Cup and Handle Rising Wedge Earnings Today AMCARWR has been traveling in a possible Bearish Narrowing Rising Wedge

This pattern is not valid unless lower trendline is broken and it has not been

I have noticed the rising wedge often bites a security at earnings though..so be careful

And it is possible, to break UP and over the rising wedge. I have noted stocks do not stay there long as a rule. But rules are made to be broken (o:

CRM broke up and out of a RW when it was added to the DOW.

Possible targets if this stock is able to beat this wedge pattern are 94.2 107.2 116

Possible stop below HL ( 59.18) or MC (46.5)

The last pivot low or support level you feel is adequate can also work

Just be safe

0HI3 trade ideas

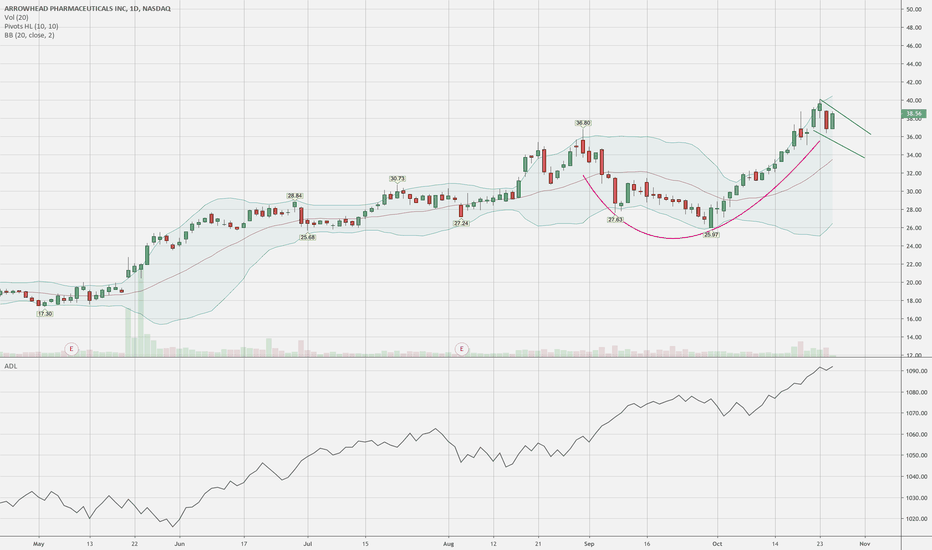

ARROWHEAD PHARMACEUTICALS Offer Hey my friends, ARROWHEAD PHARMACEUTICALS gives a hammer candle on short term MULTI FRAME with a high volume of sales at the start of the session. It is located on a strong trend support that it wishes to leave, on the TIMEFRAME 1Min we can see that it is bouncing off the VWAP. So the price is ready to take off, great possibility of breaking out the stabilization zone to reach the next high.

And fill the bullish gap if the buyers have the appetite, we can still see them fill the gap after to enter the higher that follows.

Please LIKE & FOLLOW, thank you!

Buying ARWR between $38 and $29Note: This is not an investment advice but my opinion alone. Please feel free to comment.

ARWR has seen its stock go from around $70 to about $42 as of 1/30/2020. A lot has been said about the short attack but I think this is just normal re-tracement. Using FIB, we can expect it to settle around $38 and $29. I will consider picking up shares for the first time there but will also watch for the GAP at around $20 if it breaks $29.

Please do your DD

$ARWR #ARWR again , great 2019 looking this one again , really enjoyed ride , with market as it is and Spring around a corner , all cats and dogs need some fresh air ..

I personally no T yet about bottom , but looking few days of screen time showing some life here going long , p.s congrats to shorts also :P

ARWR pointing down to fill gap: mini short on a solid longARWR has been a great long trade since mid 2019 but after recent highs around 72-73 levels the risk of a natural pull back became apparent which is why I opened a small short position at the 65 level in late December (I remain bullish on this stock with long term holdings).

Price began to consolidate and form a triangle pattern during the whole month of December. When price lost hold of original uptrend lines and began testing bottom of consolidation pattern the breakout trade profile was alerted due to the potential target towards a GAP @ the 50 level. Confirmation occurred soon after on Jan 2 and price has been holding the then formed downtrend line ever since --> Breakout trade from 62 target 52.

IF this light insurance trade fills the gap I will be closing out my mini short and reloading it into another long position at the 52 support level.

While there are opportunities for small wins during a pull back keeping your solid position on a 1-3 year stallion is more profitable in the long run (no pun intended) and this Arrow will shoot up a lot higher in that time.

Dr. RAV

TRADE to win/Trend is your friend....MANAGE the risk/Makes your success

Arrowhead Pharmaceuticals $ARWR $ARWR let me be honest this is up 6000% since Dec 2016 & they still don't have phase 3 yet which hold a variety of uncertainties. Anyhow this has been one of the best performing stocks over the past couple years, and I am still a bit hesitant to go against it. I might be early but I still want to get this out as it could be really great opportunity to play the downside.

Personally I would not want to be a buy up here as were hitting major resistance and a choppy trading zone. The monthly chart looks exhausted and ready to take a break. We all know biotechs are crazy, they can run & run and run then on the flip of a dime they crash much harder & faster than they came up.

After having this non-stop run over the past 3 year, I would not be surprised to see a pull-back in the near future even though they had a great 10Q & have plenty of cash from the Janssen deal. Here are some important notes from the 10Q

www.sec.gov

We expect that the market price of our Common Stock will continue to fluctuate significantly. We may not continue to generate substantial revenue from the license or sale of our technology for several years, if at all.

We have a history of net losses, and we expect to continue to incur net losses and may not achieve or maintain profitability.

We have incurred net losses since our inception and we expect that our operating losses will continue for the foreseeable future as we continue our drug development and discovery efforts.

Janssen, and the premium JJDC paid on the Company’s common stock during the period.

With this being said I am looking at 6/19/20 $50 Puts

& for more near-term i'm looking at 3/20/20 $50 puts

GLTA

ARWR - Breakout Play into Earnings and Maybe Swing Beyond!ARWR - historically positive ER with ascending price action

afterwards. Closed at previous candlestick resistance at

14.80's, which is also just under significant upper trendline

resistance but resting on 50ma. A break over 15 could see

a push to 100ma. A break over that could see push to 16.50's.

If we get past the 16 mark, we look to fill the gap to even

the 18's. Everyone loves filling the gap! The RSI is ok. Would be

nice to see the macd turn bullish tomorrow.

ARWR Clean TriangleARWR gapped up on good news with and has made a very clean wedge on day 2. Volume was very low relative to day 1 but the pattern is very clean here and we are low basing on a daily support. There could be a good opportunity on the open either way this plays out. If we gap under 19 and it fails to recover above 19, I would look to short. If we gap above would also be a nice entry at 19 if we can hold.