LINK: Chainlink Next Wave Up?I'm not a short term trader, but Chainlink has potentially finished a 3 wave correction at the previously monthly open + 1:1 trend based fib extension @ $13.54. Additionally, Chainlink is holding the 50 Daily Moving Orange in Orange for the 1st time as support since late March. As stated in previous cryptocurrency posts, things are getting really spicy and interesting in crypto!

Next important pivots for Chainlink to break is at $15.99 and the 1.618 white trend based fib extension at $18.56.

LINKBULLUSD trade ideas

LINK/USDT Setup: Structure Break + Fibonacci Confluence🚨 Market Watch: LINK/USDT Analysis 🚨

I'm currently keeping a close eye on LINK/USDT. 🧠 On the daily chart, we've observed a clear break in market structure 📉—and dropping down to the 4H timeframe, we see further confirmation of that shift.

At this point, price is looking a bit overextended 🏃♂️💨, and I’m anticipating a retracement back into equilibrium based on the current price swing 📊. This could set up a high-probability short opportunity 🎯.

📹 In the video, I dive into:

Overall trend direction 🔁

Market structure shifts 📐

Price action breakdown 🕵️♂️

And key support/resistance levels to monitor for target zones 🧱

My stop loss would be positioned just above entry, using around 2x ATR for smart risk control

🛡️. As for targets, we could see moves as wide as 6x ATR—but it's crucial to reference the left side of the chart for confluence 📅📈.

I’m aligning this setup with my Fibonacci retracement strategy, which we also covered in the video 🔢📏.

This is not financial advice. Always trade your own plan. ⚠️📉💼

Weekly plan for LINKIn this idea I marked the important levels for this week and considered a few scenarios of price performance

The price has already reached the support level and if the price falls under it, it will aim for the second support zone. RSI is already showing bullish divergence, but it is possible to see a sharp decline before an upward correction

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

LINK - is $14 key level for this week ?In this video I marked the important levels in this video for this week and considered a few scenarios of price performance

Locally, the price is in an uptrending channel and if the price does not break through it, there are chances to see an update of the local top at $15.3. If the channel is broken, an important support level will be at $14

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades! MURA

LINK Daily breakout?One of the most important crypto projects is undoubtedly Chainlink. Having been in a downtrend like must altcoins ever since President Trumps inauguration , LINK looks to finally be ready to exit the bearish trend channel for the first time this calendar year using the newly flipped 1D 200 EMA as a launchpad or is this a local top and the trend continues?

For the bulls a double bottom at $10.15 followed by a higher lows and now a higher high is a strong argument for a flip to bullish structure, however a breakout is needed to confirm this bullish flip in structure and with BTC + most majors at local resistance levels and looking in need of a cool off, this may be too much to ask of LINK at this time.

The bears would say this is business as usual and a rejection off the upper limit maintains the bearish trend, a loss of the 1D 200 EMA would definitely increase the likeliness this outcome.

LINK / USDT: Macro Support Zone ReachedThe price has now reached the upper boundary of the ideal macro support zone for a complex and rare corrective structure (running flat), between 11–8.5.

As long as the price holds above April’s low, my operative scenario assumes that a new multi-year uptrend (wave (3)) has already started.

Key resistance zones to watch ahead: 85–121 (first major resistance) and 150–205/220 as final macro resistance targets.

Full view of the macro structure:

Thank you for your attention and I wish you successful trading decisions!

⸻

Previous trend analysis on LINK:

Nov'24:

Jun'24:

Dec'23:

LINK bearish scenario. Strong bearish divergence. Link has finished its bullmarket in december 2024.

There is strong bearish RSI divergence on 1-2W timeframe.

At the moment price is holding at support so short-term could see a bounce to 25$.

Later crash below trend line and retest of this trend line at other side during altseason.

Bear market targets are between 2$ and 5$

Weekly plan for ChainlinkMarked the important levels in this video for this week and considered a few scenarios of price performance

Write a comment with your coins & hit the like button, and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades! MURA

LINKUSDT buy long set up 📈

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

LINKUSDTbuy long set up 📈

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

#CHAINLINK FAKEOUT? LINK is currently trying to break out of the downtrend on 1h chart. As we are in a big downtrend at the moment, link could potentially pullback to the 13.00 area and continue its bearish movement.

If we end up breaking the 13.00 resistance, link will head higher to the next resistance which sits at the 14.35 level.

I will watch link closely at the 13.00 level, once I get a confirmation of rejection from this level, I will be taking a short position there.

LINK: Last Chance for Chainlink Dominance. LINK Dominance to 1%There are currently 37 million alt coins that exist today. Most alt coins continue to bleed and get smashed against Bitcoin as Bitcoin Dominance continues to surge. Even solid cryptocurrency projects like Ethereum and Polygon are continuously making new bear market lows on their bitcoin pairs. Two alt coins that have withstood Bitcoin's onslaught are XRP and Chainlink. Both XRP Dominance and Chainlink Dominance are still above the 2022 Bear Market Low. The chart below shows Chainlink Dominance at currently 0.32%. Chainlink Dominance is barely holding onto a thread bouncing off a trendline that has historically served as support/resistance. Everytime Chainlink Dominance has tagged the trendline, it has had a rally. This is the last chance in my opinion for Chainlink to expand its dominance in the crypto space. As communicated previously, I believe Chainlink has bottomed or is close to bottoming and getting ready to surge to $100+. If that happens we should see Chainlink Dominance hit the blue fibbonaci retracement resistance area at 0.84% - 1.19%.

Some analysts are saying before the bull market is over, we will see over 100 million alt coins being minted. Obviously, Bitcoin will hold the lion share in dominance over the cryptocurrency market, but there will be opportunities in a few alt coins like Chainlink and XRP in my opinion to gain dominance in the cryptocurrency market. Targeting Chainlink to gain at least 1% of the cryptocurrency market.

Exploring a Potential Chainlink Recovery Amid Market VolatilityIn these uncertain times, we recognize that market conditions may continue to be bearish. However, I’d like to share an idea that explores a potential trend in the event that Chainlink begins to recover and follows a bullish trajectory, supported by its strong and growing fundamentals.

While there's considerable volatility across the markets, making technical predictions challenging, from a fundamental perspective, we can cautiously affirm that the Chainlink team has been executing well. It may simply be a matter of time before the market reflects this progress through a meaningful recovery in price.

With this in mind, the following is a conservative projection for the next four years, factoring in ongoing market volatility while also highlighting the potential for a strong ROI as the crypto space evolves.

CHAINLINK: Continuation of Downtrend Toward Key Support LevelsChainlink (LINK/USD) remains in a strong downtrend after failing to break above key resistance at $14.45.

Selling pressure continues to dominate, increasing the likelihood of a drop toward $11.582, a major support key-level. Read on for a full technical breakdown.

Chainlink (LINK) continues to struggle under heavy bearish pressure, failing to reclaim the $14.45 resistance level. The rejection at this key level confirms the weakness in buying momentum, reinforcing the broader bearish structure. As of today , Chainlink is trading at $14.18, maintaining a bearish trajectory as sellers push prices lower.

The immediate focus is on $11.582, the next key local support, which represents an important short-term profit target. A decisive break below this level will likely accelerate downside moves all the way toward $6.35, marking the previouse major low point from August 2024.

Chainlink’s Vision & Market Position

Despite the current bearish momentum, Chainlink remains one of the most influential blockchain projects, providing decentralized oracles that enhance smart contract functionality. Its role in enabling secure, real-world data feeds for blockchain applications remains a fundamental strength. However, short-term market sentiment continues to weigh heavily against LINK, increasing the probability of an extended corrective move before any potential recovery.

Bearish Catalysts & Technical Breakdown

Failure to Break Key Resistance: The rejection at $14.45 highlights weak buying momentum and reinforces the downside bias.

Sustained Bearish Momentum: The price structure remains firmly bearish, with lower highs and lower lows signaling continued selling pressure.

Break Below Local Support Imminent: If LINK fails to hold above $14.45, a rapid move toward $11.582 becomes highly probable.

Extended Bearish Cycle in Play: Broader market sentiment suggests that Chainlink could remain under pressure unless buyers reclaim control above $14.45.

Key Price Levels to Watch

Major Resistance: $14.45

Current Price: $14.18

Local Support & Profit Target: $11.582

Major Bearish Target: $11.582

Stop-Loss Consideration: Above $16.037

Conclusion

Chainlink’s failure to reclaim $14.45 signals a continuation of the current bearish trend, with $11.582 and even $6.35 as the next downside targets. Unless LINK can stage a significant recovery and break key resistance, sellers remain in control. Traders should monitor price action closely, particularly around $14.45, as a breakdown below this level will likely confirm further downside movement.

Chainlink LongAfter a few months of waiting on the sidelines we are back with a chainlink long after a deep retrace.

Link is showing bullish divergence on the lower timeframes after double bottoming at this crucial support and completing an 886 retracement of an informal Gartley. The support level can be seen across time below.

The only question would be to either wait until the end of the day for this support candle to print or to go in now before confirmation. We will go in with 50% of our ideal position size now and then allocate at the end of the day or tomorrow.

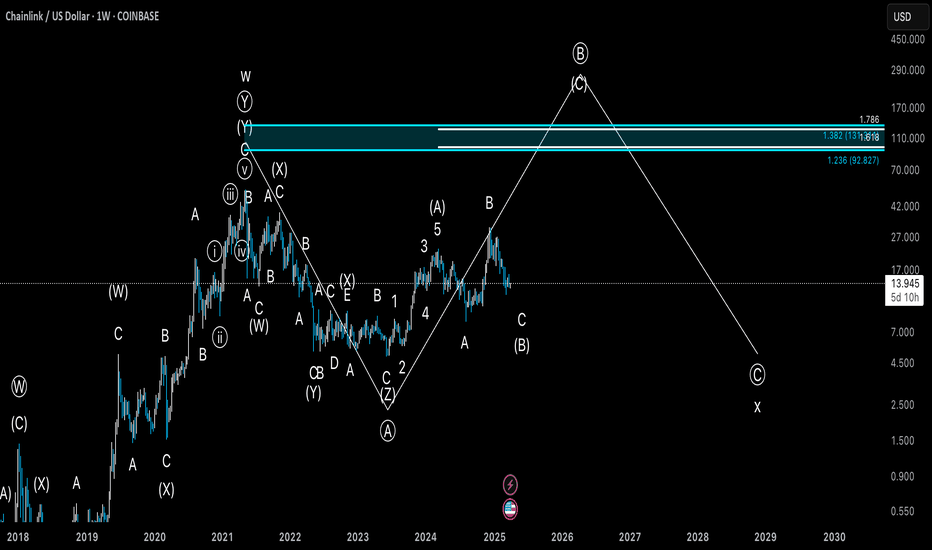

LINK: CHAINLINK to $100 Primary EW Count Primary EW Count: Chainlink is trading in an overshooting B wave in a potential flat pattern. A common fibbonaci ratio for the top of an overshooting B wave in a flat pattern is the 1.236 - 1.382 fib which spans between $92.82 - $131.31.

Not all flat patterns have an overshooting B wave, hence the Bear Case of $60 (1.618 fib) outlined in the previous Wyckoff Accumulation Schematic post.

Probably not the most favorable bullish outcome as Chainlink fundamentals continuously improve with the rise of DeFi. This idea entails that once Chainlink tops out this market cycle, Chainlink can trade back to single digits in the next bear market. In other words, Chainlink could trade sideways for the rest of the decade.

Stay strong Link Marines.

S.N. = S.N.