Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.7 USD

5.78 B USD

90.89 B USD

733.62 M

About United Parcel Service, Inc.

Sector

Industry

CEO

Carol B. Tomé

Website

Headquarters

Atlanta

Founded

1907

FIGI

BBG00JRYBQ86

United Parcel Service, Inc. is a package delivery company, which engages in the provision of global supply chain management solutions. It operates through the following segments: U.S. Domestic Package, International Package, and Supply Chain Solutions. The U.S. Domestic Package segment includes time-definite delivery of letters, documents, and packages. The International Package segment focuses on delivery and shipments in Europe, Asia, the Indian sub-continent, the Middle East, Africa, Canada, and Latin America. The Supply Chain Solutions is involved in forwarding, logistics, Coyote, Marken, and UPS Mail Innovations. The company was founded by James E. Casey and Claude Ryan on August 28, 1907 and is headquartered in Atlanta, GA.

Related stocks

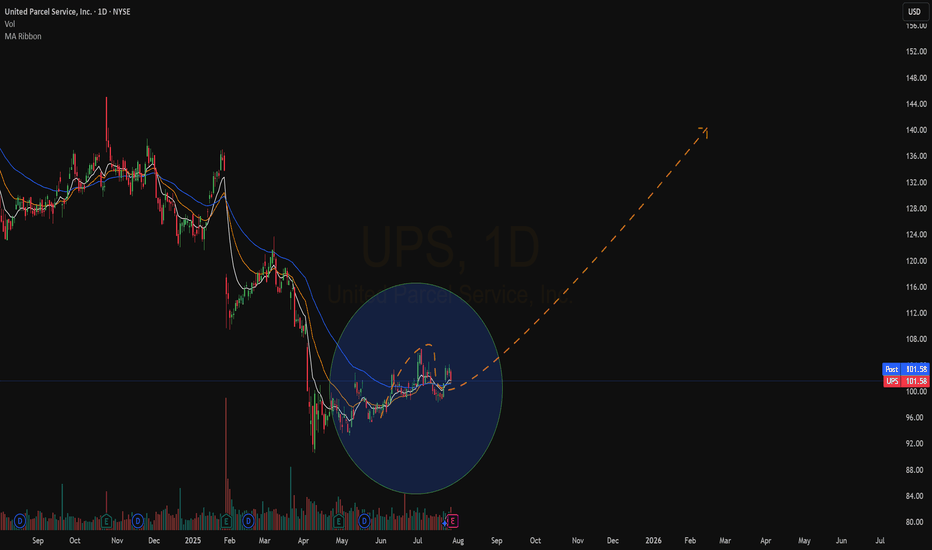

Positioning UPS Long Amid Global Logistics Tailwinds Current Price: $103.56

Direction: LONG

Targets:

- T1 = $106.00

- T2 = $108.00

Stop Levels:

- S1 = $101.00

- S2 = $99.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligen

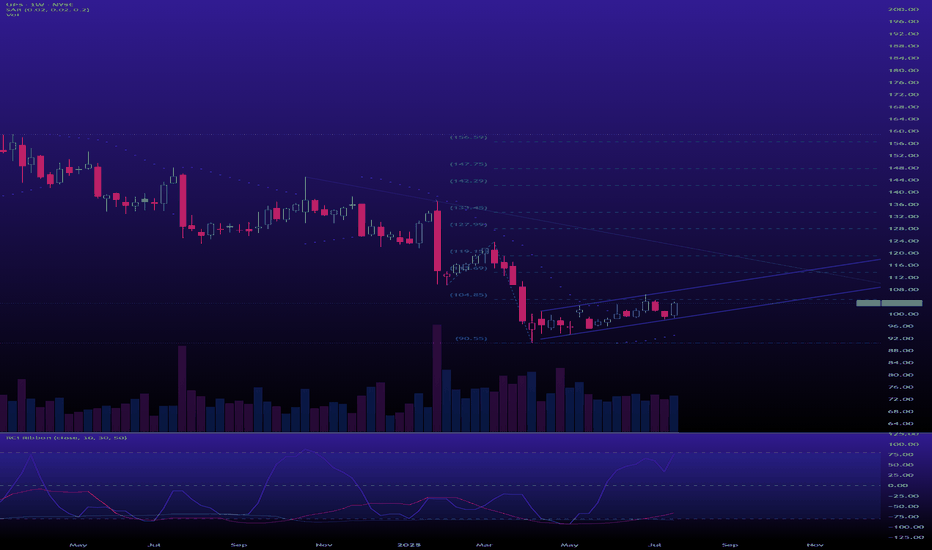

UPS is currently in the Wyckoff Accumulation Phase### **Wyckoff Phase: Accumulation**

1. **Prior Downtrend:** The weekly chart (left) clearly shows a prolonged and significant downtrend through 2024 and into early 2025. This fulfills the "Markdown" phase that precedes accumulation.

2. **Stopping Action and Base Formation:** The daily chart (righ

Things are looking UPSUnited Parcel Service served as one of our canaries in the coal mine, signalling that the real economy was much weaker than what the Biden administration was reporting. The figures presented were positively skewed, masking the harsh reality that we were all facing difficult times.

We recognized the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UPS4871926

United Parcel Service, Inc. 3.4% 01-SEP-2049Yield to maturity

6.69%

Maturity date

Sep 1, 2049

US911312AZ9

UTD PARCEL SERV. 2046Yield to maturity

6.59%

Maturity date

Nov 15, 2046

US911312BN5

UTD PARCEL SERV. 2047Yield to maturity

6.43%

Maturity date

Nov 15, 2047

UPS4808742

United Parcel Service, Inc. 4.25% 15-MAR-2049Yield to maturity

6.27%

Maturity date

Mar 15, 2049

UPS3908475

United Parcel Service, Inc. 3.625% 01-OCT-2042Yield to maturity

6.24%

Maturity date

Oct 1, 2042

XS0301197546

UnitedParcelSer 5,125% 12/02/2050Yield to maturity

6.17%

Maturity date

Feb 12, 2050

UPS5815263

United Parcel Service, Inc. 5.6% 22-MAY-2064Yield to maturity

6.00%

Maturity date

May 22, 2064

UPS5547104

United Parcel Service, Inc. 5.05% 03-MAR-2053Yield to maturity

5.93%

Maturity date

Mar 3, 2053

UPS5815262

United Parcel Service, Inc. 5.5% 22-MAY-2054Yield to maturity

5.88%

Maturity date

May 22, 2054

UPS4969032

United Parcel Service, Inc. 5.3% 01-APR-2050Yield to maturity

5.86%

Maturity date

Apr 1, 2050

UPS6075098

United Parcel Service, Inc. 6.05% 14-MAY-2065Yield to maturity

5.84%

Maturity date

May 14, 2065

See all 0R08 bonds

Curated watchlists where 0R08 is featured.

Female-led stocks: Who rules the world?

34 No. of Symbols

US truck stocks: State to state supply

24 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 0R08 is 84.8 USD — it has decreased by −1.46% in the past 24 hours. Watch UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 stocks are traded under the ticker 0R08.

0R08 stock has fallen by −17.24% compared to the previous week, the month change is a −19.06% fall, over the last year UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 has showed a −35.27% decrease.

We've gathered analysts' opinions on UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 future price: according to them, 0R08 price has a max estimate of 133.00 USD and a min estimate of 75.00 USD. Watch 0R08 chart and read a more detailed UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 stock forecast: see what analysts think of UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 and suggest that you do with its stocks.

0R08 reached its all-time high on Feb 1, 2022 with the price of 233.6 USD, and its all-time low was 86.0 USD and was reached on Mar 16, 2020. View more price dynamics on 0R08 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0R08 stock is 1.96% volatile and has beta coefficient of 0.69. Track UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 stock price on the chart and check out the list of the most volatile stocks — is UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 there?

Today UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 has the market capitalization of 71.55 B, it has decreased by −3.20% over the last week.

Yes, you can track UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 financials in yearly and quarterly reports right on TradingView.

UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

0R08 earnings for the last quarter are 1.55 USD per share, whereas the estimation was 1.56 USD resulting in a −0.83% surprise. The estimated earnings for the next quarter are 1.37 USD per share. See more details about UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 earnings.

UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 revenue for the last quarter amounts to 21.20 B USD, despite the estimated figure of 20.85 B USD. In the next quarter, revenue is expected to reach 20.89 B USD.

0R08 net income for the last quarter is 1.28 B USD, while the quarter before that showed 1.19 B USD of net income which accounts for 8.09% change. Track more UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 financial stats to get the full picture.

Yes, 0R08 dividends are paid quarterly. The last dividend per share was 1.64 USD. As of today, Dividend Yield (TTM)% is 7.74%. Tracking UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 dividends might help you take more informed decisions.

UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 dividend yield was 5.17% in 2024, and payout ratio reached 96.41%. The year before the numbers were 4.12% and 83.08% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 490 K employees. See our rating of the largest employees — is UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 EBITDA is 12.29 B USD, and current EBITDA margin is 13.53%. See more stats in UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 financial statements.

Like other stocks, 0R08 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 stock shows the sell signal. See more of UNITED PARCEL SERVICE INC CLASS'B'COM STK USD0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.