0HEM trade ideas

SMITH&WESSON ($SWBI) 🚨 | This Portnoy Pump is Locked and Loaded🔪 If you are a bear, the last thing you want is to be staring down the barrel of this Smith & Wesson chart especially after Warren Buffet's successor David Portnoy set his sites on it.

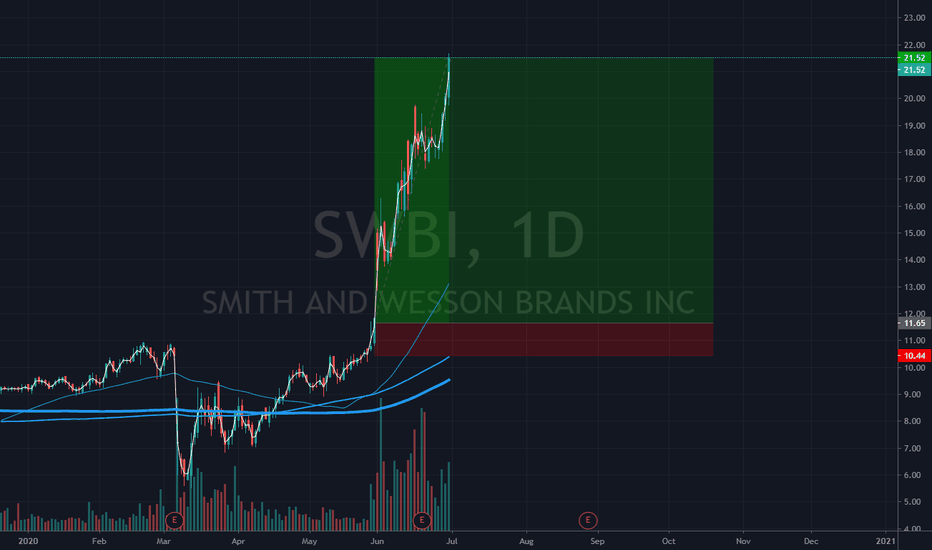

SWBI has been on an absolute beast of a run since the bottom as demand for firearms increased during COVID.

We have some clear support levels going into what should be a solid earnings report on June 18th. SWBI is locked, loaded, and ready for gains, we just need to pull the trigger as we target the next resistance.

Support:

We have tested this level already, we may see another test, or we may simply move up from here, both work well for the bulls.

If S1 can't hold, the bulls will need to see the S2 orderblock and S/R flip hold. Although this level could work, it also opens the bulls up to a potential move to the downside as illustrated on the chart.

Earnings is only two days away, losing momentum going into earnings may still result in a nice move for the bulls, but what bulls really want to see is the rally into earnings (as that gives them more flexibility to say close part of their position before earnings come out). Given this, S1 and S2 are the only logical targets for the timeframe.

Resistance:

In a perfect world, the bulls see a move off of S1 right into the R1 prior S/R flip before earnings. This simple and quick play offers about 14% profit.

If the bulls can make it past R1, perhaps on earnings strength, then the R2 orderblock is the next point of contention and is a logical place to look at closing positions after earnings.

Summary:

Nothing wrong with being long term bullish on SWBI, but for those who are just playing the Portnoy pump your ideal play here is a quick trade, in-and-out before earnings. For those a little more bullish, earnings is likely to be impressive and we could see R1 or R2 hit after depending on what happens leading up to the 18th.

What you don't want to do is try to be a hero and go bull below S2, riding the momentum makes sense, but being late to the party could mean ending up being bear food.

Resources:

www.earningswhispers.com + www.theguardian.com + www.fa-mag.com

Hit that 👍 button to show support for the content and help us grow 🐣