Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

26 USD

3.29 B USD

359.05 B USD

124.72 M

About McKesson Corporation

Sector

Industry

CEO

Brian Scott Tyler

Website

Headquarters

Irving

Founded

1833

FIGI

BBG00JRY8YZ3

McKesson Corp. engages in providing healthcare services. It operates through the following segments: U.S. Pharmaceutical, Prescription Technology Solutions (RxTS), Medical-Surgical Solutions, and International. The U.S. Pharmaceutical segment distributes branded, generic, specialty, biosimilar and over-the-counter pharmaceutical drugs. The RxTS segment offers prescription price transparency, benefit insight, dispensing support services, third-party logistics, and wholesale distribution. The Medical-Surgical Solutions segment provides medical-surgical supply distribution, logistics, and other services to healthcare providers. The International segment refers to the distribution and services to wholesale, institutional, and retail customers in Europe and Canada. The company was founded by John McKesson and Charles Olcott in 1833 and is headquartered in Irving, TX.

Related stocks

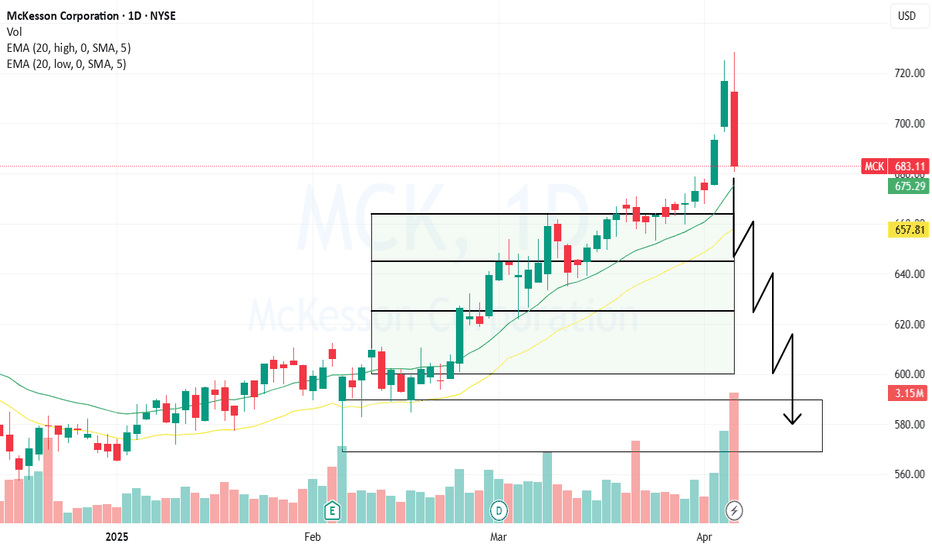

Factors that include a retrace below resistanceMany oscillators are pointing in this direction, as well as technical analysis. It has been a turbulent few weeks, but in a way, it has consistently put us at a reversal point, making it very difficult for this trend to continue beyond 700 until we see a pullback.

A major correction underway could see 500s againThe catalyst doesn't lie, but neither does the TA. We have clearly pointed out key elements to the significance of how low this can go. Major turning points sit at sub 600, volume, and volatility. This will continue to sell off, but expect a retrieval at some point closest to the low 600s.

MCK - LONG SWINGTRADEStock traders may advise shareholders and help manage portfolios. Traders engage in buying and selling bonds, stocks, futures and shares in hedge funds. A stock trader also conducts extensive research and observation of how financial markets perform. This is accomplished through economic and microec

MCK in Sell ZoneMy trading plan is very simple.

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's

Expert Analysis Reveals Key Entry Points!McKesson Corporation (MCK) continues to demonstrate resilience and growth potential, evident from its recent price action and robust financial performance. Here’s a detailed analysis for potential investors.

MCK has been in a steady uptrend, currently trading at $586.34. The stock has shown consist

MCK a large cap medical supply company LONGMCK is a large cap medical supply company- it has experienced respectable earnings reports

and steady growth as medical entities including surgery centers and hospitals are busy catching

up on electric surgeries from the COVID era. It is rising ar or under the second upper VWAP

line. The dual tim

MCK = PERMA-BULL! Long-term buy & hold.Over the past 2 years, MCK has been in a rock-solid, aggressive uptrend, gaining 50% in '22 and 30% in '23. The weekly TTM squeeze just fired LONG (again) for the 4th time in three years. This beast is a case-study in layered AVWAP! You could wait for a pullback (since it is slightly extended fro

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

O

OHIO5283946

OhioHealth Corporation 2.834% 15-NOV-2041Yield to maturity

6.52%

Maturity date

Nov 15, 2041

O

OHIO4991199

OhioHealth Corporation 3.042% 15-NOV-2050Yield to maturity

6.47%

Maturity date

Nov 15, 2050

O

OHIO4991198

OhioHealth Corporation 2.807% 15-NOV-2035Yield to maturity

5.51%

Maturity date

Nov 15, 2035

O

OHIO4991195

OhioHealth Corporation 1.775% 15-NOV-2025Yield to maturity

5.47%

Maturity date

Nov 15, 2025

O

OHIO5283943

OhioHealth Corporation 2.297% 15-NOV-2031Yield to maturity

4.84%

Maturity date

Nov 15, 2031

See all 0JZU bonds

Frequently Asked Questions

The current price of 0JZU is 714 USD — it has increased by 0.48% in the past 24 hours. Watch MCKESSON CORPORATION USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange MCKESSON CORPORATION USD0.01 stocks are traded under the ticker 0JZU.

0JZU stock has fallen by −1.17% compared to the previous week, the month change is a −0.17% fall, over the last year MCKESSON CORPORATION USD0.01 has showed a 23.13% increase.

We've gathered analysts' opinions on MCKESSON CORPORATION USD0.01 future price: according to them, 0JZU price has a max estimate of 824.00 USD and a min estimate of 735.00 USD. Watch 0JZU chart and read a more detailed MCKESSON CORPORATION USD0.01 stock forecast: see what analysts think of MCKESSON CORPORATION USD0.01 and suggest that you do with its stocks.

0JZU reached its all-time high on Jul 8, 2025 with the price of 738 USD, and its all-time low was 108 USD and was reached on Dec 24, 2018. View more price dynamics on 0JZU chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0JZU stock is 1.56% volatile and has beta coefficient of 0.36. Track MCKESSON CORPORATION USD0.01 stock price on the chart and check out the list of the most volatile stocks — is MCKESSON CORPORATION USD0.01 there?

Today MCKESSON CORPORATION USD0.01 has the market capitalization of 89.38 B, it has increased by 2.65% over the last week.

Yes, you can track MCKESSON CORPORATION USD0.01 financials in yearly and quarterly reports right on TradingView.

MCKESSON CORPORATION USD0.01 is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

0JZU earnings for the last quarter are 10.12 USD per share, whereas the estimation was 9.83 USD resulting in a 2.98% surprise. The estimated earnings for the next quarter are 8.20 USD per share. See more details about MCKESSON CORPORATION USD0.01 earnings.

MCKESSON CORPORATION USD0.01 revenue for the last quarter amounts to 90.82 B USD, despite the estimated figure of 94.30 B USD. In the next quarter, revenue is expected to reach 95.82 B USD.

0JZU net income for the last quarter is 1.26 B USD, while the quarter before that showed 879.00 M USD of net income which accounts for 43.34% change. Track more MCKESSON CORPORATION USD0.01 financial stats to get the full picture.

Yes, 0JZU dividends are paid quarterly. The last dividend per share was 0.71 USD. As of today, Dividend Yield (TTM)% is 0.40%. Tracking MCKESSON CORPORATION USD0.01 dividends might help you take more informed decisions.

MCKESSON CORPORATION USD0.01 dividend yield was 0.41% in 2024, and payout ratio reached 10.69%. The year before the numbers were 0.45% and 10.72% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 15, 2025, the company has 45 K employees. See our rating of the largest employees — is MCKESSON CORPORATION USD0.01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MCKESSON CORPORATION USD0.01 EBITDA is 4.76 B USD, and current EBITDA margin is 1.39%. See more stats in MCKESSON CORPORATION USD0.01 financial statements.

Like other stocks, 0JZU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MCKESSON CORPORATION USD0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MCKESSON CORPORATION USD0.01 technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MCKESSON CORPORATION USD0.01 stock shows the buy signal. See more of MCKESSON CORPORATION USD0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.