LEOUSD – The Coil Before ChaosLEO has stayed range-bound between $8.94 and $9.12 for days. Price action is extremely compressed with no real follow-through on either side. Liquidity is thin and the breakout (either side) could be aggressive. Watching for a move above $9.13 or below $8.90 to trigger volatility.

LEOUSD trade ideas

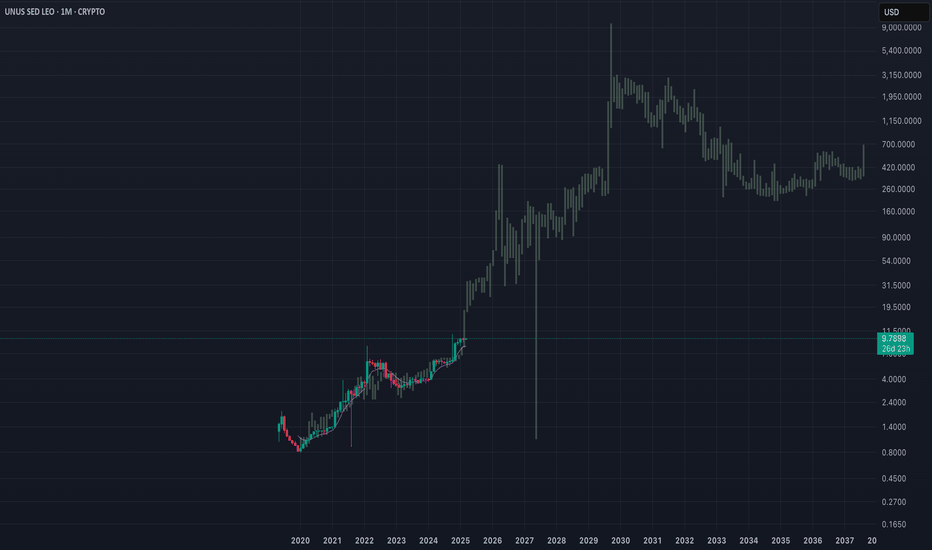

LEOUSD targeting now $9.00 on the second cyclical rally.UNUSD SED LEO (LEOUSD) has completed the 6-month consolidation by making a Higher High. As it trades now above both the 1D MA50 (blue trend-line) and the 1D MA200 (orange trend-line), it looks now ready to start the 2nd rally of the Bull Cycle.

In the previous Bull Cycle (2020 - 2022), the two major rallies were almost of the same % rise (+194.50% and +198.50% respectively). Since the December 2023 - March 2024 rally peaked after a +72.26% rise, it is technically justified to assume at least a similar Bullish Leg based on the pattern.

As a result, we are expecting at least $9.00 by early 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Key Levels and Trade Strategies for LEO/USDAs of the latest data, UNUS SED LEO (LEO/USD) is trading at approximately $5.94, exhibiting a positive trend with a daily increase of around 1.52%. The price action over the recent months indicates a strong bullish momentum that propelled the price from a consolidation phase below $4.00 to its current level. This surge suggests significant buying interest, potentially driven by favorable news or increased adoption.

The price is currently trading above the Ichimoku cloud, which indicates a bullish trend. The leading span A is above span B, reinforcing this bullish outlook. The conversion line (blue) is also above the base line (red), suggesting continued upward momentum.

If the price breaks above $6.00, it could quickly target R1 at $6.11 and potentially R2 at $6.38. A sustained move above R2 could see the price reaching R3 at $6.94.

If the price fails to break above the current resistance and falls below $5.80, it could find support at S1 ($5.55). A break below S1 may lead to a test of S2 at $5.26.

Long Position:

Entry Point: Above $6.00, confirming the breakout from the triangle pattern.

Target: $6.38 (R2) and $6.94 (R3).

Stop-Loss: Below $5.80 to manage risk.

Short Position:

Entry Point: Below $5.80, indicating a failure to sustain the bullish momentum.

Target: $5.55 (S1) and $5.26 (S2).

Stop-Loss: Above $6.00 to mitigate potential losses.

UNUS SED LEO (LEO/USD) demonstrates strong bullish signals with a possibility of further upside. Traders should watch for a decisive breakout above $6.00 for long positions, while monitoring the $5.80 level for potential short opportunities. Given the bullish indicators, the current sentiment favors a long strategy with appropriate risk management measures in place.

UNUS SED LEO 14% profit projection

LE\eo still in bearish wave with channel down, but failed to break support level at 3.6560

If this support able to hold bearish movement, we can set buy with target at channel down resistance, and maximum target at 4.1804 as resistance level with 14% profit projection

Good Luck

Bitfinex's LEO Token: An Unconventional Investment OpportunityAs I made a case for FTT and have made a case for COIN and GBTC before, I want to keep sharing some unique charts and cases. Again, my FTT idea was banned (from a little mistake), so I just reposted it and want to continue with more special cases. By special cases, I mean stuff that looks weird, infeasible, or tricky, where sentiment is leaning against my case, while there could be a significant catalyst that helps the trade.

In my previous ideas, I went deep on some of those, and in the idea below, I shared some extra ones, like LEO. For example, FTT had people very negative about FTX being bankrupt, yet FTX might be revived, boosting the token's price. COIN had everyone bearish due to the SEC lawsuit, yet it's pumping hard, as most of the news was priced in, and Coinbase might win against the SEC. GBTC had a massive discount as everyone was bearish and worried, yet an ETF is coming. So what about LEO?

LEO is a token created by Bitfinex, an exchange token with some 'special' rights. Those rights are that if Bitfinex gets the 2016 hacked coins back, it will distribute 80% to LEO holders. The FBI caught the hackers 1-1.5 years ago and is sitting on those coins. I assume that it will eventually give Bitfinex the coins back. If they don't, LEO will crash, but if they do, LEO could easily do a 2-3x from here.

As you can see in the chart above, if the price of LEOBTC goes up to the highs it reached when the FBI caught the hackers, that's a 150% increase. Is it reasonable? The current market cap of LEO, in BTC terms, is 120k BTC. The hacked coins were 120k BTC. 80% of that is 96k BTC will go into buying back LEO tokens, and the rest to the Bitfinex team and shareholders.

I expect that Bitfinex will get a big boost from this. As Binance is in a bad state, Bitfinex could capitalize on this opportunity. They have been making tremendous progress on many fronts, and I believe that this could be a significant catalyst. Giving 3B back to LEO holders and Shareholders is massive. The publicity will be huge too.

The main issue against my idea is that LEO is the second biggest exchange token, yet Bitfinex isn't in the top exchanges by real volume. That means that, to a large extent, LEO has the return of the coins priced in because its price would otherwise not be so high.

In my opinion, there is a chance that they will give the coins back to Bitfinex holders, potentially before the launch of the ETF, to cause selling pressure on the Bitcoin price. As BTC faces selling pressure from several 'sides' (Mt.Gox, US gov, Bitfinex, Bankrupt companies), prominent players/whales may use that opportunity to scoop cheap coins before the ETF launch.

LEOUSD Triple bullish test ahead. Maybe the best opportunity.It has been a (very) long time since we last looked at LEOUSD. In fact it has been since February 05 2022 when we accurately projected the Fibonacci Target Zone with its All Time High (ATH) coming just 3 days later:

As the price is rebounding and hit the 1D MA50 (blue trend-line) again so quickly after the dump 2 weeks earlier, it is about time to look at LEO's enormous buy opportunities. First of all, while the price has been on Lower Lows since September 24, the 1W RSI has been on Higher Lows, indicating a strong Bullish Divergence. Secondly, the November 09 Low was made exactly on the Fibonacci 1.0 level, which was the top of the previous Buy Zone (0.0 - 1.0).

There is a Triple Resistance barrier ahead. First it is the Lower Highs trend-line since the September 01 High (dashed line). A break above should most likely target the 1D MA200 (orange trend-line) for the first time since also September 02 and that can lead to the ultimate Bear Cycle test of the Lower Highs trend-line by the February 09 2022 All Time High.

Failure to break that, will keep LEOUSD within the 1.0 - 2.0 Fibonacci levels, i.e. our new Buy Zone, that will inevitably break the February Lower Highs early in 2023. A break above it before though, can kick-start an aggressive medium-term rally, the first into the new Bull Cycle, targeting the 3.0 Fib. In both cases, LEO is at levels where long-term investors should consider buying.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

🎲 #LEOPERP #LONG #SCALP 🎲🎲 #LEOPERP #LONG #SCALP 🎲

"Roll The Dice"

Risk

- Med-High

Entry Conditions:

- Breaking out of local trendline

- Holding long term support

News Source:

- Fed Announcements on Weds will disrupt market 75 BPS will likely pump the market

ENTRY:

4.6731

TP1: 3.79%

4.8514

TP2: 6.06%

4.9562

SL: 1.83%

4.5874

Leo short - Bitfinex is deadHello, altho Bitfinex is a dead exchange for some random reason the exchange token LEO is still near ATH.

Leo seems to trade in a triangle and im planning to take a short at the resistance with close stoploss.

Warning: I wouldnt be surprised if Bitfinex vanishes in this bear market. It is an exchange from criminals. Tether (which is from the guys from Bitfinex) is likely unbacked, to what extend is hard to say.If you have funds on Bitfinex, be careful and be ready to loose it in case they Tether guys are vanishing. Not saying its likely, but theres a ~20% chance this is happening. which is way to high to risk it.

Red flags all over the place: bennettftomlin.com

So shorting Leo is pretty rational as it is the exchange token of Bitfinex.

Leo Burns are currently nonexistent: www.theblock.co

Im highly recommending stoploss (as for most of my trades), as the Leo price is likely manipulated as it doesnt make any sense that it is still so high.

DYOR and only invest what you can afford to loose.

Crypto is very very likely a Bubble, please "invest" carefully.

LEO is doing what LEO does.LEOUSD is having one of its best weeks, so far reaching a +63% rise. Since the March 2020 market bottom, it has been rising parabolically smashing every Fibonacci extension after the other. Yesterday the price came near the Fib 5.0 extension as it did on the May 13 2021 High.

A similar rise (+58%) was done in February 2021. If Fib 5.0 breaks, the target should be the Fib 6.0 extension. If not, a pull-back will be required back to the 1D MA50 (blue trend-line) in order to confirm a new Higher Low. This could be on the prior All Time High and former Resistance.

Undoubtedly, LEO seems one of the best long-term investments in the market.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

UNUS SED LEO (LEO) • Bitfinex coin set to outperform its peersLEO token is finally set to outperform coins like BNB or FTT (other exchange coins) after prolonged delay

Since this token barely moved for quite long time and we are seeing some healthy momentum on the chart. It is likely this will print new highs soon.

Set potential target but I actually believe the best approach here is to follow the trend since as it is very likely we will see some significant price advances.

Trading bellow 2.8 invalidate this bullishness and is back into "neutral" waters.

UNUS SED LEO (LEO) • Probably not late to jump into next move Bitfinex's coin LEO is looking like is building volume and momentum for significant move. This coin have been in a strong and very annoying consolidation for last month and half but barely saw any significant drawdown as compared to other major coins.

I think time is coming for this to continue to next target.

LEOPERP (LEO) – Ready to pop!BUY: 2.098 – 2.125

TARGETS:

1) Trail stop – let it run. This could go very high.

STOP: When a 4h candle closes below 1.949.

Rationale:

-Price is accumulating at resistance and has not been affected by Bitcoin’s recent movements, which tells us this coin is showing a lot of strength.

-The RSI is compressing within a pennant and the range has been getting tighter as it approaches the apex. It has now reached the apex and is ready to break.

-A diagonal support has formed for the price (white line) which corresponds with the 100EMA. The 100EMA has been acting as strong support during the uptrend and the price is currently well above it. This confluence tells us it should be a very strong support level.

When this coin breaks through the resistance level it will run hard!

Your risk, your reward. This is not financial advice.

Happy trading.

LEO / DOLLAR Long William Alligator : the crypto is in a bullish position because the candle sticks are above the Teeth, Lips and Jaw. The lines are “eating with an open mouth” and this show that the crypto is in a strong uptrend.

MACD : the line is above the signal line, this is a bullish confirmation. Moreover, the green vertical bars indicate that the price is increasing.

ADX : the line is at 25.59, so the stock is in a strong uptrend.

Candlestick pattern s: there is three white soldiers which is a bullish confirmation.

Overall : it can be interesting to take a buy position on this crypto because all the indicators indicate that the price is increasing and will continue like that. Moreover, the crypto is in a strong uptrend. Entry price is higher than the current price for assurance and stop loss is set about -5%.