0HYJ trade ideas

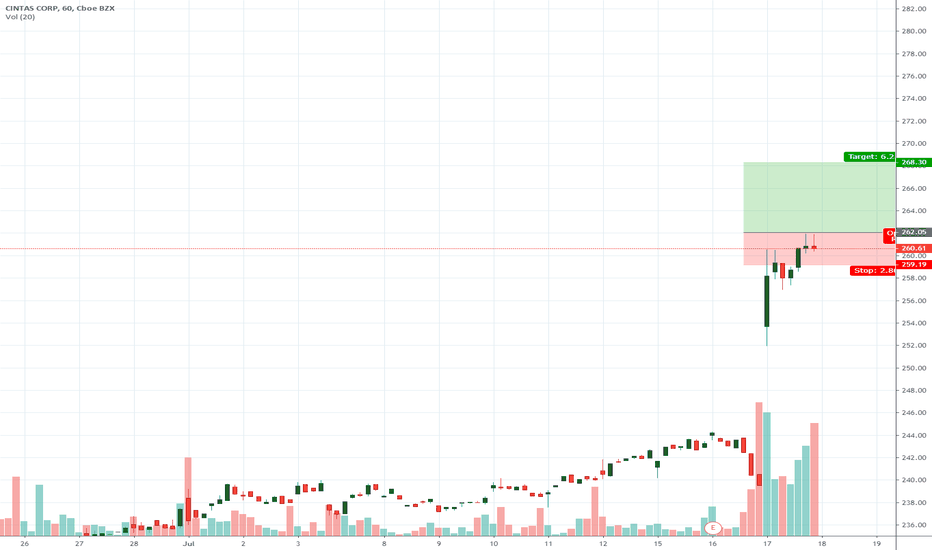

$CTAS Cintas Corp Needs a correction, Bearish divergences Longs may be a little nervy into earnings tomorrow, the stock has had a incredible run higher in 2019, but the indicators are showing weakness. Although the company has a fantastic earnings beat history, technical traders will have a close eye on this stock for a sell off regardless of results. Bearish divergences are present on the indicators and that should not be ignored, fundamentally it is fine to be bullish but that is only 50% of the signals you should use.

The main concern on the indicators is the CMF and Momentum which signals enthusiasm for the stock is dying, be cautious that if the stock has a positive pop post earnings, don't go chasing it, don't be the last to the party,

pickings will be slim.

AVERAGE ANALYSTS PRICE TARGET $223

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 32

SHORT INTEREST 3.64%

COMPANY PROFILE

Cintas Corp. engages in the provision and supply of corporate identity uniform programs. It operates through the following segments: Uniform Rental and Facility Services, First Aid and Safety Services, and All Other. The Uniform Rental and Facility Services segment consists of rental and servicing of uniforms and other garments including flame resistant clothing, mats, mops and shop towels, and other ancillary items. The First Aid and Safety Services segment comprises of first aid and safety products and services. The All Other segment includes fire protection services and its direct sale business. The company was founded by Richard T. Farmer in 1968 and is headquartered in Cincinnati, OH.

CTAS ... Resistance level?... short coming?... CTAS have ALL indicators to the top... I mean all of them.. uhuuu yes.. pass 52 weeks high... RSI high.. accumulation High.. and the chart is showing resistance at $223. I believe is time to short and drop price so it will prepare for distribution again,,, great company. Usually when this stock drop it will lose easily $8 - $15.. lets see if it breaks $223. doubt it.

CTAS. No more room to run or...?Position trading only. avg. volume is below 1M, try at ur own risk. There will be 2 levels from which you can try to short - 1. Hourly chart. most recently we broke through $200 level, so u can try to short on the retest of this level. I wouldn't recommend to short right now, unless u can afford $10 SL. so, short @ $200, TP $190 or even lower, depends on whether we hold $190 or not. I would recommend to close 1st half at this price. 2. Weekly chart. Watch levels $210-220 for possible double top, just in case if we go higher from $190.

"Are We About To See A Break Down?"Cintas Corporation (NASDAQ: CTAS) is at a Critical Make-Or-Break Point right now. If it continues to lose momentum, then we may see a good Down Side as per TTC Breakdown Formation.

For Short-term targets, Trader should eye on 147 Zone . Then 144 is the next support. For Swing Traders, 141 Zone is Very Critical. Below which we can see a good amount of selling.

Cintas Corporation is an American company with headquarters in Cincinnati, Ohio that provides specialized services to businesses, primarily in North America. The firm designs, manufactures and implements corporate identity uniform programs and provides entrance mats, restroom cleaning and supplies, tile and carpet cleaning, promotional products, first aid, safety, and fire protection products and services.