BX : First Attempt at Silent StockBlackstone has now decided to invest in Europe.

The stock is technically above the 50 and 200 period moving averages.

After leveling the trend line, an increase in volume was also observed.

In that case, holding a short-medium term or opening a long position with a reasonable risk/reward ratio in a

Key facts today

Blackstone Inc. has formed a partnership with Legal & General to originate private credit investments tailored for annuities, marking its entry into the UK pension risk-transfer market.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.2 EUR

2.68 B EUR

12.03 B EUR

720.58 M

About Blackstone Inc.

Sector

Industry

CEO

Stephen Allen Schwarzman

Website

Headquarters

New York

Founded

1985

FIGI

BBG00JWMZ0Y8

Blackstone, Inc. engages in the provision of investment and fund management services. It operates through the following segments: Real Estate, Private Equity, Credit and Insurance, and Hedge Fund Solutions. The Real Estate segment includes management of opportunistic real estate funds, Core+ real estate funds, high-yield real estate debt funds, and liquid real estate debt funds. The Private Equity segment consists of management of flagship corporate private equity funds, sector and geographically focused corporate private equity funds, core private equity funds, an opportunistic investment platform, a secondary fund of funds business, infrastructure-focused funds, a life sciences investment platform, a growth equity investment platform, a multi-asset investment program for eligible high net worth investors and a capital markets services business. The Credit and Insurance segment refers to Blackstone Credit, which is organized into two overarching strategies: private credit which includes mezzanine direct lending funds, private placement strategies, stressed and distressed strategies and energy strategies, and liquid credit which consists of CLOs, closed-ended funds, open ended funds and separately managed accounts. In addition, the segment includes an insurer-focused platform, an asset-based finance platform, and publicly traded master limited partnership investment platform. The Hedge Fund Solutions segment focuses on Blackstone Alternative Asset Management, which manages a broad range of commingled and customized hedge fund of fund solutions. It also includes a GP Stakes business and investment platforms that invest directly, as well as investment platforms that seed new hedge fund businesses and create alternative solutions through daily liquidity products. The company was founded by Stephen Allen Schwarzman in 1985 and is headquartered in New York, NY.

Related stocks

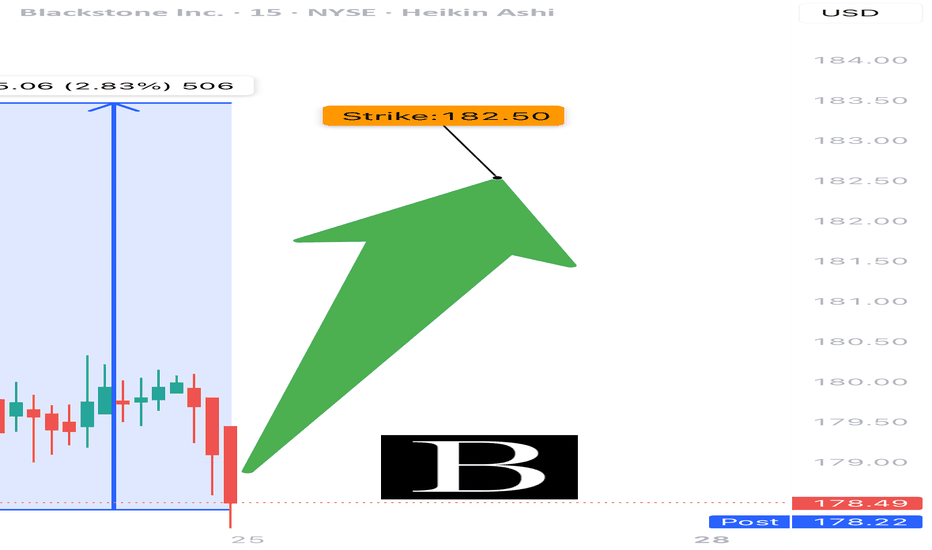

BX EARNINGS TRADE (07/24)

🚨 BX EARNINGS TRADE (07/24) 🚨

💼 Blackstone drops earnings after close — setup looks 🔥 bullish

🧠 Key Insights:

• 📉 TTM Revenue: -8.2%, but Q2 bounce back = $764M profit

• 💰 Margins: Strong → 45.3% operating, 20.6% net

• 📈 RSI: 73.88 = HOT momentum

• 🧠 AUM: $1.2 Trillion = 🐘 heavyweight

• 🔥 Options

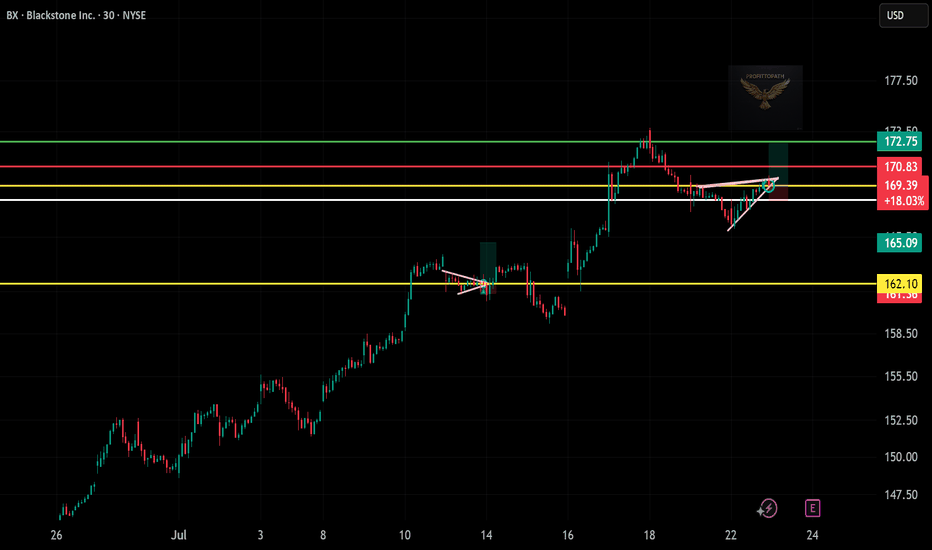

BX Long Trade Setup!📊

⏱️ Timeframe:

30-minute chart

📍 Technical Highlights:

Bullish pennant breakout forming after a strong uptrend (continuation pattern ✅)

Breakout area: Around $163 (red resistance)

Support held near $162 zone (white/yellow lines)

🎯 Targets:

TP1: $164.15

TP2: $165.05

(Both resistance levels mar

Blackstone Leads the Revival of IPOs in Spain Blackstone Leads the Revival of IPOs in Spain with Cirsa and HIP

Ion Jauregui – Analyst at ActivTrades

Blackstone, the world’s largest investment fund, has strongly reactivated the IPO market in Spain with two of its most prominent portfolio companies: Cirsa, a gaming industry giant, and Hotel In

Catalonia Drives Away Residential Real Estate CapitalBy Ion Jauregui – Analyst at ActivTrades

Rental market regulations in Catalonia are triggering a real capital flight among major international funds. Following Patrizia’s moves, Blackstone and Azora have also begun divesting from the region’s rental housing market, prioritizing unit-by-unit proper

Black Stone Stock Chart Fibonacci Analysis 050925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 129/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

What is a war chest and lessons we can learn from Blackstone...In case you haven't heard, NYSE:BX is hogging over $100 billion of dry powder that is ready for deployment at the snap of a finger. Now, just because we cant get our hands on hundreds of billions of dollars doesn't mean that we shouldn't have a war chest of our own.

Why a war chest is a must hav

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

GE3882924

General Electric Capital Corporation 3.0% 15-AUG-2025Yield to maturity

11.69%

Maturity date

Aug 15, 2025

GE4036332

General Electric Capital Corporation 3.65% 15-AUG-2025Yield to maturity

7.23%

Maturity date

Aug 15, 2025

B

BX5337775

Blackstone Private Credit Fund 4.0% 15-JAN-2029Yield to maturity

7.10%

Maturity date

Jan 15, 2029

B

BX5049999

Blackstone Holdings Finance Co. LLC 2.8% 30-SEP-2050Yield to maturity

6.99%

Maturity date

Sep 30, 2050

B

BX5302996

Blackstone Private Credit Fund 3.25% 15-MAR-2027Yield to maturity

6.86%

Maturity date

Mar 15, 2027

B

BX4546377

Blackstone Holdings Finance Co. LLC 4.0% 02-OCT-2047Yield to maturity

6.75%

Maturity date

Oct 2, 2047

B

BX5257560

Blackstone Private Credit Fund 2.625% 15-DEC-2026Yield to maturity

6.67%

Maturity date

Dec 15, 2026

B

BX4880259

Blackstone Holdings Finance Co. LLC 3.5% 10-SEP-2049Yield to maturity

6.60%

Maturity date

Sep 10, 2049

See all 0HO8 bonds

Curated watchlists where 0HO8 is featured.

Frequently Asked Questions

The current price of 0HO8 is 145.4 EUR — it has decreased by −4.33% in the past 24 hours. Watch BLACKSTONE INC COM USD0.00001 CLASS A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange BLACKSTONE INC COM USD0.00001 CLASS A stocks are traded under the ticker 0HO8.

0HO8 stock has fallen by −3.97% compared to the previous week, the month change is a 10.99% rise, over the last year BLACKSTONE INC COM USD0.00001 CLASS A has showed a 7.94% increase.

We've gathered analysts' opinions on BLACKSTONE INC COM USD0.00001 CLASS A future price: according to them, 0HO8 price has a max estimate of 188.33 EUR and a min estimate of 113.87 EUR. Watch 0HO8 chart and read a more detailed BLACKSTONE INC COM USD0.00001 CLASS A stock forecast: see what analysts think of BLACKSTONE INC COM USD0.00001 CLASS A and suggest that you do with its stocks.

0HO8 reached its all-time high on Jul 25, 2025 with the price of 153.4 EUR, and its all-time low was 105.0 EUR and was reached on Apr 9, 2025. View more price dynamics on 0HO8 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0HO8 stock is 4.52% volatile and has beta coefficient of 1.35. Track BLACKSTONE INC COM USD0.00001 CLASS A stock price on the chart and check out the list of the most volatile stocks — is BLACKSTONE INC COM USD0.00001 CLASS A there?

Today BLACKSTONE INC COM USD0.00001 CLASS A has the market capitalization of 182.21 B, it has increased by 1.10% over the last week.

Yes, you can track BLACKSTONE INC COM USD0.00001 CLASS A financials in yearly and quarterly reports right on TradingView.

BLACKSTONE INC COM USD0.00001 CLASS A is going to release the next earnings report on Oct 16, 2025. Keep track of upcoming events with our Earnings Calendar.

0HO8 earnings for the last quarter are 1.03 EUR per share, whereas the estimation was 0.93 EUR resulting in a 10.26% surprise. The estimated earnings for the next quarter are 1.08 EUR per share. See more details about BLACKSTONE INC COM USD0.00001 CLASS A earnings.

BLACKSTONE INC COM USD0.00001 CLASS A revenue for the last quarter amounts to 2.61 B EUR, despite the estimated figure of 2.36 B EUR. In the next quarter, revenue is expected to reach 2.82 B EUR.

0HO8 net income for the last quarter is 648.77 M EUR, while the quarter before that showed 568.33 M EUR of net income which accounts for 14.15% change. Track more BLACKSTONE INC COM USD0.00001 CLASS A financial stats to get the full picture.

Yes, 0HO8 dividends are paid quarterly. The last dividend per share was 0.81 EUR. As of today, Dividend Yield (TTM)% is 2.38%. Tracking BLACKSTONE INC COM USD0.00001 CLASS A dividends might help you take more informed decisions.

BLACKSTONE INC COM USD0.00001 CLASS A dividend yield was 2.00% in 2024, and payout ratio reached 95.26%. The year before the numbers were 2.54% and 180.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 4.89 K employees. See our rating of the largest employees — is BLACKSTONE INC COM USD0.00001 CLASS A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BLACKSTONE INC COM USD0.00001 CLASS A EBITDA is 6.20 B EUR, and current EBITDA margin is 56.69%. See more stats in BLACKSTONE INC COM USD0.00001 CLASS A financial statements.

Like other stocks, 0HO8 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BLACKSTONE INC COM USD0.00001 CLASS A stock right from TradingView charts — choose your broker and connect to your account.