Key facts today

Bronstein, Gewirtz & Grossman, LLC is investigating potential misconduct by Five Below, Inc. Investors who bought Five Below shares before December 1, 2022, and still hold them can participate.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.0 USD

253.61 M USD

3.88 B USD

53.66 M

About Five Below, Inc.

Sector

Industry

CEO

Winifred Y. Park

Website

Headquarters

Philadelphia

Founded

2002

FIGI

BBG00JVXCXG8

Five Below, Inc. operates as a specialty value retailer. It operates through the following segments: Leisure, Fashion and Home, and Party and Snack. The Leisure segment includes items such as sporting goods, games, toys, tech, books, electronic accessories, and arts and crafts. The Fashion and Home segment consists of personal accessories, “attitude” t-shirts, beauty offerings, home goods, and storage options. The Party and Snack segment offers party and seasonal goods, greeting cards, candy, and other snacks and beverages. The company was founded by David Schlessinger and Thomas G. Vellios in January 2002 and is headquartered in Philadelphia, PA.

Related stocks

FIVE Five Below Options Ahead of EarningsIf you haven`t bought FIVE before the previous earnings:

Now analyzing the options chain and the chart patterns of FIVE Five Below prior to the earnings report this week,

I would consider purchasing the 115usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $

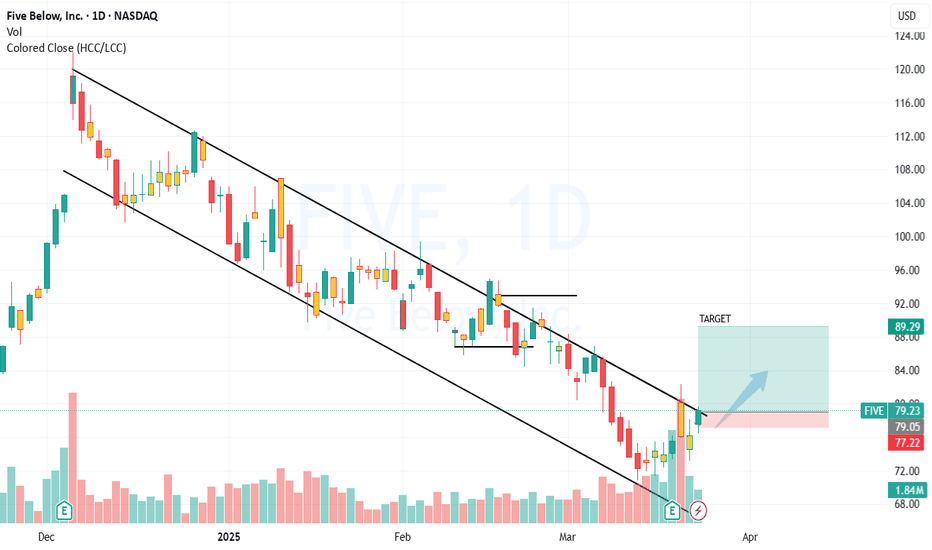

Clean break to upper 80s with the catalyst + TABased on numerous ideas indicating a breakout from the current downtrend, one as close to rising is oscillators midway towards their range. It is sitting on resistance, but too many things are going against a continuing pattern (not to say it can't happen) and staying within the current scope of thi

Five Below, Inc. (NASDAQ: FIVE) Surge 10% In Premarket Trading Five Below, Inc. (NASDAQ: NASDAQ:FIVE ) a company that operates as a specialty value retailer in the United States today announced financial results for the fourth quarter and full year of fiscal 2024 ended February 1, 2025.

The fourth quarter and full year of fiscal 2023 ended February 3, 2024 c

FIVE BELOW Stock Chart Fibonacci Analysis 011125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 100/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

FIVE Five Below Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FIVE Five Below prior to the earnings report this week,

I would consider purchasing the 100usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $5.00.

If these options prove to be profitable prior to the ea

$FIVE - back to $60 - call it a low fiveFibs show a lot of room to fall, key support is broken have to move chart to weekly just to find support and it's $60ish. Look at that regression channel! Holy snapped in half batman. It is forming an all new regression that can't even be mapped yet....

I don't even know what this company does but

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 0IPD is 123.0 USD — it has decreased by −1.02% in the past 24 hours. Watch FIVE BELOW INC COM USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange FIVE BELOW INC COM USD0.01 stocks are traded under the ticker 0IPD.

0IPD stock has fallen by −1.25% compared to the previous week, the month change is a 12.93% rise, over the last year FIVE BELOW INC COM USD0.01 has showed a 8.16% increase.

We've gathered analysts' opinions on FIVE BELOW INC COM USD0.01 future price: according to them, 0IPD price has a max estimate of 160.00 USD and a min estimate of 69.00 USD. Watch 0IPD chart and read a more detailed FIVE BELOW INC COM USD0.01 stock forecast: see what analysts think of FIVE BELOW INC COM USD0.01 and suggest that you do with its stocks.

0IPD reached its all-time high on Aug 26, 2021 with the price of 230.0 USD, and its all-time low was 52.0 USD and was reached on Apr 4, 2025. View more price dynamics on 0IPD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0IPD stock is 1.03% volatile and has beta coefficient of 1.96. Track FIVE BELOW INC COM USD0.01 stock price on the chart and check out the list of the most volatile stocks — is FIVE BELOW INC COM USD0.01 there?

Today FIVE BELOW INC COM USD0.01 has the market capitalization of 6.79 B, it has increased by 1.11% over the last week.

Yes, you can track FIVE BELOW INC COM USD0.01 financials in yearly and quarterly reports right on TradingView.

FIVE BELOW INC COM USD0.01 is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

0IPD earnings for the last quarter are 0.86 USD per share, whereas the estimation was 0.83 USD resulting in a 3.51% surprise. The estimated earnings for the next quarter are 0.56 USD per share. See more details about FIVE BELOW INC COM USD0.01 earnings.

FIVE BELOW INC COM USD0.01 revenue for the last quarter amounts to 970.53 M USD, despite the estimated figure of 966.52 M USD. In the next quarter, revenue is expected to reach 980.99 M USD.

0IPD net income for the last quarter is 41.15 M USD, while the quarter before that showed 187.46 M USD of net income which accounts for −78.05% change. Track more FIVE BELOW INC COM USD0.01 financial stats to get the full picture.

No, 0IPD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 23, 2025, the company has 23.2 K employees. See our rating of the largest employees — is FIVE BELOW INC COM USD0.01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FIVE BELOW INC COM USD0.01 EBITDA is 515.34 M USD, and current EBITDA margin is 13.16%. See more stats in FIVE BELOW INC COM USD0.01 financial statements.

Like other stocks, 0IPD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FIVE BELOW INC COM USD0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FIVE BELOW INC COM USD0.01 technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FIVE BELOW INC COM USD0.01 stock shows the buy signal. See more of FIVE BELOW INC COM USD0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.