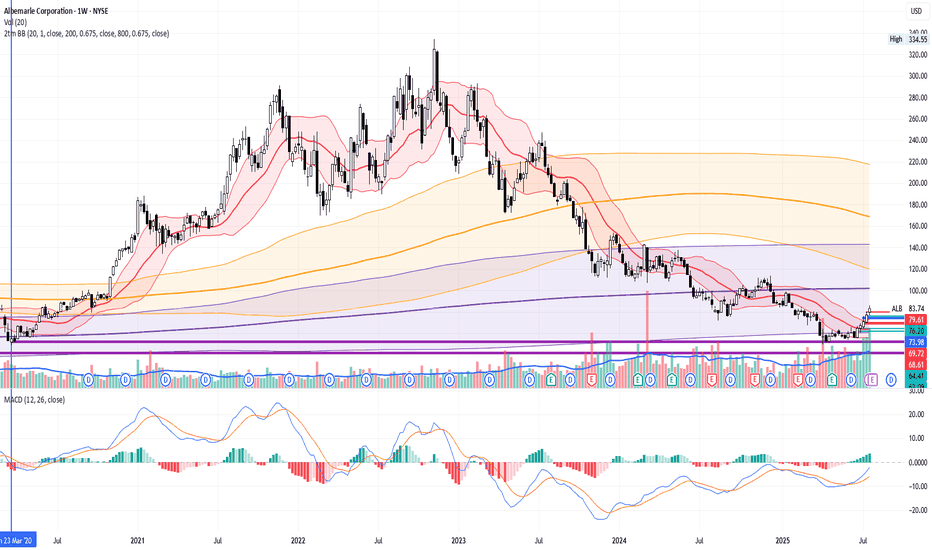

ALB Long, Resurrection of lithium trendALB have started to rise in recent weeks. It's price stays near 5-year lows.

Long-term Price Levels already have worked to bounce the stock by around 50%+.

Most likely funds have started to trade it in Mean Reversion strategies. So, the movement back to 200MA and 800MA on Weekly time-frame is quite possible.

As fast as banks would start to rise stock's rating - it will go sky high.

Recently UBS already cut it's rating to "Sell". Yet, trend already is mighty enough and just kept going higher.

Full margin on every black 1D candle!

0HC7 trade ideas

Correction over? Worth keeping an eye on itIs this the end of the final 5th wave? It’s hard to tell. This stock has been a disaster for those trying to pick bottoms. I’m waiting for a sign of strength before jumping in. We may be seeing that as the RSI is slowly gaining strength.

Personally I’d like to see it change market structure and take out some resistance levels to the upside.

Keeping an eye on this before I pull the trigger.

ALB | Price PredictionNYSE:ALB is one of my key assets in the stock portfolio. I believe that the price of this stock is highly related to the resource price and cycles. I expect massive upside because of the potential rise in lithium demand. Moreover, new EVs, robots, drones, and next-gen gadgets all need lithium.

Price Prediction is based on my platform, so I'm sharing it here. I believe that the key levels are "Base" and "Bullish".

$Albemarle Harmonic Pattern and Short stock infoLooking at the daily chart for Albemarle, it appears to be to have a short sale harmonic pattern. The second pattern finished up today's trading with dramatic fashion. I'm looking for the same rebound to the $110 area in the next few weeks.

First go at publishing an idea!

$ALB suggesting potential undervaluation.Albemarle Corporation (NYSE: ALB) is a leading global producer of lithium, a critical component in electric vehicle (EV) batteries. The company's performance is closely tied to lithium market dynamics, which have experienced significant fluctuations recently.

Technical Analysis:

As of February 15, 2025, ALB's stock price stands at $81.21. The stock has faced a downward trend, with a 52-week price change of -30.95%. The 50-day moving average is $93.35, and the 200-day moving average is $98.91, indicating a bearish trend. The Relative Strength Index (RSI) is at 30.29, suggesting the stock is approaching oversold territory.

STOCKANALYSIS.COM

Resistance levels are identified at $111.30, with support around $85.23.

Fundamental Analysis:

Albemarle's recent financial performance reflects challenges in the lithium market. In Q4 2024, the company reported a profit of $33.6 million, a significant turnaround from a loss of $617.7 million in the same period the previous year. However, adjusted results showed a loss of $1.09 per share, missing analyst expectations of a $0.70 loss. This underperformance is largely due to a substantial drop in lithium prices, leading to a $1.1 billion revenue decline in the Energy Storage division.

In response to market conditions, Albemarle has implemented cost-cutting measures, including workforce reductions and the suspension of expansion projects, such as a key U.S. lithium refinery. Capital expenditures for 2025 are projected to be $700-$800 million, approximately half of the previous year's budget.

Analysts have adjusted their outlooks accordingly. UBS Group recently lowered its price target for ALB from $99.00 to $86.00, maintaining a 'Neutral' rating.

Despite these challenges, the intrinsic value of ALB stock is estimated at $173.10 under a base case scenario, suggesting potential undervaluation.

Investment Considerations:

Given the provided trading parameters:

Target Price: $92.75

Profit Potential: 14.2%

Stop/Trailing Stop: $77.14

Potential Loss: 5%

Profit/Loss Ratio: 2.8:1

These parameters indicate a favorable risk-reward ratio. However, investors should remain cautious due to the volatile lithium market and Albemarle's recent financial adjustments. Monitoring lithium price trends and Albemarle's strategic responses will be crucial in assessing the viability of this investment.

Brace for Impact? Critical support line being heldCould this be the final leg down, Wave 5 capitulation? I'm watching this closely, the only think holding is up now is a long term trendline. The chart is very nice, a massive 5 wave supercycle which has peaked. We have been in a long bear market and there is no clear catalyst to suggest that a recovery is on the horizon.

Lithium prices have tanked and ALB is sitting on a lot of supply due to overproduction. The Chinese demand for lithium is strong but North America and Europe remain weak.

If we fall out of this wedge pattern and lose the current price, we could easily tumble down to $71 to retest support. If we do get down to that level I expect capitulation down to $63 which is the NPOC.

Keeping an eye on this, i'm not shorting but also not buying.

Albemarle Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Albemarle Stock Quote

- Double Formation

* 146.00 USD | Completed Survey

* 012345 | Wave Count Entry Bias | Subdivision 1

- Triple Formation

* ((Pennant Structure)) | Downtrend Continuation | Subdivision 2

* Numbered Retracement | Short Set Up | Subdivision 3

* Daily Time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Robert Shiller Would Be ProudAlbemarle has finally started to show some signs of life over the last few months - up over 50% since August, when its CAPE ratio was at its lowest level since the Global Financial Crisis.

The last three times the Shiller PE was this low, the stock saw returns of not percentages, but multiples over the next few years.

ALB: Strong technical signals suggest upward momentum aheadALB is showing signs of an upward shift, holding above the 200-day moving average, breaking a long-term trendline, and forming a reversal pattern. The upside potential points to a range between 250 and 300, while the downside risk is estimated at 80 to 90.

Last quarter, the stock rebounded from a low of 72, which aligns with a long-term trendline. If ALB stays above the 100 mark, the upward trend is likely to continue.

Albemarle (ALB) shows promise due to increasing lithium demand driven by electric vehicles, cost-saving measures, and operational efficiency improvements. However, challenges include softer lithium prices leading to reduced earnings raising concerns about short-term performance.

ALB & GPN's Reversal Breakout Could Spark Significant GainsAlbemarle Corporation NYSE:ALB

● On the monthly chart, the stock is bouncing back from a long-standing trendline support that has held firm over the years.

● The daily chart reveals the emergence of an Inverted Head & Shoulders pattern following a significant decline.

● With a recent breakout, the stock appears poised for a potential trend reversal.

● Traders should keep a close eye on this stock for potential buying opportunities.

Global Payments NYSE:GPN

● The stock has formed a Double Bottom pattern after a brief period of consolidation.

● Recently, the price broke out from this formation and has been maintaining its position above the breakout point.

● The price movement suggests a short-term buying opportunity, as the resistance level is quite distant from the current price.

ALB - 5 months HEAD & SHOULDERS══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

Breakout Area, Target, Levels, each line drawn on this chart and any other content represent just The Art Of Charting’s personal opinion and it is posted purely for educational purposes. Therefore it must not be taken as a direct or indirect investing recommendations or advices. Entry Point, Initial Stop Loss and Targets depend on your personal and unique Trading Plan Tactics and Money Management rules, Any action taken upon these information is at your own risk.

═════════════════════════════

ALB: Lithium to Fuel Decoring Earth & "Saving Energy" InflationA growth pattern through 2026. It may complete at any point and define a new pattern. Time will tell.

If you do not want to decore the earth...do not buy stocks in material to fuel a beast when consumption is the not the least.

Other stocks/companies..anything down the pipeline of great thinkers, we must not support companies reacting to the insights said...those first movers are blind to our issue or beholden to the beast.