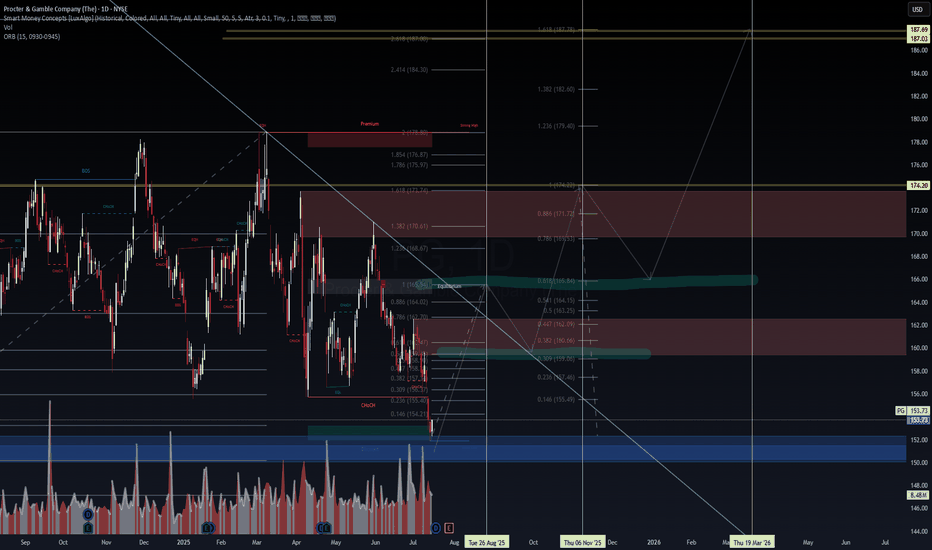

PG Approaching Oversold Discount Zone Ahead of Q4 Earnings BTFD?📝 Procter & Gamble (NYSE: PG) is trading at $153.73 (-10.8% YTD), lagging the S&P 500’s +6.5% YTD gain. Despite recent weakness, a confluence of technical support, dividend resilience, and a looming catalyst could signal a tactical entry. Let’s break it down:

🔍 Fundamentals & Catalysts

Q4 Earnings

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.4 USD

14.88 B USD

84.04 B USD

2.34 B

About Procter & Gamble Company (The)

Sector

Industry

CEO

Jon R. Moeller

Website

Headquarters

Cincinnati

Founded

1837

FIGI

BBG00JHW0213

Procter & Gamble Co. engages in the provision of branded consumer packaged goods. It operates through the following segments: Beauty, Grooming, Health Care, Fabric and Home Care, and Baby, Feminine and Family Care. The Beauty segment offers hair, skin, and personal care. The Grooming segment consists of shave care like female and male blades and razors, pre and post shave products, and appliances. The Health Care segment includes oral care products like toothbrushes, toothpaste, and personal health care such as gastrointestinal, rapid diagnostics, respiratory, and vitamins, minerals, and supplements. The Fabric and Home care segment consists of fabric enhancers, laundry additives and detergents, and air, dish, and surface care. The Baby, Feminine and Family Care segment sells baby wipes, diapers, and pants, adult incontinence, feminine care, paper towels, tissues, and toilet paper. The company was founded by William Procter and James Gamble in 1837 and is headquartered in Cincinnati, OH.

Related stocks

$PG - Charting is Therapeutic NYSE:PG forming solid base at $159 support after 15% pullback from Feb highs.

Strong fundamentals intact with 19% profit margins in Q3. Recent analyst actions positive RBC upgraded to BUY in April, Evercore just raised PT to $190 (19% upside).

Defensive consumer staple with reliable dividend (65

Bullish $PGNYSE:PG forming solid base at $159 support after 15% pullback from Feb highs. Strong fundamentals intact with 19% profit margins in Q3. Recent analyst actions positive - RBC upgraded to BUY in April, Evercore just raised PT to $190 (19% upside). Defensive consumer staple with reliable dividend (65%

Can P&G Weather the Economic Storm?Procter & Gamble, a global leader in consumer goods, currently faces significant economic turbulence, exemplified by recent job cuts and a decline in its stock value. The primary catalyst for these challenges stems from the Trump administration's tariff policies, which have directly impacted P&G's s

Procter&Gamble: Short-Term Strength Still Fits the PlanPG has extended its rally, pushing turquoise wave C higher. While some selling pressure is starting to show, we’re sticking with our primary view: the stock should still break above $180.43 to complete beige wave b before turning lower. However, in our 37% likely alternative scenario, beige wave al

PROCTER & GAMBLE: This volatility implies a major market bottom.Procter & Gamble is neutral on both the 1D (RSI = 47.822, MACD = 0.180, ADX = 17.832) and 1W (RSI = 49.820, MACD = 0.340, ADX = 20.781) technical outlooks as despite last week's rebound and this ones early strong rise, it pulled back and is about to close the 1W candle flat. We are exactly on the 1W

PG - Procter & Gamble Company (Daily chart, NYSE)PG - Procter & Gamble Company (Daily chart, NYSE) - Long Position; Short-term research idea.

Risk assessment: High {volume & support structure integrity risk}

Risk/Reward ratio ~ 1.33

Current Market Price (CMP) ~ 170.40

Entry limit ~ 169

1. Target limit ~ 174 (+2.96%; +5 points)

Stop order

Harmonically Bullish on Procter and Gamble. PGXABC bullish zigzag, within a structure harmonically consistent with a developing XABCD. In harmonic reactions, retracements are often indicative of extensions to follow, which in this case is 1.618. This conveniently aligns in a Fibonacci cluster with a .886 larger retracement, consistent with a Ba

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PRGM

PROCTER&GAMBLE 20/50Yield to maturity

6.25%

Maturity date

Mar 25, 2050

PRGJ

PROCTER GAMBLE 17/47Yield to maturity

6.21%

Maturity date

Oct 25, 2047

US742718FJ3

PROCTER&GAMBLE 20/40Yield to maturity

5.72%

Maturity date

Mar 25, 2040

US742718DB2

PROCTER GAMBLE 2034Yield to maturity

4.90%

Maturity date

Aug 15, 2034

US742718GN3

PROCTER&GAMB 25/35Yield to maturity

4.85%

Maturity date

May 1, 2035

US742718GL7

PROCTER&GAMB 24/34Yield to maturity

4.83%

Maturity date

Oct 24, 2034

XS15860308

PROCTER GAMBLE 02/33Yield to maturity

4.82%

Maturity date

Jan 19, 2033

US742718GG8

PROCTER&GAMB 24/34Yield to maturity

4.78%

Maturity date

Jan 29, 2034

US742718DF3

PROCTER GAMBLE 07/37Yield to maturity

4.76%

Maturity date

Mar 5, 2037

US742718FY0

PROCTER&GAMB 23/26Yield to maturity

4.70%

Maturity date

Jan 26, 2026

US742718FM6

PROCTER&GAMB 20/30Yield to maturity

4.67%

Maturity date

Oct 29, 2030

See all 0NOF bonds

Curated watchlists where 0NOF is featured.

Frequently Asked Questions

The current price of 0NOF is 153.4 USD — it has increased by 0.47% in the past 24 hours. Watch PROCTER & GAMBLE CO COM NPV stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange PROCTER & GAMBLE CO COM NPV stocks are traded under the ticker 0NOF.

0NOF stock has fallen by −2.83% compared to the previous week, the month change is a −5.16% fall, over the last year PROCTER & GAMBLE CO COM NPV has showed a 91.85% increase.

We've gathered analysts' opinions on PROCTER & GAMBLE CO COM NPV future price: according to them, 0NOF price has a max estimate of 186.00 USD and a min estimate of 152.00 USD. Watch 0NOF chart and read a more detailed PROCTER & GAMBLE CO COM NPV stock forecast: see what analysts think of PROCTER & GAMBLE CO COM NPV and suggest that you do with its stocks.

0NOF reached its all-time high on Jun 2, 2025 with the price of 169.2 USD, and its all-time low was 59.0 USD and was reached on Apr 25, 2018. View more price dynamics on 0NOF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0NOF stock is 0.98% volatile and has beta coefficient of 0.09. Track PROCTER & GAMBLE CO COM NPV stock price on the chart and check out the list of the most volatile stocks — is PROCTER & GAMBLE CO COM NPV there?

Today PROCTER & GAMBLE CO COM NPV has the market capitalization of 357.96 B, it has decreased by −2.05% over the last week.

Yes, you can track PROCTER & GAMBLE CO COM NPV financials in yearly and quarterly reports right on TradingView.

PROCTER & GAMBLE CO COM NPV is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

0NOF earnings for the last quarter are 1.54 USD per share, whereas the estimation was 1.52 USD resulting in a 1.31% surprise. The estimated earnings for the next quarter are 1.42 USD per share. See more details about PROCTER & GAMBLE CO COM NPV earnings.

PROCTER & GAMBLE CO COM NPV revenue for the last quarter amounts to 19.78 B USD, despite the estimated figure of 20.15 B USD. In the next quarter, revenue is expected to reach 20.84 B USD.

0NOF net income for the last quarter is 3.77 B USD, while the quarter before that showed 4.63 B USD of net income which accounts for −18.57% change. Track more PROCTER & GAMBLE CO COM NPV financial stats to get the full picture.

Yes, 0NOF dividends are paid quarterly. The last dividend per share was 1.06 USD. As of today, Dividend Yield (TTM)% is 2.67%. Tracking PROCTER & GAMBLE CO COM NPV dividends might help you take more informed decisions.

PROCTER & GAMBLE CO COM NPV dividend yield was 2.32% in 2024, and payout ratio reached 63.61%. The year before the numbers were 2.43% and 62.39% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 108 K employees. See our rating of the largest employees — is PROCTER & GAMBLE CO COM NPV on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PROCTER & GAMBLE CO COM NPV EBITDA is 22.52 B USD, and current EBITDA margin is 27.48%. See more stats in PROCTER & GAMBLE CO COM NPV financial statements.

Like other stocks, 0NOF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PROCTER & GAMBLE CO COM NPV stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PROCTER & GAMBLE CO COM NPV technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PROCTER & GAMBLE CO COM NPV stock shows the strong buy signal. See more of PROCTER & GAMBLE CO COM NPV technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.