in late 2024. The present correction is ending as a higher low in relation to this same long-term support, the black line on the chart.

Since the market bottom, June/July 2022, LDOUSDT has been sideways with a wide range. The last bullish breakout was really small and the present retrace is also small, the market always seeks balance, so a small breakout leads to a small retrace.

There is more.

The consolidation phase is very long, years of sideways action. The market always seeks balance. A long consolidation phase will lead to a very strong bull-market. The bull-market is now, it is happening now, starting this month —March, this year (2025) and it will extend for a long-term.

So we have long-term support, long-term sideways and a long-term bullish market.

Thanks you for reading.

Namaste.

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.20

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.23

First target 1.28

Second target 1.34

Third target 1.41

#LDOUSDT: Triangle Breakout – Next Move?Market Overview:

#LDOUSDT has been in a strong uptrend and recently formed a triangle pattern on the 1-hour timeframe. This pattern typically signals trend continuation, and we just witnessed a breakout!

Key Observations:

🔹 Triangle breakout confirmed – bullish signal!

🔹 Resistance Level: Watch for a clean break for further confirmation.

🔹 Potential Targets (TPs): Higher highs expected if momentum holds.

Strategy:

🔹 If price retests the breakout zone and holds, we could see a strong bullish continuation.

🔹 Invalidation: If price falls back into the pattern, we may see a fakeout scenario.

What’s your take? Will #LDOUSDT pump higher or is this a bull trap? Share your thoughts below!

Follow for more chart updates, trade ideas, and market insights!

LDO/USDT Technical Analysis – 1D# 📉 LDO/USDT Technical Analysis – Daily Timeframe

🔍 LDO price is currently sitting on its **90-day support level**. This is a crucial area because if the price manages to hold this support, we could see an upward move toward **2.35 USDT**, which is a key daily resistance level.

📌 **Bullish Scenario:** If buyers step in and defend this support zone, we might witness a rally toward **2.35 USDT**, representing a **51% increase** from the current price.

⚠ **Bearish Scenario:** However, if the **1.544 USDT** support level is lost on the daily timeframe, the next critical support would be at **0.925 USDT**. This is the **last major support zone** on the daily chart, and losing it could trigger further downside.

📊 **Indicators Overview:**

🔹 **Volume:** An increase in volume at key levels signals strong buying or selling pressure. Currently, volume is declining compared to the average, indicating uncertainty among traders.

🔹 **RSI:** The Relative Strength Index (RSI) is at **44.22**, suggesting that the market is in a neutral zone with balanced buying and selling pressure.

👀 **Do you think LDO can bounce from this support level, or are we about to see another drop? Share your thoughts in the comments!**

---

🔹 **This analysis is for informational purposes only and should not be considered financial advice. Please manage your risk accordingly before making any trading decisions.**

✅ If you agree with this analysis, drop a comment and share it with others! 🚀

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.64

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.71

First target 1.80

Second target 1.87

Third target 1.95

LDOUSDT approaches strong demand zoneLDOUSDT is trading within a potential ascending broadening wedge, with a horizontal base acting as a major support zone.

The price recently tapped into this support, leading to an immediate bounce, making this area a strong accumulation zone. The target is set towards the upper trendline of the pattern.

Share your thoughts on this trading idea.

LDO Buying Opportunity ?I've been following LDO for a while, and beyond its strong fundamentals in providing liquid staking services, I genuinely believe it is developing a solid uptrend structure. Personally, I've been dollar-cost averaging (DCA) around the $1.50 level, as I see a potential right inverse shoulder forming, which could lead to a breakout toward higher targets.

As a high-risk trader, I've positioned myself accordingly. However, for a more conservative approach, waiting for a confirmed breakout above the neckline of this significant weekly inverse head-and-shoulders pattern would provide stronger confirmation. The trade would be invalidated if LDO loses this key support level.

I've also added it to my spot portfolio in anticipation of an upcoming rally in altcoins. Let me know your thoughts!