Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.6 USD

668.00 M USD

16.35 B USD

303.64 M

About Ally Financial Inc.

Sector

Industry

CEO

Michael George Rhodes

Website

Headquarters

Detroit

Founded

1919

FIGI

BBG00LVF4206

Ally Financial, Inc. engages in the provision of automotive financing and insurance services. It operates through the following segments: Automotive Finance Operations, Insurance Operations, Corporate Finance Operations, and Corporate and Other. The Automotive Finance Operations segment offers automotive financing services to consumers, automotive dealers and retailers, companies, and municipalities. The Insurance Operations segment includes consumer finance protection and insurance products sold primarily through the automotive dealer channel, and commercial insurance products sold directly to dealers. The Corporate Finance Operations segment is involved in senior secured asset-based and leveraged cash flow loans to mostly U.S.-based middle-market companies, with a focus on businesses owned by private equity sponsors. The Corporate and Other segment consists of centralized corporate treasury activities, such as management of the cash and corporate investment securities and loan portfolios, short- and long-term debt, retail and brokered deposit liabilities, derivative instruments, original issue discount, and the residual impacts of corporate FTP and treasury ALM activities. The company was founded in 1919 and is headquartered in Detroit, MI.

Related stocks

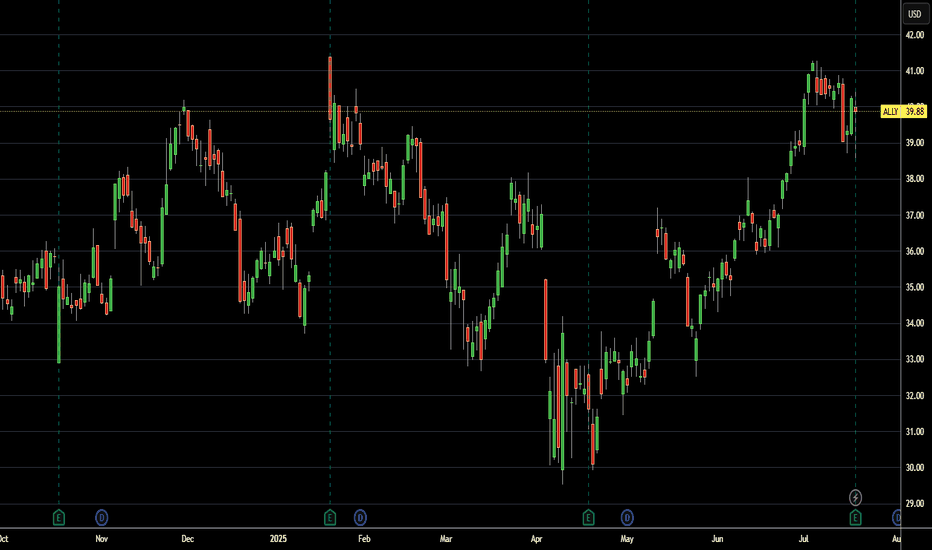

Time to BUY. Time to become an $ALLYKey Stats:

Market Cap: $12.18B

P/E Ratio (FWD): 15.81

Dividend Yield: 3%

Next Earnings Date: Jan 17, 2025

Technical Reasons for Upside:

Breakout Potential: ALLY recently tested resistance around $40, with increasing volume indicating a potential breakout towards higher highs. A move

ALLY Ally Financial Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ALLY Ally Financial prior to the earnings report this week,

I would consider purchasing the 36usd strike price Calls with

an expiration date of 2024-10-25,

for a premium of approximately $1.30.

If these options prove to be profitable prior to th

ALLY FINANCIAL LONGAlly Financial

MTF Analysis

Aly Financial Yearly Demand Breakout 20.6

Aly Financial 6 Month Demand BUFL 28.18

Aly Financial Qtrly Demand BUFL 35.56

Aly Financial Monthly Demand 30.05

Aly Financial Weekly Demand BUFL 31.71

Aly Financial DAILY DEMAND 32.28

ENTRY 31.71

SL 25

RISK 6.71

Tar

Ally Financial's Credit Woes Deepen: Rising DelinquenciesAlly Financial (NYSE: ALLY) faced a steep decline as its Chief Financial Officer, Russ Hutchinson, highlighted worsening conditions within its auto loan portfolio. Rising delinquencies, heightened net charge-offs, and the ongoing struggles of its typical borrower amid a challenging economic environm

Synchrony's Strategic Move to Acquire Ally's Point-of-Sale

In a significant development in the financial sector, Synchrony (NYSE: NYSE:SYF ) and Ally Financial Inc. (NYSE: NYSE:ALLY ) have recently inked a definitive agreement for Synchrony to acquire NYSE:ALLY 's point-of-sale financing business, encompassing $2.2 billion in loan receivables. The move

ALLY Ally Financial Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ALLY Ally Financial prior to the earnings report this week,

I would consider purchasing the 31usd strike price Puts with

an expiration date of 2024-2-16,

for a premium of approximately $0.80.

If these options prove to be profitable prior to the e

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ALLY5201198

Ally Financial Inc. 1.3% 15-JUN-2026Yield to maturity

7.75%

Maturity date

Jun 15, 2026

ALLY5705341

Ally Financial Inc. 7.7% 15-NOV-2033Yield to maturity

7.46%

Maturity date

Nov 15, 2033

ALLY5700824

Ally Financial Inc. 7.7% 15-NOV-2033Yield to maturity

7.45%

Maturity date

Nov 15, 2033

ALLY5470852

Ally Financial Inc. 4.6% 15-SEP-2027Yield to maturity

7.35%

Maturity date

Sep 15, 2027

ALLY5711874

Ally Financial Inc. 7.45% 15-DEC-2033Yield to maturity

7.35%

Maturity date

Dec 15, 2033

ALLY5648623

Ally Financial Inc. 7.45% 15-SEP-2033Yield to maturity

7.27%

Maturity date

Sep 15, 2033

ALLY5594570

Ally Financial Inc. 7.35% 15-JUN-2033Yield to maturity

7.26%

Maturity date

Jun 15, 2033

ALLY5263289

Ally Financial Inc. 1.3% 15-SEP-2026Yield to maturity

7.25%

Maturity date

Sep 15, 2026

ALLY5680208

Ally Financial Inc. 7.6% 15-NOV-2028Yield to maturity

7.19%

Maturity date

Nov 15, 2028

ALLY5656541

Ally Financial Inc. 7.3% 15-SEP-2028Yield to maturity

7.19%

Maturity date

Sep 15, 2028

ALLY5502195

Ally Financial Inc. 7.25% 15-NOV-2032Yield to maturity

7.19%

Maturity date

Nov 15, 2032

See all 0HD0 bonds

Curated watchlists where 0HD0 is featured.

Frequently Asked Questions

The current price of 0HD0 is 36.3 USD — it has decreased by −4.83% in the past 24 hours. Watch ALLY FINANCIAL INC COM USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange ALLY FINANCIAL INC COM USD0.01 stocks are traded under the ticker 0HD0.

0HD0 stock has fallen by −5.21% compared to the previous week, the month change is a −9.78% fall, over the last year ALLY FINANCIAL INC COM USD0.01 has showed a −19.31% decrease.

We've gathered analysts' opinions on ALLY FINANCIAL INC COM USD0.01 future price: according to them, 0HD0 price has a max estimate of 59.00 USD and a min estimate of 37.00 USD. Watch 0HD0 chart and read a more detailed ALLY FINANCIAL INC COM USD0.01 stock forecast: see what analysts think of ALLY FINANCIAL INC COM USD0.01 and suggest that you do with its stocks.

0HD0 reached its all-time high on Jun 2, 2021 with the price of 56.4 USD, and its all-time low was 12.0 USD and was reached on Apr 3, 2020. View more price dynamics on 0HD0 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0HD0 stock is 5.39% volatile and has beta coefficient of 1.13. Track ALLY FINANCIAL INC COM USD0.01 stock price on the chart and check out the list of the most volatile stocks — is ALLY FINANCIAL INC COM USD0.01 there?

Today ALLY FINANCIAL INC COM USD0.01 has the market capitalization of 11.37 B, it has decreased by −2.94% over the last week.

Yes, you can track ALLY FINANCIAL INC COM USD0.01 financials in yearly and quarterly reports right on TradingView.

ALLY FINANCIAL INC COM USD0.01 is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

0HD0 earnings for the last quarter are 0.99 USD per share, whereas the estimation was 0.81 USD resulting in a 21.89% surprise. The estimated earnings for the next quarter are 1.01 USD per share. See more details about ALLY FINANCIAL INC COM USD0.01 earnings.

ALLY FINANCIAL INC COM USD0.01 revenue for the last quarter amounts to 2.08 B USD, despite the estimated figure of 2.04 B USD. In the next quarter, revenue is expected to reach 2.12 B USD.

0HD0 net income for the last quarter is 352.00 M USD, while the quarter before that showed −225.00 M USD of net income which accounts for 256.44% change. Track more ALLY FINANCIAL INC COM USD0.01 financial stats to get the full picture.

Yes, 0HD0 dividends are paid quarterly. The last dividend per share was 0.30 USD. As of today, Dividend Yield (TTM)% is 3.24%. Tracking ALLY FINANCIAL INC COM USD0.01 dividends might help you take more informed decisions.

ALLY FINANCIAL INC COM USD0.01 dividend yield was 3.33% in 2024, and payout ratio reached 66.70%. The year before the numbers were 3.44% and 43.23% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 10.7 K employees. See our rating of the largest employees — is ALLY FINANCIAL INC COM USD0.01 on this list?

Like other stocks, 0HD0 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ALLY FINANCIAL INC COM USD0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ALLY FINANCIAL INC COM USD0.01 technincal analysis shows the strong sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ALLY FINANCIAL INC COM USD0.01 stock shows the sell signal. See more of ALLY FINANCIAL INC COM USD0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.