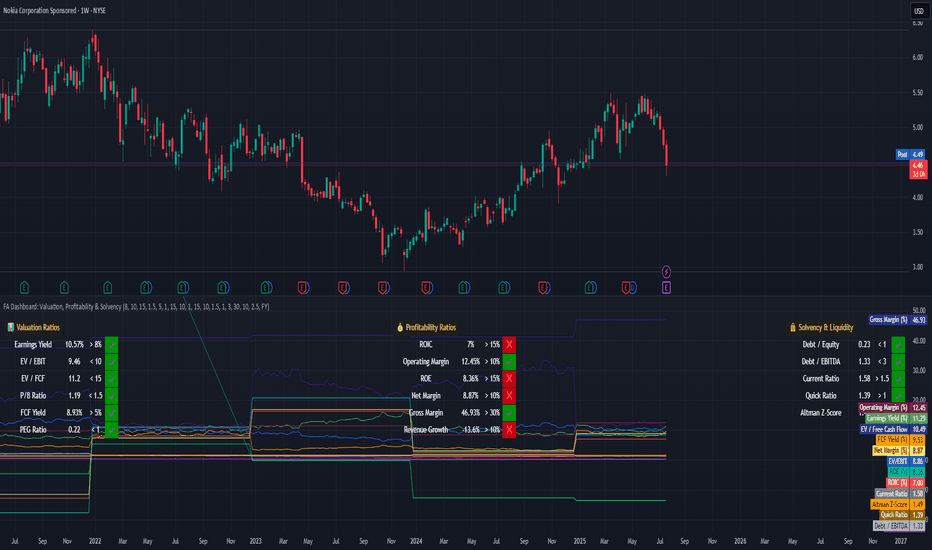

How to Evaluate Companies with a Fundamental Dashboard**Tutorial: How to Evaluate Companies with a Fundamental Dashboard (Example: Nokia)**

This tutorial explains how to use a custom-built dashboard in TradingView to evaluate companies based on key financial dimensions: **Valuation**, **Profitability**, and **Solvency & Liquidity**.

---

🛠 **How to Use This Tool**

This dashboard is meant to be an educational visual filter for fundamental analysis. Here’s how you can use it:

1. Add the script to any stock chart in TradingView.

2. Choose your preferred data period: annual (FY) or quarterly (FQ).

3. Adjust the thresholds in the script settings to reflect your investment approach.

4. The dashboard displays 17 key financial ratios grouped into three categories.

5. Each metric is evaluated visually with ✔️ (meets threshold) or ❌ (falls short).

6. Use this dashboard to identify companies worth deeper analysis — not to make automatic decisions.

---

📊 **Understanding the Dashboard Sections**

### 🔹 Valuation Metrics

Used to assess whether a stock appears undervalued based on price-to-value fundamentals:

- Earnings Yield

- EV/EBIT, EV/FCF

- P/B Ratio

- Free Cash Flow Yield

- PEG Ratio

### 💰 Profitability Metrics

Evaluate how efficiently the company turns revenue into profit:

- ROIC, ROE

- Operating, Net, and Gross Margins

- Revenue Growth

### 🔒 Solvency & Liquidity

Assess financial strength and balance sheet resilience:

- Debt/Equity, Debt/EBITDA

- Current Ratio, Quick Ratio

- Altman Z-Score

---

📍 **Case Study: Nokia (Ticker: NOK)**

This tutorial applies the dashboard to Nokia to demonstrate how to interpret results:

- ✅ **Valuation is strong**: Most metrics meet or exceed typical value thresholds.

- ⚠️ **Profitability shows weaknesses**: ROIC and revenue growth fall below expectations.

- 💪 **Solvency is healthy**: Debt is under control, though Altman Z-Score signals some risk.

This example helps show how the tool highlights strengths and red flags at a glance.

---

🎯 **Key Takeaway**

This dashboard is not a signal generator — it’s a thinking aid.

Its purpose is to help investors explore company fundamentals visually and consistently. The thresholds are customizable, and the tool encourages deeper due diligence.

---

⚠️ **Educational Disclaimer**

This tutorial is for educational purposes only. It does **not** provide investment advice or recommendations.

It is intended to demonstrate how to use a script to organize and interpret fundamental financial data.

Always do your own research and exercise independent judgment before making any financial decisions.

870737 trade ideas

Nokia:Inverted Head and Shoulders Structure + Retest of BreakoutOn the weekly chart of Nokia, a classic Inverted Head and Shoulders reversal pattern has formed. The breakout above the neckline occurred with increased volume, confirming the strength of the move. Currently, the price is undergoing a standard technical retest of the neckline from above — a typical phase before a potential continuation higher.

The structure remains active: the projected height (H) points to an initial target at $5.48, based on the distance from the neckline to the head. If momentum continues, Fibonacci extension targets are located at $6.18 (1.272), $6.55 (1.414), and $7.08 (1.618).

Technical view: the retest of the neckline is happening on declining volume, strengthening the probability of a bullish reversal. EMA 50/100/200 are beginning to align in a bullish crossover. The ascending channel structure also supports the upward movement.

Fundamentals: Nokia is progressing with its strategic programs in 5G and upcoming 6G network technologies, reinforcing its long-term growth prospects. Improved financial performance and the recovery in demand for telecommunications infrastructure amid global digitalization trends continue to support investor interest in the stock.

The Inverted Head and Shoulders pattern is confirmed by the breakout and current retest. As long as the price holds above the neckline, the bullish scenario toward $5.48 and beyond remains intact. This is a medium-term trend reversal structure — strong setups like this form the foundation for major moves. Don’t miss them.

Halftime Update: NOK - Nokia CorporationNokia brought out of it's current channel, tapping $5.14 before pulling back which we expect it to come back to the $4.53 for another potential entry before it's stronger continuation to the upside within this channel, ultimately heading back to the $6.50 Price Levels.

FINANCIAL NEWS:

Nokia Oyj (NYSE:NOK) shares are trading higher by 6.25% to $5.104 during Monday’s session after the company announced, along with industry leaders, an acceleration of AI-RAN development and will establish an AI-RAN center in the US.

What To Know: Nokia’s stock surged Monday following its collaboration with Lockheed Martin Corp (NYSE:LMT) and Verizon Communications Inc (NYSE:VZ) to integrate its military-grade 5G solutions into Lockheed's 5G.MIL® Hybrid Base Station (HBS).

Read Also: Kroger Stock Is Sliding Monday: What’s Going On?

Per a Sunday press release, this partnership advances battlefield communications by seamlessly merging commercial 5G with military networks, enhancing situational awareness and decision-making for defense operations. Nokia’s technology will ensure real-time data exchange across defense networks.

What Else: Initial integration tests took place at Verizon’s Boston Innovation Center and Lockheed Martin’s Pennsylvania and Texas facilities, demonstrating successful interoperability with existing military systems.

Plans include further integration at Lockheed Martin's 5G.MIL Experimental Network site in Orlando, leveraging Nokia's 5G to expand tactical communications.

Why Zaza bought Nokia shares at $4.00 and is holding now30 Oct, Bota Kiri, Perak Darul Ridzuan: Why Nokia Stock Could Be Your Best Choice Right Now 📈

If you're looking for a stock with potential to grow, now might be the right time to consider Nokia (NYSE: NOK). Priced around $4.00, Nokia stock offers an attractive long-term investment opportunity. 🌟

Why Zaza & Team, ZZCM Bought Nokia at $4.00

Zaza recently purchased Nokia shares at $4.00, confident that the company has promising future projects to drive growth. Here’s why Zaza feels optimistic about the future of this tech company.

Exciting Projects in 5G & Future Technologies 🚀

Nokia is strengthening its position in the 5G industry, which is increasingly important worldwide. Nokia’s 5G infrastructure and network solutions are recognized as solid. With partnerships with several major telecom operators, Nokia is now a leading provider of 5G technology in multiple countries.

Beyond 5G, Nokia is also focusing on new technologies like 6G, AI networking, and the Internet of Things (IoT). These projects open new revenue streams for Nokia and position it for substantial gains when these technologies are adopted more widely.

Positive Recent Developments for Nokia 📊

Recent developments have helped solidify Nokia's prospects:

👉 Partnerships with Major Telecom Companies: Nokia has numerous agreements with prominent telecom companies in Europe, North America, and Asia 🌍. These deals not only bring stable revenue but also reinforce Nokia’s brand in the market.

👉 Government Support & Strategic Contracts: Nokia recently secured contracts for secure communication networks with government agencies in several countries. This further proves Nokia is a trusted partner for secure networks 💼.

👉 Investment in Cloud & Edge Computing: Nokia is focusing on cloud and edge computing, increasingly vital for digital transformation 🔗. Nokia can offer end-to-end solutions from 5G to cloud services.

Benefits of Buying Nokia Now

Attractive Valuation: With a price around $4.00, Nokia is considered undervalued.

Strong Financials: Nokia has a solid balance sheet, enabling continued investment in new technology.

Dividend Potential: As Nokia’s financial position strengthens, there’s potential for increased dividends, which would be attractive to shareholders.

Continued Demand: With growing digitalization, demand for 5G, cloud, and IoT is expected to keep rising 📈.

So, Why Now is the Best Time to Buy 💰

With a low price and bright prospects, Zaza believes Nokia is well-positioned for growth. With its focus on 5G, IoT, AI, and edge computing, Nokia could be a profitable long-term investment opportunity. Buying now at around $4.00 offers you the chance to get in early before these projects make a full impact. 🚀

NOK Nokia Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOK Nokia prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2024-7-19,

for a premium of approximately $0.09.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Nokia to acquire Infinera in 2.3B USD dealNokia Corp ADR is poised to significantly enhance its capabilities in the optical equipment sector with the 2.3 billion USD acquisition of Infinera Corp. This strategic move aims to double Nokia's capacity to produce data centres integrated with artificial intelligence, positioning the company to compete more effectively with industry giants like Huawei and Ciena.

Post-acquisition, Nokia is set to become the second-largest player in the global networking sector, surpassing Ciena and trailing only behind China's Huawei. The deal is anticipated to immediately boost Nokia's profits, with expectations that Infinera's contributions will increase Nokia's net profit by more than 10% by 2027. Additionally, the acquisition will enable Nokia to accelerate the development and release of new products, thereby enhancing its competitive edge in the telecom equipment market.

Technical analysis of Nokia Corp ADR (NYSE: NOK)

Examining the stock chart from a technical analysis perspective:

Timeframe: Daily (D1)

Current trend: There has been a global uptrend since the end of December 2023

Resistance level: 3.85 USD

Support level: 3.55 USD

Potential downtrend target: If a downtrend forms, the potential downside target could be set at 2.50 USD

Short-term target: If the uptrend continues and the stock breaks the resistance at 3.85 USD, the short-term target could be set at 4.10 USD

Medium-term target: The price could potentially rise to 4.35 USD

This acquisition not only promises to bolster Nokia's financial performance but also strategically positions the company at the forefront of innovation in the networking and data centre industries. Investors may want to monitor this stock closely as the market reacts to this significant corporate development.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.88% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Nokia Has Completed the Acquisition of Fenix GroupNokia ( NYSE:NOK ) has completed the acquisition of Fenix Group, a privately held company specializing in tactical communications solutions for the defense communities yet the stock is down 2.53% on Thursday's market trading. The acquisition, announced in December 2023, strengthens Nokia's position in the defense sector by adding Fenix's broadband tactical communications products, such as the Banshee family and Talon MANET radios, to its existing solutions portfolio.

This expanded portfolio will allow Nokia ( NYSE:NOK ) to offer a more comprehensive suite of 3GPP-based solutions to its defense customers worldwide. Interoperable, 3GPP-based mobile networks will play an important role in the digitalization of military communications. The acquisition, including the Committee on Foreign Investment in the United States (CFIUS) review and approval, marks a significant milestone in Nokia's U.S. strategy and underscores its commitment to being a trusted provider of secure and innovative solutions to the U.S. Federal government.

The combination of Nokia ( NYSE:NOK ) and Fenix supports the objective of bringing dual-use technology capabilities to the warfighter. Mike Loomis, President of Nokia Federal Solutions, said the acquisition marks a significant step forward in Nokia's strategy to grow its defense business and overall U.S. strategy. Dave Peterson, CEO of Fenix Group, expressed excitement about joining forces with Nokia, stating that by combining their innovative solutions with Nokia's global reach and resources, they can create even greater value for customers and make a significant impact on the future of secure military communications.

NOKIA - Long-Term"Long" Term does not imply "going Long" mind you .. just means .. eh .. like much time ..

Made a nice "Fib", they seem to be important to 'Traders' and 'Anal-ysts®' (not to me, sorry),

I just draw that humbug in here because all my other IDEA's usually have pretty empty charts (see some lines further below .. ).

Just saw an elaborate IDEA about 'stuff' the other day were the author actually thought they explain anything by incorporating "Fibonacci" .. as if it has some magically meaning explaining by mere presence why things happen the way they happen, of course everybody happy about it, not seeing it did not explain ANYTHING, well .. people don´t wanna learn or understand anything truly 🤷. I'm not gonna bother any more.

Overview:

Price seems to like this 0.618 fib thingy, great (I'll bet if we make up more fibs, some of them look important too, 'muh nature laws').

Zooming in some more, we can see pareidolia in the form of a Dandruff-pattern®, which 'played out' very quickly and violently .. messed with a lot of people (whole discussions to be found and had about this one).

Zoom in even more for some more funny Dandruff:

price seems to be stuck at the very important 0.287fib

and EXTREME close-up:

Not gonna bother drawing any more pretty lines and fundicators in here.

'TBH', my trades have nothing to look at but TradingView does not like that (they already killed some of my previous charts because I was trading almost Butt-naked)

What is shown here holds pretty much NO meaning to me or my trades, just drew some of the stuff that most people could/should/would find if they want to Anal-yze® the chart.

Already entered in November but (why sell (some) in Profit when it's more fun to see it return to Break-even, am I right? 😉) .. like with the other stuff .. couldn't be ***ed to make public chart before. But I'm bored .. so .. here is one now.

Chart does have some areas I might Buy or Sell some .. will see 'whence we got there' (👈 'past future tense' / 'futuristic past tense'? ) .

I wouldn't trade this if I were you. Nokia does some phone stuff (no I did not mean "phunky" or "phunny" stuff, even though it sounds like it, reading it back) .. like .. 5G etc.

BUT

I am not you .. so I trade it anyway.

IF you were me .. than .. I guess you would be typing this ?

nokia-Weekly 26 EMA breaking after repetitive attempts. Right now is flat pointing straight.

-Weekly MACD heading on the upper half.

-Daily 26 EMA pointing upwards after a strong bull absorption candle with a second candle breaking the range.

Long trades preferred.

Wait for the pullback of this initiative move and enter after a confirmative strong bull candle or pattern.

Stop loss below this pullback.

Take profit on some next reference point.

The trade provided is indicative.

My final idea on NokiaToday there is an article on TradingView in regards to Nokia and AT&T.

AT&T has apparently chosen Ericsson to "modernize its U.S. telecoms network" instead of Nokia for a $14,000,000,000 contract.

www.tradingview.com

Nokia share prices have plummeted almost 16% in the past 3 trading days, today being -5%.

For Nokia, that is a *gigantic* drop.

It's also kinda ... weird timing. For multiple reasons.

At the end of last week, I was looking at Nokia's daily chart and was feeling pretty certain it was about to drop again:

1) Massive volume fall off as Nokia had a slight bullish retracement.

2) It bounced off what I see as a critical former support trend line with absolutely ZERO vigor. It barcoded. At a former support.

3) After breaking 50 RSI, there was a green daily candle on that support, but by only +0.29%. Huge signal of weakness.

Looking at the weekly RSI, I felt even more certain Nokia was about to drop again:

1) Nokia has not entered oversold on the weekly since early 2020.

2) In early 2020 Nokia entered oversold, it bounced, then did it again shaving nearly 50% off the share price.

Now don't get me wrong, I didn't see a 16% drop coming, but it was pretty clear it was about to drop again is all I'm saying.

So then yesterday and today there is news about AT&T rejecting Nokia for a contract.

Yet I want to point something out that caught my eye in that above article:

"We understand that the operator took this decision for specific reasons that are not related to the quality (or lack thereof) of Nokia's products and solutions. That said, after the loss of 5G footprint at Verizon to Samsung, this is yet another significant setback for Nokia in the crucial (highest-margin) U.S. market," Peterc added.

Interestingly, this decision by AT&T was not made over Nokia's actual products/performance?

Is this not a huge red flag to anyone else? Especially considering this next part?

Now we take a look at the chart itself for another interesting bit:

Zoomed in:

Now that I've looked at it a bit more ... the 2021 'meme' spike (in Nokia at least) makes a bit more sense:

It has been almost 3 years since Nokia had that major spike in Jan 2021. From the moment it happened and ever since, I have believed there was *a lot* more to that jump than meets the eye. My hunch then and always has been that it was an attempted breakout/attempted downtrend reversal. Initially it was the smaller (pictured) inverted head and shoulders. Then it was the theory of a massive multi-decade inverted head and shoulders, yada yada. Clearly, I will admit, I must have been wrong.

To keep things simple, I am starting to believe it was just the first real breakout attempt of the ATH downtrend line.

That breakout was my largest unrealized profit trade ever and I blew it. Won't go into details on that.

Ever since, I have blown every single winning trade I've taken. (Other than my most recent PayPal trade which netted me a whopping$100.)

Anyway, enough with that.

With this weeks drop, Nokia is today sitting directly on that ATH downtrend line, which started in November of 2007.

This will be my final attempt at trading Nokia. Like the 'meme' spike, I am again entering into $7 call contracts. Their expiration is 1/16/2026. With the exception of a few hundred dollars, I am all in on my 2nd largest trade since 2021, and will continue to add more contracts as time goes on if somehow I come upon some spare cash.

On the worst news Nokia has seen in a while.

Right on the downtrend line.

I am here again.

For the final time.

Nokia (NOK) possible recoveryNokia completed the share buyback, which started in February 2022, in November 2023. On the monthly chart, there is divergence in the MFI, KDJ is looking to cross upwards. Apparently 2024 will be a key year for the company. The fair price at the moment seems to be around the VPVR, around $5

Nokia and Cybernet deploy Pakistan’s first 6G commercial networkKarachi, Pakistan – Nokia and Cybernet, the leading fixed-line telecommunications provider in Pakistan, today announced they have deployed the country’s first DWDM network operating at 600Gbps per wavelength. The DWDM network enables Cybernet to deliver a high capacity, robust network that is capable of meeting requirements of even the most demanding customers. This new optical network connects Cybernet’s main metro sites and provides the enhanced network capacity needed to support growing consumer and enterprise demand for fast, high-quality broadband services across Pakistan.

By further strengthening its global footprint through the establishment of its international points of presence (POPs) in MC-1 in Barka (Oman), MRS-2 in Marseille (France), SmartHub in Fujairah (UAE) and SG1 in Singapore, Cybernet is providing its global peering community members with its advanced IXP platform powered by the Nokia 7750 SR and 7250 IXR routers. This platform ensures optimum connection capacity to meet both current and future needs. Cybernet offers Internet, EVPN and MPLS-based services with rich Quality of Service (QoS) at its international POPs.

To better meet the rising demand for high-speed broadband access and network speeds, operators are looking to upgrade their optical networks. Committed to ensuring its customers can tap into the high-speed services it provides, Cybernet partnered with Nokia for the deployment of a future-proof optical network capable of delivering over 600Gbps per lambda. This enhances the capacity and speed of its network used to connect main metro sites within the country. Leveraging Nokia’s PSS 1830 optical transport platform, Cybernet can effectively scale its total network capacity to 28Tbs, serving broadband and enterprise customers across Pakistan.

Cybernet successfully implemented Nokia’s advanced integrated ROADM architecture based on flexgrid technology. Through this deployment, Cybernet can better optimize and extend the reach of its optical network

Is NOKIA about to wake from its deep deep sleep?Perhaps.

** investment opportunity **

23 years ago traders were exchanging Nokia stock at $60 a share. No splits since that time and now yours for under $4. Dividend yield @ 1.98%.

On the above 3-week chart price action has corrected over 90%. A number of reasons now exist for a bullish outlook. They include:

1) Price action and RSI resistance breakouts.

2) Price action backtests past resistance as support on a macro bull-flag. Make no mistake how important this signal is. For 23 years it has been huge resistance. This is big news.

3) Support and resistance. Look left. Blue circle. A beautiful signal.

4) Last but not least price action is currently testing the 0.236 Fibonacci level.

Is it possible price action keeps falling? Sure.

Is it probable? No.

Ww

Type: Investment

Risk: <=6%

Timeframe for long: A month at best

Return: Will say elsewhere.

NOK Nokia Oyj Options Ahead of EarningsAnalyzing the options chain of NOK Nokia Oyj prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2023-9-15,

for a premium of approximately $0.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

NOKIA: Bullish Deep Gartley Visible on the Daily.There's not much to go off of other than the Deep Gartley, but I like the area it's at and it looks like the perfect spot to try to catch a bigger move up after having what could be seen as an overly negative reaction to a slight miss on the earnings report.