870737 trade ideas

Beautiful fall from NokiaNot only crypto can fall 20% in a couple of hours, tradiional stock market also love to surprise investors. Nokie, those undestroyable phones are already thing of the past, now everyone is focused on 5G and Internet of Things, but that's where the problem for nokia is. More competitors, more diffcult to earn new clients. As a result, new progft warning...

Nokia now sees 2019 underlying earnings per share (EPS) at 0.18 euros to 0.24 euros and 2020 EPS at 0.20 euros to 0.30 euros. It had earlier forecast 2019 EPS at 0.25 to 0.29 euros, and 2020 EPS in the range of 0.37 to 0.42 euros.” The reason for lower outlook is tougher competition in 5G and the need of further investments to compete.

Nokia’s board decided not to distribute the third and fourth quarterly instalments of the dividend for the financial year 2018 in order to increase 5G investments, investments in areas of growth like software and strengthen cash position.

Hopefully they achieve to solve the issue soon. Nevertheless, it can be a good opportunity to buy in a couple of days, as shares will finally stop falling.

NOK short continuationRejected at zone and falling.

Brokevthrough trendline. Watch area

Around emas. With macd crossdown

Could retest bottom zone. Were on a

Gap fill end and at emas. Need confirmation

Below.

Join our discord for free colaboration, Chart Breakdowns, Trade Idea Alerts, Market Chat

discord.gg

NOKIA potential long opportunityNokia is currently uptrending after completing a large bullish Cypher pattern that even appears on the weekly time scale. Now there is another opportunity for entry, as we are showing a lower low double bottom with daily bullish divergence. Price action (dragonfly doji followed by bullish continuation) indicates a trend reversal.

If entering a trade, one could play the double bottom, placing their stop loss just below the lower low. As price action continues to the upside, especially around the completion zone of the imperfect bearish Cypher (shown in red), one should look out for divergence on the oscillators and consider raising their stop loss if it starts to look bearish. Overall, I see this as a long opportunity with a very high reward/risk ratio.

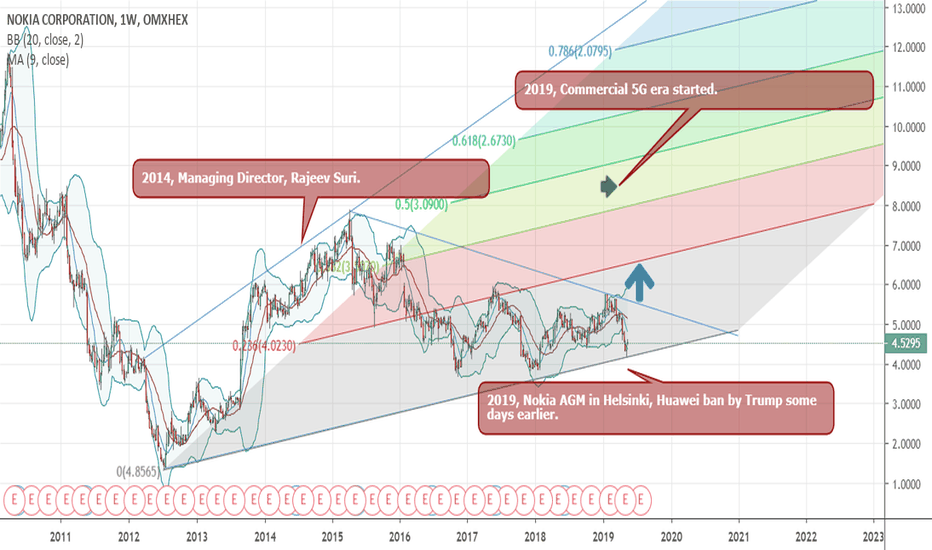

Nokia's road to $8 and higher - Strong BuyNokia beat 2Q19 expectations, but the better news came from an upbeat narrative regarding the next few quarters.

"Will 5G Boost Nokia Stock? - There’s one more piece of good news worth highlighting. Again, cost cuts should help margins and 5G should drive growth. The question is whether, with China’s Huawei facing security concerns, Nokia can outperform rival Ericsson (NASDAQ:ERIC) in 5G. Early returns look good."

seekingalpha.com

www.stocksequity.com

Despite the US trade war with China, Nokia will be one of the winners in our opinion.

$ 6,50 before september 2019

$ 8,00 before november / december 2019

$NOK Nokia loves a good trade war. 5G heaven. HUAWEI has had market dominance for years, but the tough stance the USA has taken on banning their products will have many benefactors, one of which is Nokia. Having competed against a government subsidized Huawei, this is great news for NOK and as POTUS urges other countries to take similar actions the picture looks good for Nokia in the upcoming 5G roll-out.

ANALYST RATING OVERWEIGHT

AVERAGE PRICE TARGET $6.36

14 BUY

4 OVERWEIGHT

10 HOLD

COMPANY PROFILE

Nokia Oyj provides network infrastructure, technology and software services. It operates through the following segments: Ultra Broadband Networks, Global Services, IP Networks and Applications and Nokia Technologies. The Ultra Broadband Networks segment comprises mobile networks and fixed networks. The Global Services segment provides professional services with multi-vendor capabilities, covering network planning and optimization, systems integration. The IP Networks and Applications segment comprising IP/Optical networks and applications & analytics.

2 Big Developments in America’s 5G Rollout My longtime readers know 5G is the most disruptive force of the decade.

In short, 5G will supercharge America’s wireless networks. It will give us internet speeds 1,000x faster than today’s.

This will open up a whole new world of disruption.

Think of 5G as a “tool” that will enable tomorrow’s disruptive businesses, one of which I revealed in my free special report, The Great Disruptors.

For example, how many of the following do you use?

• Music streaming services like Spotify

• YouTube’s video streaming

• Ride-hailing from Uber

• Amazon’s online store

The last wireless upgrade—4G—is the driving force behind them all.

4G arrived in the early 2010s and brought us much faster speeds. With that came the ability to do things like watch movies, stream music, or shop from anywhere on your phone.

4G allowed disruptors like Google (GOOG), Amazon (AMZN), and Netflix (NFLX) to flourish. From 2010 to today, their stocks grew 325%, 1,350%, and 3,825%.

5G will be MUCH bigger than 4G.

4G was an upgrade. 5G is a total overhaul. It’s going to enable transformative disruptions like self-driving cars and remote surgery.

Today, I’ll tell you about two big new developments in 5G—and what they mean for investors.

Quietly, 5G Is Driving One of the Biggest Disruptions of 2019

As you may have heard, the US Government recently banned Chinese telecom giant Huawei from doing business in the US.

I warned back in February this was likely to happen. My prediction ruffled some feathers. Huawei reps even contacted me to insist I was wrong!

Huawei is the world’s second-largest phone maker, behind only Samsung. It stands accused of placing secret “backdoors” in its equipment. If true, these backdoors allow the Chinese government to spy on Americans who use Huawei’s gear.

Huawei is a private company. It has no publicly-traded stock. But its ban rocked markets all the same...

You see, Huawei buys a ton of parts from American companies. It bought $20 billion worth of computer chips from US companies last year, according to investment bank Evercore.

US chipmaker Qorvo (QRVO) gets 13% of its revenue from Huawei...

Radio-frequency firm Skyworks Solutions (SWKS) counts Huawei as its third-largest customer...

And facial recognition company Lumentum (LITE) gets almost 20% of its sales from Huawei.

All three stocks tanked on the news.

While the Huawei ban is terrible for companies that sell to it, it’s GREAT for companies that compete with it in 5G.

Nokia and Ericsson Will Take the Lead in the 5G Race

Huawei is the world’s largest maker of 5G infrastructure.

It had secured $100 billion worth of 5G contracts—more than five times any of its rivals. But with Huawei all but banned from the Western world, those contracts have been torn up.

Only two other companies can step up to fill the void: Nokia (NOK) and Ericsson (ERIC).

Both stocks jumped when Huawei’s ban was confirmed... and they’ve continued to march higher.

The Sprint and T-Mobile Merger Is a Big Deal

If you live in America, I can almost guarantee you use one of four carriers: AT&T (T), Verizon (VZ), T-Mobile (TMUS), or Sprint (S).

These four have the US cell market on lockdown. They own 98% of the $260 billion/year market.

The US government has always been leery of letting phone companies grow too powerful. If too much power concentrates with too few companies, they can take advantage of customers.

When the old AT&T got too big back in the 70s, the government broke it up into seven smaller companies.

The government has also blocked several phone company mergers. In 2011, it shot down AT&T’s attempt to buy T-Mobile.

So, many investors were caught off guard when the US government all but approved a merger between Sprint and T-Mobile.

Sprint and T-Mobile are America’s third- and fourth-largest cell companies.

Together, they’ll form a new “supercarrier” with 136 million customers—making it a close third to Verizon with its 155 million customers.

The stocks of all four US cell companies jumped higher on the news. Sprint shot up 25% in a single day.

With this merger, three companies will effectively control the whole US cell market.

Why would the US government allow this?

It all comes back to 5G...

The US government, and the Trump administration in particular, have been adamant that the US be first in 5G. In April Trump said: “The race to 5G is a race America must win.

A 2019, GSM Association report estimates US cell companies will have to spend $100 billion over the next two years to get America 5G ready.

In short, T-Mobile and Sprint didn’t have the cash to build their own 5G networks. So they’re joining forces to build one giant network.

According to one estimate, the merger will boost the number of 5G markets Sprint and T-Mobile can serve by 8x.

Think of 5G Like Gravity…

As we all learned back in school, gravity is an invisible force that pulls objects toward each other.

The earth’s gravity keeps your feet planted on the ground… and makes apples fall from trees.

Like gravity, 5G is a hidden force affecting everything right now.

It’s a key reason why the US government blacklisted Huawei.

It’s why the government made the unusual move to greenlight the Sprint / T-Mobile merger.

And keep in mind, the 5G buildout is still only in first gear. 5G will cause massive disruption as it comes online in the next couple years.

Buy This Pick-and-Shovel 5G Stock Before It Takes OffWireless technology has come a long way.

The first generation of wireless known as 1G was rolled out in the 1980s. The only thing a user could do with 1G was make a phone call.

At times, the call quality could rival that of two tin cans connected by a string.

But wireless tech has made huge advances since those early days.

About every 10 years we’ve seen a new generation of wireless—1G, 2G, 3G, and today’s 4G. Each was faster and more reliable than the previous generation.

As you may already know, we are about to see the next generation of wireless. It’s the new 5G technology, which is slated to hit the market this year.

And that creates a big opportunity for investors.

Why 5G Is So Important

To understand why 5G is such a big deal, you must understand one thing: latency.

Latency is delays in sending information from one point to the next. This is different than bandwidth, which is the volume of data being transferred, not the speed of the transfer.

The lower the latency, the faster information can race across a network.

And the 5G network has very, very, very low latency. This core attribute of 5G will revolutionize many industries.

Remote medical procedures are just one example. Low latency will enable remotely located robots to instantly mimic human movements.

This will give doctors the real-time response they need to perform surgery on a patient located anywhere in the world.

The next era of self-driving cars will also depend on 5G. The new technology will allow cars to “talk” to each other in real time.

5G will even change farming. Farm equipment company John Deere is developing 5G technology that promises to radically boost crop yields.

5G is a gamechanger. And there’s been a ton of money flowing into 5G-related companies.

Major Investment in 5G Is Already Underway

Companies have already spent over $200 billion on 5G infrastructure.

Most of this money has gone toward building 5G-ready cell towers.

That’s a lot of money, but there is much more to come. Research firm Moor Insights & Strategy expects that 5G-related IT hardware spending will reach $326 billion by 2025.

See, to achieve the speed and reliability of 5G requires lots of cell towers.

Today, the 4G network uses 25,000 cell towers across the US. Each one is 100 feet (or more) tall, and they are spaced several miles apart.

The 5G network will need 200,000 cell towers that are much smaller and spaced in a much tighter web across the US.

So in the near term, almost all 5G spending will go to building out the cell tower grid.

When it’s ready, 5G speeds will be 20 gigabytes per second. That’s 1000x faster than today’s 4G technology.

5G will make wireless bandwidth seem infinite. And the companies building the infrastructure for this new technology will be the first to profit.

Picking the Right Horse in the Race to 5G

There are a few ways to invest in the evolution to 5G.

You could buy the stock of companies that maintain and operate 5G infrastructure. These would be stable dividend companies like AT&T, Verizon, and China Mobil.

These are low-risk, limited-upside investments that will take time to bear fruit.

Things work slowly in the telecom space. We saw this play out when 4G was introduced.

To gain the benefits of the 4G network, users had to replace their 3G phones. Phones aren’t cheap, and 3G phone owners had to first be convinced that the new phones and features were worth the money. That took some time.

Instead, I recommend going the “picks and shovels” route. This means companies who build the infrastructure that supports 5G technology.

These companies are making money from their 5G investments right now.

I like to buy companies that sell the “picks and shovels” that industries need… like investing in farm machinery companies rather than agricultural businesses.

In the 5G space, this would be companies that sell the hardware, software, and services to telecom companies.

And we can leverage our bet by owning a company with exposure to the international adoption of 5G technology.

There’s only one company that fits these criteria.

Nokia Corp. (NOK)

Nokia is a Finnish multinational telecommunications company. It is the world’s third-largest telecom equipment manufacturer after Huawei and Cisco.

The company is split into two segments:

• Nokia Networks (90% of sales) : provides systems and software to build high capacity network infrastructure.

• Nokia Technologies (10% of sales) : develops consumer products and licenses technology for the Nokia brand.

Almost all of Nokia’s business comes from selling data networking and telecom equipment. That’s just what we want, because I expect those types of sales will see big growth as 5G investment ramps up.

The build out of the 5G network will be global, and Nokia is a truly international company.

Even better, two of Nokia’s biggest rivals—ZTE and Huawei, were blacklisted by the US government. This will shrink NOK’s competition in this US market to pretty much just one company—Ericsson.

The investment flow into 5G from the major telecom companies has already started to climb.

In July, Nokia received a $3.5 billion contract from T-Mobile US, which was reportedly the largest 5G deal ever.

T-Mobile has about a 17% share of the US wireless market, making this a major win for NOK.

This Play Will Take Time… Be Patient

The flow of investment will not, however, hit the 5G market like a giant wave.

It will be more like a steadily rising tide. In fact, NOK management expects 5G investment to be soft in the first half of 2019.

But that’s perfect for investors. It gives us an opening to get in before the tide of money starts to rise.

The multibillion-dollar contract from T-Mobile looks like a sign of some early pump priming for more 5G spending.

The other major wireless carriers in the US aren’t going to let themselves lag behind in the race to 5G.

I think we will soon see more big 5G contracts make the headlines. As a major player in a market with limited competition, Nokia will almost certainly win a lot more US sales by the end of 2019.