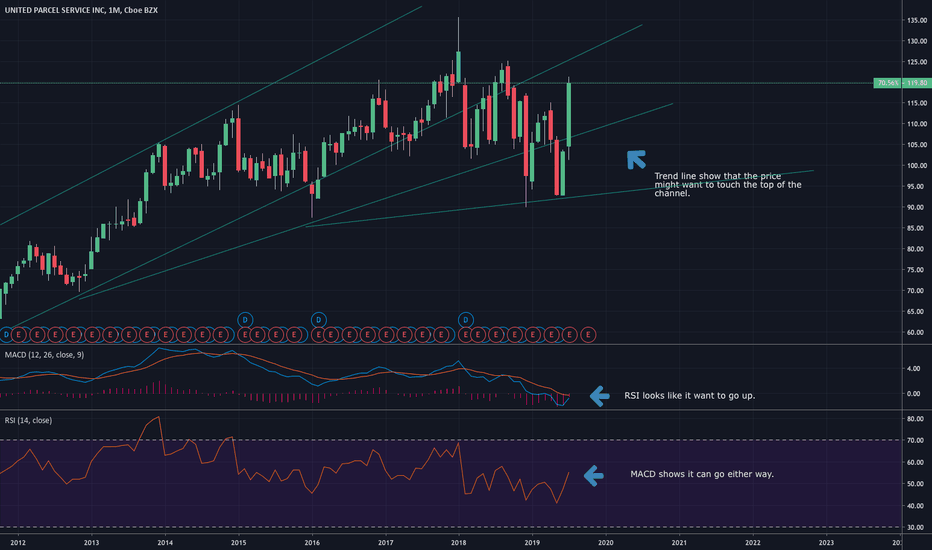

0R08 trade ideas

UPS long Trend line playMissed the perfect entry as we gapped up. small position in already, will add on if we hold the current zone. If you have questions about the trendlines and horizontal area of interest (zones/colors/ meanings etc) you will have to DM me as it is too involved to go over in a comment. Happy to communicate though, just give me a little time.. Happy trading and stay green!

UPS: Shipping giant holds the 50-day SMA before Cyber MondayUnited Parcel Service has been adapting to the new digital landscape. And now it's bouncing at a potentially key level right before the holiday-shopping/holiday-shipping season.

UPS had a monster rally in July after shifting to next-day delivery services. That business line continued to grow 24 percent last quarter, although the stock fell on weak profit and the retirement of Chief Operating Officer Jim Barber.

UPS has also struggled with transports lagging the broader market because of slow economic growth and worries about China. But will that remain a worry as the S&P 500 hits new highs and Cyber Monday approaches?

UPS is also holding its 50-day simple moving average. That could give buyers a potential line to cut losses, but with a lot more space to the upside if they're targeting the highs from early 2018.

$UPS Monday trade in UPSEntry level $120.50 = Target price $135.00 = $stop loss $114.50

Bullish fundamentals post earnings.

Average price target $126 | Overweight.

P/E ratio 20.8

Yield 3.7%

Company profile

United Parcel Service, Inc. operates as a logistics and package delivery company providing supply chain management services. Its logistics services include transportation, distribution, contract logistics, ground freight, ocean freight, air freight, customs brokerage, insurance, and financing. The company operates through the following segments: U.S. Domestic Package, International Package, and Supply Chain and Freight. The U.S. Domestic Package segment offers a full spectrum of U.S. domestic guaranteed ground and air package transportation services. The International Package segment includes small package operations in Europe, Asia-Pacific, Canada and Latin America, Indian sub-continent, and the Middle East and Africa. The Supply Chain and Freight segment offers transportation, distribution, and international trade and brokerage services. The company was founded by James E. Casey and Claude Ryan on August 28, 1907 and is headquartered in Atlanta, GA.

Your Parcel may be delayedUnited Parcel may be entering into a phase of correction as the signs are aligned for the bears.

First up, the long legged doji at the supply zone is a sign. Sellers may be kicking in in large numbers tonight.

Rising Wedge formation.

Potential overbought crossing

The buying gap is still hollow, perhaps price may stage a strong rebound there.