$ZION, Hoping that tech investments pays off in Zion BancorpEarnings projections are quite mixed among analysts in Zion like many in the banking sector. Zion has invested heavily in modernizing and improving the approach to technology and It is hoped that it reaps rewards, we see this as a nice long term hold which has been oversold unduly. Crossing above the 200ma would be pivotal for the stock so maybe set $49 as a alert for possible entry.

0M3L trade ideas

ZION Approaching Support, Potential Bounce! ZION is approaching our first support at 45.03 (horizontal swing low support, 61.8%, 100% fiboancci extension) where a strong bounce might occur pushing price up to our first resistance at 48.19 (23.6%, 76.4% Fibonacci retracement, 100% Fibonacci extension). Stochastic (89,5,3) is also approaching support where we might see a corresponding bounce above this level.

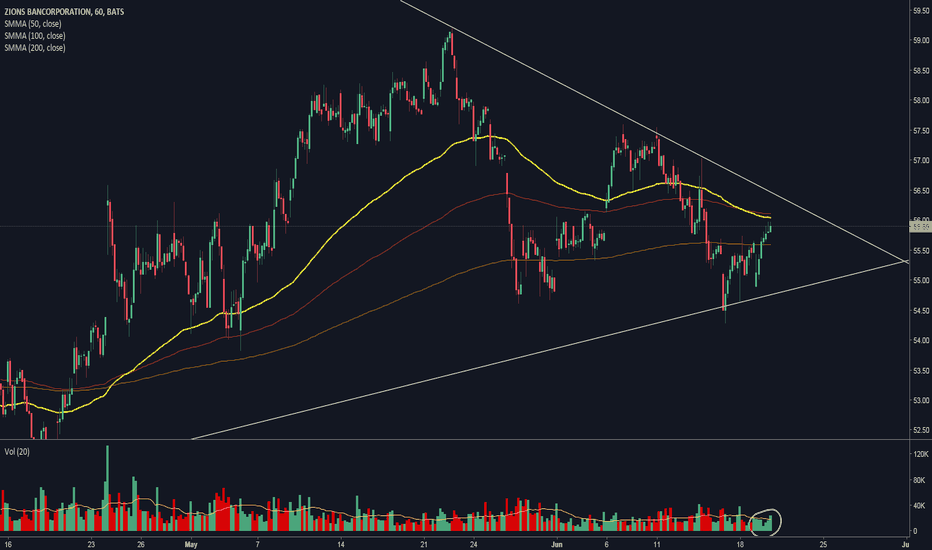

ZION Utah regional bankZION appears to be moving inside a symmetrical triangle pattern, nearing the end of this continuation pattern the volatily near the end of the triangle provides for a graet oppotunity for a long.

With upcoming stress test on thurday and most if not all banks expected to pass and raise dividends and increase payout by 100% ZION provides a great opportunity for a long positon.

Plan: buy equity/calls

Trade Setup in ZIONFrom its February 6 low of $49.76 ZION is up 14.65% hitting a high of $57.05 on March 9th. It then proceeded to shed 4.52% to a $54.47 low, before rebounding strongly on Friday, to close at the 13 EMA - $55.52. This sets up a classic "4x4 retracement" signal - four consecutive lower closes followed by a rebound towards the primary trend on the fifth day. With a risk management stop just below Thursday's low of $54.47 and a near-term target of $58.75, this trade has a good risk/reward ratio.

ZION Banc To DropOn March 31, 2017 the Zion Bancorporation ( NASDAQ:ZION ) crossed below its 100 day for the second time in 9 trading days. Historically this has occurred 169 times and the stock does not always drop. It has a median loss of 3.454 % and maximum loss of 30.112 % over the next 15 trading days.

When we take a look at other technical indicators, the relative strength index (RSI) is at 42.6531. RSI tends to determine overbought and oversold levels. I personally use anything above 75 as overbought and anything under 25 as oversold. The current reading declares the stock is slightly heading down, but not in a strong manner.

The true strength index (TSI) is currently -14.910. The TSI determines overbought/oversold levels and/or current trend. I solely use this as an indicator of trend as overbought and oversold levels vary. The TSI is double smoothed in its calculation and is a great indicator of upward and downward movement. The current reading declares the stock is moving down.

The negative vortex indicator (VI) is 1.42. The VI determines current trend and direction. When the positive level is higher than 1 and higher than the negative indicator, the overall price action is moving upward. When the negative level is higher than 1 and higher than the positive indicator, the overall price action is moving downward. The current reading declares the stock moving down.

The stochastic oscillator K value is 49.9104.8377 and D value is 37.7580. This is a cyclical oscillator that is highly accurate can be used to identify overbought/oversold levels as well as pending reversals. I personally use anything above 80 as overbought and below 20 as oversold. When the K value is higher than the D value, the stock is trending up. When the D value is higher that the K value the stock is trending down. The current reading declares the stock is trending up with decently large divergence which indicates the potential for continued upward movement.

Considering the moving average crossover, RSI, TSI, VI and stochastic levels, the overall near-term stock direction appears to be downward. Based on historical movement compared to current levels and the current position, the stock could drop 3.79% over the next two weeks. Last time the stock crossed below this MA, it dropped 3.672%. There is a level of support around 40.41 which is where I would expect the stock to drop to.

$ZION Has a huge upside with the slightest De-Regulation They might be in the best position to profit with any compromise to Dodd Frank. Right now systematically important banks are categorized as any banks with over 50 billion dollars AUM. Zion is around 64 Billion which means the narrowly made the cut. Because of this they have hired hundreds of staff positions to deal with compliance and paperwork. One popular measure that seems to have bi partisan support is increasing that threshold from 50 billion. If this is the Case Zion will have a huge cost reduction which will increase its already significant profits.