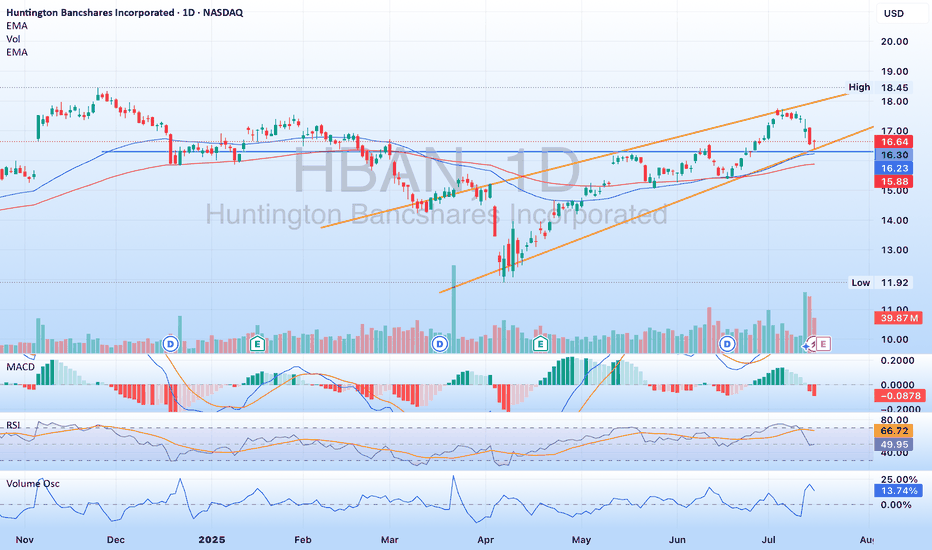

$HBAN - well positioned to continue on its pathNASDAQ:HBAN has been in a rising channel since April, and is no touching the lower band of the channel. His area also includes some previous resistance turned support, as well as some movement paces. NASDAQ:HBAN recently announced they are acquiring Veritex ( NASDAQ:VBTX ) which will strengthen t

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.35 USD

1.94 B USD

11.85 B USD

1.45 B

About Huntington Bancshares Incorporated

Sector

Industry

CEO

Stephen D. Steinour

Website

Headquarters

Columbus

Founded

1866

FIGI

BBG00JRY8M89

Huntington Bancshares, Inc. is a bank holding company, which engages in the provision of full-service commercial and consumer deposit, lending, and other banking services. It operates through Consumer and Regional Banking, and Commercial Banking. The Consumer and Regional Banking segment provides a wide array of financial products and services to consumer and business customers including deposits, lending, payments, mortgage banking, dealer financing, investment management, trust, brokerage, insurance, and other financial products and services. The Commercial Banking segment is involved in expertise through bankers, capabilities, and digital channels, and includes a comprehensive set of product offerings. The company was founded in 1866 and is headquartered in Columbus, OH.

Related stocks

HBAN BULLISH TRIANGLE The daily chart of Huntington Bancshares Incorporated (HBAN) shows a well-formed ascending triangle pattern, indicating potential for further bullish movement, especially if the stock can break through its current resistance zone around $15.00. Here's a detailed analysis based on the key technical s

New Support for Huntington Bank?Huntington Bancshares isn’t an actively traded name, but its chart may have some potentially interesting patterns this week.

First is the level around $12.19, its highest weekly close last summer. HBAN jumped above that price in mid-December before testing it in January and again this month. Old re

$HBAN: Navigating Challenges, Paving the Way for Growth

Huntington Bancshares Incorporated (NASDAQ: NASDAQ:HBAN ) has weathered the challenges of the past year and emerged with a strategic vision for growth. In the recent fourth-quarter earnings call, the financial institution reported a year of increased deposits and loans, showcasing resilience in ma

HBAN Huntington Bancshares Incorporated Options Ahead of EarningAnalyzing the options chain and the chart patterns of HBAN Huntington Bancshares prior to the earnings report this week,

I would consider purchasing the 110usd strike price in the money Puts with

an expiration date of 2023-10-20,

for a premium of approximately $0.87.

If these options prove to be p

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HBAN5938865

Huntington Bancshares Incorporated 6.141% 18-NOV-2039Yield to maturity

5.83%

Maturity date

Nov 18, 2039

HBAN5742456

Huntington Bancshares Incorporated 5.709% 02-FEB-2035Yield to maturity

5.35%

Maturity date

Feb 2, 2035

HBAN5411509

Huntington Bancshares Incorporated 5.023% 17-MAY-2033Yield to maturity

5.23%

Maturity date

May 17, 2033

HBAN4943706

Huntington Bancshares Incorporated 2.55% 04-FEB-2030Yield to maturity

4.91%

Maturity date

Feb 4, 2030

HBAN5634797

Huntington Bancshares Incorporated 6.208% 21-AUG-2029Yield to maturity

4.79%

Maturity date

Aug 21, 2029

HBAN5938864

Huntington Bancshares Incorporated 5.272% 15-JAN-2031Yield to maturity

4.77%

Maturity date

Jan 15, 2031

HBAN5412277

Huntington Bancshares Incorporated 2.487% 15-AUG-2036Yield to maturity

4.69%

Maturity date

Aug 15, 2036

HBAN5455646

Huntington Bancshares Incorporated 4.443% 04-AUG-2028Yield to maturity

4.49%

Maturity date

Aug 4, 2028

HBAN5411508

Huntington Bancshares Incorporated 4.552% 17-MAY-2028Yield to maturity

4.44%

Maturity date

May 17, 2028

HBAN5237266

Huntington Bancshares Incorporated 2.487% 15-AUG-2036Yield to maturity

—

Maturity date

Aug 15, 2036

See all 0J72 bonds

Frequently Asked Questions

The current price of 0J72 is 16.80 USD — it has decreased by −0.71% in the past 24 hours. Watch HUNTINGTON BANCSHARES INC COM STK NPV stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange HUNTINGTON BANCSHARES INC COM STK NPV stocks are traded under the ticker 0J72.

0J72 stock has fallen by −1.30% compared to the previous week, the month change is a 3.48% rise, over the last year HUNTINGTON BANCSHARES INC COM STK NPV has showed a 12.03% increase.

We've gathered analysts' opinions on HUNTINGTON BANCSHARES INC COM STK NPV future price: according to them, 0J72 price has a max estimate of 21.00 USD and a min estimate of 16.00 USD. Watch 0J72 chart and read a more detailed HUNTINGTON BANCSHARES INC COM STK NPV stock forecast: see what analysts think of HUNTINGTON BANCSHARES INC COM STK NPV and suggest that you do with its stocks.

0J72 reached its all-time high on Nov 25, 2024 with the price of 18.45 USD, and its all-time low was 6.90 USD and was reached on Apr 3, 2020. View more price dynamics on 0J72 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0J72 stock is 2.55% volatile and has beta coefficient of 1.30. Track HUNTINGTON BANCSHARES INC COM STK NPV stock price on the chart and check out the list of the most volatile stocks — is HUNTINGTON BANCSHARES INC COM STK NPV there?

Today HUNTINGTON BANCSHARES INC COM STK NPV has the market capitalization of 24.69 B, it has decreased by −5.24% over the last week.

Yes, you can track HUNTINGTON BANCSHARES INC COM STK NPV financials in yearly and quarterly reports right on TradingView.

HUNTINGTON BANCSHARES INC COM STK NPV is going to release the next earnings report on Oct 17, 2025. Keep track of upcoming events with our Earnings Calendar.

0J72 earnings for the last quarter are 0.34 USD per share, whereas the estimation was 0.33 USD resulting in a 1.75% surprise. The estimated earnings for the next quarter are 0.37 USD per share. See more details about HUNTINGTON BANCSHARES INC COM STK NPV earnings.

HUNTINGTON BANCSHARES INC COM STK NPV revenue for the last quarter amounts to 1.95 B USD, despite the estimated figure of 1.97 B USD. In the next quarter, revenue is expected to reach 2.03 B USD.

0J72 net income for the last quarter is 536.00 M USD, while the quarter before that showed 527.00 M USD of net income which accounts for 1.71% change. Track more HUNTINGTON BANCSHARES INC COM STK NPV financial stats to get the full picture.

Yes, 0J72 dividends are paid quarterly. The last dividend per share was 0.16 USD. As of today, Dividend Yield (TTM)% is 3.68%. Tracking HUNTINGTON BANCSHARES INC COM STK NPV dividends might help you take more informed decisions.

HUNTINGTON BANCSHARES INC COM STK NPV dividend yield was 3.81% in 2024, and payout ratio reached 50.83%. The year before the numbers were 4.87% and 50.09% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, 0J72 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HUNTINGTON BANCSHARES INC COM STK NPV stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HUNTINGTON BANCSHARES INC COM STK NPV technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HUNTINGTON BANCSHARES INC COM STK NPV stock shows the strong buy signal. See more of HUNTINGTON BANCSHARES INC COM STK NPV technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.