Advanced Auto Parts | AAP | Long at $64Advanced Auto Parts NYSE:AAP has gone through an exquisite shakeout of shareholders. Currently trading near $64, the stock is currently testing my "stock crash" simple moving average (seen green SMA lines). From a technical analysist standpoint, it's in a personal buy zone. This stock has tested this simple moving average level a few times in the past and recovered very well. Will history repeat?

Target #1 = $88.00

Target #2 = $110.00

0H9G trade ideas

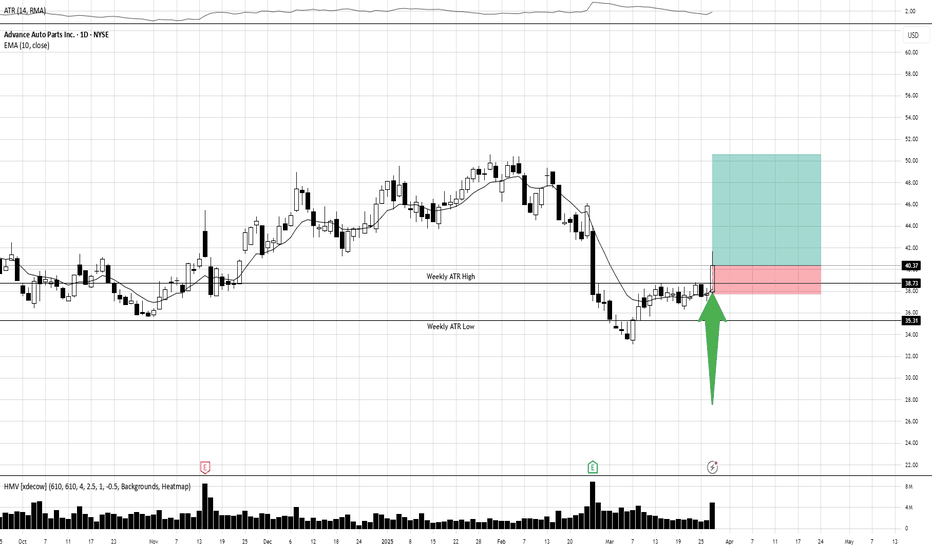

AAP to $40-43 on positive earnings report in 2 days?1. Fundamentals

The company was beaten down because of losing competition. This is a retail auto parts store chain, and not az OEM supplier.

The company presented a relatively good 2024 Q4 earnings in February, but fell on weak guidance.

Insiders bought shares in 2025 March

They completed a restructuring plan in 2024, because of margin collapse.

Earnings expectations are low, i guess they can be profitable for 2025Q1 if they presents the analyst expectations for revenue of 2.5B. (Analysts expecting this with a negative EPS)

2. Technicals

42% correction between 2025 February and April (i guess everyone remembers the day on April, so i don't need to tell the exact date, lol)

First higher high on April 23.

This was taken out on May 16., now we are in uptrend.

The stock took out the 50MA

Look left: 2024 december the stock plunged 42%, then consolidated, regained the 50MA and rallied 25% in 25 days - history repeating?

Long-term i have much higher price targets, ever triple digits!

I expect $39-40 on earnings and $43 in July.

Looking for an immediate buy on AAP! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

AAP/USD – 30-Min Long Trade Setup !📌 🚀

🔹 Asset: AAP (Advance Auto Parts Inc.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $34.35 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $33.66 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $35.42 (First Resistance Level)

📌 TP2: $36.60 (Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $34.35 - $33.66 = $0.69 risk per share

📈 Reward to TP1: $35.42 - $34.35 = $1.07 (1:1.5 R/R)

📈 Reward to TP2: $36.60 - $34.35 = $2.25 (1:3.2 R/R)

🔍 Technical Analysis & Strategy

📌 Falling Wedge Breakout: Price breaking out of a downward wedge, signaling a bullish reversal.

📌 Support Rejection: Strong bounce from $33.66 support, indicating buying pressure.

📌 Volume Confirmation Needed: Ensure high buying volume when price holds above $34.35 to confirm breakout.

📌 Momentum Shift Expected: If price sustains above $34.35, potential rally toward $35.42, then $36.60.

📊 Key Support & Resistance Levels

🟢 $33.66 – Stop-Loss / Strong Support

🟡 $34.35 – Breakout Level / Long Entry

🔴 $35.42 – First Resistance / TP1

🔴 $36.60 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $34.35 before entering.

📉 Trailing Stop Strategy: Move SL to entry ($34.35) after TP1 ($35.42) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $35.42, let the rest run toward $36.60.

✔ Adjust Stop-Loss to Break-even ($34.35) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If price fails to hold above $34.35 and drops back, exit early to avoid losses.

❌ Wait for a strong bullish candle close above $34.35 before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Breakout from falling wedge suggests a potential trend shift.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.5 to TP1, 1:3.2 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀📈

#StockMarket 📉 #AAP 📊 #TradingNews 📰 #MarketUpdate 🔥 #Investing 💰 #Trading 📈 #Finance 💵 #ProfittoPath 🚀 #SwingTrading 🔄 #DayTrading ⚡ #StockTrader 💸 #TechnicalAnalysis 📉 #EconomicNews 🏛️ #FinancialFreedom 💡 #MarketTrends 📊 #StockAlerts 🔔 #TradeSmart 🤓 #Bullish 🐂 #RiskManagement ⚠️ #TradingCommunity 🤝

AAP Trading Idea AAP is showing potential for a solid move. You can consider entering at $36 or $35, or even at the current market price if momentum is strong.

🎯 Profit targets:

$42 (first resistance)

$48 (next key level)

$50+ (potential breakout)

🔹 Always manage risk wisely and set stop losses based on your strategy.

⚠️ This is not financial advice. Please conduct your own research before making any trading decisions.

Short Opportunity? Earnings were bad with a initial drop in price, followed by heavy buying with reports that the stock was still a buy. Today's option activity shows a potential rotation into calls from puts inline with that opinion.

I don't think it will move much higher considering the earnings and store closures so I'm watching for a drop as the news picks up on store closures over the next few days. By the end of the day most of the volume was selling. Most of the put option volume had a delta of <=.20 possibly indicating hedging the calls or speculative on a large downside move which is where I'm leaning. If there is not a meaningful direction by close Friday I will exit.

AAP to $49MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading system is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM Squeeze in in play.

I hold until target is reached or end of year, when I can book a loss.

So...

Here's why I'm picking this symbol to do the thing.

Price at bottom channel

Stochastic Momentum Index (SMI) at oversold level

TTM Squeeze is off

TTM Squeeze momentum is down

Impulse MACD is at extreme levels

Price at near Fibonacci level (3.618 ext)

In @ $40.60.

Exit at top of channel, around $49

AAP to $53 by 10/4MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading system is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM Squeeze in in play.

I hold until target is reached or end of year, when I can book a loss.

So...

Here's why I'm picking this symbol to do the thing.

Price at bottom channel

Stochastic Momentum Index (SMI) at oversold level

Impulse MACD at extreme levels

VBSM at max levels

Price near 3.618 Fibonacci ext

Looking for move back toward 1.618 Fib ext @ 53.46 by 10/4

Advance Auto Parts Sells Worldpac for $1.5 BillionAdvance Auto Parts (NYSE: NYSE:AAP ), one of North America's leading automotive aftermarket parts providers, has made a significant strategic decision to sell its wholesale arm, Worldpac, for $1.5 billion. The sale, made to funds managed by the Carlyle Group, is a critical part of Advance Auto Parts’ ongoing efforts to streamline its operations and sharpen its focus on core business areas as it faces industry challenges and pressure from activist investors.

The Sale of Worldpac: A Game-Changer for Advance Auto Parts

The decision to divest Worldpac, a major revenue driver with approximately $2.1 billion in revenue and $100 million in EBITDA over the last 12 months, is a bold move by Advance Auto Parts (NYSE: NYSE:AAP ). The sale is expected to be finalized by the end of the year, providing Advance with much-needed financial flexibility. This capital infusion will allow the company to intensify its efforts in turning around its core retail and commercial operations, particularly the Advance blended box business.

Shane O’Kelly, CEO of Advance Auto Parts, emphasized the importance of this transaction, stating, “The sale enables our team to sharpen their focus on decisive actions to turn around the Advance blended box business. Proceeds from the transaction will provide greater financial flexibility as we continue our strategic and operational review to improve the productivity of the company’s remaining assets and better position the company for future growth and value creation.”

Pressure from Activist Investors and Industry Challenges

The sale comes at a time when Advance Auto Parts has been under significant pressure from activist investors to divest non-core assets like Worldpac to improve shareholder value. The sale to the Carlyle Group is seen as a strategic response to these pressures, allowing the company to focus on its core strengths in retail and commercial auto parts.

The automotive aftermarket industry has been resilient, largely due to the increasing age of vehicles on the road. With the average car now 12 years old, there is sustained demand for parts and services, even as new car production faces challenges. Worldpac, with its focus on wholesale distribution, was well-positioned in this market, but its sale allows Advance Auto Parts to focus more closely on its retail and commercial customers, where it faces stiff competition from rivals like O’Reilly Automotive and AutoZone.

Financial Performance: A Mixed Bag

Advance Auto Parts (NYSE: NYSE:AAP ) also released its second-quarter 2024 financial results, highlighting both the challenges and opportunities ahead. Net sales for the quarter totaled $2.7 billion, flat compared to the same period last year. Comparable store sales saw a modest increase of 0.4%, reflecting the company’s ability to maintain its customer base despite a challenging demand environment.

However, the company’s gross profit decreased by 2.3% to $1.1 billion, with gross profit margins narrowing from 42.5% to 41.5%. This decline was primarily due to strategic pricing investments and higher product costs, which the company will need to manage more effectively in the future.

Operating income also took a hit, dropping to $71.8 million, or 2.7% of net sales, down from 4.7% in the previous year. Despite these challenges, Advance Auto Parts saw an improvement in cash flow, with net cash provided by operating activities increasing to $87.8 million, compared to a cash outflow in the same period last year.

Looking Ahead: A Focus on Core Operations

With the sale of Worldpac, Advance Auto Parts (NYSE: NYSE:AAP ) is now better positioned to focus on improving the performance of its core operations. The company’s next steps will involve a thorough strategic and operational review aimed at enhancing the productivity of its remaining assets and driving stronger returns for shareholders.

As the company navigates this transition, it will need to leverage its strengths in the retail and commercial sectors while continuing to innovate and adapt to the evolving needs of its customers. The sale of Worldpac is a significant milestone in this journey, providing the company with the financial flexibility and strategic focus needed to thrive in a competitive market.

Technical Outlook

Advance Auto Parts (NYSE: NYSE:AAP ) has experienced a notable decline in its stock price, which is currently down 15.92% during the trading session on Thursday. This decrease reflects a significant amount of selling activity, leading to the stock being classified as oversold at present. The Relative Strength Index (RSI) for the stock stands at 31, which is quite low and suggests that there is considerable selling pressure affecting its value. Furthermore, when analyzing the daily price chart, we observe a distinct downward gap pattern that has emerged. This pattern is typically interpreted as a strong bearish reversal signal, indicating that the stock may continue to face downward momentum. However, historical trends suggest that such gaps are often filled over time, and we anticipate this will occur in the near future as market conditions evolve.

Conclusion

Advance Auto Parts’ (NYSE: NYSE:AAP ) decision to sell Worldpac marks a pivotal moment in the company’s history. While the sale comes with its own set of challenges, it also presents an opportunity for Advance Auto Parts to refocus its efforts on its core operations, ultimately positioning the company for long-term growth and success. As the company continues its strategic review and operational improvements, stakeholders will be watching closely to see how these changes impact the company’s performance and shareholder value in the coming quarters.

AAP Good situation to buy!!! Not Investing Advice!!!1) I applied WMA(14 period) on CCI indicator and it gave us to buy sign before 2 months ago.

2) I applied SMA(8 period) on Momentum indicator but it have not cross yet. They are very close each other. It is close to break its resistance level.

3) RSI indicator is going approximately 25-30 level for monthly period. Also it broke its resistance line. 25-30 level is meaning that security has been sold a lot. It can be good opportunity to buy in this area but it is not working very good when security has strong trend. RSI's 2 moving average did not cross each other and it is sign to us for waiting.

4) MACD has light red bars as you see on the screen and please check out all arrows on the screen. In my opinion they will cross each other soon. Light red bars are giving this message to us Down Trend is decreasing and Upper Trend can show itself.

5) We have no any divergence on indicators.

6) DMI indicator has 3 moving average and Red one represents ADX. Orange one represents -DI. Blue one represent +DI. If Blue cuts above Orange line it is buy sign but they are away from each other. On the other hand if ADX cuts above -DI it is buy sign and they are going each other.

7) I applied DEMA on prices and their period Orange one is 5 period and Red one is 20 period. We have not got any buy sign from there.

Advance Auto Parts, Inc stock Nosediving to New Support LevelThe recent decision by Palm Valley Capital Fund to divest its position in Advance Auto Parts, Inc. (NYSE: NYSE:AAP ) has sparked interest and raised questions about the future trajectory of this automotive replacement parts and accessories provider. As investors dissect the rationale behind this move, it's imperative to explore the factors influencing Palm Valley's decision and assess the implications for Advance Auto Parts moving forward. This led Advance Auto Parts, Inc. stock ( NYSE:AAP ) to slide by 1.60% trying to set foot on new support level at the $73.05 Pivot.

Understanding the Decision:

Palm Valley Capital Fund's decision to exit its position in Advance Auto Parts during the first quarter of 2024 was rooted in a nuanced assessment of the company's prospects. While the fund realized a modest gain on the investment, concerns about the challenges facing Advance Auto Parts' ( NYSE:AAP ) profitability weighed heavily on their decision-making process.

Key Factors:

One significant factor contributing to Palm Valley's decision was the perceived difficulty in achieving a robust recovery in Advance Auto Parts' profits. Despite initial optimism surrounding the investment, observations made since the stock's acquisition in 2023 led the fund to reassess its outlook. As the automotive industry undergoes rapid transformations, including shifts towards electric vehicles and changes in consumer preferences, the path to sustained profitability for traditional auto parts retailers like Advance Auto Parts appears increasingly uncertain.

Additionally, Palm Valley expressed reservations about the potential impact of the company's divestiture of its Worldpac wholesale distribution business. While this move is expected to generate material proceeds, uncertainties loom regarding the profitability of Advance Auto Parts' remaining retail store operations. Concerns about thinning margins in the retail segment further dampened Palm Valley's confidence in the company's ability to deliver strong financial performance in the future.

Market Insights:

Advance Auto Parts' ( NYSE:AAP ) absence from the list of 30 Most Popular Stocks Among Hedge Funds underscores the mixed sentiment surrounding the company among institutional investors. While the stock remains held by a substantial number of hedge fund portfolios, recent trends indicate a slight reduction in investor interest, reflecting a degree of caution regarding the company's prospects.

Looking Ahead:

As Advance Auto Parts ( NYSE:AAP ) navigates these challenges, investors are keen to observe how the company adapts its strategy to address evolving market dynamics. Key areas of focus may include initiatives to enhance operational efficiency, expand product offerings, and capitalize on emerging opportunities in the automotive aftermarket.

Technical Outlook

Despite trading above the 200-day Moving Average (MA), Advance Auto Parts ( NYSE:AAP ) stock is down by 1.50% as of the time of writing with a weak Relative Strength Index (RSI) of 47.79. indicating a selling bias.

AAP Autoparts Retailer Retraces and Reverses down SHORTAAP on a 240 minute chart has completed a Fibonacci retracement of the previous trend down

which covered April to October 2023. Support was retested for a month or so. The retracement

starting in December is now to the standard level and price is being rejected there. The faster

RSI topped out at 65 while the slower RSI line ( black ) never got over 50. As an aside,

AAP is weak compared with AZO, its peer and leader in the market sector. I am looking for

stocks to short to get synergy from and general market downturns. I have found one. This short

trade is supported by the predictive algorithm of LuxAlgp.

AAP Advance Auto Parts, +130% Upside potentialHUGE UPSIDE POTENTIAL

Fundamentals are there. So it TA.

The inverse head & shoulder pattern has spoken: first target is $109.

Then possible pull back & consolidation at our breakout level of ~$80

I expect a return to $200 at the end of summer 2025 but timing market is just 🔮🤷🏻

NYSE:AAP #AAP

Stage 2 Breakout in AAPAdvance Auto Parts is a household name. If you’ve ever changed your own oil or replaced an alternator in the driveway, you are familiar with the company.

The weekly chart above outlines a quick stage analysis over the last 3 ½ years. After tripling in price from the 2020 lows to the peak of the 2021 bull market, AAP entered a severe Stage 4 decline.

Elevated material, labor and transportation costs forced Advance Auto Parts to cut its forecast and dividend last year. This, along with a dip in earnings, led to a significant decline in the company’s stock price. It fell 80% from a peak of $244 to a low of $50. This is typical in Stage 4 declines as most stocks fall 50-80%.

Following the selloff, AAP carved out a low over the next 9 months in a Stage 1 base. The share price oscillated in the $50-$70 range as long-term investors built positions in the beaten-down auto parts retailer. And we now know who was doing a lot of that buying.

On Wednesday it was announced that activist investor Daniel Loeb and his Third Point hedge fund reached an agreement with Advance Auto Parts for a stake in the company and three board seats.

Loeb takes a value-oriented approach and has a long history of turning around underperforming companies.

Loeb added 3 independent directors to the AAP board of directors effective immediately - Brent Windom, Gregory Smith, and Thomas Seboldt - all of whom have automotive and supply chain expertise.

Windom is the former CEO of Uni-Select, a distributor of aftermarket parts. Smith is an executive vice president at medical device company Metronic overseeing supply chains. And Seboldt spent most of his career with O’Reilly Automotive, one of the company’s main competitors.

The market seems optimistic about these changes, and AAP stock is now emerging from its Stage 1 base. Zooming in to a daily chart, we can see the shallowing action which took place over the last six months:

Notice the saucer pattern being formed as pullbacks got shallower and price action tightened up against the 200-day moving average.

The yellow resistance line at $75 was the line in the sand. This has been a major supply level where sellers have taken the opportunity to dump stock they mistakenly bought after the big drop in June 2023.

I have also drawn out the compression pattern - a pattern we often see in stocks as they absorb sellers and shares become concentrated in a smaller number of “strong hands.”

AAP now trades above both this $75 resistance level and its 200-day moving average - a key level watched by both institutional investors and systematic hedge funds.

The strength demonstrated by AAP over the last few weeks is undeniable. The stock is up 32% in 16 days on a big increase in volume. This is most likely the start of a new Stage 2 uptrend that should last from several months to a year or more.

How quickly AAP rises from here is unknown. But if the rally is real and this is in fact the start of a new Stage 2 rally, the stock should hold above its 50-day moving average and definitely the 200-day. A break below that is where the chart would sour and point to a failed move.

For this reason, I would placing a stop loss at $63.00, just beneath the 200-day moving average, for protection to risk 20% on the trade.

AAP Adam & Eve? Cup and Handle?Adam & Eve is a double bottom pattern. I think I see one here, but I don't have a lot of experience 1) catching these or 2) trading on them. I'm posting this less of a long call, but as an exercise to see how price action reacts at these levels.

Sometimes price will confirm the double bottom then waffle up and down, forming a handle. When price breaks out of this region, it often moves up in a strong trend. (source: thepatternsite.com)

I can also make out what I think is a cup and handle.

Note to Self: Study how/if A&E and C&H can/do work together.

AAP Advance Auto Parts Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AAP Advance Auto Parts prior to the earnings report this week,

I would consider purchasing the 70usd strike price at the money Puts with

an expiration date of 2023-9-1,

for a premium of approximately $5.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.