DR COPPER vs GOLD as a Safe HavenAn enlightening ratio provides additional proof that 2026 is set to be a remarkable year of economic growth, propelling us into the upcoming peak of the #AI cycle.

A key indicator of the AI peak is the initial public offering (IPO) of Open AI on the stock market. This is a definitive signal to capitalise and harvest as much economic energy as possible during the euphoric frenzy, and establish Open AI as a new Tech Titan for the next decade.

CA1! trade ideas

How can I be late to the copper bull era?How can I be late to the copper bull era when the party hasn’t even started?

The rocket-ship moments for copper lie ahead—not behind us.

There’s no need to front-run anything.

No pressure. No rush. Just readiness.

Wait.. where did I read something similar before... Mmm

Copper to Pump soon, W formation and small cap rumblingsIf you look closely there's a beautiful W formation that has been tested numerous times and has passed. This is high time frame and inconsideration of goals massive run, market makers are going to be looking into smaller cap assets this time of year. Small cap accumulation will last about 2 years. The precious metals like copper which are akin to small caps are going to eat as well. Looks like it's going to double or triple in value notice the parallel Channel as well. Measured moves off the W show the targets.

Candlestick Reversals vs. IndicatorsA simple question to think about. Do indicators make charts too confusing, have mixed success, and ultimately fall victim to whipsaw with an occasional big winner?

Would it be better to use an indicator free daily chart and just observe the buyer and seller psychology that candlesticks offer?

Candlestick patterns are powerful. Especially when you observe them around areas of price congestion, support or resistance.

I would love to hear some opinions on these questions. For and against my thoughts.

Morningstar Candlestick Pattern Forming at the monthly PivotThis 3 candle pattern is a good indicator that a bullish reversal is underway. Price was driven lower on day 1. On day 2 price was initially driven lower but buyers stepped in to take control. And they took control at the monthly pivot which adds even more significance to the move. Finally, on day 3 price moved up which means buyers are in control and bears are losing control. This is likely headline driven and economic outlook driven but the momentum shift at the monthly pivot is an important point to note.

Elliott Wave: Copper (HG) Impulsive Rally Signals More UpsideCopper ( NYSE:HG ) has been displaying a strong bullish trend, with the rally from the July 11, 2022 low unfolding in a Elliott Wave diagonal. This rally is structured as a 5-swing pattern, which is characteristic of a motive wave. This suggests that the broader trend favors further upside. As of the latest price action, the metal has completed a significant corrective phase and is now positioned for additional gains.

The recent pullback to the 4.03 low on April 7, 2025, marked the completion of wave ((4)). It is a corrective wave within the larger 5-wave diagonal structure. Following this low, copper has turned higher, initiating wave ((5)). This wave ((5)) is the final leg of the motive sequence. Within wave ((5)), the short-term rally from the wave ((4)) low at 4.03 appears to be unfolding in an impulsive manner, indicating strong upward momentum. Wave 1 ended at 4.465 and pullback in wave 2 ended at 4.038. The metal then rallied higher in wave 3 towards 4.748 and wave 4 dips ended at 4.564.

Expect cycle from April 7, 2025 low to end soon with wave 5 of (1) and the metal to see a 3 waves pullback. However, as long as pullbacks remain above the 4.03 low, copper is expected to see more upside. The Elliott Wave framework continues to support a bullish bias for NYSE:HG in the near term.

Daily HG analysisDaily HG analysis

A long position with the target and stop loss as shown in the chart

The trend is up, we may see more upside

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special recommendations, with a success rate of 95%, for any inquiry or request for analysis, contact me

COPPER The 1D MA50 is the key.Last time we looked at Copper (HG1!) was on January 24 (see chart below) giving a buy signal that easily hit our 4.6550 Target:

This time the market is in front of a critical moment. The 2025 pattern has been a Channel Up, which last Wednesday reached the top (Higher Highs trend-line) of the 1-year Channel Up. As long as the 2025 pattern holds, the recent pull-back is a buy opportunity targeting 5.3745.

If the 1D MA50 (blue trend-line) breaks however, we expect a quick dive, rebound re-test and rejection, similar to July 05 2024. In that case, we will target the bottom of the 1-year Channel Up at 4.150.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

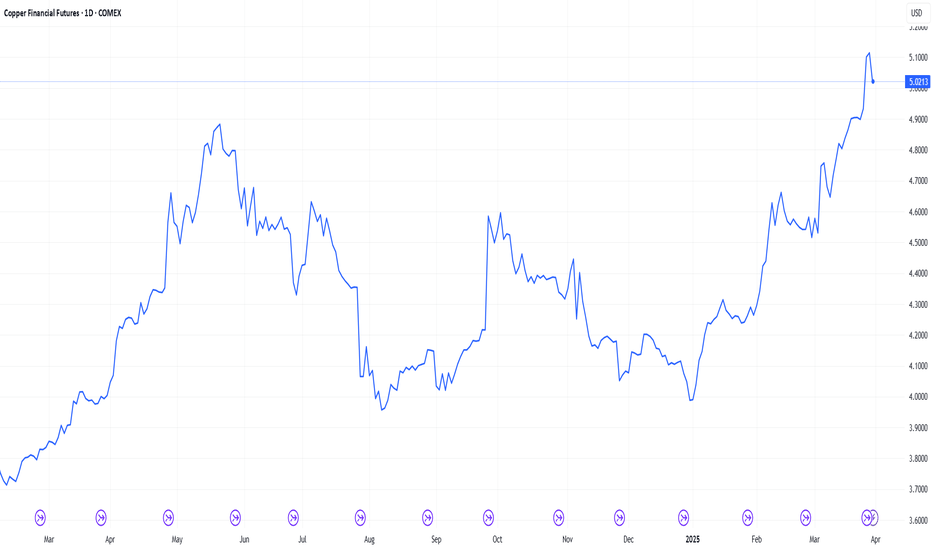

Copper is red hot right now. Here’s whyCopper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons.

Tariffs

The additional premium of COMEX prices over the London Metal Exchange (LME) prices reflects aggressive buying by US traders importing copper in anticipation of a possible 25% tariff on copper imports. This speculation has been fuelled by President Trump last month ordering a probe into the threat to national security from the imports of copper. As aluminium imports were also recently subjected to tariffs, markets are speculating that copper might be next.

This rush has triggered a shift in global flows, with metal moving out of LME warehouses and into US Comex facilities, where copper is held on a “duty paid” basis to avoid future levies. As traders front-run potential policy changes, this behaviour is tightening global supply and fuelling price gains, adding to a market already under pressure from rising demand and a looming supply squeeze.

Demand

China has given an additional boost to copper prices having announced a new action plan to boost domestic consumption by raising household incomes. The stimulus is seen as a positive signal for copper demand, especially as retail sales have already shown stronger-than-expected growth early in the year. China has also set itself a GDP growth target of 5% for 2025, and so far this year, its manufacturing Purchasing Managers' Index (PMI) has remained in expansionary territory — a sign that the economy is holding steady. With momentum building across consumption and manufacturing, copper is getting a fresh tailwind despite lingering weakness in the property sector.

Further support for industrial metals, including copper, has come from Germany’s recently unveiled €1 trillion infrastructure and defence spending plan — a move that will inevitably drive greater demand for base metals.

Supply

Supply tightness in the copper market is being driven by several structural and emerging challenges. Exceptionally low processing fees—caused by an oversupply of smelting capacity, particularly in China—have placed financial strain on global smelters, prompting companies like Glencore to halt operations at its facility in the Philippines. Looking ahead, Indonesia’s proposal to shift from a flat 5% copper mining royalty to a progressive rate of 10–17% risks discouraging future production growth. These supply-side pressures come as the International Copper Study Group reported a slight global copper deficit in January 2025. While a similar shortfall at the start of 2024 eventually turned into a surplus, this time the combination of weakening smelting economics, policy headwinds, and solid demand could make the current deficit more persistent and impactful.

Several major copper miners have recently downgraded their production estimates for 2025, adding further pressure to an already tight market. Glencore suspended output at its Altonorte smelter in Chile2, while Freeport-McMoRan delayed refined copper sales from its Manyar smelter in Indonesia due to a fire3. Anglo American expects lower output from its Chilean operations amid maintenance and water challenges, and First Quantum Minerals faces reduced grades and scheduled downtime4. These disruptions are likely to tighten global copper concentrate supply, potentially widening the market’s supply-demand imbalance just as demand continues to strengthen.

Sources:

1 Source: Bloomberg, based on total return index as of 28 March 2025.

2 Reuters, March 26, 2025

3 Reuters, October 16, 2024

4 Metal.com. February 14, 2025

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Copper's Grip: Stronger Than Oil's?Is the U.S. economy poised for a red metal revolution? The escalating demand for copper, fueled by the global transition to clean energy, the proliferation of electric vehicles, and the modernization of critical infrastructure, suggests a shifting economic landscape where copper's significance may soon eclipse oil. This vital metal, essential for everything from renewable power systems to advanced electronics, is becoming increasingly central to U.S. economic prosperity. Its unique properties and expanding applications in high-growth sectors position it as a linchpin for future development, potentially rendering it more crucial than traditional energy sources in the years to come. This sentiment is echoed by recent market activity, with copper prices hitting a new record high, reaching $5.3740 per lb. on the COMEX. This surge has widened the price gap between New York and London to approximately $1,700 a tonne, signaling strong U.S. demand.

However, this burgeoning importance faces a looming threat: the potential imposition of U.S. tariffs on copper imports. Framed under the guise of national security concerns, these tariffs could trigger significant economic repercussions. By increasing the cost of imported copper, a vital component for numerous domestic industries, tariffs risk inflating production costs, raising consumer prices, and straining international trade relationships. The anticipation of these tariffs has already caused market volatility, with major traders at a Financial Times commodities summit in Switzerland predicting copper could reach $12,000 a tonne this year. Kostas Bintas from Mercuria noted the current "tightness" in the copper market due to substantial imports heading to the U.S. in anticipation of tariffs, which some analysts expect sooner than previously anticipated.

Ultimately, the future trajectory of the U.S. economy will be heavily influenced by the availability and affordability of copper. Current market trends reveal surging prices driven by robust global demand and constrained supply, a situation that could be further exacerbated by trade barriers. Traders are also anticipating increased industrial demand as major economies like the U.S. and EU upgrade their electricity grids, further supporting the bullish outlook. Aline Carnizelo of Frontier Commodities is among the experts forecasting a $12,000 price target. However, Graeme Train from Trafigura cautioned that the global economy remains "a little fragile," highlighting potential risks to sustained high demand. As the world continues its march towards electrification and technological advancement, copper's role will only intensify. Whether the U.S. navigates this new era with policies that ensure a smooth and cost-effective supply of this essential metal or whether protectionist measures inadvertently hinder progress remains a critical question for the nation's economic future.

Copper Bounce? $HG1! at Key Demand Zone!Back at a strong demand level on COMEX:HG1! (Copper futures). The key invalidation is a 4-hour close below 3.92, so I'll be watching closely to manually close.

I'm looking for a potential bounce from here, and if the weekly candle closes bullish, I may consider this a reversal setup. The confluence between the weekly support and the current demand zone gives me confidence to take the trade.

If the move fails, my next level to watch is 3.7 for another potential entry.

Let’s see if COMEX:HG1! behaves this time.

The impact of Trump's tariffs on the copper marketBy Ion Jauregui - ActivTrades Analyst

The copper market is going through a decisive phase, influenced by political and economic factors that could alter its behavior in the coming months. The return of Donald Trump to the U.S. presidency and his reactivation of tariff policies has generated expectations of a new record in the price of the red metal since the beginning of the year. Executives of the copper sector indicated at that time that its value could exceed 13,000 dollars per ton (approximately 404.35 dollars per ounce). One troy ounce is equivalent to 31.1034768 grams; therefore, there are 32.15074657 troy ounces in 1 kg. This means that the value of copper is multiplied by 32.1 times, a level that was already surpassed on Tuesday with its current price at 517 dollars per ounce.

United States accumulates copper while China suffers shortages

Trade tensions have led to a redistribution of global supply. It is estimated that 500,000 tons are being diverted to the U.S., which is drastically reducing stocks in China, the world's largest consumer. This supply imbalance could put further pressure on prices.

Factors driving the rise in copper prices

1. Electrification and renewable energies: The growing adoption of electric vehicles and the expansion of electric infrastructures increase the demand for copper.

2. Production constraints: Chile and Peru, the world's leading producers, face disruptions due to labor disputes, environmental regulations and lower investment in mining infrastructure.

3. U.S. trade policy: Tighter tariffs have encouraged the accumulation of reserves in the U.S. and other countries, further restricting global supply and putting upward pressure on prices.

4. Restrictions on the export of scrap from the EU: The European Union is evaluating the implementation of tariffs on the export of scrap, which could impact the supply of raw material for the production of refined copper. This measure seeks to strengthen the domestic industry and reduce dependence on third countries, but could also affect the global supply of the metal.

5. Geopolitical instability: International conflicts, trade sanctions and changes in central banks' monetary policies influence copper prices. Industrial demand from China continues to be a determining factor in the market equation.

Copper price outlook

In 2021, the metal reached an all-time high of $10,700 per tonne at $505 per ounce. Now, with the combination of growing demand and increasingly tight supply, the market could surpass this level. The evolution of trade policies and China's response will be decisive in its trajectory. Looking at the chart, it reached a new high of $518.45 on Monday. The current price oscillates between $510 and $512, showing an accumulation structure by institutional traders initiated in the last impulse of March 11. The control point (POC) is distant at around $477 per ounce, and the volume distribution shows a third dominance zone near $512. Since March 11, the golden crossover of the moving averages has facilitated bullish expansion, although the 50-average has brushed the 100-average on several occasions. Currently, both averages are in price confluence, which coincides with an RSI that has corrected from 71.84% to 54.40%. This movement could indicate the possibility of a new upward momentum that takes the price above $535.

Impact of tariff measures on the industry.

If Trump ultimately ends up implementing new tariffs on industrial metals, it could drastically alter the flow of global copper trade. Tariffs on imports could incentivize domestic copper mining in the U.S. and raise costs for importers, affecting the competitiveness of manufacturing companies. On the other hand, China may be forced to diversify its sources of supply or develop technological alternatives to reduce its dependence on imported copper.

In addition, restrictions on the export of scrap by the European Union could influence the availability of recycled copper, a key source for industrial production in China and other markets. The EU seeks to reduce the leakage of strategic materials, which could lead to higher prices on the international market for all rare metals and materials.

Conclusion

Copper is at a turning point. The combination of production restrictions, increased global demand and protectionist policies could push its price to record levels. The evolution of the geopolitical and economic context will be key to define the direction of the market in the coming months. Investors and companies in the sector will have to pay close attention to the evolution of trade policies and the response of the main market players in order to anticipate possible movements in copper prices.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Copper Pending Short: Ending of 5-waves in Ending DiagonalTake note that there is a rule breach in this analysis where wave IV is in the price zone of wave I.

Aside from that, I have drawn a 5 waves overlapping each other for wave 5 thus expecting an ending diagonal. The target of $5.22 is from the convergence of 2 Fibonacci extensions. Also, it is near to the resistance trendline. Thus the stop loss is placed above the trendline.

Good luck!

Copper Nears Possible Resistance ZoneCopper faces a potential resistance zone between 5.18 and 5.30, where seven Fibonacci extension targets align with the May 2024 peak. If this level holds, a retracement to 4.984–4.75 is possible. This area is supported by a three-point Fibonacci symmetry and the 34 EMA wave.

MACD Wobbling, crazyIn the H1 TF, price movements seem unstable, imbalanced impredictable. Just touching previous ATH last year.

MACD indicator wobbling, indicates so many traps entry.

Better stay away for awhile or proper trade strategy and money management.

Anyway, still copper futures like chibai