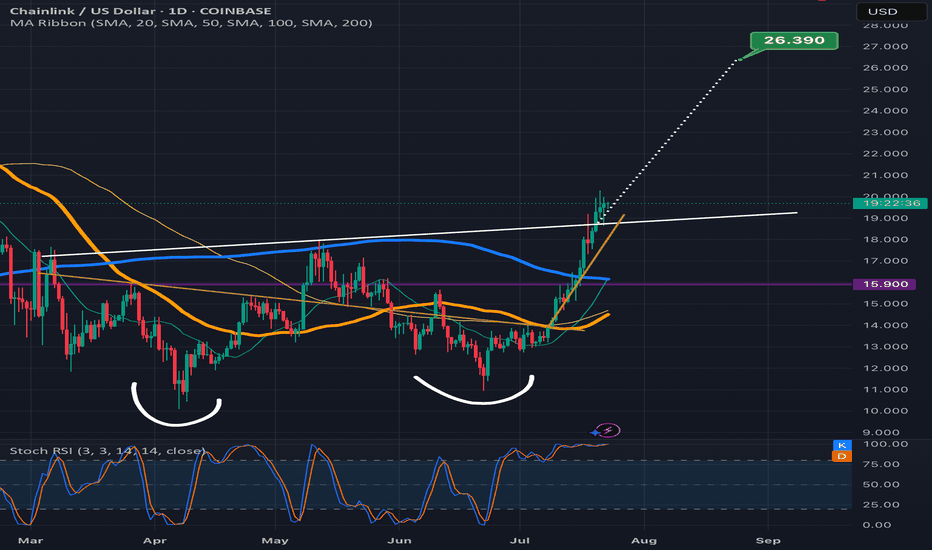

Chainlink climbing the measured move line staircaseLooks like Chanlink is ready to confirm the double bottom breakout here as the past few candles have already started to climb up the measured move line like a staircase.Always possible for a dip back below the neckline at this point but probability slightly favors the readout being validated instead for now. *not financial advice*

LINKUSD trade ideas

Long trade www.tradingview.com

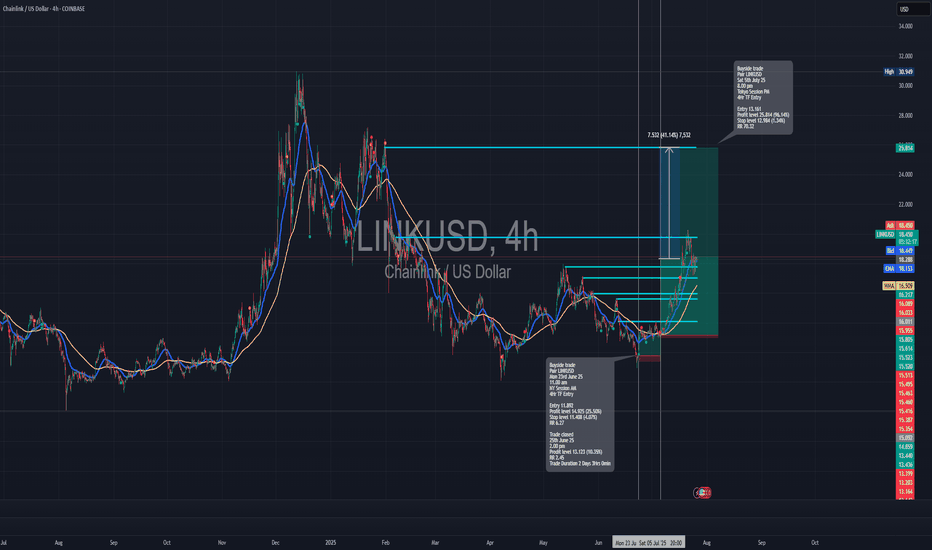

🟢 Buyside Trade

Pair: LINKUSD

Date: Saturday, 5th July 2025

Time: 8:00 PM

Session: Tokyo Session PM

Time Frame: 4Hr TF Entry

🔢 Trade Metrics

Entry Price: 13.161

Take Profit (TP): 25.814 (+96.14%)

Stop Loss (SL): 12.984 (−1.34%)

Risk-Reward Ratio: 70.32: 1

📈 Chart Analysis

Structure: Price broke the previous consolidation zone and retested key support levels near the 13.16 area before launching upward.

Indicators:

200 WMA (Yellow) & 50 EMA (Blue) both support continuation.

Break of market structure confirmed prior resistance as new support.

The Oracle Singularity: CHAINLINK is Inevitable or Cooked?How many marines are tracking this ascending channel?

How many are watching this Fibonacci time sequence unfold?

How many are following the mirrored bar fractal that might just be a crystal ball into the future?

Today you get all three in one TA. The value here is absurdly high . Even though I offloaded most of my LINK a while back it continues to act like a compass for future macro crypto moves.

You really need to look at the TA to understand what I mean

Now look at this

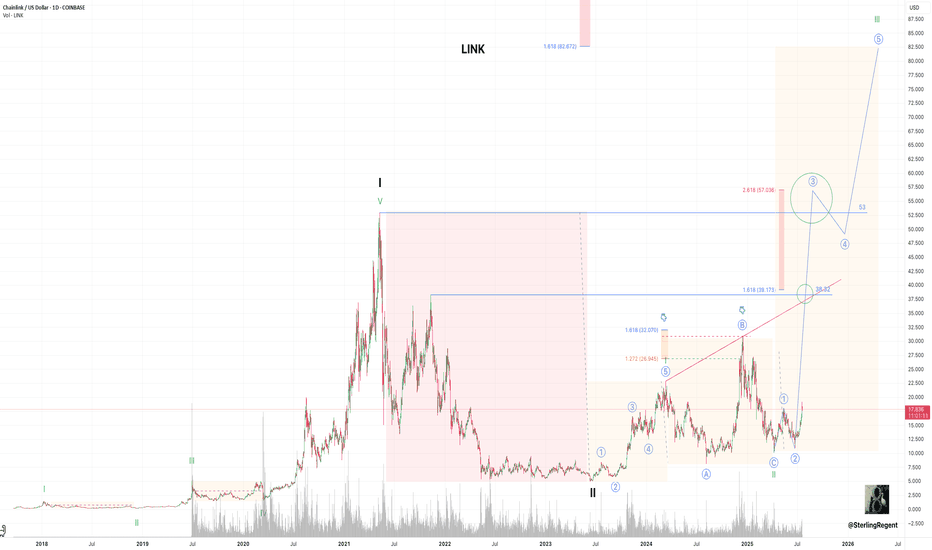

The deviation in the LINK bar pattern seems to be reaching its conclusion around mid October 2025 and if you’ve seen my last Bitcoin TA you know I’ve been targeting that same mid October 2025 window for a potential BTC top. That’s a serious timeline confluence.

But here's the twist

The main chart projects a $200 LINK by April 2026. If that plays out then I have to entertain the possibility that this cycle extends past my original thesis and that my Bitcoin top call may come in earlier than Chainlink's final move.

If Bitcoin does in fact top in mid October then LINK likely won’t have the legs to hit those upper targets.

Back in 2021 when LINK was trading at a similar price it only took 119 days to reach $50 that would put us at November 2025 for a repeat. Something doesn’t quite add up

Now check the main chart again

This Fibonacci time sequence is liquid gold. It’s nailed major tops and bottoms for years (see the blue circles). Every major move has hit right on time except for the 3.618 in October 2022 which was a rare miss.

But here's the kicker

There’s no Fib time event between October and December 2025. The next ones are in August 2025 and then April 2026

So is LINK trying to tell us the cycle extends into 2026?

Maybe. All I’ll say is this

If the cycle doesn’t extend into 2026 then LINK IS COOKED

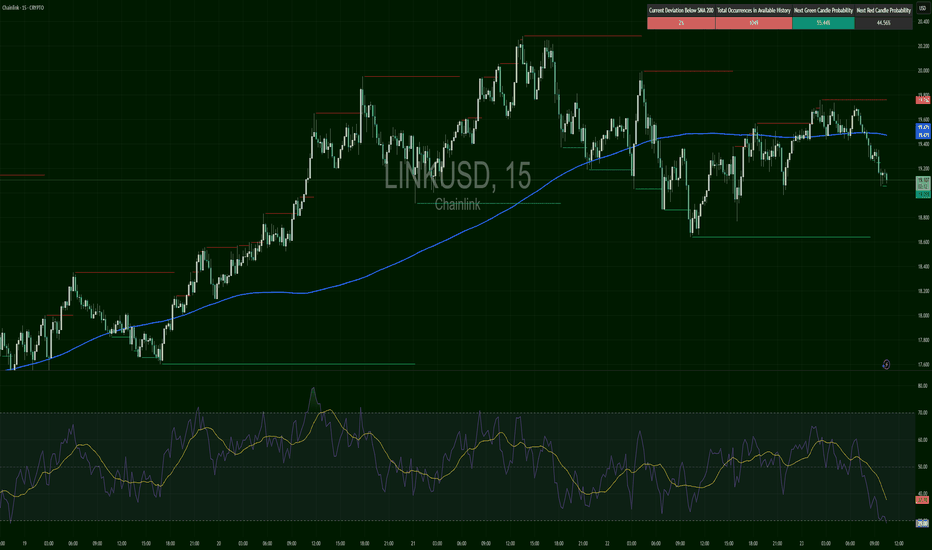

LINKUSD – Structure Snapped, Momentum GoneLINK broke trend structure clearly. After peaking around $19.76, it rolled over, crossing below the 200 SMA. RSI hit 30.54 — deeply oversold. Price is now compressing near $19.05. A rejection from $19.20–$19.30 would confirm bearish continuation. However, if RSI bounces above 40+ and price flips $19.35, it could fake out bears.

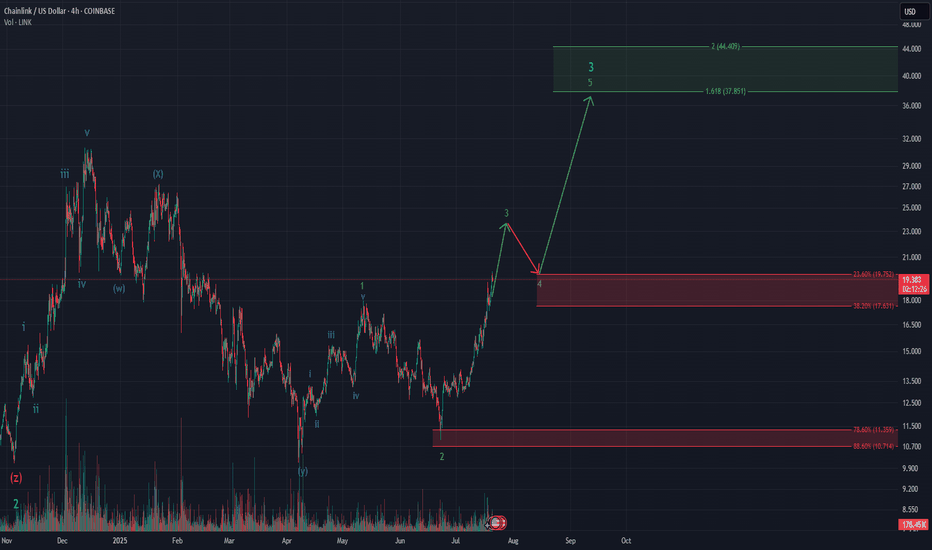

Chainlink – Deep Wave 2 Retracement / Powerful Wave 3?The current 4h chart on CRYPTOCAP:LINK is a textbook Elliott Wave setup – clean structure, impulsive momentum, and retracements that align beautifully with Fibonacci levels.

Wave 2 of the ongoing impulse retraced deeply – almost 88.6%, technically valid but aggressive. According to Neely’s Rule of Alternation, this increases the probability that wave 4 will be shorter and less complex.

I expect the next short-term target for wave 3 around the 23.6% retracement at $19.75, before we build wave 5 to complete a much larger green (3) – targeting $37.851 as the minimum projection.

Momentum is strong, volume is picking up – and this might just be the move that brings retail traders back to LINK.

🔹 Are you bullish on Chainlink?

🔹 How high do you think wave 3 can go?

👇 Drop your thoughts in the comments and follow for more detailed Elliott Wave crypto setups.

#Chainlink #LINK #ElliottWave #Fibonacci #CryptoAnalysis #Wave3 #TechnicalAnalysis #Altseason #ImpulseWave #LINKUSDT #TradingView

LINK to $230 - $1,087 ALT EW Count Stablecoin Supercycle Part 6!Genius Stablecoin Act just got passed! LETS GO! STABLECOIN SUPERCYCLE!

A few months ago I presented a Primary Elliott Wave Count that suggested Chainlink would top out between $60-$100. Here is the Alternative Elliott Wave Count that suggests that Chainlink will easily hit $230 this market cycle and possibly even 4 digits!

In this alternate wave count, Chainlink is trading in a series of nested 1-2, 1-2, 1-2, 1-2 structures, and the Wave 3 expansions that are about to occur aren't going to send Chainlink to the moon, they are going to send Chainlink to Pluto and beyond. Chainlink will easily hit the 1.618 fibbonaci retracement from the 2021 Bull Market Top to the 2023 Bear Market Bottom which results in a $230 Chainlink. The 2.272 fibbonaci retracement lands Chainlink at $1,087. LOL!

Is this a high probability trade setup? No. Nested 1-2 structures are prone to failing because if one single 1-2 setup fails, it becomes a domino effect where the next 1-2 wave structures are prone to failing. As stated before, I am still expecting the primary wave count to take place with Chainlink topping between $60-$100.

Why did I make this post? Because... everyone is still very underweight alt coins lmao. As stated in previous Ethereum posts, DISBELIEF RALLY happening before your very eyes.

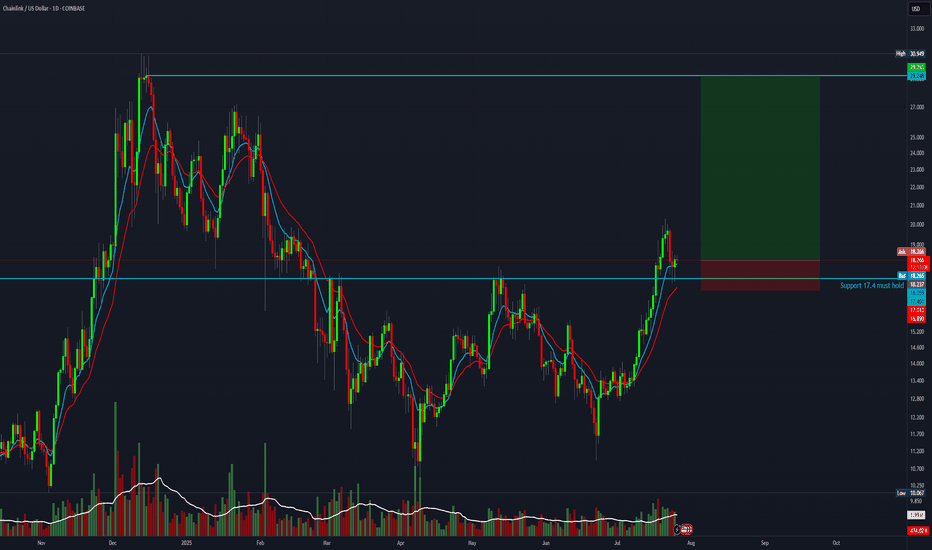

LINKUSD – Relentless Rally HoldingLINK rallied off $14.70, then chopped into $16.50 resistance. After a brief rejection, bulls took control again and printed a new local high. Trend is aggressive and persistent, with every dip bought. Support is $16.20–$16.25 — bulls must hold that zone to stay in control.

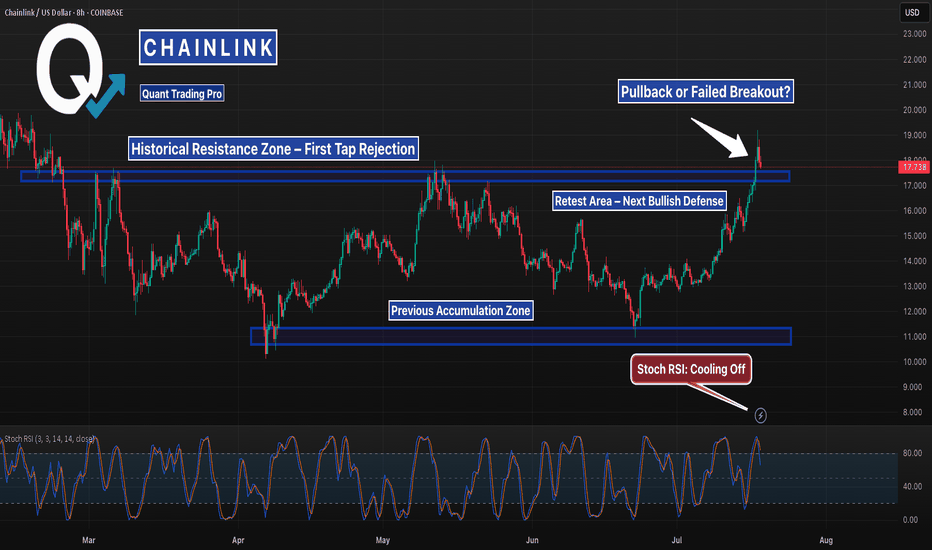

LINKUSD – Mid-Range Reclaim | Push Toward $18-20?Chainlink has reclaimed the mid-range supply zone between $14.50–$15.50 and is now pushing higher.

The structure looks clean with a potential target near $18.80 if bulls maintain strength.

Key support now sits around the breakout zone. Watching for continuation or a failed retest.

#LINKUSD #Chainlink #RangeBreakout #SupportResistance #QuantTradingPro #TradingView

LINK‑USDT | 4H / 1H Confluence Play – “Gap Rebalance or Flush?” LINK‑USDT | 4H / 1H Confluence Play – “Gap Rebalance or Flush?”

LINK is drifting up into a Potential Reversal Zone (PRZ) at 16.48 – 16.65 USDT, created by:

4H + 1H Fair‑Value Gap (bearish displacement candle of 22 May)

TPO single‑print strip on both Binance LINKUSDT perp and spot – un‑auctioned prices from 16.48 to 16.60

0.764 / 0.786 fib retrace of the current downswing

Minor composite LVN just above at 16.70‑16.75 – ideal liquidity sweep level

Historically, 70 % of crypto FVGs of this height (≤ 0.8 %) get at least a midpoint tag within 5 sessions. The mean reversal clock is 10‑15 minutes once price first pokes the gap; if we churn inside for > 3× M5 bars without rejection, odds flip to acceptance.

What I’m watching inside the zone

M5 structure break – lower‑high or close below last M5 swing low.

OI stall or roll‑over – no new longs piling in.

CVD flip ≤ 0 – aggressive sellers absorb bids.

When all three align, I’ll size up; otherwise this is just a magnet, not a wall.

Blind‑limit ladder (probe only)

16.535 (gap midpoint) – 25 % size

16.590 (single‑print top) – 35 %

16.665 (liquidity sweep under LVN) – 40 %

Unified stop: 16.78 (above LVN cluster, 0.9 % risk)

Trade thesis: This zone is “unfinished business.” If order‑flow confirms rejection, expect a swift mean reversion; if price converts single prints into value (multiple prints + rising OI), abandon the short bias and look for acceptance > 16.80.

LINKUSD - Possible Correction from Channel ResistanceStructure: Ascending Channel

Indicators: RSI Overbought, Bearish Divergence Forming

📌 Confirmation:

Look for:

A strong bearish candle or

RSI breaking below 60

Volume divergence

Bias: Short-term bearish correction, bullish structure intact as long as price holds the channel.

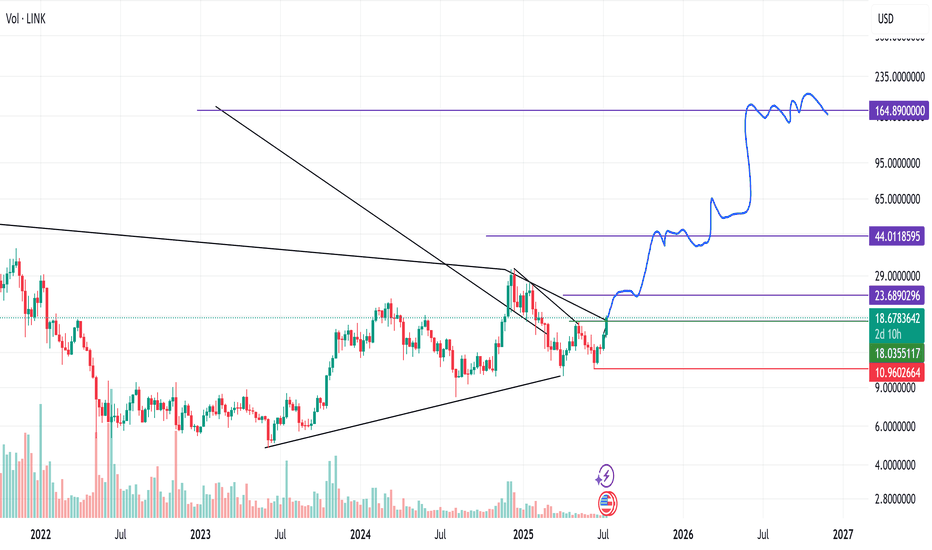

Chainlink Just Broke Out — Is $30 The Next Stop?After nearly 250 days of compression inside a falling wedge, Chainlink has officially broken out. The chart shows a textbook breakout with clean structure, higher lows, and a confirmed break of structure (BOS). A retest zone between $12.8–$14.0 could offer a “buy the dip” opportunity before any continuation.

With momentum shifting and sentiment improving, bulls have eyes on the $30 target — a prior high and wedge-measured move. This is a breakout you don’t want to ignore.

LINK: Critical Chainlink Update!! | Stablecoin Supercycle Part 4🚨 New Video Just Dropped! 🚨

Today, I cover the latest Genius Stablecoin Act update, Shanghai’s surprising interest in stablecoins, and go deep into Chainlink’s technical setup — including Wyckoff, Elliott Wave, short-term outlook, and Fibonacci time analysis.

Video Timestamps:

0:00 Genius Stablecoin Act Update

1:25 Shanghai considers stablecoins!

2:53 Chainlink Risk/Regression Analysis

5:55 Chainlink Wyckoff Accumulation Analysis

8:12 Chainlink Primary Wave Count Elliott Wave Analysis

10:14 Chainlink Short Term Analysis

11:27 Chainlink Fibbonaci Time Analysis

Crucial hour for $LINKAfter a massive leg up, longer time frame charts show there’s still some left in the tank but the hourly chart beg to differs.

First time today that we have the MACD touching and on the brink of a crossover to the down-side along with then stoch RSI on longer time frames showing a downtrend now.

The rising volume is encouraging and we will need a very strong hourly push here shortly if we want to keep the party going.

CHAINLINK (LINKUSD): Very Bullish Outlook

I see 2 strong bullish confirmations on LinkUSD on a daily time frame.

The price violated 2 significant structures: a vertical falling resistance - a trend line

and a neckline of an inverted head & shoulders pattern.

With a high probability, the market will rise more.

Next resistance - 15.38

❤️Please, support my work with like, thank you!❤️

Link long - zoom in on weekly closeWe are approaching a breakout.

Maybe this week's close is the trigger that all the bulls (and altcoins) have been waiting for.

Generally speaking, I don't like trading Chainlink. Although if we see a weekly close just above 14.2, above the 20 MA, I think it could be a good investment entry.

I think Chainlink will be one of the utility coins that completely explodes before retail has time to react. A good weekly close is something that smart money probably would appreciate. If you think long-term, I think Chainlink is in a good position with good upside without any immediate big risk.