0L7S trade ideas

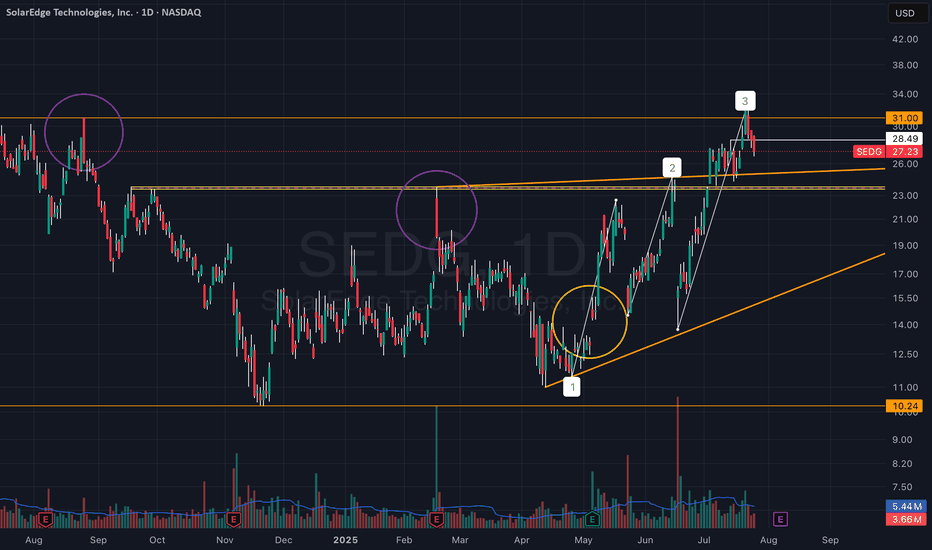

Are We Witnessing a Trend Reversal in SEDG?Something I’ve been watching closely these past few days — SEDG (SolarEdge):

There’s a setup unfolding that I think could benefit from a few more eyes on it:

• The two purple circles mark large vector candles that initiated sharp downward moves.

• The yellow circle highlights the quarterly earnings release, which triggered a strong upward move toward the $20–24 zone — the area of the first vector candle.

These vector candles reflect strong institutional activity that clearly impacted price movement.

A breakout above these zones could signal a meaningful trend reversal forming in the stock.

Price was rejected twice from this area with strong dips, but on the third attempt, it broke through, reaching the next vector candle zone around $26–31.

Now, price is approaching this upper zone with strong momentum following the breakout.

After reviewing the recent earnings report, I noticed a clear recovery and a significant upward revision in guidance, suggesting the company may be shifting direction.

Whether this holds is uncertain — but price action suggests the market is pricing in real change.

We recently printed a high of $32.45, above the $31 vector zone — a notable sign of strength.

At the moment, we appear to be pulling back into support, and structure remains intact.

Yes, there’s clearly a strong battle happening now — but I’m convinced the momentum is with the bulls.

It feels like someone already knows what’s coming in the next earnings release, or at least senses a shift in the company’s trajectory.

Everything seems to be building toward the next earnings report, expected early August.

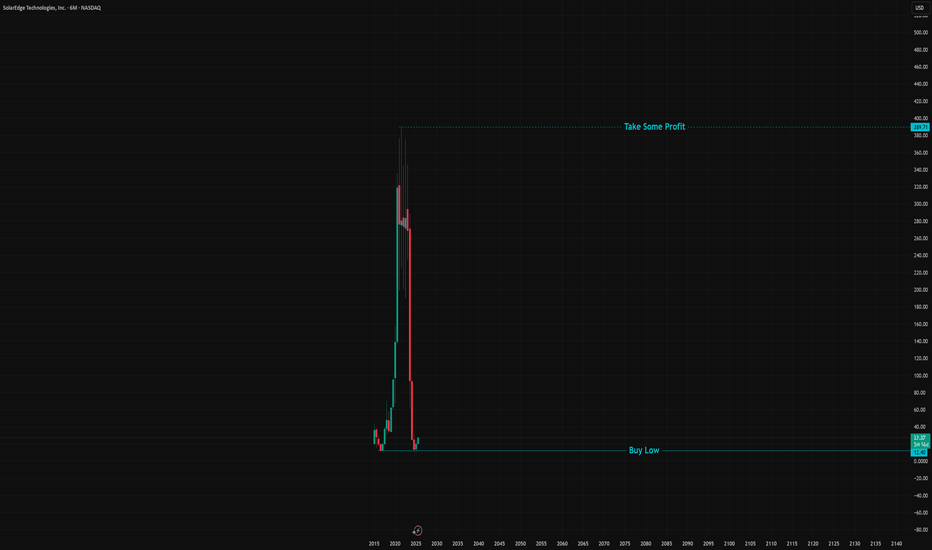

Solaredge!! Ready for a rebound?Solar stocks have taken quite a hit. There are several reasons for that, the biggest is high interest rates. Solar companies (installers) often sell solar by having the end-customer finance the up front cost of the system. When interest rates sky-rocketed post-covid, that made it a lot harder to sell solar for many solar companies, the ones who built their entire business model around financed solar. Several solar companies went belly up who owed Solaredge a lot of money. This pushed the stock down even further.

Solaredge is #1 or #2 in many market segments GLOBALLY. They make a good product and are constantly improving it.

If the US removes the tax credit for residential solar, which it looks like it will, the stock will take another tumble but I do not expect it'll ever go below $16/share again.

My best guess would be that the stock is strong the rest of 2025, while there's a huge rush the get as much residential solar installed as possible before the U.S. residential tax credit (25D) expires, then 2026 will be a slow year, then democrats take over Congress and re-enact the solar tax credit which would send the stock back into the $300/share range. We'll see :)

Are you ready for a short squeeze?39.47% short interest while 98.8% of shares held by institutions sounds like pure madness of the short sellers when the stock is down 97%.

RenTech (The Famous Quantitative Hedge Fund by Jim Simons) increased its position in the last F13 by 79%.

I opened my position at 10.76 and closed 47% at 23! I have free exposure to a potential squeeze!

$SEDG BEATS + and No Worries! Confessions from the DeskConfessions from the Desk: 10X, Black Coffee, and No Worries

SolarEdge is up 20%, and my Feb 21, 2025, $20 strike call has officially 10X’d. That’s right—after weeks of my portfolio looking like a crime scene, I’ve finally hit a clean, beautiful, 10X multiplier.

And today? I’m sipping my black coffee like a hedge fund manager who actually knows what they’re doing. Not even the endless tariff talk, geopolitical panic, or Fed fearmongering can shake me today. Let them try—I’ll just take another sip.

Now, let’s be real. Am I suddenly a genius? No. Did I see this coming? Also no. But I’m here, and I’m winning. And in this market, that’s all that matters.

So cheers to today. The market gods have finally smiled upon me.

SEDG SolarEdge Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-2-28,

for a premium of approximately $1.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SEDG Possible Play's Again my cus trades stocks so I figured I would post what I charted up for him. When looking at possible play's you will need to go down to a 2min time frame to get your entries. With the gaps in these stocks it can be difficult to find entries with so much missing data. maybe I don't pay enough to see it . I cannot post lower time frames and zones but set up 30min wick highs / lows -zones 3 candles back and you will see the support and resistance

SEDG Solaredge - More losses ahead?Solaredge Chart Analysis

The stock is in a clear downtrend since February

with a Significant resistance level at around $32.11

The Minor support seems at around $17.12

Increased volume during price drops indicates strong selling pressure and

Prices below the EMA are clues for bearish momentum

Key Points for a Trade

Entry: Consider waiting for a break below support or a pullback at resistance.

Stop-Loss: Set slightly above recent swing high ($24) to manage risk.

In case of pullback look for Stops at around $32.90

Trend continuation: Be cautious at EMA crossover or strong volume spikes, which could indicate a trend reversal.

Additional Clues:

Todays Put Option Volume increased 1,4 times of what was expected indicating bearish flow

Solaredge should have bottomed out now .......... !?!NASDAQ:SEDG

I think after 95% down and ABC Correction - Also all sub Waves look to be finished - We could maybe now see the low in many Solar related stocks like Solaredge, Enphase, Jinko, Trina etc.

Two Days ago we had a Hammer Daily and could see that weekly we get also a Hammer and daily we had just 3 day formation of Morning Star .....

www.tradingview.com