0M0F trade ideas

Tandem Diabetes Care Inc Has Huge growth potentialJim Cramer spoke with Kim Blickenstaff, executive chairman at Tandem Diabetes Care (TNDM) , which posted strong earnings last week but quickly reversed, Blickenstaff blamed the sudden reversal in their shares on global uncertainty. He said Tandem has no business in China and is in "acceleration mode."

Currently, only 30% of Type 1 diabetes patients are using a pump, Blickenstaff said, leaving a lot of room for growth for Tandem. The market potential is even greater worldwide, especially in Europe as the condition continues to become a epidemic.

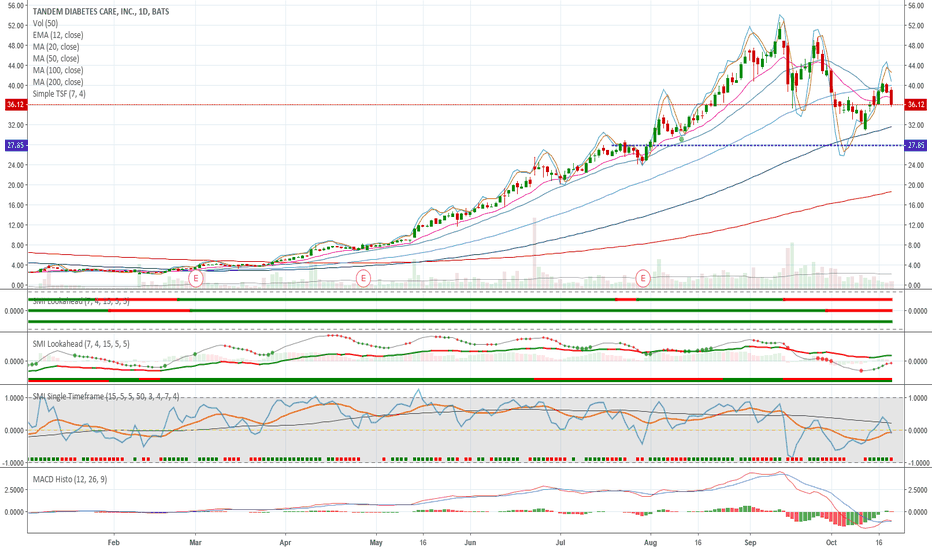

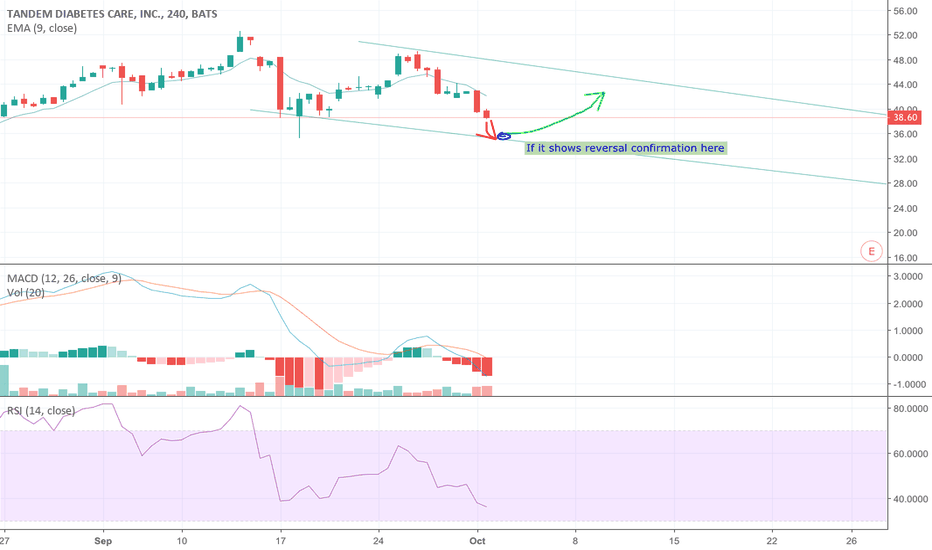

The chart remains bullish but maybe more confirmation required before placing a trade.

TANDEM DIABETES CARE INC.

Tandem Diabetes Care, Inc. engages in the design, development, and commercialization of products for people with insulin-dependent diabetes. Its flagship product, t:slim X2 Insulin Delivery System, operates as a small insulin pump. The company was founded by Paul M. DiPerna on January 27, 2006 and is headquartered in San Diego, CA.

AVERAGE ANALYSTS PRICE TARGET $82

AVERAGE ANALYSTS RECOMMENDATION BUY

SHORT INTEREST 7%

$TNDM - The trading system Equity Trend to go long todayToday at the market open (Jan 9), the equity trading system Equity Trend will open a long position in Tandem Diabetes Care Inc. (ticker: TNDM)

Each day, the system scans around 10,000 stocks to find just 1 or 2 which are ready to move immediately.

The system combines elements of breakout trading, trend following and risk management from Turtle trading.

System: bit.ly

TNDMI folled at $2 forgot all about it.Bought at $111/im May.Ive never seen such a sweet upwatd trend.Well In Aug? or so.It dropped from $53 to $26(fenerbace 50 %)

i didnt want to let gor fo any shares-i was gdlike.Last 6 months have been brutal-But THE JAUARY EFFECT IS effective,chart show breakout/first time since downtrent.$40.00 /%60n$75 $100,$150 $200 the ?

Bullish outlook for T-Slim X2 Basal-IQ tech$TNDM was once a $300 stock, struggled on sales and debt. At the time, they did not have the supreme product and it crashed. Compare to $PODD Omnipod that only has bolus and you have to manually suspend, you would want to be with t-slim if you are a diabetic patient. T-slim x2 is marketed globally, sales are up on Q2. Expecting a BIG Q3 from these guys. Pullback? Maybe a little, maybe later, but it's definitely not too late to get in, it's too hot right now. PT $80

+279% 200SMA, +54% 50SMA, +27% 20SMA, Are you sure that you want to be on the other side of the trade?

TNDM a BTFD opportunity?Bullish divergence in Stochastic, Chaiken Money Flow, where the momentum is printing higher lows. Money is flowing into the ticker since late October as price was moving lower so the dips were being picked up, perhaps a significant movement to the upside is expected for the year end?

TANDEM 7 RRRTrading Methodology:

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch points, beginning at the earliest touch point.

3. A trend-based Fibonacci retracement triangle is drawn starting from the earliest trend touch point and ending at the earliest touch point of the opposite trend line .

4. Based on the degree, of the earlier defined angle, the appropriate (and secret) levels are selected for the fibonacci retracement ; two levels for stop-loss and two levels for take-profit. The closest stop-loss level to the current price level is the top priority stop-loss. Though the secondary stop-loss level is often chosen for some markets such as FX and some equities in order to account for seldom unexpected resistance breaks. The greater target level is the top priority, and where majority of the shares are sold, though some may choose to close part of the position at the first target level or set it to be the stop-loss once price exceeds it. Entries should be laddered in around the levels closest of the yellow line.

This trading strategy can be applied to any market and time frame, and positions most often garner the greatest risk-to-reward ratio with the highest success rate. What more can you ask for?

Canada ApprovalSep-26-18 Reiterated Piper Jaffray Overweight $32 to $56

Sep-26-18 Reiterated Dougherty & Company Buy $45 to $56

-31.25% off 52 wk high, pullback to somewhere around $31 while the market sell-off. We should be good to go for another run. BUY. Your decision if you want to hold through earnings this October. Let me know

Tandem is oversold going into ER monthThe recent analyst day was great, in my opinion, with strong product pipeline which should be followed by strong delivery. Guidance is up and most likely conservative going into next month's earnings call. Short term headwinds with regards to overbought status should dissipate soon as Tandem is far from being overbought. It has a strong chance of becoming a market leader a few years down the road, especially with international expansion. Control-IQ and t:sport will propel the stock to new highs.