0ADE trade ideas

AppLovin Corporation (APP) – Rewiring Ad Tech with AI at ScaleCompany Snapshot:

AppLovin NASDAQ:APP is shedding its legacy gaming identity and emerging as a pure-play AI advertising infrastructure leader. Post its $900M gaming unit divestiture, the company is laser-focused on AXON 2.0, its next-gen AI ad engine, positioning APP as one of the most transformative players in the digital ad ecosystem.

🚀 Key Growth Drivers:

🧠 AXON 2.0 – AI-Powered Programmatic Ad Platform

Delivers real-time ad bidding with predictive optimization

Retail and eCommerce verticals seeing rapid adoption

Scalable infrastructure = operating leverage + high margin tailwinds

🛠️ Self-Serve & GenAI Expansion

Self-serve ad tools on the roadmap = democratizing access for SMBs

Generative AI ad creatives enable fast, customized campaigns at scale

Broadens TAM beyond top-tier advertisers to long-tail marketers

💰 High-Margin, Asset-Light Model

Post-divestiture, APP’s margins are structurally higher

Lean, software-first model with strong unit economics and cash generation

Flexibility for buybacks, R&D, or strategic M&A

📊 Market Positioning & Flywheel

Network effects: More advertisers = better data = smarter bidding

Competes with The Trade Desk, Google DV360, and Meta in ad optimization

First-mover advantage in mobile AI bidding infrastructure

📈 Financial & Strategic Highlights:

Q/Q margin expansion amid rising advertiser retention

Structural cost improvements post-gaming spinout

Potential for SEED_TVCODER77_ETHBTCDATA:2B + in annualized EBITDA as AI scaling accelerates

🧭 Investment Outlook:

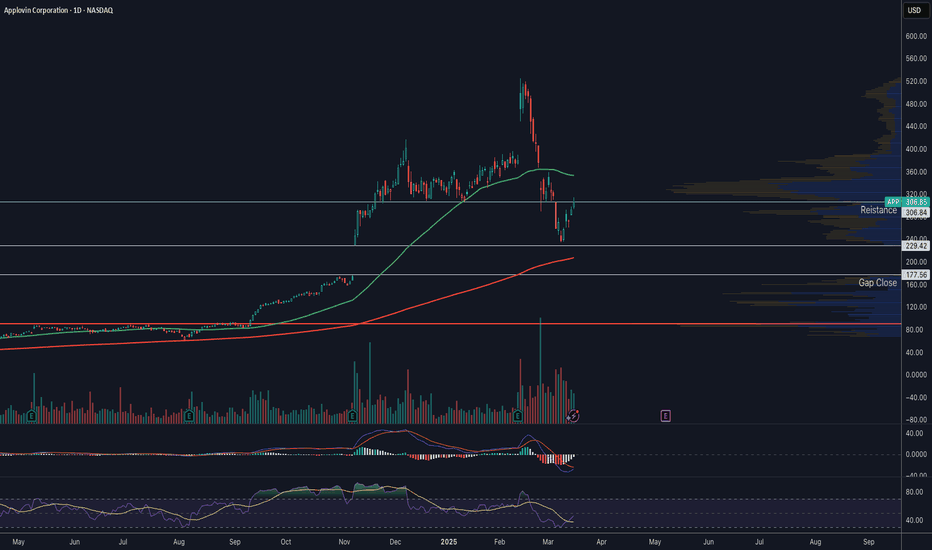

✅ Bullish Above: $255.00–$260.00

🚀 Upside Target: $520.00–$525.00

🎯 Thesis: AppLovin is evolving into the NVIDIA of mobile ad tech—using proprietary AI infrastructure to reshape programmatic advertising. With high-margin growth, expanding use cases, and a clear product vision, APP is a top-tier AI advertising compounder.

#AppLovin #APP #AdTech #AXON #AIAdvertising #Programmatic #DigitalMarketing #GrowthStock

Longs should be careful with this one.boost and follow for more! 🔥

could push to 359-416 short term before it tops out, from risk reward perspective theres much better options in this market.

I personally wouldn't chase this one to the upside with so many options out there, big money may think the same and sell it off. Id be a buyer at trend support or near it.

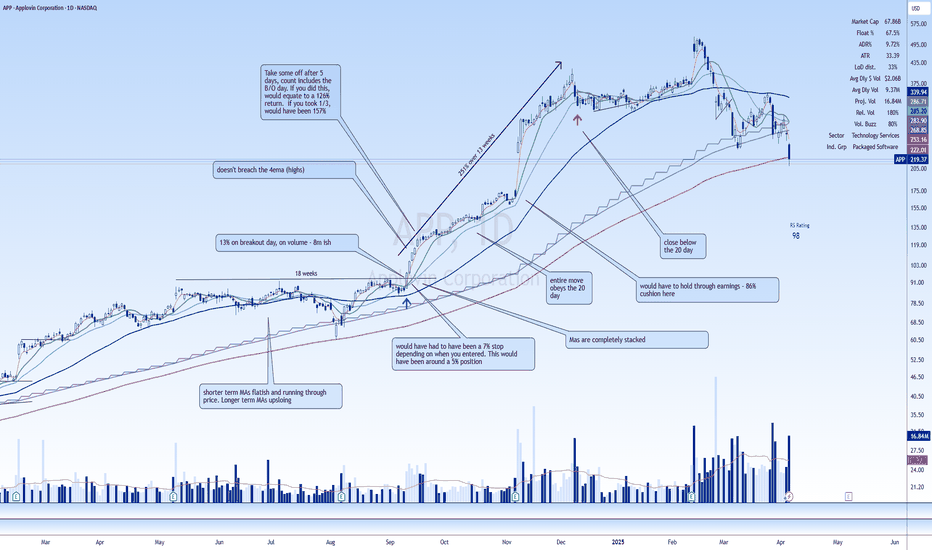

AppLovin the Rocket Ship40% revenue growth quarter after quarter, these guys are the real deal. The stock price reflects the aggressive growth made by AppLovin. Unless there is some serious accounting fraud going on, this is the type of stock you buy on the dip for the next leg up. I entered a swing trade at the confluence of 200 Day moving average and the golden pocket fibonacci level around $237.

The bounce was strong and my stop loss has been moved up to break even . If they have another strong quarter showing 40% growth the 5th Wave could be in play.

Not financial advice, do what's best for you.

APPLOVIN’S Q4 2024—$APP BLASTS OFF WITH AI-AD SURGEAPPLOVIN’S Q4 2024— NASDAQ:APP BLASTS OFF WITH AI-AD SURGE

(1/9)

Good evening, Tradingview! AppLovin’s Q4 2024 earnings hit—$1.37B revenue, up 44% YoY, crushing $1.26B estimates 📈🔥. AI-powered AXON drives a 37% stock pop. Let’s unpack NASDAQ:APP ’s monster quarter! 🚀

(2/9) – REVENUE & EARNINGS

• Q4 Revenue: $1.37B, +44% YoY ($953.3M Q4 ‘23) 💥

• Ad Revenue: $999.5M, +73% YoY

• Apps Revenue: $373.3M, -1% YoY 📊

• EPS: $1.73, beats $1.24 est.

• Net Income: $599.2M, +248% YoY

(3/9) – BIG MOVES

• Stock Surge: +37% post-earnings (Feb 13) 🌍

• Buybacks: $2.1B retired 25.7M shares in ‘24 🚗

• Debt Play: $3.55B notes issued Nov ‘24 💸

• Q1 ‘25 Guide: $1.355-1.385B, tops $1.32B est.

(4/9) – SECTOR SHOWDOWN

• Market Cap: $175B (Feb 13) 🌟

• Trailing P/E: 116 vs. TTD (50), META (33)

• Growth: 44% YoY beats TTD (26%), META (19%)

• 1Y Stock: +1,000%, 2Y: +3,000%

Premium price, growth screams value!

(5/9) – RISKS TO FLAG

• Valuation: 116 P/E—high stakes, no misses 📉

• Debt: $3.51B vs. $567.6M cash—leverage looms ⚠️

• AI Rivals: Google, Meta eye AXON’s turf 🏛️

• Regs & Economy: Ad spend cuts lurk

(6/9) – SWOT: STRENGTHS

• Growth: 44% revenue, $599M profit soars 🌟

• Margins: 62% EBITDA, $2.1B FCF in ‘24 🔍

• AXON: 73% ad surge—AI’s the champ 🚦

NASDAQ:APP ’s a profit powerhouse!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Apps dip (-1%), $3.51B debt 💸

• Opportunities: E-commerce ads, AI edge, acquisitions 🌍

Can NASDAQ:APP turn risks into riches?

(8/9) – NASDAQ:APP ’s Q4 stuns—where’s it headed?

1️⃣ Bullish—AI keeps it soaring.

2️⃣ Neutral—Growth holds, risks balance.

3️⃣ Bearish—Valuation bites back.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

AppLovin’s Q4 dazzles—$1.37B revenue, $599M profit, stock blazing 🌍🪙. High P/E, but AI growth shines. Debt and rivals loom—gem or peak?

AppLovin (APP) AnalysisCompany Overview:

AppLovin NASDAQ:APP is a mobile marketing leader, providing developers with tools for user acquisition, ad optimization, and analytics. The company also benefits from its owned apps, such as Monopoly GO!, which contribute 30% of its revenue.

Key Catalysts:

AI-Driven Revenue Expansion 🤖

AI plays a pivotal role in AppLovin’s success, driving 80% of its revenue growth. This AI advantage helps optimize user engagement and ad targeting, boosting overall platform efficiency.

Mobile Gaming Growth 🎮

The mobile gaming industry is projected to grow at an 8% annual rate through 2027, positioning AppLovin to benefit as a key player in game monetization and marketing solutions.

E-Commerce Ad Expansion 🛒

AppLovin’s new e-commerce ad pilot could generate FWB:30M -$50M in Q4 2024, with a self-service platform launch in mid-2025 targeting the $200B+ global e-commerce ad market.

Analyst Confidence 📊

Oppenheimer has reiterated its Outperform rating, with a $480 price target, citing AppLovin’s earnings potential, robust ad revenue streams, and growing monetization avenues.

Investment Outlook:

Bullish Case: We are bullish on APP above the $380.00-$400.00 range, supported by AI adoption, ad growth, and entry into e-commerce advertising.

Upside Potential: Our price target is $650.00-$670.00, reflecting AppLovin’s potential to expand its revenue base across multiple high-growth sectors.

📢 AppLovin—Driving Innovation in Mobile Advertising and Game Monetization. #AppMarketing #AI #MobileGaming

What I'm doing with APPSo I had call options into the earnings 🥳 , here's my plan... $584 Should act as resistance or potential future support. That's why I'm going to close them there. That protects those options for a potential pullback to $417. If instead Applovin breaks above resistance I'll look for a pullback to consolidate back into the $584 support and get long once again.

Good luck!

From Market Underdog to Tech Titan| AppLovin’s Explosive Growth AppLovin: Making Ads Great Again, One Algorithm at a Time

AppLovin Corp, a prominent software company valued at $57 billion, offers an advanced mobile marketing platform. Over the past year, its stock price has surged by an impressive 500%, far outpacing the S&P 500’s 39% increase. The company’s financial growth is equally remarkable, with a year over year revenue boost of 40%, a 188% jump in operating profits, and a 300% surge in net income in its latest quarterly report

With 40% of the company held by insiders and a shareholder friendly stance that includes share buybacks, AppLovin presents a compelling investment opportunity. Additionally, its valuation remains competitive relative to other software companies, supporting my "buy" rating.

From Ad Nerds to Tech Lords, AppLovin’s Secret to Winning Over Wall Street

AppLovin operates a comprehensive software platform that helps clients achieve crucial KPIs, such as revenue growth and business expansion. Leveraging AI, its software platform stands out as a powerful tool for advertisers, providing capabilities like automated marketing, customer engagement, and monetization. It’s built to optimize targeted content delivery to the most suitable audience, supported by analytics and monetization features that drive maximum value.

At the core of AppLovin’s technology is AXON, an AI engine that powers AppDiscovery. This feature matches advertiser demand with publishing opportunities through a sophisticated real-time auction algorithm, shifting from traditional waterfall systems to an intelligent, programmatic approach.

AppLovin has positioned itself as a leader in the future of advertising, driven by its cutting-edge AI capabilities. I believe there’s immense growth potential here that the company is just beginning to explore.

Performance

In the third quarter, AppLovin reported a 39% year-over-year revenue increase, moving from $864 million to $1.2 billion. This marks its highest-ever quarterly revenue and extends its streak of sequential topline gains to seven quarters. For the first nine months of 2024, AppLovin saw a 43% year-to-date revenue increase, largely fueled by a 76% rise in software platform revenue. This growth was driven by AppDiscovery, whose installations surged by 39% in Q3, underscoring its strong appeal to advertisers.

Beyond software platform growth, AppLovin’s in-app purchases and advertising revenues also increased modestly by 3% and 7%, respectively, despite challenging comparisons, supported by a 53% boost in advertising impressions.

The company achieved record operating cash flows of over $550 million in Q3, alongside significant margin improvements across gross, operating, and EBITDA levels. These gains highlight the company’s explosive growth and underscore the stock’s 500% rise over the past year.

Given AppLovin’s strategic success and positive advertiser response, I anticipate ongoing improvements in cash flow and profit margins. With over $3.3 billion spent on share buybacks since 2022—$980 million in 2024 alone—the company continues to reward its shareholders while capitalizing on its profitable AI-driven platform.

Valuation

Although APP’s trailing P/E ratio of 74.52 and PS ratio of 19.33 might appear high compared to the IT sector averages, a comparison with peers in the Application Software industry reveals a different perspective.

In a peer group of large software companies, APP ranks third in EV/Sales ratio at 18.65 but also boasts a forward topline growth rate of over 24.1%, placing it among the top performers. This high growth potential appears to justify the stock’s premium, positioning it attractively in terms of PS ratio relative to anticipated growth.

Despite recent heavy buying, APP remains an appealing value investment. As long as it maintains its relative positioning, I continue to view the stock favorably.

Risks

Despite my optimism, I recognize that AppLovin’s momentum could be part of a broader AI-driven market surge, raising concerns about a potential AI bubble. If the market faces a downturn similar to the dot-com bubble, APP could experience a sharper decline than its peers, especially given its relatively weak balance sheet.

Additionally, with an RSI of 96 signaling heavy overbuying, there may be potential for a future correction. While APP’s 500% rise is impressive, it could be vulnerable if the market undergoes a broader correction

Conclusion

Advertising is on the cusp of an AI driven transformation, and AppLovin is well-positioned to capitalize on this shift with its powerful AI-enabled platform. Despite the stock’s impressive 12-month performance, there’s still significant growth potential