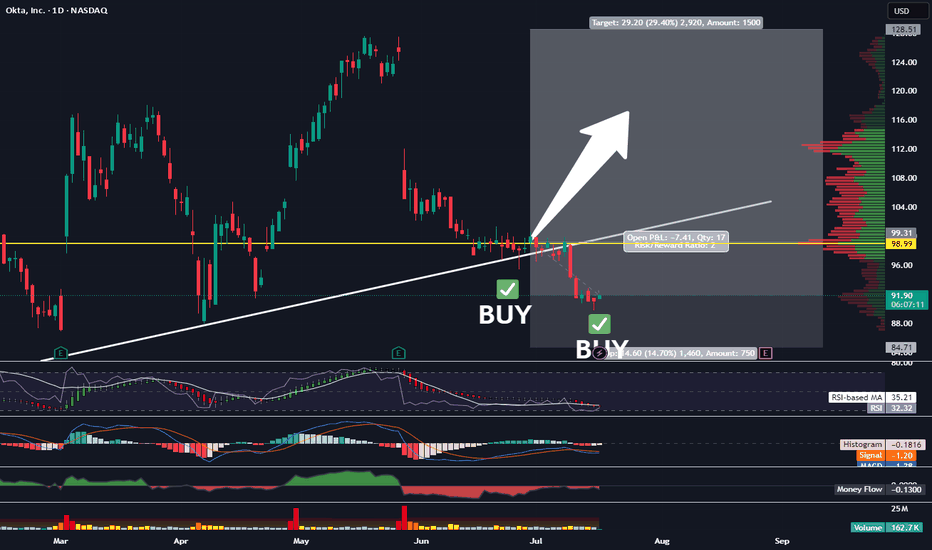

Picked Up More OKTATraders,

We’re nailing it in the stock division. Our portfolio has gained nearly 30% since the inception of our new indicator in Sept. of last year. And we’ve done that with 50% of our cash on the sidelines nearly the entire time, further reducing risk. It is amazing how I stumbled upon this new tr

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.8 USD

28.00 M USD

2.61 B USD

166.16 M

About Okta, Inc.

Sector

Industry

CEO

Todd McKinnon

Website

Headquarters

San Francisco

Founded

2009

FIGI

BBG00JVRGCT9

Okta, Inc. engages in the provision of an identity management platform for enterprises. It operates through the United States and International geographical segments. The firm's products include single sign-on, multi-factor authentication, access gateway, API access management, authentication, adaptive MFA and lifecycle management. The company was founded by Todd McKinnon and J. Frederic Kerrest in 2009 and is headquartered in San Francisco, CA.

Related stocks

Long OKTA To 128.50 For Nearly 30% PP. 1:2 RRR.Good Afternoon Trading Fam,

We are nailing it with our stock trades since implementing my new liquidity indicator. I've got another buy signal given here on OKTA with a 1:2 rrr ratio and potential profit of nearly 30%.

On the technical side, you can see that we are just above a large liquidity blo

OKTA Trade Analysis | Technical Swing Setup with ~9% UpsideEntry: $104.43

Target: $114.76

Stop: $100.90

Risk/Reward: 2.93

This swing trade in OKTA was initiated following a pullback to key technical support levels. Price action has stabilized near the top of the Ichimoku cloud (Senkou Span A), which aligns with the daily Pivot Point around $100.58. The bul

OKTA - DAY TRADE IDEAOKTA is setting up for a day trade scalp long...perhaps an aggressive swing trade as well. The day trade is a much higher probability of success around the $98.50-$99.30

Okta's stock has seen some volatility recently. After a strong rally earlier this year, it pulled back following cautious guidanc

$OKTA Gen AI tailwinds are not materializing as of now!- I'm a seller of NASDAQ:OKTA at $124 . Company was undervalued at 70s but has run so much without tangible materializing Gen AI tailwinds.

- Theoretically, Agentic AI should have been a great tailwind for SSO but it appears that industry is not yet focussed on security aspect of it when it come

$OKTANASDAQ:OKTA reports earnings post-market tomorrow.

📉 Expecting intraday pressure down to the $118 zone.

➡️ Potential continuation toward $112 over the next two weeks.

🛑 Watching for support to form between $110 – $112.

30-minute chart attached for context.

#Stocks #Trading #OKTA #Earnings #Techni

$OKTA is ready to RIP! 58% UpsideNASDAQ:OKTA was a big name I was talking about end of last year before we took a big dip in the markets...well we are back at the CupnHandle breakout level now and this trade looks ready to RIP!

Warning earnings on May 27th!

- Looking for a close on Friday above the breakout level for an entry he

Okta: Strong In a Weak Market?Okta has been quietly fighting higher, and some traders may see opportunity in its latest pullback.

The first pattern on today’s chart is the series of higher weekly lows since November. That contrasts sharply with the S&P 500 and Nasdaq-100, which have made lower weekly lows.

Second, the 50-day s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

OKTA5049821

Okta, Inc. 0.125% 01-SEP-2025Yield to maturity

5.16%

Maturity date

Sep 1, 2025

OKTA5205585

Okta, Inc. 0.375% 15-JUN-2026Yield to maturity

5.00%

Maturity date

Jun 15, 2026

See all 0KB7 bonds

Curated watchlists where 0KB7 is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 0KB7 is 95.0 USD — it has increased by 2.59% in the past 24 hours. Watch OKTA INC COM USD0.0001 CL A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange OKTA INC COM USD0.0001 CL A stocks are traded under the ticker 0KB7.

0KB7 stock has risen by 0.45% compared to the previous week, the month change is a −4.21% fall, over the last year OKTA INC COM USD0.0001 CL A has showed a −2.00% decrease.

We've gathered analysts' opinions on OKTA INC COM USD0.0001 CL A future price: according to them, 0KB7 price has a max estimate of 148.00 USD and a min estimate of 75.00 USD. Watch 0KB7 chart and read a more detailed OKTA INC COM USD0.0001 CL A stock forecast: see what analysts think of OKTA INC COM USD0.0001 CL A and suggest that you do with its stocks.

0KB7 reached its all-time high on Feb 16, 2021 with the price of 292.0 USD, and its all-time low was 28.6 USD and was reached on Feb 6, 2018. View more price dynamics on 0KB7 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0KB7 stock is 3.51% volatile and has beta coefficient of 1.01. Track OKTA INC COM USD0.0001 CL A stock price on the chart and check out the list of the most volatile stocks — is OKTA INC COM USD0.0001 CL A there?

Today OKTA INC COM USD0.0001 CL A has the market capitalization of 16.71 B, it has increased by 0.59% over the last week.

Yes, you can track OKTA INC COM USD0.0001 CL A financials in yearly and quarterly reports right on TradingView.

OKTA INC COM USD0.0001 CL A is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

0KB7 earnings for the last quarter are 0.86 USD per share, whereas the estimation was 0.77 USD resulting in a 11.69% surprise. The estimated earnings for the next quarter are 0.84 USD per share. See more details about OKTA INC COM USD0.0001 CL A earnings.

OKTA INC COM USD0.0001 CL A revenue for the last quarter amounts to 688.00 M USD, despite the estimated figure of 680.28 M USD. In the next quarter, revenue is expected to reach 711.19 M USD.

0KB7 net income for the last quarter is 62.00 M USD, while the quarter before that showed 23.00 M USD of net income which accounts for 169.57% change. Track more OKTA INC COM USD0.0001 CL A financial stats to get the full picture.

No, 0KB7 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 5.91 K employees. See our rating of the largest employees — is OKTA INC COM USD0.0001 CL A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. OKTA INC COM USD0.0001 CL A EBITDA is 114.00 M USD, and current EBITDA margin is 1.34%. See more stats in OKTA INC COM USD0.0001 CL A financial statements.

Like other stocks, 0KB7 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade OKTA INC COM USD0.0001 CL A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So OKTA INC COM USD0.0001 CL A technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating OKTA INC COM USD0.0001 CL A stock shows the neutral signal. See more of OKTA INC COM USD0.0001 CL A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.